Can Private Credit Save WildBrain Ltd ($WILD.TO)?

Hollywood Strikes, Debt Challenges, and the Role of Private Credit in WildBrain’s Potential Rebound

🚨 Connect with me on Twitter / Instagram / Threads | Estimated Read Time: 19 Minutes

💡 Got a credit long/short idea to share? I’m open to hearing your pitch and having you publish— drop me a message!

🚀 We’re expanding! Interested in part-time or internship opportunities? Get in touch!

WildBrain Ltd. is an interesting leveraged equity situation that recently caught my eye. Some of you in the leveraged finance community may be familiar with this company as it was formerly known as DHX Media. On July 23, 2024, the company announced a new private credit financing solution, typically uncommon for publicly traded companies. But this is a TSX-listed company after all so perhaps an important distinction! Anyways, this recent action catalyzed significant upward price movement in its stock as an important overhang was now removed. In this post, I’ll explore and try to understand what private credit saw in this otherwise challenged and highly leveraged business.

Situation Overview:

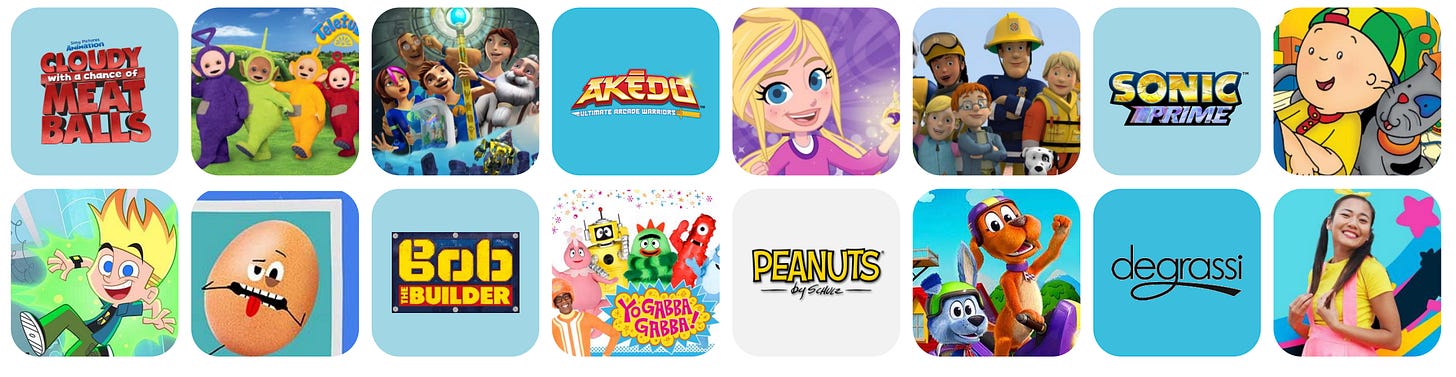

Founded in 2004, WildBrain Ltd. (“WILD”) is an independent Canadian content production and distribution company. WILD’s primary focus is on developing and monetizing high-quality children’s programming, which it distributes through various channels such as streaming, linear TV, and advertising-based video on demand (AVOD). The company’s owned library comprises ~13,000 half-hours of programming and includes brands like Peanuts (41% owned), Inspector Gadget, Teletubbies, and Strawberry Shortcake. The company additionally generates revenue through consumer products licensing related to its intellectual property.

Hollywood Strikes and Production Disruptions

While the period following the initial stages of the COVID-19 pandemic proved to be a boon for WildBrain, the company has recently faced significant headwinds due to the Actors’/Writers’ Hollywood strikes in 2023. These disruptions impacted the company’s production schedules and content pipeline, while a higher cost of capital led streamers to reduce content investment, focusing instead on profitability. Moreover, the slower-than-expected return to normalcy has led management to revise guidance and adjust near-term growth expectations as the industry gradually stabilizes.

To illustrate the impact of these industry-wide issues, in Q3’24 (quarter ended March 31), WILD’s revenues dropped 29% y/y to $100 million, with Adj. EBITDA was down 40% y/y to $20 million.

Debt-Fueled Expansion and Resulting Leverage

It’s worth noting that in the years leading up to 2020, WildBrain embarked on an aggressive expansion strategy, largely fueled by debt-funded acquisitions. This approach significantly increased the company’s leverage, leaving it vulnerable to industry headwinds and economic shocks. The elevated debt levels have since become a persistent challenge for the company, with management consistently emphasizing their commitment to deleveraging. As of Q3’24, WildBrain’s company-reported leverage ratio stood at 4.97x, up from 4.45x at the end of Q2’24, underscoring the ongoing struggle to improve its balance sheet in the face of operational challenges. These leverage concerns have historically weighed on the company’s outstanding convertible debentures.

Efforts to Address Financial Challenges

To address its debt burden and improve its balance sheet, WildBrain has been exploring potential sales of non-core IP assets, targeting aggregate proceeds in the range of $100 million to $300 million. However, the execution of these sales has faced delays, partly due to challenging market conditions across the industry.

A significant breakthrough came in July 2024 when WildBrain announced a new five-year US$415 million Senior Secured Credit Facility with Sagard’s Credit Partners. The proceeds of this new facility were used to address the company’s near-term debentures and refinance its existing credit facilities. With the convertible debt maturity addressed, the company’s publicly traded shares saw a 50%+ increase in the weeks that followed announcement.

Current Outlook and Remaining Challenges

Despite recent ebbs and flows, WILD is positioning itself for a potential rebound in FY’25 and beyond. The company has reported that ~60% of its production pipeline for FY’25 has already been greenlit, with an additional 50% secured for FY’26—levels significantly above historical averages. However, the company must continue to execute flawlessly on its content strategy and successfully monetize its IP portfolio. Additionally, while the recent refinancing has addressed near-term liquidity concerns, WILD still faces the task of substantially reducing its leverage to create a more sustainable financial foundation for long-term growth.

In the next section, I’ll review the pro forma capitalization and financials, and provide my opinion on whether the recent equity move is warranted or perhaps underappreciated.

Disclosure: The information provided is for informational purposes only and should not be considered as investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release me from any liability. Seek professional advice tailored to your financial situation and objectives.