High Yield Weekly Market Minutes: When Markets Work While You're Not Watching (July 7, 2025)

July 4th Week Delivers +0.46% Gains: The Flow Machine Doesn't Take Vacations

🚨 Connect on Twitter | Threads | Instagram | Bluesky | Reddit

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list — limited spots.

Here’s the thing about markets: they don’t care about your calendar. While half the Street was planning BBQs, high yield quietly delivered a +0.46% return during the shortened July 4th week. CCCs led the charge with another +1.03% surge (their second consecutive week above +1%) and by Thursday’s close, we hit fresh 3-year lows in yields at 6.95%.

The numbers tell a story that’s hard to ignore. Spreads compressed another 24bps to 268bps. We’re now sitting at the very low end 52-week range for yields and just 8% for spreads. When you can hit historic lows during a week when institutional flow was supposed to dry up, something bigger is happening.

But here’s what really caught our attention: the primary market absorbed $6.5 billion across seven deals during a holiday week. Venture Global casually priced dual $2 billion energy tranches, Hilton executed a smooth $1 billion refi, and nobody seemed surprised. That’s not normal seasonal behavior, that’s technical dominance operating on autopilot.

Every rating bucket participated. BBs gained +0.31%, Bs advanced +0.49%, CCCs surged +1.03%. When was the last time you saw that kind of broad-based performance during shortened trading? The consistency is what matters here, not just the magnitude.

The question isn’t whether this rally makes sense anymore. The question is whether you’re positioned for what’s actually happening instead of what should be happening.

Weekly Performance Recap

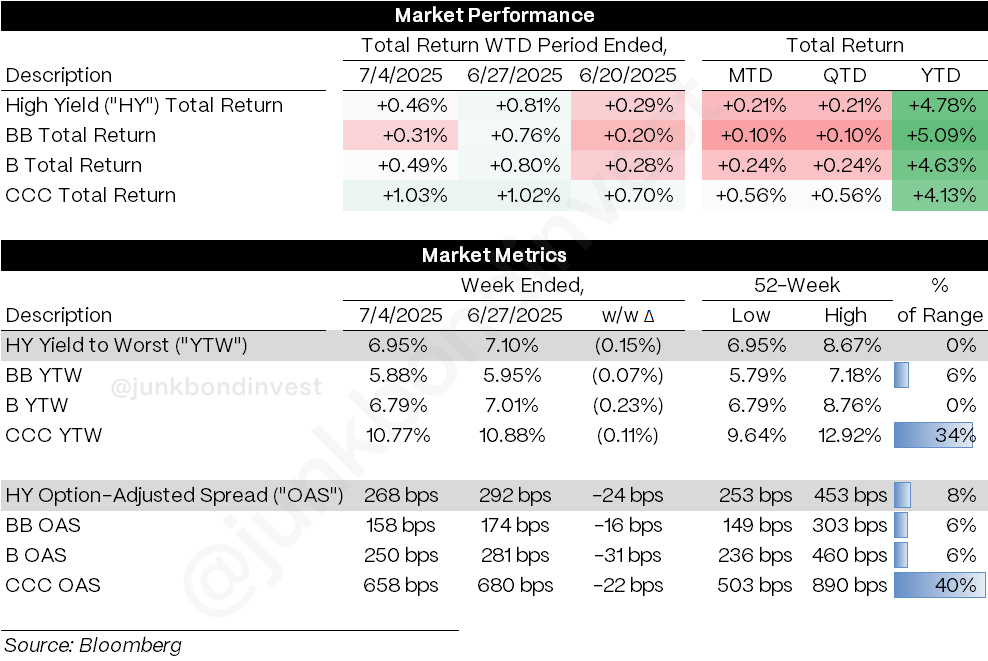

The numbers reveal a market operating with remarkable consistency. HY posted +0.46% gains, with performance distributed across the credit spectrum:

CCCs led at +1.03%, marking their second consecutive week above +1% and pushing YTD returns to +4.13%

Bs delivered +0.49%, maintaining steady momentum with YTD performance now at +4.63%

BBs advanced +0.31%, the most conservative performance but still solid given the holiday backdrop, bringing YTD gains to +5.09%

The technical progression continued its relentless path:

Overall index yields fell 15bps to 6.95%, reaching 0% of the 52-week range—essentially touching historic lows

Spreads compressed 24bps to 268bps, moving to just 8% of their annual range

All rating buckets saw meaningful tightening: BBs -16bps to 158bps, Bs -31bps to 250bps, CCCs -22bps to 658bps

The Thursday NFP reaction was telling. While 10-year yields spiked 10bps and Fed Funds futures collapsed, high yield barely registered the hawkish shift. That disconnect suggests the credit rally has achieved independence from rate expectations.

Primary Market Activity

The primary market maintained steady activity despite the holiday disruption, with seven deals totaling $6.5 billion:

Venture Global Plaque dominated with dual $2 billion energy tranches priced at 6.5% and 6.8% yields, demonstrating continued institutional appetite for energy infrastructure credits

Hilton Domestic Operating successfully executed a $1 billion consumer discretionary refinancing at 5.8% yield, showing quality hospitality names command attractive pricing

CP Atlas Buyer completed a $500 million first lien transaction at 9.8% yield for consumer discretionary financing

Arbor Realty brought a $500 million financial services offering to market with solid execution

Execution quality remained strong with most transactions pricing at or near initial guidance. The ability to clear $6.5 billion during a holiday week speaks to the depth of institutional demand, though this pace will be tested as supply calendars normalize in coming weeks.

Secondary Market Dynamics

Secondary trading showed selective strength with notable sector differentiation:

Outperformers:

Energy led with NFE bonds advancing +7-13pts on company-specific developments and continued sector rotation dynamics

Consumer Discretionary showed resilience with BALY credits gaining +10-12pts despite broader economic uncertainty

Communications maintained momentum with DISH posting +6.3pts gains

Relative Underperformers:

Technology faced modest pressure with some profit-taking in recent outperformers

Consumer Discretionary saw dispersion with selective names like ACPROD giving back recent gains

Financials experienced mixed performance despite overall sector stability

The sector rotation patterns suggest investors are positioning for potential economic shifts while maintaining overall risk appetite. The ability of even underperforming sectors to limit downside during a holiday week indicates strong technical support levels.

Looking Ahead

The setup for this week couldn’t be more consequential. With Wednesday’s tariff deadline approaching and Treasury Secretary Bessent promising “a very busy next 72 hours,” trade deal momentum is accelerating. The EU says it’s “ready for a deal,” while last week’s Vietnam agreement (40% levy on China transshipments) likely sets the template for other nations.

Thursday’s NFP beat changed the game. While 147k jobs vs 106k estimate looked solid on the surface, hourly earnings growth hit its smallest increase in over a year. More importantly, the print killed July rate cut hopes.

The immediate catalysts are stacking up:

Wednesday’s Fed Minutes become the week’s highlight in an otherwise thin macro calendar

Bank earnings kick off 2Q season late in the week, setting the tone for leveraged credit fundamentals

Trade deal announcements could reshape tariff expectations before Wednesday’s deadline

Wednesday’s JOLTS and Friday’s CPI could reshape Fed expectations

Most importantly, the technical picture shows high yield has decoupled from rate expectations. When spreads can compress nearly 10bps on a day that 10-year yields spike 10bps, traditional correlations have broken down. Yet institutional rebalancing may actually accelerate in July as pension funds increase credit allocations.

The refinancing dynamic adds another layer. Companies that can refi at these levels are rushing to market, supporting near-term technicals but potentially creating a supply void later in the year. Smart managers are positioning for the timing mismatch while others debate sustainability.

This week determines whether we’re seeing a pause at historic levels or the beginning of new territory where traditional valuation metrics become irrelevant. Both scenarios create opportunities for prepared investors, but require very different positioning strategies.

The market has been remarkably consistent in ignoring macro concerns this year. Whether that continues as we approach levels where spread compression historically stalls remains the summer’s key question.

Find the most recent JunkBondInvestor posts below

Disclosure: The information provided is based on publicly available information and is for informational purposes only. While every effort has been made to ensure the accuracy of the information, the author cannot guarantee its completeness or reliability. This content should not be considered investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release the author from any liability. Always seek professional advice tailored to your financial situation and objectives.