High Yield Market Weekly Minutes: Regional Banks Panic, High Yield Yawns...Then Rallies (October 20, 2025)

A Brief Recap of Last Week’s High Yield Market Performance

🚨 Connect on Twitter | Threads | Instagram | YouTube

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list — limited spots.

TL;DR

High yield up +0.47% despite bank-fraud headlines. Yields -20 bps to 6.79%, OAS -11 bps to 293. CCCs lag on spread basis (rates did the work). TeraWulf prints a $3.2bn, 3x-covered, sole-book green deal (MS). Public HY = fine. Private credit = noisy.

Regional banks sold off last Thursday on fraud-related headlines. High yield rallied +0.47% anyway.

Index yields fell 20 bps to 6.79% while spreads compressed 11 bps to 293 bps, cutting last week’s -0.73% loss roughly in half. Zions flagged roughly ~$60 million tied to alleged fraud on two commercial credits, and Western Alliance had litigation headlines related to allegedly fraudulent lending to commercial mortgage funds. The credit market barely blinked. By Friday both stocks had retraced most of the drop as investors concluded the exposure was contained.

On the primary tape, TeraWulf’s $3.2 billion print pulled in more than $10 billion of demand. A crypto miner funding AI data centers just delivered the largest US high yield sole-book since the RJR Nabisco era, and Morgan Stanley ran it solo. It is the first crypto company to tap US HY for data center expansion, structured as five-year green bonds, and it cleared around 3x subscribed. That tells you where sponsorship is strongest right now: anything tethered to AI infrastructure.

Underneath that demand is simple math: cheaper debt, lot of cash waiting to deploy, and syndicate appetite to match. That same setup is what makes large LBOs feasible again. In case you missed it, I broke down three LBO candidates where the EA playbook could repeat. Read it here:

Meanwhile, Jamie Dimon warned about cockroaches in private credit, and Blue Owl’s Marc Lipschultz told banks to check their own books first. The back and forth dominated headlines all week, but the tape did not care. When the loudest voices argue on TV and spreads grind tighter anyway, real money is not nervous.

Weekly Performance Recap

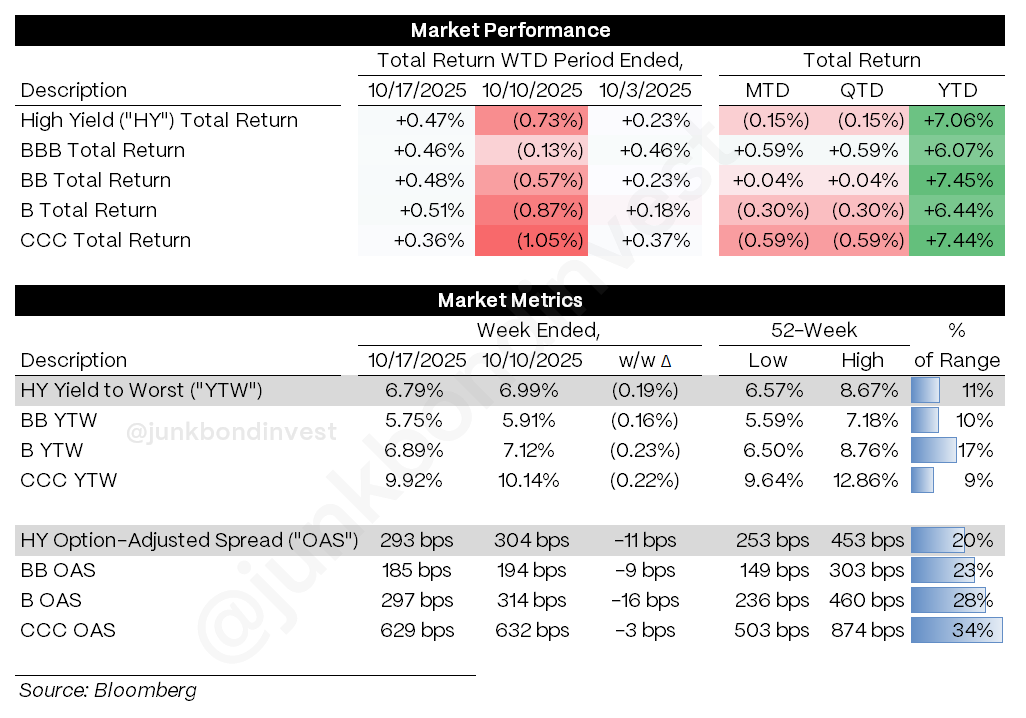

Overall HY delivered +0.47% with quality divergence becoming more apparent:

Bs led at +0.51%, +6.44% YTD

BBs gained +0.48%, +7.45% YTD

CCCs returned +0.36%, +7.44% YTD

Yields moved hard. Index YTW dropped 20 bps to 6.79%. Single-Bs fell 23 bps to 6.89%, BBs down 16 bps to 5.75%, CCCs declined 22 bps to 9.92%. CCCs stayed just under 10% after last week’s brief spike above that line, which fits a rates-led rally rather than a chase into the riskiest cohort.

Spreads told a different story than total returns. Overall OAS compressed 11 bps to 293 bps. Single-Bs led with 17 bps of tightening to 297 bps. BBs narrowed 9 bps to 185 bps. CCCs barely moved at 3 bps to 629 bps.

That CCC lag on spread confirms this was duration doing the work, not buyers getting aggressive on the lowest quality. October is still ugly though. Month-to-date and quarter-to-date both at -0.15%. The year’s gains have stalled for now.

Primary Market Activity

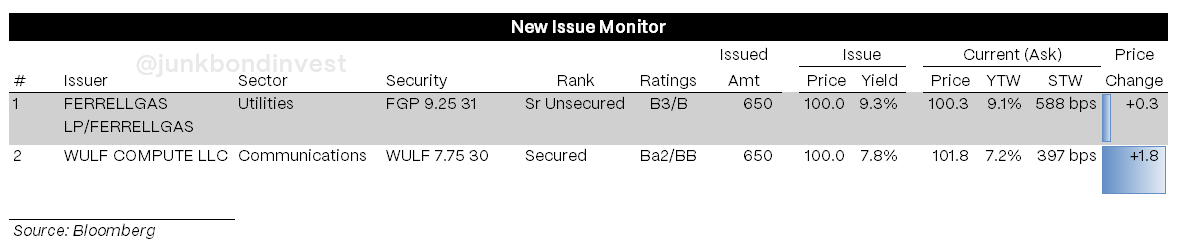

Light calendar, but TeraWulf dominated. The $3.2 billion five-year green bonds due 2030 priced at 7.75% with Morgan Stanley as sole lead. Orders topped $10 billion, underscoring that AI-infrastructure adjacency commands real demand even when the issuer’s core business is crypto mining.

This was not garden-variety crypto risk. The story was framed around building data center capacity for AI compute. That matters. It is the first US HY deal by a crypto company for data center build-out, and it worked. Expect more issuers to copy this playbook if prints like this keep clearing.

The sole-book angle matters on its own. Morgan Stanley running a $3.2 billion HY book alone is a throwback in size and conviction. It signals confidence in both the credit and the broader theme.

Ferrellgas was the other notable US print. The propane distributor priced $650 million 2031s at 9.0%, wider than 8.50-8.75% talk. Selectivity is creeping in at the lower end even as higher-quality paper sails through. Proceeds address 2026 maturities at a still-attractive refi level despite the concession. I wrote about the company last July; time for a refresh.