High Yield Market Weekly: Powell's Jackson Hole Gift...Yields Crater to 40-Month Lows in Summer's Final Act (August 25, 2025)

Fed Easing Signals Meet Summer's End

🚨 Connect on Twitter | Threads | Instagram | YouTube

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list — limited spots.

Summer’s swan song couldn’t have been scripted better. While primary markets took their predictable late-August breather with zero new deals, Powell delivered an early Labor Day gift from Jackson Hole that sent high yield into overdrive. Yields collapsed to a 40-month low of 6.87% as the Fed chair pivoted definitively toward easing, with Friday alone delivering a 17bp yield drop and the strongest single-day gains since May.

The setup was perfect: no competing supply, maximum seasonal calm, and a Fed chair basically promising September rate cuts. High yield gained +0.27% for the week while spreads held dead flat at 279bps, meaning the entire rally came from pure duration effect as Treasury yields plunged. When you eliminate new issue competition and get the Fed pivot you’ve been waiting for, this is exactly what should happen.

The big picture question: with sellside now forecasting as much as $300 billion in junk supply for 2025, can this technical momentum survive the post-Labor Day issuance tsunami?

Continue the discussion at r/leveragedfinance.

Weekly Performance Recap

The absence of primary market noise created ideal conditions for a pure rates rally. Overall HY delivered +0.27% weekly returns, though the leadership patterns revealed subtle divergences:

BBs led the charge at +0.32%, benefiting most from duration as higher-quality credits outperformed

Bs trailed at +0.21%, showing modest underperformance in the middle market

CCCs managed just +0.25%

The underlying technicals painted a picture of relentless compression:

Yields crashed to 6.87%, hitting 40-month lows

Spreads stayed perfectly flat at 279bps, with the entire rally driven by Treasury moves

Friday’s 17bp single-day yield collapse delivered the strongest performance since May as Powell’s dovish pivot took hold

Most notable was the pure interest rate sensitivity driving returns. With spreads unchanged, this was textbook duration play as investors positioned for aggressive Fed easing. BB yields hit lows at 5.80% while CCC yields dropped 20bps on Friday alone to 10.58%.

YTD performance reached fresh peaks: +5.88% overall, with all rating buckets posting solid gains led by CCCs at +5.95% and BBs at +6.18%. The technical momentum remains intact even as fundamental questions multiply.

Primary Market Activity

The complete absence of new supply represented classic late-summer dynamics rather than any structural shift. Zero deals launched, zero pipeline, complete radio silence as issuers took their traditional pre-Labor Day pause. YTD volume sits at $206 billion, still running ahead of last year despite the current lull.

September supply is expected to remain robust driven by strong corporate earnings, attractive all-in yields despite recent tightening, and expectations of Fed accommodation create ideal issuance conditions. When borrowers can still access 7-8% funding costs while Treasury yields are collapsing, the refinancing and M&A activity should accelerate dramatically.

The contrast between this week’s silence and September’s expected surge couldn’t be starker. Smart issuers are using this quiet period to finalize documentation and prepare for what could be one of the busiest months in years once markets reopen after Labor Day.

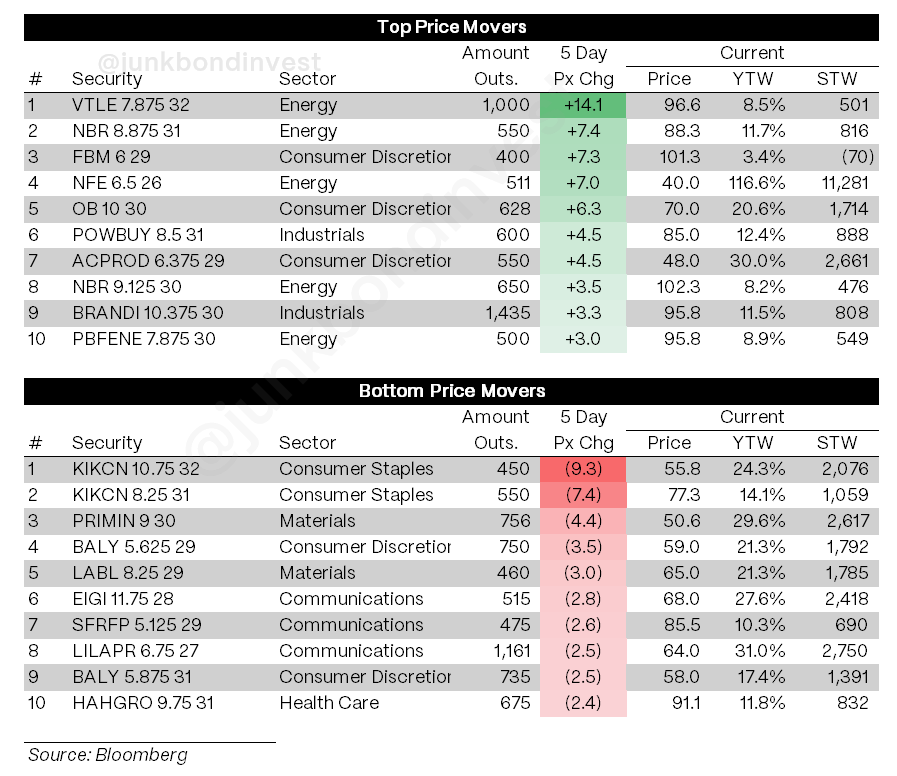

Secondary Market

Looking Ahead

Friday’s Jackson Hole speech represented a meaningful shift in Fed positioning. Powell’s remarks signaled a clear willingness to ease policy as soon as September, driven more by employment concerns than lingering inflation worries. The market’s response was immediate and decisive, with global markets rallying sharply as investors repositioned for US monetary accommodation.

The political backdrop added drama but didn’t derail the economic message. Despite Trump’s continued Fed criticism and the removal of protesters from the conference, Powell stayed focused on data-driven policy decisions. His emphasis on Fed independence while signaling accommodation struck the perfect balance for risk asset investors.

Jackson Hole’s updated policy framework shifts away from the previous emphasis on below-target inflation concerns, refocusing on the Fed’s traditional employment and price stability goals

For credit markets, the implications are clear: lower short-term rates, steeper yield curves, and continued hunt for yield across risk assets. When Fed funds are headed lower while credit spreads sit at bottom end of their historical ranges, the technical setup couldn’t be more supportive.

Expect Another Light Issuance Week

The last week of August typically brings minimal primary market activity as issuers wind down summer operations ahead of the post-Labor Day rush.

This week’s economic calendar includes durable goods orders on Tuesday and personal income and spending data on Friday, which will provide more clarity on the housing and consumer spending trends that have been weighing on growth expectations.

The light issuance environment should continue to support technical conditions. Yields at 40-month lows, spreads near multi-year tights, and Fed accommodation on the horizon create strong support for secondary market performance while primary markets remain quiet.

The real test comes after Labor Day. Summer’s technical rally has been aided significantly by reduced new supply competition. Once issuers return in force with refinancings and new money deals, we’ll discover whether this Fed-driven momentum can absorb heavier volume.

For now, Powell’s Jackson Hole pivot has bought high yield another week of light supply and strong technicals. Whether that momentum survives September’s expected issuance acceleration will determine if this summer’s rally extends into fall or becomes autumn’s reality check.

Find the most recent JunkBondInvestor posts below

Disclosure: The information provided is based on publicly available information and is for informational purposes only. While every effort has been made to ensure the accuracy of the information, the author cannot guarantee its completeness or reliability. This content should not be considered investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release the author from any liability. Always seek professional advice tailored to your financial situation and objectives.