High Yield Market Weekly: Reality Check Arrives...First Weekly Loss Since May as Rates Bite Back

The Tariff Extension Honeymoon Ends: HY Down -0.22% as 10-Year Hits 4.41%

🚨 Connect on Twitter | Threads | Instagram | Bluesky | Reddit

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list — limited spots.

Well, that was inevitable. High yield posted its first weekly loss since May, dropping -0.22% as the tariff extension to August 1st failed to offset rising rate concerns. After weeks of ignoring Treasury volatility, credit markets finally felt the sting of 10-year yields hitting 4.41%, up 6bps on the week and sitting near recent highs.

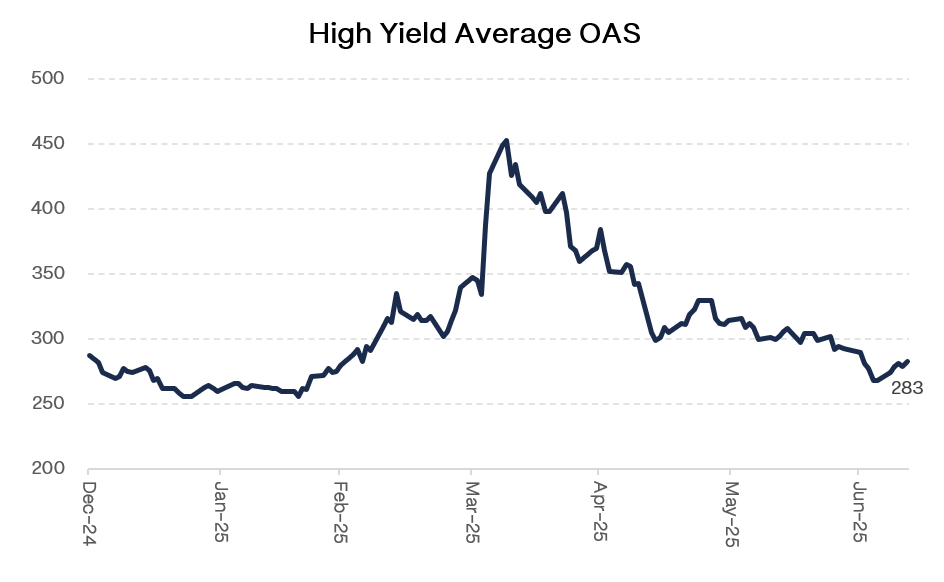

The damage was broad but not catastrophic. BBs led the decline at -0.35%, Bs fell -0.27%, while CCCs managed to stay positive at +0.15% (their resilience continuing to confound traditional credit logic). More telling: yields jumped 19bps to 7.14% while spreads widened just 15bps to 283bps. A reminder that credit markets can’t completely ignore the rate environment

But here’s what kept the week from being a disaster: the primary market absorbed another $8.2 billion across six deals, bringing July’s total to over $12 billion. Carnival led the charge with a massive $3 billion offering at 5.75%, pricing inside their May deal and demonstrating that quality credits can still access historically attractive financing despite the backup in rates.

Even Gray Media’s (broadcast TV if you can believe this still exists) successful $900 million second lien refinancing at 9.625% shows the primary machine keeps churning. When a CCC-rated broadcaster can upsize and tighten pricing during a week of rate volatility, the technical backdrop remains supportive despite the headline decline.

The question isn’t whether this correction was overdue. The question is whether rising rates finally provide the headwind that slows the relentless spread compression, or if this proves to be another buying opportunity for yield-hungry investors.

Weekly Performance Recap

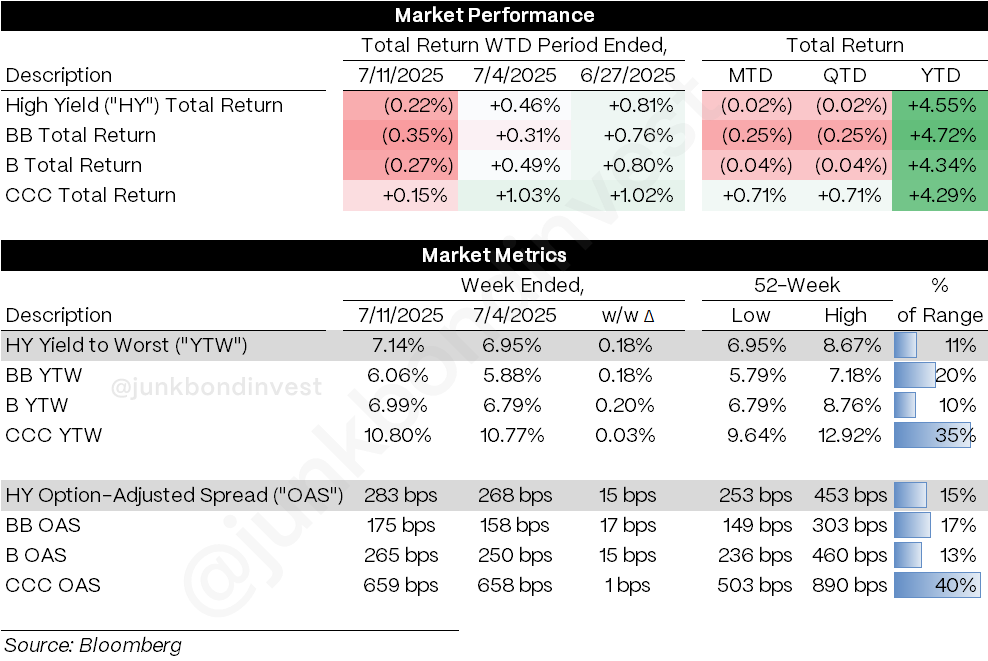

The numbers reveal a market finally acknowledging rate reality. HY declined -0.22% with performance diverging by credit quality:

BBs bore the brunt at -0.35%, their worst week since the April tariff shock, bringing MTD performance to -0.25%

Bs fell -0.27%, also posting their first meaningful decline in weeks with MTD losses of -0.04%

CCCs bucked the trend at +0.15%, extending their year of outperformance with MTD gains of +0.71%

The technical picture showed the impact of rising rates:

Overall index yields jumped 18bps to 7.14%, moving from 0% to 11% of the 52-week range in a single week

Spreads widened 15bps to 283bps, though remaining at just 15% of their annual range

Rating-specific moves varied significantly: BBs widened 17bps to 175bps, Bs expanded 15bps to 265bps, while CCCs actually tightened 1bp to 659bps

The rate sensitivity was unmistakable. When 10-year yields rose 6bps to 4.41% and the entire curve steepened, high yield couldn’t maintain its recent immunity to Treasury moves. Yet the relatively contained spread widening suggests credit fundamentals remain intact.

Primary Market Activity

Despite the rate backup, issuers kept coming with six deals totaling $8.2 billion, only slightly below recent weekly averages:

Carnival Corp dominated headlines with a $3 billion offering of 5.75% 2032 senior notes, upsized from $2 billion and pricing at even tighter terms than their May deal

Nissan Motor’s fallen angel debut brought $4.5 billion across five tranches (USD and EUR), marking their first high yield issuance since losing IG status

Gray Media executed a crucial refinancing with $900 million of 9.625% second lien notes, pricing tight of talk

Amynta returned to CCC supply with $350 million of 7.50% notes for dividend purposes

Execution quality remained solid despite rate headwinds. Carnival’s ability to upsize and tighten from their previous deal, Gray Media’s successful refinancing of troublesome 2027 maturities, and Amynta’s sub-8% CCC print all suggest primary demand remains robust.

Secondary Market Dynamics

Secondary trading revealed clear sector winners and losers as rate sensitivity dominated:

Top Performers:

Communications dominated the weekly leaderboard with ACPROD (+8.5pts), GLOBAU (+8.6pts), and multiple SFRFP issues surging on sector rotation momentum

Consumer Discretionary showed resilience despite rate concerns, with several names posting solid gains

Media credits rallied on Gray Media’s successful refinancing, validating the sector’s improving fundamental outlook

Bottom Performers:

Technology faced the biggest pressure with XRX bonds declining 7-8pts as growth concerns mountes

Utilities felt rate sensitivity with CPN and AES credits declining 4-7pts as infrastructure valuations came under pressure

Materials saw selective weakness with CONSEN and others retreating on economic growth concerns

The sector dispersion suggests tactical rotation rather than broad-based credit concerns. When communications can rally while tech struggles, it points to stock-specific factors and rate sensitivity rather than systemic stress.

Looking Ahead

The setup for this week brings multiple potential catalysts that could determine whether last week’s decline was a healthy pause or the start of something more meaningful. With CPI Tuesday, retail sales Thursday, and housing starts Friday, the economic calendar offers plenty of opportunities for rates to move in either direction.

The key developments to watch:

Primary calendar expected at $7+ billion with several large deals potentially testing demand after last week’s rate volatility

CPI Tuesday could reshape Fed expectations if inflation shows renewed acceleration or continued cooling

Bank earnings begin 2Q season late in the week, providing fundamental context for credit markets

Tariff implementation details emerge as the August 1st deadline approaches for over 20 countries receiving new rate notifications

Most importantly, the yield backup to 7.14% brings high yield closer to levels where historical resistance emerges. While still well below the 8%+ peaks seen during tariff panics, the market is approaching territory where pure yield attraction may face competition from other fixed income sectors.

The refinancing calendar remains supportive with companies like Gray Media successfully addressing near-term maturities, but rising rates add complexity to the equation. Issuers may accelerate refinancing plans to lock in financing before conditions potentially worsen.

The technical picture faces its first real test since the spring rally began. After eleven consecutive weeks of inflows, flow data this week becomes critical in determining whether investors view this as a buying opportunity or reason for caution.

The market delivered a reminder that gravity still exists, even in the most technically supported environments. Whether this proves to be a brief interruption in the rally or the beginning of a more meaningful correction likely depends on how rates behave from here—and whether primary execution can maintain its recent strength despite slightly higher borrowing costs.

Find the most recent JunkBondInvestor posts below

Disclosure: The information provided is based on publicly available information and is for informational purposes only. While every effort has been made to ensure the accuracy of the information, the author cannot guarantee its completeness or reliability. This content should not be considered investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release the author from any liability. Always seek professional advice tailored to your financial situation and objectives.