ZipRecruiter ($ZIP): When the Music Stops, Someone's Left Without a Chair

Revenue collapsed 50% in two years, bonds yield double digits, and nobody knows what happens next

🚨 Connect: Twitter | Threads | Instagram | Reddit | YouTube

The industry group chat is at r/leveragedfinance.

Half a billion dollars in revenue. Gone. Just like that.

ZipRecruiter went from printing money during the pandemic hiring frenzy to watching their business crater by ~50% in two years. The growth story is over. Now we’re talking survival.

The company built a real business solving a real problem: making it easier for small businesses to find employees without manually posting to dozens of job sites. They were profitable before the pandemic boom, and they’re still profitable after the bust. That’s more than most tech darlings from 2021 can claim.

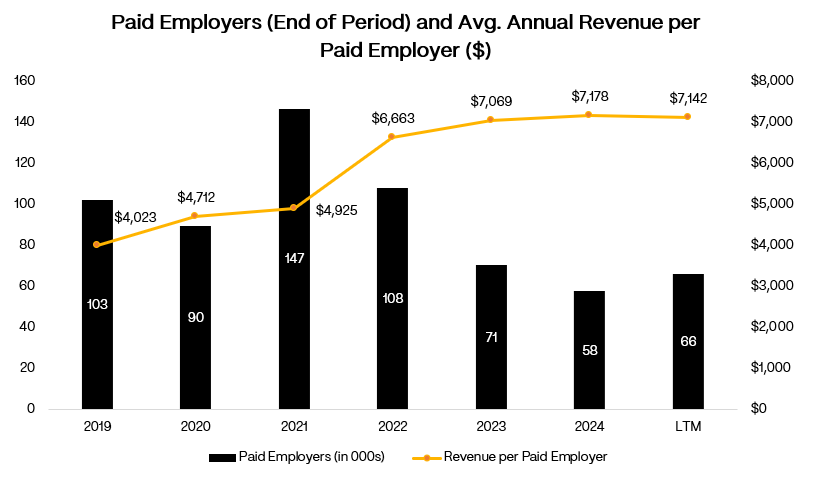

The headlines scream “revenue collapse” and “employer exodus.” True. Paid employers dropped from ~169K at the peak to ~66K today. Also true. But here’s the interesting part: the customers who stayed are paying nearly double what they used to.

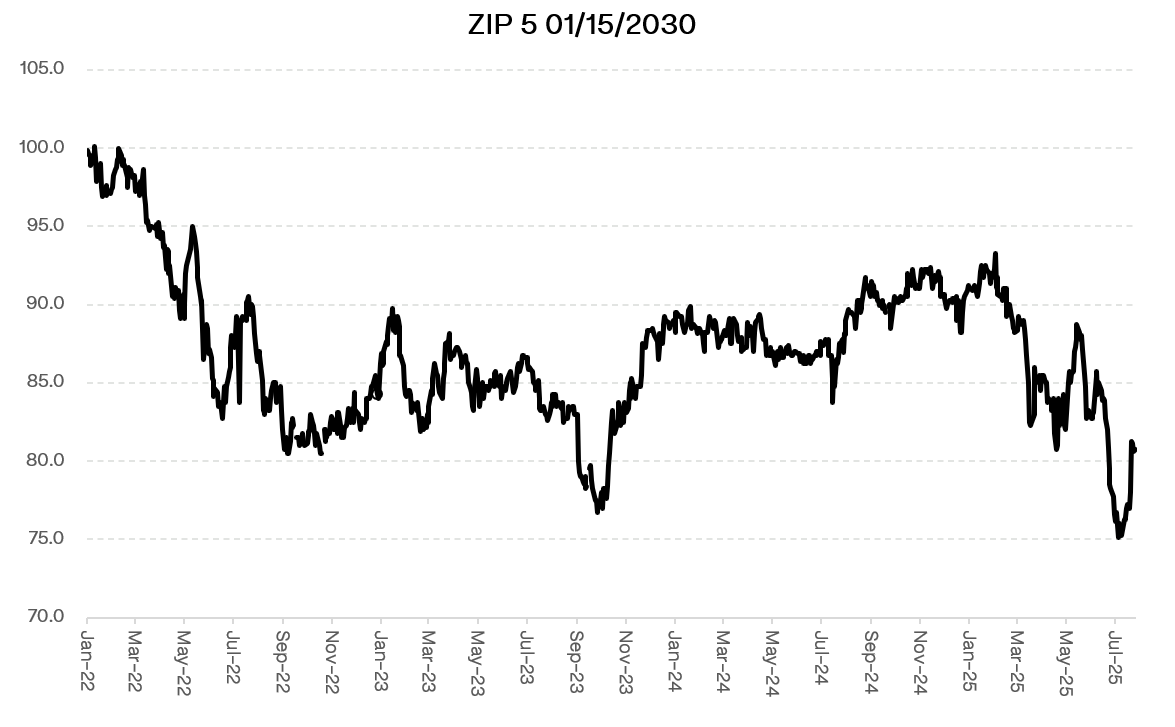

The bond market’s verdict adds nuance to the “survival” story. ZipRecruiter’s debt trades in the low 80s yielding double digits, which is wide for a market characterized by historically tight credit spreads. Either the bond market is overreacting to what’s essentially a cyclical downturn, or credit investors see structural risks that equity analysts are missing.

The bigger question is what happens when hiring eventually recovers. Will ZipRecruiter be positioned to capitalize, or will they discover that LinkedIn and Indeed used the downturn to lock up more market share? Small business hiring is still a massive market, but it’s getting more competitive every quarter.

They’ve got cash, they’re still profitable, and their job seeker traffic is actually growing while revenue tanks. That’s either a sign of strength or a warning that people use the platform but companies won’t pay for it.

Nobody knows what happens next. The hiring market might recover and reward ZIP’s patience. Or they might discover that surviving the downturn was the easy part.

Either way, it’s going to be interesting to watch.