Credit Weekly: The Software Reckoning Arrives (February 1, 2026)

Software Repricing Goes Systemic, Flight to Quality Returns

🚨 Connect: Twitter | Instagram | Reddit | YouTube | Job Board

TL;DR

High yield returned -0.16% as Tech pain hit lower-quality credit. CCCs lost 75 bps, Bs dropped 24 bps, BBs barely held positive. Spreads widened 9 bps to 265. Sponsor-backed software paper got hammered across the board. Private credit is feeling it too: one major BDC cut NAV by 19%, another allowed redemptions well above normal caps. The Fed held and sounded comfortable staying put. Warsh got the nod for Chair. Consumer sentiment is souring. January primary cleared ~$30 billion; Sealed Air and EA still on deck.

The pain finally showed up, and it came from software.

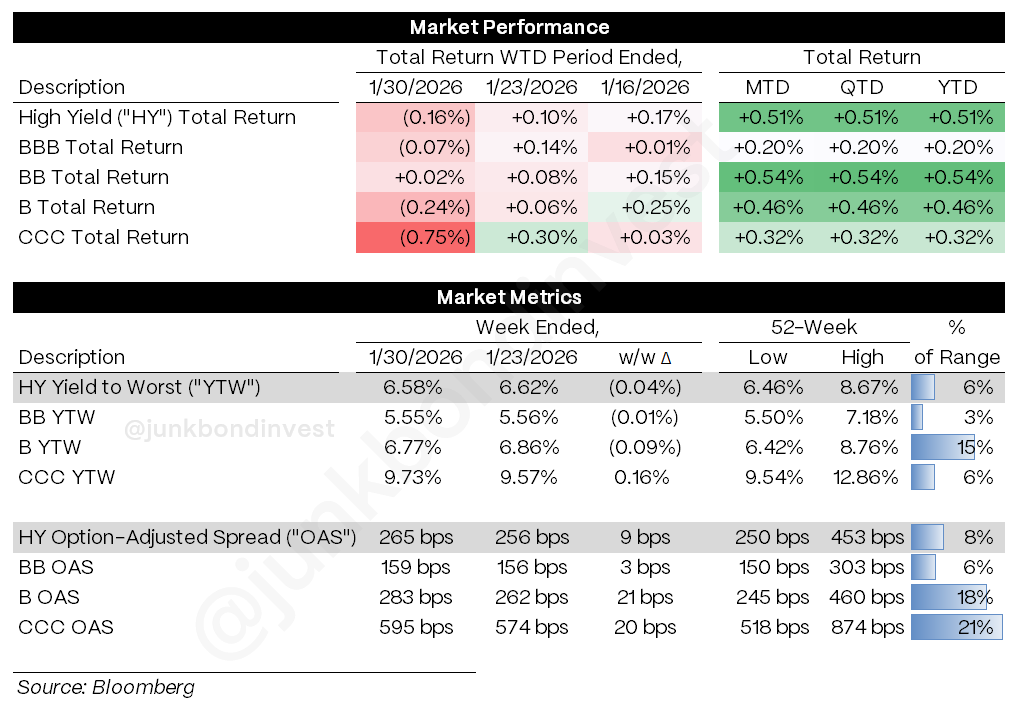

High yield posted its first meaningful down week in over a month, returning -0.16% as the Tech repricing hit lower-quality credit. CCCs lost 75 bps on the week with spreads widening 20 bps to 595. Bs dropped 24 bps as spreads blew out 21 bps to 283. BBs were the only tier to stay positive at +0.02%, widening just 3 bps to 159.

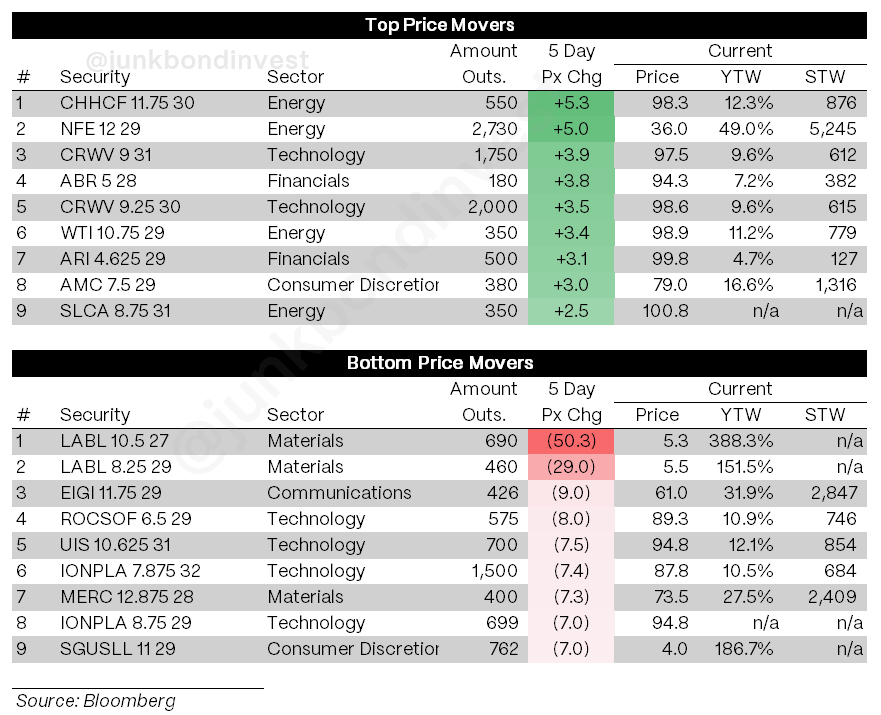

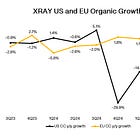

This has been building in mega-cap tech equities since October. Last week it finally bled into levered credit, and it hit hard. Sponsor-backed legacy software paper led the losses. The sector now trades third-widest in the index. Loan prices are back to ~96 for the first time since April. The bid has evaporated for anything with software exposure and a question mark around growth.

The Fed met and the message was clear: we are fine where we are. The statement read firmer than December, with less hand-wringing about labor and more comfort with growth. Powell’s tone was basically “we can wait,” and the market heard it. No cut is priced before June.

Then Friday brought the headline: Kevin Warsh nominated as the next Fed Chair, succeeding Powell in May. He has historically leaned hawkish but has been making the case for productivity-driven cuts more recently. The reality is that any Chair needs the committee behind them to move policy. How that plays out remains to be seen.

On the consumer, sentiment is cracking. Confidence hit levels not seen in over a decade. Households are increasingly reporting that jobs are harder to find. The consumer is not collapsing, but the mood has shifted.

Weekly Performance Recap

CCCs returned -0.75%, Bs lost -0.24%, BBs held at +0.02%. Index spreads widened 9 bps to 265, now at 8% of the 52-week range. Bs widened 21 bps to 283, CCCs widened 20 bps to 595. Yields were mixed: index fell 4 bps to 6.58%, but CCC yields rose 16 bps to 9.73%. YTD returns at +0.51% for the index, with BBs leading at +0.54% and CCCs lagging at +0.32%. The quality rotation has flipped.

Primary Market Activity

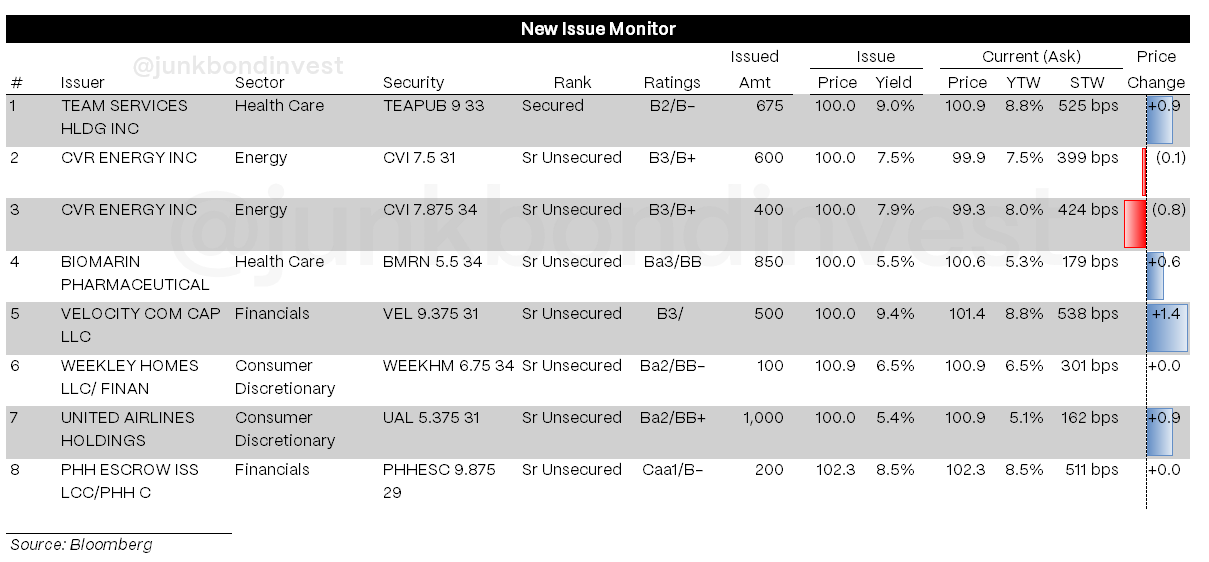

January closed at $30 billion, the busiest month since September and the second-busiest January since 2021. The final week moderated to $6.5 billion as issuers navigated the FOMC meeting and earnings.

Execution stayed strong where credit quality was not in question. United Airlines priced $1 billion of 5-year unsecured notes at 5.375%, tight of talk, with a book 5x covered and the deal upsizing from $500 million. When an airline can do that on unsecured paper, the bid is still there for names the market trusts.

The pipeline is where it gets interesting. Banks are working on $7.9 billion of debt to back CD&R’s buyout of Sealed Air, per Bloomberg, with the bond piece expected to yield in the low 7s. TreeHouse Foods is marketing $550 million of secured notes to fund its buyout. And EA’s roughly $20 billion financing is still waiting. How these deals clear will say a lot about whether the software repricing stays contained or spills into broader risk appetite.

Secondary Market

Sponsor-backed software credits led the selloff. The thesis is straightforward: AI lowers barriers, increases competition, compresses margins. Deals underwritten at 15-20x EBITDA when rates were zero look different now that growth has slowed and equity multiples have compressed. Software is roughly 12% of the loan index and 10-15% of most BDC portfolios. The pain has room to spread.

AI-adjacent credits moved the other way. CoreWeave rallied nearly 3 points after Nvidia’s $2 billion investment. Applied Digital hit fresh highs. Oracle announced plans to raise $45-50 billion for cloud infrastructure, half in debt. But even here, the circular financing dynamics are drawing scrutiny.

Elsewhere, energy stayed firm on geopolitical premium. Mortgage originators were weak after disappointing results from one large player. Multi-Color filed prepack after entering an RSA with 70% of first-lien lenders, cutting $3.9 billion of debt. The stress in lower-quality industrials is real. But it is not limited to public markets.

Private Credit

The pressure in loans is now bleeding into private credit portfolios.

One major BDC, BlackRock TCP, fell 17% after disclosing a 19% cut to net asset value. Six investments drove most of the damage, including e-commerce aggregators and a home improvement company headed for liquidation. Analysts flagged the size of the move as unusual and warned it could reignite concerns around marks and liquidity across the sector. Separately, Blue Owl allowed redemptions well above its normal quarterly cap on one fund.

The response from BDCs has been to lock in funding while they can. Per Bloomberg, nine vehicles raised $5.3 billion in investment-grade debt this month at roughly 200 bps over, building war chests ahead of fourth-quarter earnings. That tells you something about what those earnings might look like.

PIMCO’s president was blunt in an interview this week: investors are underestimating the risks in private credit, and returns are likely to disappoint. He pointed to a large overhang of problem loans made earlier this decade that will take years to work through. His view: if credit stress is emerging now, with the economy still healthy, what happens when conditions actually deteriorate?

The public market reprices daily. Private credit marks quarterly. Eventually those marks catch up.

Looking Ahead

The software story is what I keep coming back to. This is not about one or two names. It is structural. AI is reshaping competitive dynamics. Leverage that looked manageable at purchase is harder to carry now. And this is not a small corner of the market. When something this large reprices, it tends to create knock-on effects.

The uncomfortable question is what this says about underwriting. Credit stress emerging while growth is tracking 2.5% and unemployment is still low is not a cyclical story. It is a structural one. The 2021-2022 vintages were priced for perpetual low rates and multiple expansion. That world is gone. This feels more like the 2015-2016 energy repricing - a large, over-levered sector slowly working through defaults and restructurings over 12-18 months. The difference is that software is more embedded in BDC and CLO portfolios than energy ever was. The contagion paths are shorter.

The speed of the quality rotation is what stands out. Two weeks ago CCCs were leading the rally. This week they got destroyed. That is not a gradual shift; it is a sentiment change. And in credit, sentiment tends to compound.

I am not predicting a crisis. Growth is holding. Labor is softening but not breaking. This is a repricing, not a meltdown.

But repricing does damage. The problem loans made in 2021 and 2022 do not disappear. They refinance at higher rates, restructure, or default. That process takes years. We are still early.

Primary will be the tell. Sealed Air, EA, TreeHouse - these are big, levered deals. If they clear well, the bid is intact. If they struggle - wider pricing, downsized deals, pulled tranches - that is a signal the repricing is bleeding into broader risk appetite. That is when it gets messier.

ISM Manufacturing Monday. ADP Wednesday. Payrolls Friday. CPI February 11.

Spreads at 265 with CCCs gapping wider, software under pressure, and private credit starting to crack is a different tape than a month ago. The complacency is fading.

Upcoming Events

The Wharton Restructuring and Distressed Investing Conference is February 20 at The Plaza Hotel in NYC. Given this week’s theme, the timing feels apt. Use code “JBI-FREE” for 10% off. Let me know if you’re attending.

Early Access List

Something new is coming. Built for people who actually care about credit. If you want a first look before it opens up, join the early access list.

Find the most recent JunkBondInvestor posts below

Disclosure: The information provided is based on publicly available information and is for informational purposes only. While every effort has been made to ensure the accuracy of the information, the author cannot guarantee its completeness or reliability. This content should not be considered investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release the author from any liability. Always seek professional advice tailored to your financial situation and objectives.

Your analogy to 2015-16 is smart. One difference now (as you noted) is how embedded leveraged tech exposure is across structured products and funds. That can shorten the feedback loop between spread widening and actual portfolio markdowns, creating nonlinear repricing even without a macro downturn.

This analysis perfectly frames the coming pressure point. The stress in sponsor-backed software isn't contained - it flows downhill. The most vulnerable links are often SME suppliers and service providers locked into long payment terms with these levered companies. When BDCs mark down portfolios and credit tightens, those SMEs face a liquidity crunch long before a formal default.

The 2015-2016 energy analogy is apt, but as you note, software is more embedded. The contagion to the broader business ecosystem via payables may be faster.