Five9 Inc ($FIVN): Caught Between an AI Dream and Call Center Reality

What the Market’s Missing About Five9’s Next Chapter

🚨 Connect: Twitter | Threads | Instagram | Reddit | YouTube

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list — limited spots.

Nine out of ten investors have never heard of Five9.

But if you’re running a call center, you know exactly who they are. “Contact Center as a Service,” they call it. CCaaS. Everything’s an acronym nowadays.

Five9 is currently stuck in the middle of the biggest question in customer service: will AI kill the call center industry?

On one side, you’ve got the bear case that AI chatbots will replace human agents, shrinking Five9’s addressable market. On the other side, there’s the bull case that AI increases revenue per customer enough to offset any seat reduction. And in the middle? Five9, trading at $25/share, trying to convince everyone that AI is their savior while their core business slows down.

The problem isn’t that AI doesn’t work. The problem is nobody knows whether it works for Five9 or against them.

Here’s what we know: Five9’s AI bookings tripled year-over-year. Here’s what we also know: AI is still only 10% of their enterprise revenue. Management keeps talking about this massive AI transformation while most of their money still comes from old-fashioned human agents answering phones.

Meanwhile, their CEO just announced he’s retiring “to focus on his health.” Nothing says confidence in the AI revolution like the captain jumping ship. Their dollar-based retention rate? Stuck at 108% for four straight quarters, suggesting customers aren’t exactly rushing to buy more AI features.

The converts are trading at 88 cents on the dollar. Smart money is betting Five9 survives the AI transition but doesn’t thrive from it. At 4.6% yield to maturity, you’re basically buying treasuries with a tiny chance of upside.

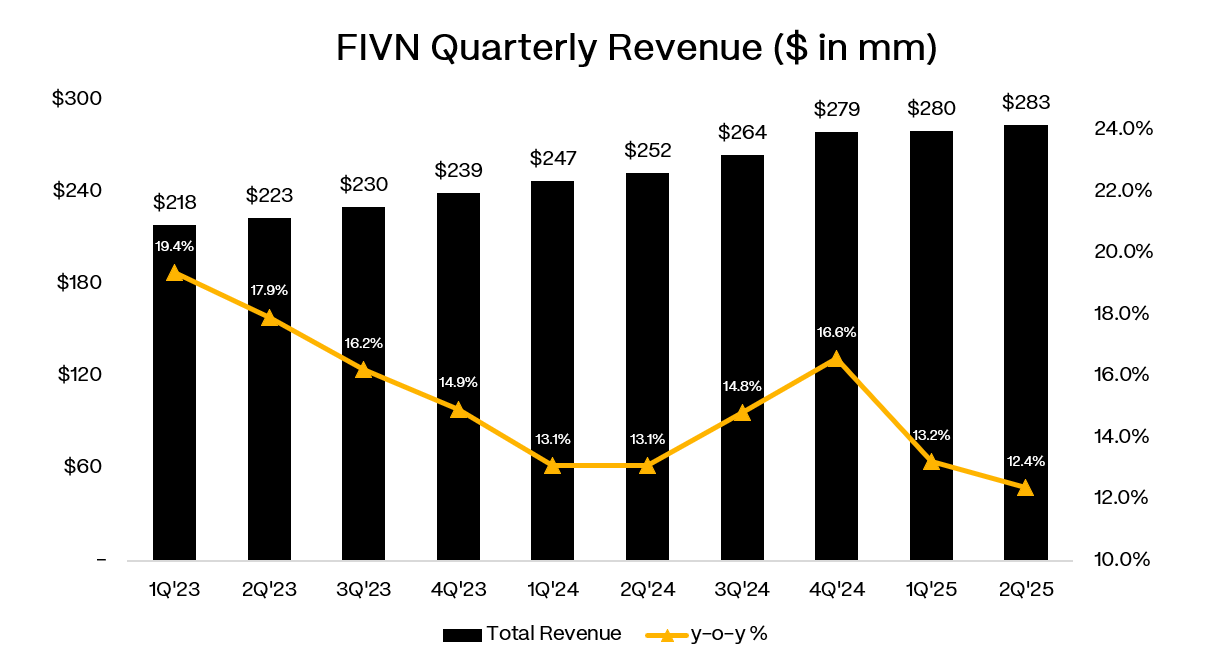

Meanwhile, the stock trades at 8.3x EBITDA. For a company growing 12% a year while claiming to ride the biggest technology wave since the internet, that’s either a bargain or a warning.

The market has spoken, and it’s pricing in a lot of uncertainty about which way the AI story goes.

Background

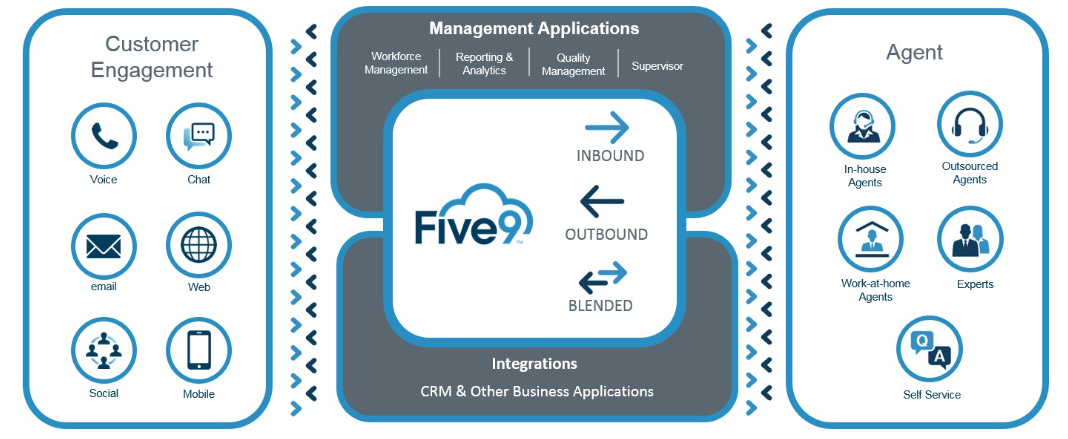

Five9 runs call centers in the cloud.

That’s it. That’s the business. When you call customer service and get routed to the right agent, when your call gets recorded for “quality assurance,” when a chatbot tries to help you before connecting you to a human…that’s what Five9 builds.

Twenty years ago, every company had to buy expensive hardware and software to run their call centers. Servers in closets, phone systems that cost millions, IT teams to keep it all running. Five9 said forget all that, we’ll run it for you in the cloud. Pay per seat, per month. No hardware, no headaches.

It was a great idea at exactly the right time.

The company went public in 2014, riding the wave of everything moving to the cloud. While Salesforce was doing it for sales and Workday was doing it for HR, Five9 was doing it for customer service. They grew like crazy because the value proposition was obvious: why own a call center when you can rent one?

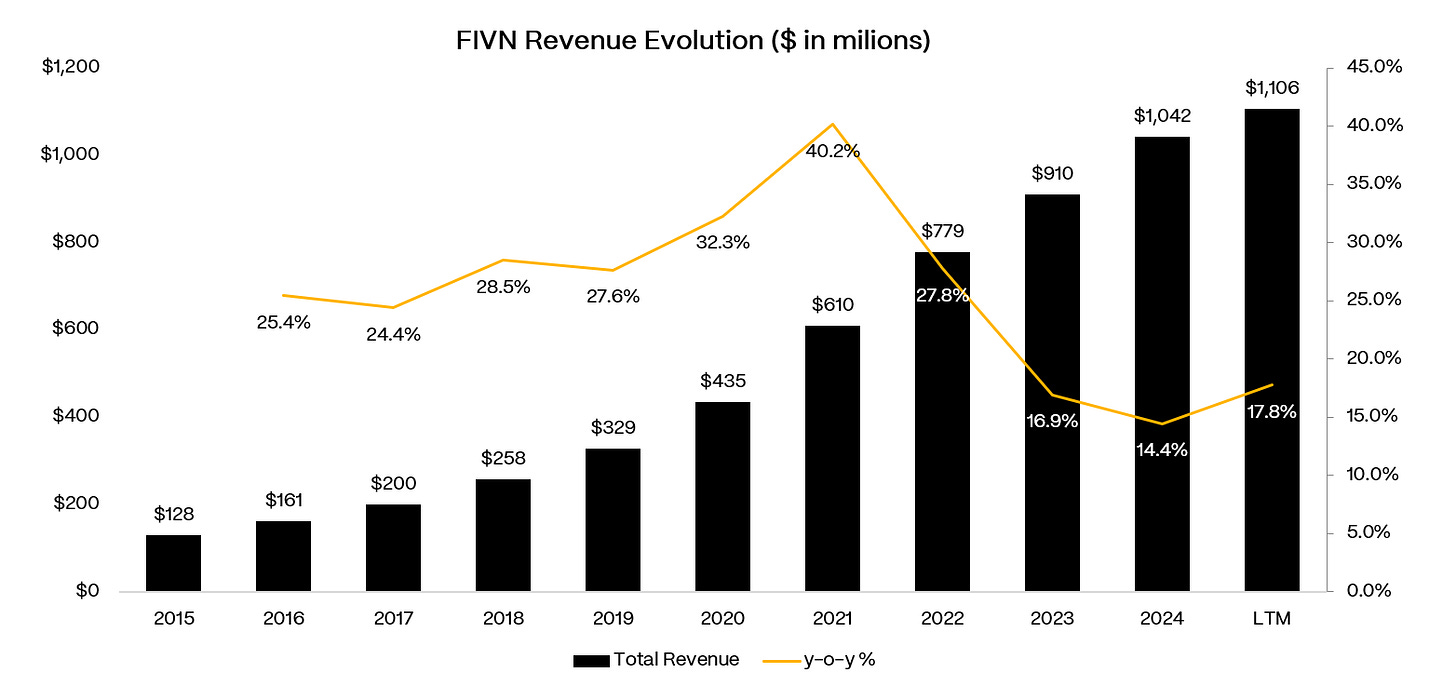

For years, it worked beautifully. Five9’s growth actually accelerated through the late 2010s, peaking at 40% in 2021 as remote work made cloud contact centers essential. Even as hyperscalers like Amazon Connect, Microsoft Teams, and Google entered the market, Five9 kept winning because they were the pure-play specialist.

But then the easy wins ran out.

By 2022, most companies that wanted to move to the cloud had already done it. What was left were either massive enterprise deals that took forever to close, or small companies that didn’t move the revenue needle. The low-hanging fruit was gone.

Then the macro environment turned ugly. Interest rates spiked, tech budgets got slashed, and enterprise software spending came under intense scrutiny. The “growth at any cost” era ended overnight. Suddenly every software purchase required three levels of approval and a detailed ROI analysis.

At the same time, artificial intelligence started creating uncertainty about the future of contact centers altogether. Why invest in a big contact center migration when AI might eliminate half your agents in two years? Customers began delaying decisions, waiting to see how the AI story played out.

Five9 got hit by a perfect storm: market saturation, macro headwinds, and technological disruption all at once. The growth deceleration from 40% in 2021 to 12% today wasn’t caused by any single factor, it was the inevitable result of a maturing company facing multiple headwinds simultaneously.

Today Five9 finds itself in the dreaded middle.

They’re too small to compete on price. They’re too big to pivot like a startup. They’ve got 211 customers paying over $1 million a year…that’s real business. But they also have a problem: their best customers are exactly the ones most likely to get poached by hyperscalers offering “free” AI features.

The company’s response? Double down on artificial intelligence.

They’re pushing AI agents, AI-powered routing, AI everything. The pitch is simple: sure competitors have cheap compute, but Five9 has twenty years of call center data to train better AI models. AI bookings tripled year-over-year, but it’s still only 10% of enterprise revenue. The AI story is real but tiny.