Monday Morning Minutes: Last Week’s HY Market Recap

A Brief Recap of Last Week's High Yield Market Performance

🚨 Connect with me on Twitter / Instagram / Threads | Estimated Read Time: 7 Minutes

I’m going to try something new. In addition to my weekly credit/stock write-ups, I’m going to send out a HY market recap first thing Monday morning to all subscribers. I’ll keep this brief and focused on the information that you might actually care about, supported with concise visuals.

If there’s anything specific you’d like me to include, let me know. Or, if this is something you wouldn’t be interested in and/or find redundant, please also let me know. Would appreciate any feedback, comments, or suggestions.

Weekly Performance Recap:

The HY market continued its positive momentum last week, building on strong YTD performance. For the week ended August 16th, the overall index returned +0.77%, with spreads compressing by 20bps to 319bps. This strong performance has been driven by expectations of Fed rate cuts, improved economic data, resilient high yield corporate earnings, and continued inflows into the asset class.

The overall yield to worst (YTW) for the HY market now stands at 7.47%, down 25bps from 7.72% at the start of the year and 83bps tighter than the wides (8.30%) seen in April 2024. This compression in yields reflects both the rally in treasuries and the tightening of credit spreads. The index YTW is now at its tightest level over the past year, although spreads are still moderately wider vs. their 52-week lows.

Despite underperforming in the month of August, CCCs rebounded sharply last week, up +1.12%. CCC yields have now decreased for 8 consecutive sessions, bringing YTD returns to +6.47% (remember everyone was “moving up in quality” last year?) However, it’s important to highlight that there remains significant dispersion within the CCC space with huge bifurcation between performing and distressed paper.

Interesting Sharable Stats:

Last week marked the 1st time in 3 months that all HY rating categories (BB, B, and CCC) simultaneously posted positive weekly returns

The 31bps tightening in CCC spreads is the largest weekly tightening since March 2024

At 7.47%, the HY YTW is at its lowest level since December 2023

The % of bonds trading above par (i.e., 100) increased to 29% vs. 25% last week

The duration of the HY index (3.0 years) is at its lowest level in the last 4 years

Primary High Yield Market:

Despite the typical August slowdown, last week’s primary market saw a surge in activity, with volumes reaching $9.4 billion across 11 tranches. This unexpected increase, up from the prior week’s $7 billion, was fueled by reports of cooling inflation and higher retail sales, bolstering hopes for a soft economic landing. The energy sector dominated the offerings, departing from the more diverse sector representation of previous weeks.

This robust activity has pushed MTD volumes to $17.8 billion, marking a 3-year high for August issuance. Additionally, high yield bond issuance now stands at $203 billion YTD. Historically, the primary market is set to experience a summer lull, with no new issues typically priced after August 18 since at least 2016, barring the exceptional years of 2020 and 2021. However, this year’s strong performance has bucked the trend, showcasing healthy new issuance in the typically quiet month of August.

As the market drifts into its late-summer lull, all eyes are on September, a month known for its volatility. Issuers are expected to aggressively tap the markets after Labor Day, aiming to complete deals well ahead of the presidential election in November.

Notable deals last week included:

JetBlue Airways (B+/B1/BB-) issued a comprehensive $3 billion debt package, including $2 billion of senior secured notes due 2031 (upsized from $1.5 billion), a $765 million term loan, and $400 million of convertible notes. The secured notes priced at 99.363 to yield 9.875%; However, the bonds have traded down to 98.6 post-issuance, highlighting investor caution around the airline sector.

Shift4 Payments (Ba3/BB) placed $1.1 billion of 6.75% senior unsecured notes due 2031 at par. Proceeds were earmarked to repay outstanding convertible notes and existing senior notes. The bonds traded up to 102 post-issuance.

Arcosa Inc. (B+/Ba3) priced $600 million of 6.875% senior notes due 2032 at par. The bonds cleared at the tight end of 7% area talk, and tight of 7-7.25% initial price talk. The bonds traded up to 102.25 post-issuance.

Midcontinent Communications (B+/B3) upsized its offering to $650 million of 8% senior notes due 2032, from an initial $400 million. The bonds priced at par, at the wide end of 7.875% area guidance. The bonds traded flat to slightly up at 100.5 post-pricing.

Prime Healthcare Services (B-/B3/B) increased its secured notes offering to $675 million from $500 million, priced at 9.375%. The upsizing led to the cancellation of a planned $500 million term loan B. The bonds traded slightly up post-issuance.

Interesting Stats:

New issue volume over the past week totaled $9.4 billion, the highest amount for this period since November 2021.

Non-refinancing deals accounted for 48% of issuance, a significant increase from the 24% share seen earlier this year.

CCC-rated issuance was notably absent last week, though the YTD share for CCC bonds has improved to 8%, up from 5% last year but still below the 14% average of the previous 5 years.

MTD volumes reached $17.8 billion, with the WTD figure standing at $9.4 billion. This puts August on track to potentially surpass the $30 billion mark, a level not seen in August since 2016.

Secondary Market:

Trading activity in the secondary market was relatively muted last week as investors focused on key economic data releases, particularly Wednesday’s inflation print. CPI came in at its lowest annual level since spring 2021, fueling Fed rate cut bets. Surprisingly strong retail sales data tempered concerns about an economic slowdown.

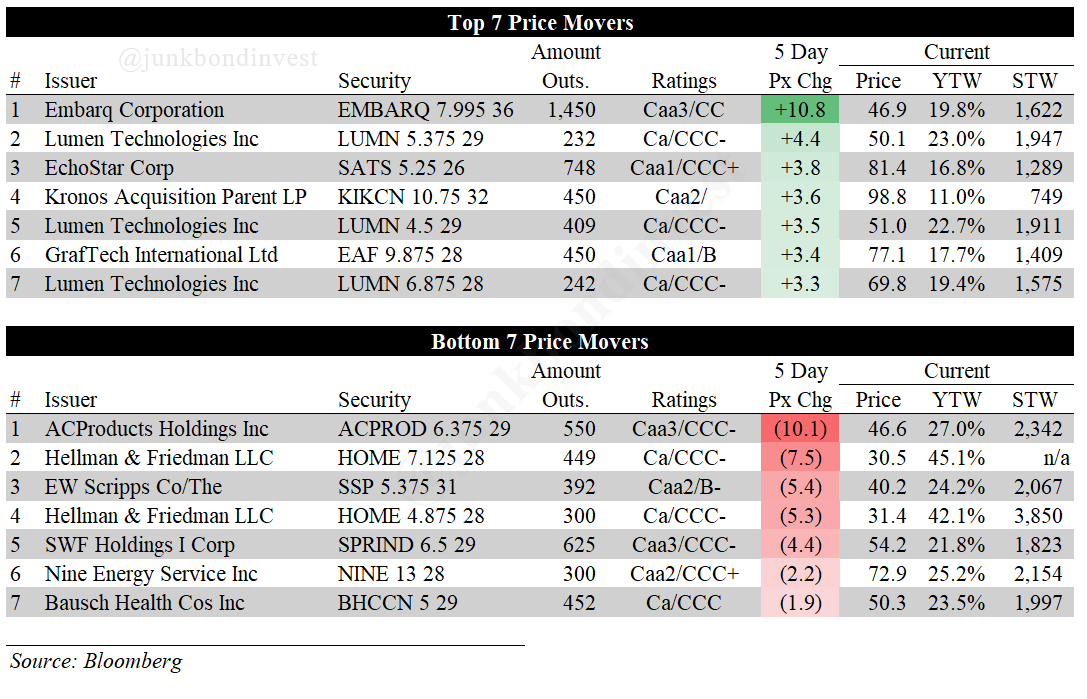

Notable price movers last week included:

Lumen Technologies ($LUMN): Bonds continued to rally after the company announced it had secured $5 billion in new business driven by AI demand. Management emphasized the potential of their new Private Connectivity Fabric (PCF) division during the earnings call, suggesting it could help “self-fund” future investments. However, Q2’24 results showed continued revenue and EBITDA declines. Despite near-term challenges, the market appears to be pricing in potential long-term benefits from AI-driven demand.

Brightspeed ($EMBARQ): The company’s bonds (assumed from Lumen) rallied following news of a comprehensive restructuring involving senior lenders. These legacy bonds do not appear to be part of the transaction.

Victoria’s Secret ($VSCO): Bonds gained last week as the company announced the appointment of Hillary Super as the new CEO. Super brings nearly three decades of retail merchant expertise, most recently serving as CEO of Savage X Fenty. The company also released preliminary Q2 results, indicating performance at the top end of previous guidance for revenues and earnings.

GrafTech International ($EAF): Bonds remained under pressure as the company reported continued challenges in the graphite electrode market. Q2’24 net sales decreased 26% y/y to $137 million. However, management highlighted sequential improvements in key metrics and cost reduction efforts. While near-term headwinds persist, the company remains optimistic about long-term growth driven by increased adoption of electric arc furnace steelmaking and potential demand from the EV battery market

E.W. Scripps ($SSP): Bonds traded lower following mixed Q2 results. While local media segment revenue grew 4% y/y, the Scripps Networks segment saw a 10% decline, worse than expected. However, the company raised its full-year political advertising revenue guidance to $270-$290 million, citing record expected levels. Management also emphasized ongoing efforts to reduce debt, including potential asset sales of Bounce TV and certain real estate.

Find the most recent JunkBondInvestor posts below

Disclosure: The information provided is for informational purposes only and should not be considered as investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release me from any liability. Seek professional advice tailored to your financial situation and objectives.

I love this. This is great. Please keep doing this. It will be very helpful if markets get ugly.

I love this - a great recap to the prior week with some data points either I wasn’t paying attention to, or forgot altogether. Really like the format of the supporting tables as well.