High Yield Market Weekly Minutes: Bad News, Great Rally...Employment Miss Locks in Fed Cuts (September 9, 2025)

When Bad News Becomes the Best News

🚨 Connect on Twitter | Threads | Instagram | YouTube

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list — limited spots.

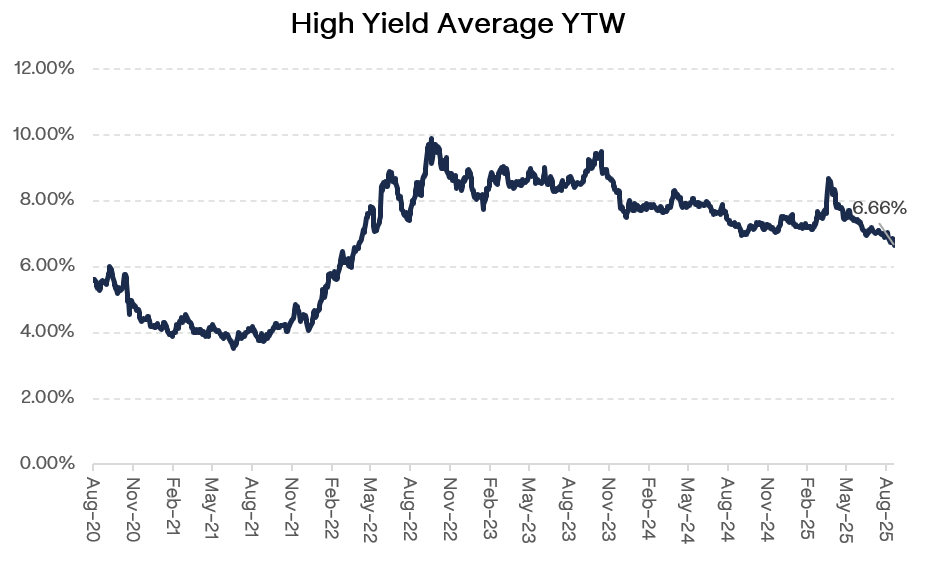

Sometimes the market gets exactly what it wants, even when the news is terrible. Friday’s payrolls barely registered at 22,000 against forecasts of 75,000, virtually sealing the case for a September 17th rate cut. The result? High yield celebrated with +0.32% weekly gains while yields dropped another 9bps to 6.66%, hitting fresh multi-year lows.

But here’s what made this week truly remarkable: after two weeks of silence, the primary market reopened with almost $10 billion of issuance. Deals ranged from Sunoco’s $1.9 billion M&A financing to Cleveland-Cliffs, which nearly doubled the size of its offering. Tallgrass Energy increased its refinancing to $700 million, while Lithia Motors and Marriott Vacations also priced smoothly. When that kind of supply can clear the market while yields keep grinding lower, you are looking at pure technical demand.

The investor sentiment reversal was equally striking. After several weeks of outflows, high yield funds finally saw fresh inflows as the weak jobs print reinforced confidence in Powell’s dovish turn. That is classic momentum behavior, but it also shows how completely the rate cut narrative has captured psychology.

The bigger question: with markets now expecting about 72bps of Fed easing by December and yields sitting at 2022 levels, how much more fuel does this rally really have?

Continue the discussion on Reddit at r/leveragedfinance.

Weekly Performance Recap

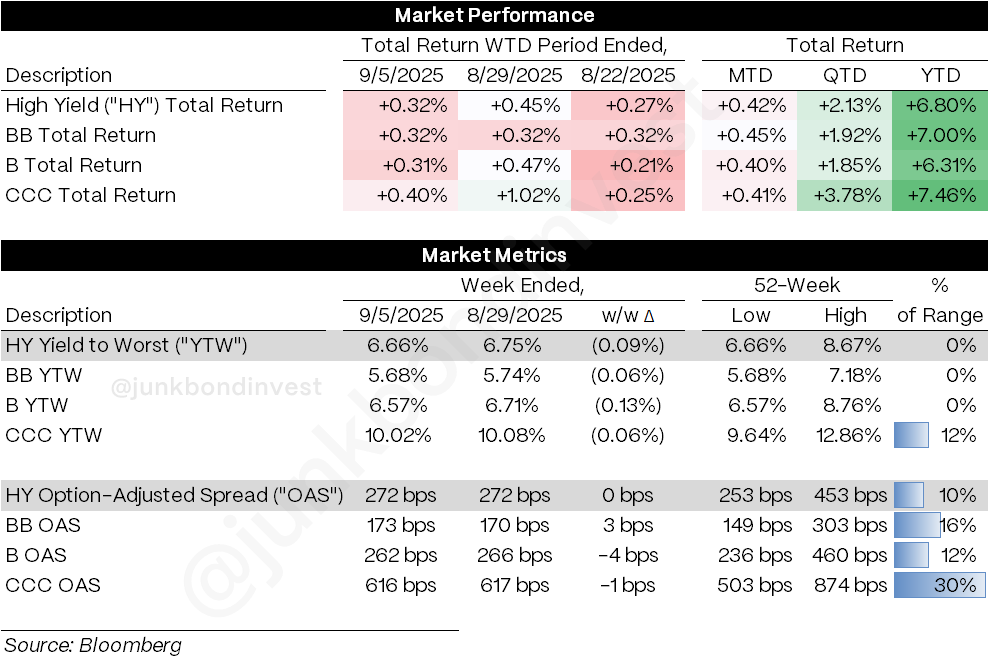

The first full week of September delivered broad-based gains driven entirely by rate cut expectations. Overall HY advanced +0.32% for the week, with notable uniformity across credit quality:

CCCs led at +0.40%, capitalizing on their longer duration profile as yields fell 6bps to 10.02%

BBs and Bs both gained +0.32% and +0.31% respectively, demonstrating widespread participation in the rally

Yield compression drove the entire move, with overall HY yields declining 9bps to 6.66% and approaching early 2022 levels

The spread dynamics revealed important nuances beneath the surface rally:

Overall spreads stayed flat at 272bps, confirming this was a pure rates play rather than credit improvement

BB spreads actually widened 3bps to 173bps despite strong price performance, suggesting new issue pressure

B spreads compressed 4bps to 262bps while CCC spreads barely budged at 616bps

The divergence between returns and spread movement tells the real story. BBs delivered solid gains while spreads widened, indicating duration effects overwhelmed credit concerns. Meanwhile, Bs saw both price appreciation and spread tightening, suggesting different supply-demand dynamics across rating segments.

The fund flow reversal captured the week’s sentiment shift perfectly. After weeks of redemptions, high yield funds attracted significant inflows as investors raced back in following the employment disappointment

Primary Market Activity

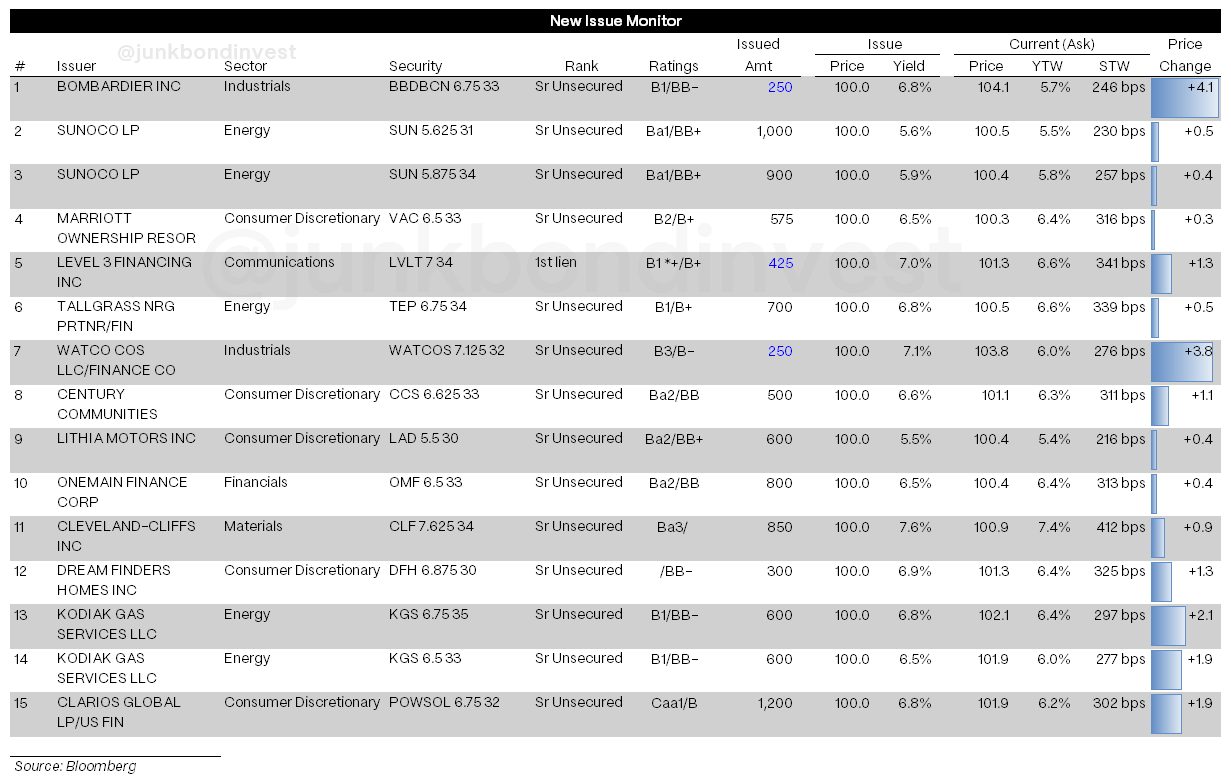

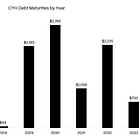

The post-holiday calendar delivered $9.6 billion of new US dollar deals, the busiest week since June. Issuance spanned sectors:

Energy: Sunoco’s $1.9 billion dual-tranche for its Parkland acquisition; Tallgrass Energy refinancing upsized to $700 million at 6.75%

Consumer/Industrial: Lithia Motors priced $600 million at just 5.50% for BB-rated paper; Cleveland-Cliffs lifted its deal to $850 million at 7.75%

Housing/Hospitality: Marriott Vacations raised $575 million at 6.50% for refinancing; Century Communities and Dream Finders Homes tapped the market as well

Execution was excellent. Most deals priced at or inside guidance, many were upsized, and secondary trading was stable. That tells you the demand pool is still deep.

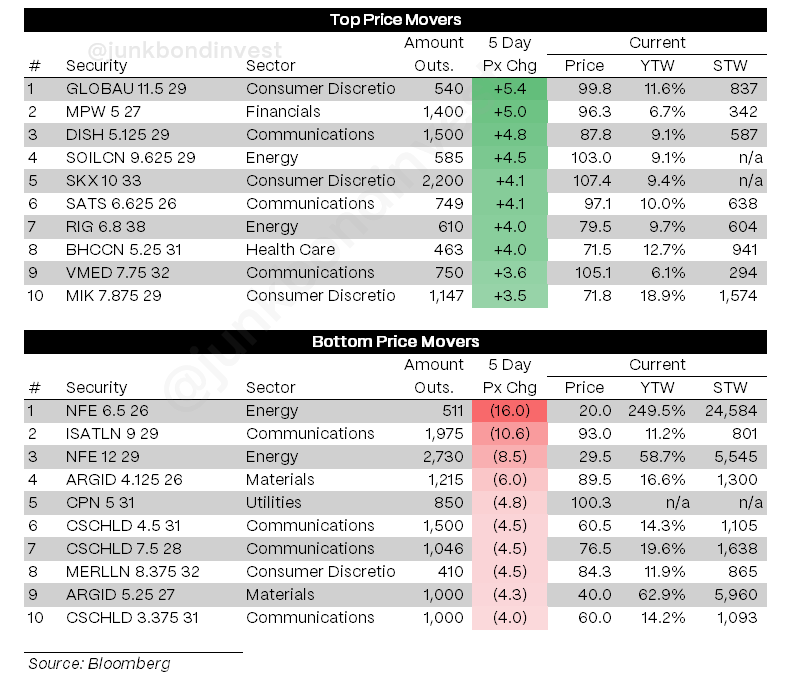

Secondary Market

Looking Ahead

Friday’s jobs report marked a decisive shift in monetary policy outlook. The 22,000 payroll increase significantly undershot forecasts and validated the labor market concerns Powell emphasized at Jackson Hole. Downward revisions to prior months compounded the weakness, showing hiring has decelerated to historically low levels.

Rate cut probabilities immediately reset, with September easing moving to near-certainty and total expected accommodation through year-end reaching ~72 bps. Treasury yields dropped sharply across the curve, providing the foundation for high yield’s duration-driven performance.

Unemployment climbing to 4.3% places it at the upper boundary of what Fed officials consider consistent with maximum employment. The broader U-6 underemployment measure continued rising, suggesting more comprehensive labor market stress beyond headline figures.

This creates optimal conditions for credit markets: employment weakness justifies Fed accommodation while corporate fundamentals remain relatively stable. Provided job market softening doesn’t trigger widespread credit deterioration, high yield can benefit from both lower base rates and continued yield-seeking behavior.

Fed Decision Week Approaches

Next week’s September 17th FOMC meeting now carries enormous significance, with 25bp easing virtually assured following Friday’s employment miss. The critical question centers on Powell’s forward guidance and whether the Fed signals more aggressive action ahead.

Mid-week inflation releases could influence Fed messaging. Wednesday’s PPI and Thursday’s CPI data will show whether price pressures are moderating, helping determine if the Fed can focus primarily on employment objectives or must balance competing dual mandate concerns.

Primary issuance should stay active, with another ~$8 billion projected this week. Companies want to lock in attractive terms before yields fall further. Technicals remain strong with inflows resuming and dealer balance sheets manageable.

The risk few are talking about: if job losses accelerate, the cuts that feel like good news now could morph into a warning sign. Historically, aggressive Fed easing tied to employment weakness has been a bad signal for credit. For the moment, though, investors are happy to ride the rally.

Find the most recent JunkBondInvestor posts below

Disclosure: The information provided is based on publicly available information and is for informational purposes only. While every effort has been made to ensure the accuracy of the information, the author cannot guarantee its completeness or reliability. This content should not be considered investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release the author from any liability. Always seek professional advice tailored to your financial situation and objectives.