High Yield Market Minutes: Record Supply Meets Tighter Spreads (June 9, 2025)

Spreads Tighten 15bps Despite Busiest Week in 12 Months

🚨 Connect on Twitter | Threads | Instagram | Bluesky | Reddit

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list — limited spots.

How’s that “wait for better levels” strategy working out for you?

High yield just posted its 8th straight winning session while swallowing a historic $13 billion in new issue paper, making it the busiest week in a year. The punchline that’ll surprise even the optimists? Spreads compressed another 15bps to 300bps during this supply deluge. Anyone sitting on cash waiting for “better entry points” just watched another opportunity slip by.

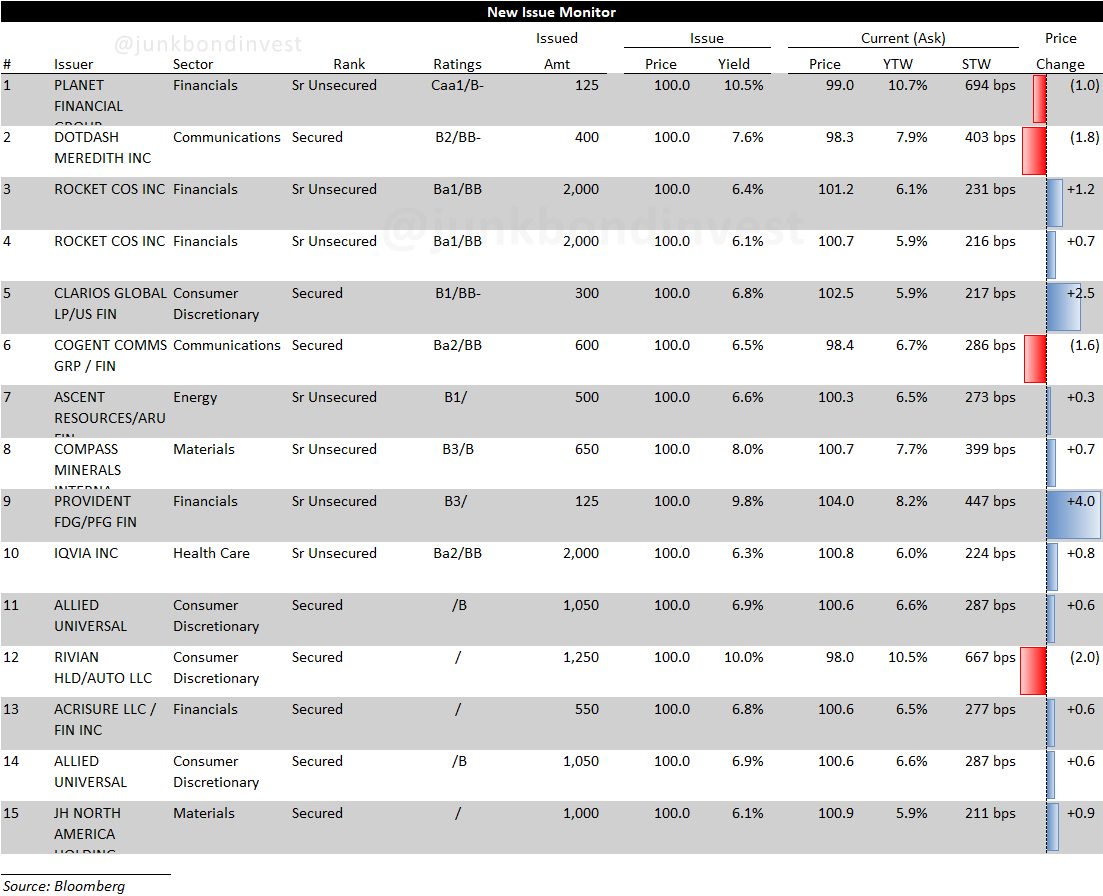

Primary issuance execution was remarkably smooth. Rocket Companies’ $4 billion refinancing didn’t just get done, it got absolutely mobbed, pricing at the tight end of talk and trading above 101 immediately. When you can execute a deal that size that’s multiple times oversubscribed during the busiest week in a year, it signals genuine market strength that’s hard to ignore.

However, not every deal found smooth sailing. Several new issues including Rivian, Dotdash Meredith, and Cogent traded down on the break, with Rivian’s debut green bonds dropping two points to 98 despite pricing at par with a 10% yield. The EV maker’s cash burn and broader concerns about plans to eliminate EV tax credits weighed on secondary performance, highlighting that even in a euphoric market, if your story stinks, investors will still walk away.

Meanwhile, fund flows continued their supportive trend. The 6th consecutive weekly inflow demonstrated sustained investor appetite for the asset class, with ETFs maintaining their dominant role in driving demand.

But here’s what should give everyone pause: Friday’s stronger-than-expected jobs report sent Treasury yields surging and crushed rate-cut expectations, yet high yield barely reacted. When a market can maintain stability during the biggest supply week in a year while rates are rising, you’re either witnessing exceptional technical support or watching a setup for future volatility.

Something’s got to give. The question is what will be first.

Weekly Performance Recap

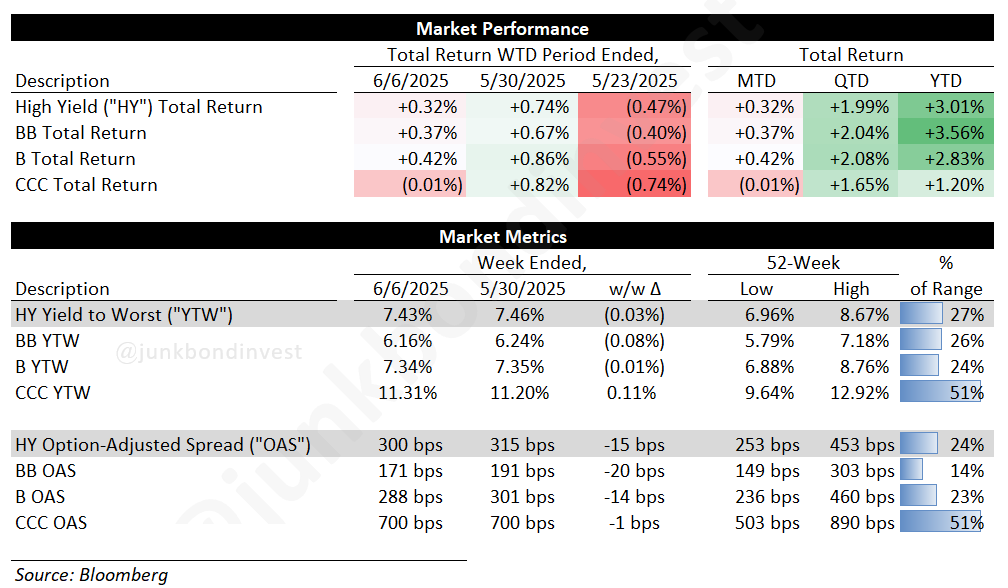

The numbers showcase a market firing on all cylinders despite massive new supply. Overall HY gained +0.32% for the week, maintaining momentum across most rating categories:

BBs advanced +0.37%, extending their winning streak to eight sessions with +2.04% QTD performance

Bs climbed +0.42%, showing resilient demand for mid-tier credit with +2.08% QTD gains

CCCs stumbled slightly at -0.01%, the only rating bucket to pause amid the broader rally, though still positive at +1.65% QTD

The overall picture remained constructive despite rate headwinds:

Overall index yields edged down 3bps to 7.43%, holding near three-month lows at 27% of the 52-week range

Spreads compressed 15bps to 300bps, with BBs leading the tightening at -20bps to 171bps

B spreads narrowed 14bps to 288bps, while CCCs held steady with minimal movement

Primary Market Activity

Most remarkably, the market absorbed $13 billion in new supply while still posting positive returns, demonstrating the extraordinary depth of the current technical bid. The fact that spreads tightened during the busiest issuance week in 12 months speaks to demand dynamics that are approaching historic proportions.

Rocket Companies commanded attention with a massive $4 billion two-tranche refinancing, split between 5-year and 8-year maturities, drawing $10 billion in orders and trading above 101

Rivian Automotive made its high-yield debut with $1.25 billion of green bonds at 10% yield, fully refinancing their floating-rate second-lien notes due 2026

IQVIA Inc brought $2 billion of seven-year senior notes at 6.25%, using proceeds to repay revolver borrowings

Allied Universal completed another $1.05 billion secured refinancing at 6.875%, redeeming their 9.75% notes due 2027

Multiple other issuers including Dotdash Meredith, Acrisure, and Planet Financial rounded out Thursday’s massive $5+ billion single-day volume

The execution quality remained exceptional despite the volume surge. Most deals priced at or through guidance, with several trading up immediately in the aftermarket.

Secondary Market Dynamics

The sector breakdown revealed clear winners and losers in the new paradigm:

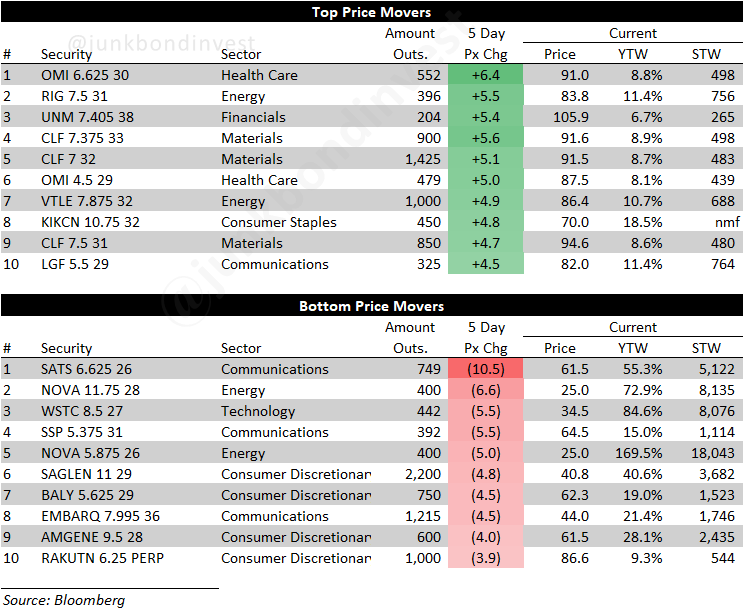

Healthcare and materials dominated the top performers, with OMI bonds surging +6.4 points and multiple CLF issues gaining 4-5+ points on steel tariff benefits

Energy sector found broad support with multiple names posting solid gains as Venture Global broke ground on a $28 billion LNG project

Communications sector continued its nightmare, with SATS plunging -10.5 points after electing not to pay $326 million in coupon payments on spectrum bonds

Consumer discretionary showed mixed results, with some distressed names like SAGLEN declining while others found support

Technology names faced pressure from rate concerns, though the sector held up better than expected given Friday’s Treasury selloff

Looking Ahead

This week brings critical inflation data that could reshape the rate outlook:

Wednesday’s CPI report will test whether tariff pressures are feeding through to consumer prices

Thursday’s PPI data will show if producer price pressures are building after April’s sharp decline

Both reports come as Friday’s jobs data already reduced July rate-cut expectations significantly

The economic data is flashing warning signs while credit markets keep partying. ISM Manufacturing just posted its 4th straight monthly decline, falling deeper into contraction territory as tariff chaos destroys order visibility. ISM Services contracted for the first time in nearly a year, with new orders hitting multi-year lows. Export orders across both surveys reached concerning levels that haven’t been seen in years.

Construction spending has fallen for three straight months because—surprise!—high rates actually matter when you’re building things. Meanwhile, the trade deficit is shrinking fast as that tariff-driven import binge finally reverses. Net exports might actually help Q2 GDP, which is about the only good news in this economic picture.

Here’s the uncomfortable truth: Strong demand keeps absorbing every deal that hits the market. But when spreads are at 300bps, primary volume is at record levels, and economic data looks increasingly problematic, something doesn’t add up.

The market’s ability to keep this juggling act going gets tested real soon. Because when the music stops, there won’t be enough chairs for everyone.

Find the most recent JunkBondInvestor posts below

Disclosure: The information provided is based on publicly available information and is for informational purposes only. While every effort has been made to ensure the accuracy of the information, the author cannot guarantee its completeness or reliability. This content should not be considered investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release the author from any liability. Always seek professional advice tailored to your financial situation and objectives.