High Yield Weekly Minutes: Labor Day's Last Stand...Yields Hit 2022 Lows as Supply Desert Continues (September 2, 2025)

The Calm Before September's Storm

🚨 Connect on Twitter | Threads | Instagram | YouTube

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list — limited spots.

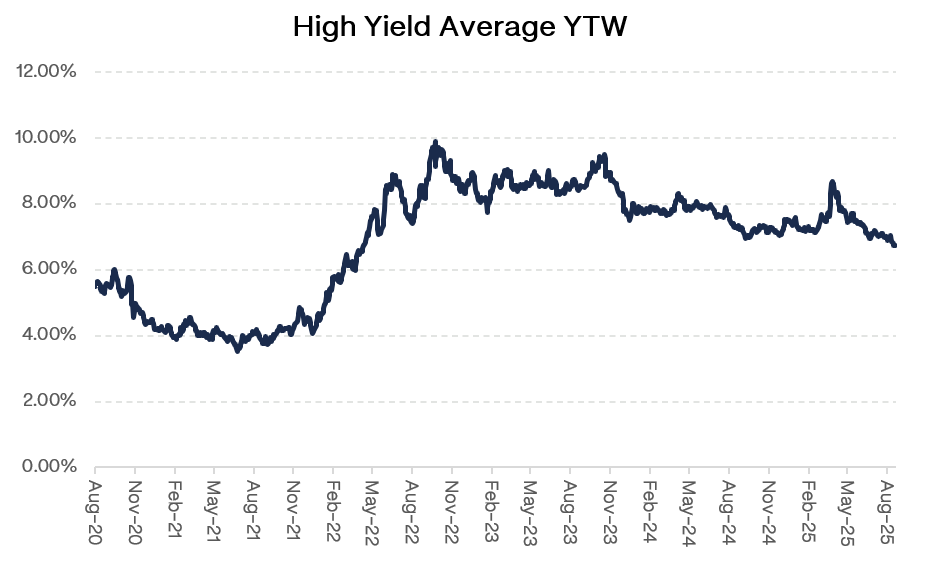

Summer went out with a bang, not a whimper. The week before Labor Day saw high yield deliver its strongest performance in months, with overall returns hitting +0.45% as CCCs absolutely exploded higher by over 1%. Yields continued their relentless march lower, hitting 6.75% for the index overall. That puts us at levels not touched since early 2022, back when the world looked very different.

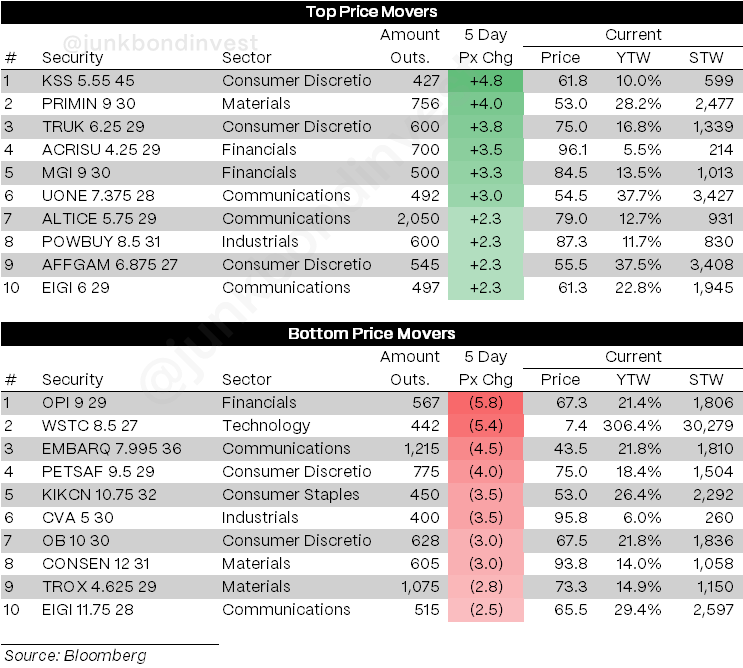

Unsurprisingly, zero primary market activity yet again, but instead of the usual late-summer doldrums, buyers went into full acquisition mode. CCCs led the charge with spreads compressing 44bps in a single week while yields plunged 50bps. When the lowest-quality credits are moving like that with no competing supply, you’re watching pure technical momentum in action.

Now comes the moment of truth. With Labor Day behind us, borrowers are expected to flood back with pent-up financing needs. Early estimates pointed to potentially $10 billion hitting in the first few weeks of September. The big question: can this technically-driven rally handle the return of normal supply patterns?

Continue the discussion at r/leveragedfinance.

Weekly Performance Recap

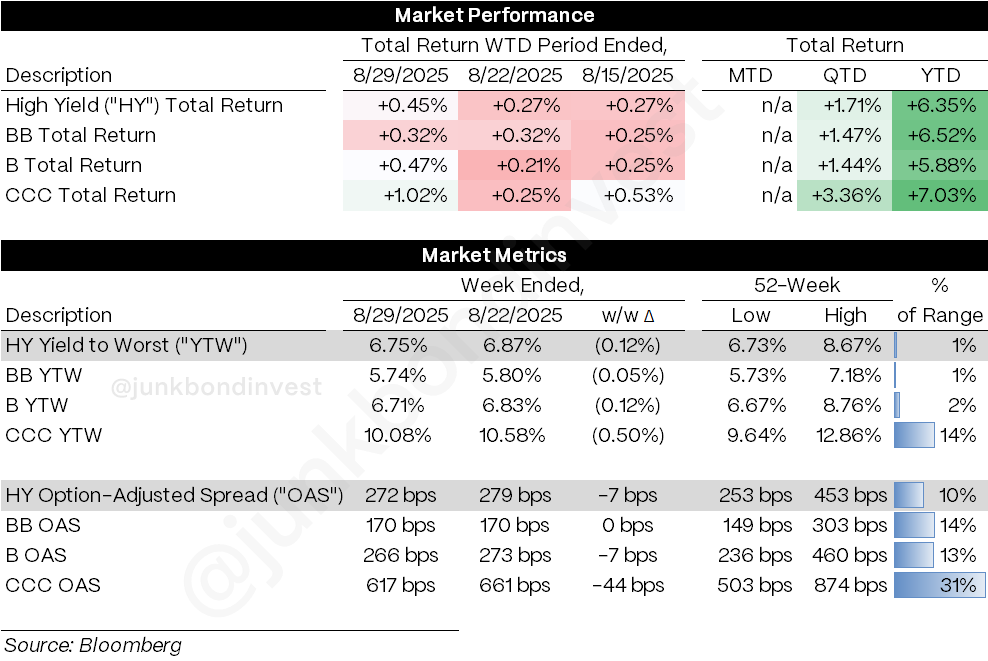

The final week of August delivered a surprisingly strong finish to the summer rally. Overall HY gained +0.45% for the week as yields dropped another 12bps to 6.75%, with CCCs absolutely dominating performance:

CCCs exploded +1.02% for the week, posting their strongest performance in months as yields plunged 50bps to 10.08%

Bs gained +0.47%, showing solid performance across the middle market with yields down 12bps to 6.71%

BBs delivered +0.32%, with yields dropping 5bps to 5.74%

The underlying spread picture revealed massive compression, particularly in lower-rated credits:

Overall spreads tightened 7bps to 272bps, driven by strong technical momentum

CCC spreads led the compression, narrowing a massive 44bps to 617bps in the strongest weekly move in months

Single-B spreads tightened 7bps to 266bps while BB spreads held flat at 170bps

This created a textbook risk-on environment: yields collapsing while spreads also compressing across all rating buckets. The move was broad-based and technically driven, with CCCs leading the charge as investors positioned for continued Fed accommodation.

Primary Market Activity

Week two of complete radio silence as issuers remained in their traditional Labor Day holding pattern. Zero deals launched, absolute quiet ahead of what was expected to be a busy September reopening.

The contrast with what was coming couldn’t have been starker. Market consensus pointed to $10+ billion of issuance in just the first weeks of September as borrowers would emerge with refinancing needs and opportunistic transactions. The refinancing calendar alone was expected to provide steady supply given the attractive all-in rates available despite recent tightening.

The summer’s technical support came largely from this supply-constrained environment combined with Fed accommodation expectations. September would reveal whether that bid could handle normal market conditions or if we had been witnessing a technically-driven rally sustained only by absence of alternatives.

Secondary Market

Looking Ahead

The macro backdrop heading into September presents increasingly mixed signals. Economic growth got an upward revision to 3.3% annualized for Q2, driven by stronger tech spending and equipment investment. That’s the kind of corporate strength that typically supports credit fundamentals.

But consumer dynamics tell a different story. Confidence dropped to 97.4 in August, with labor market perceptions showing particular weakness. The percentage of consumers describing jobs as “hard to get” jumped to 20% - the highest reading since February 2021.

Housing sector deterioration continues accelerating. July new home sales declined while builder confidence collapsed to levels not seen since 2012. The NAHB survey revealed current sales conditions at decade-plus lows with equally pessimistic future outlooks.

These trends suggest the consumer spending patterns that have supported economic growth may be reaching their limits, particularly as tariff pressures continue building through the system.

This Week’s Tests

With Labor Day now in the rearview mirror, this week immediately puts high yield’s technical foundation to the test. After two weeks of zero supply competition, any meaningful issuance volume will reveal whether the summer rally was built on genuine demand or simply the absence of alternatives.

The economic calendar adds another layer of complexity. Friday’s employment report could reshape Fed policy expectations after three months of averaging just 35K monthly job gains.

Consumer spending patterns remain the crucial wild card. Recent data shows strength in necessities but weakness in discretionary categories: exactly what you’d expect from households feeling price pressures. If this trend accelerates, it could undermine the corporate earnings strength that’s supported credit markets.

Markets are currently pricing 2+ Fed cuts by December with another 1-2 by April 2026. This week’s employment data could either validate or challenge those expectations, with major implications for rate-sensitive credit performance.

Here’s the setup that should concern credit investors: yields at 2022 levels during 2025’s economic uncertainty while smart money posts consecutive outflows suggests we’re closer to a technical top than extension. The momentum has been extraordinary, but even the strongest rallies need fundamental support once normal market conditions resume.

This week will determine whether summer’s rally represented genuine economic optimism or simply the technical result of supply constraints combined with Fed accommodation hopes. The first few days back from Labor Day could decide whether high yield extends its remarkable run or finally encounters the resistance that’s been building beneath the surface.

Find the most recent JunkBondInvestor posts below

Disclosure: The information provided is based on publicly available information and is for informational purposes only. While every effort has been made to ensure the accuracy of the information, the author cannot guarantee its completeness or reliability. This content should not be considered investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release the author from any liability. Always seek professional advice tailored to your financial situation and objectives.