Credit Weekly: The Index Is Lying To You (February 16, 2026)

How AI disruption is quietly reshaping the credit market

🚨 Connect: Twitter | Instagram | Reddit | YouTube | Job Board

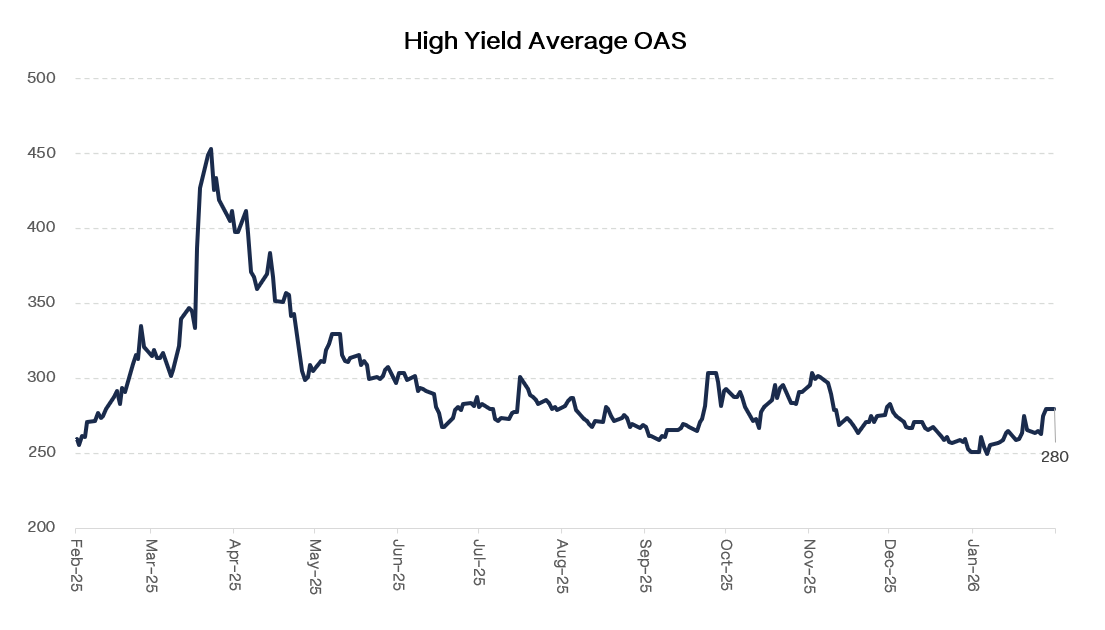

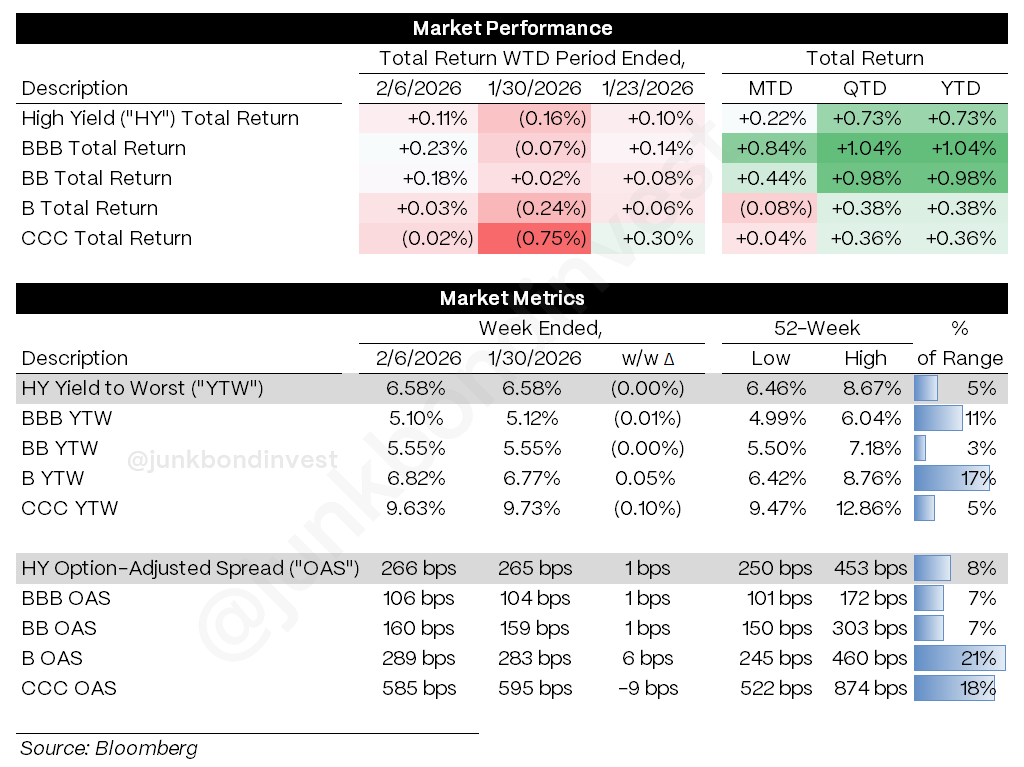

HY spreads are sitting near 52-week tights. YTD issuance is running ahead of last year. Deals are clearing at the tight end of guidance, trading up on the break, getting upsized mid-marketing. If you just look at the index, everything is fine.

Everything is not fine.

BBs are behaving like honorary IG paper, grinding tighter week after week. Move down the quality spectrum and the mood shifts quickly. Single-Bs are treading water. CCCs are slipping. It’s showing up everywhere. In primary. In secondary. Credits insulated from AI disruption are getting rewarded with aggressive pricing. Anything that carries AI risk, or frankly any idiosyncratic hair at all, is getting punished. The index is just averaging all of it into a number that looks calm.

Let me show you what I mean.

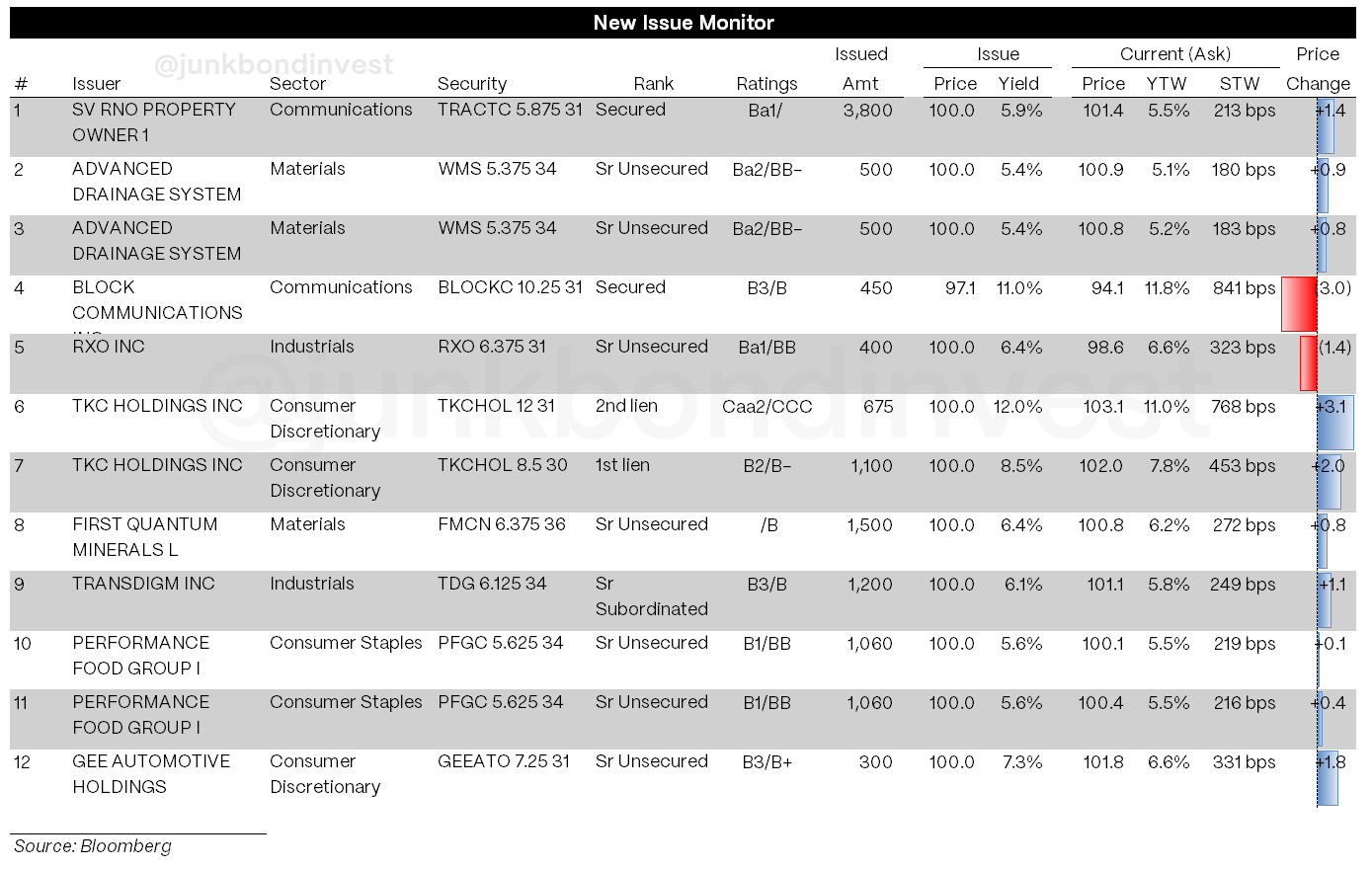

In the primary, AI-insulated credits are clearing like it’s 2021.

YTD supply is tracking roughly 30% ahead of last year. Refis dominated the calendar. Every deal that didn’t carry an AI question mark cleared at or near the tight end of guidance. Part of why: liquid HY has less significantly less software exposure than BSLs or BDCs. Money looking to deploy without loading up on disruption risk has been gravitating to HY bonds.

The deal that captures the mood best is TKC Holdings. A prison-food vendor. CCC-rated at the second-lien level. Borrowing over $2 billion. The deal got upsized during marketing, with the extra proceeds used to double the dividend back to its PE sponsor. Both bond tranches traded up. The business has nothing to do with software, nothing to do with AI. That’s the point. When a CCC-rated corrections-industry credit can upsize to pay a bigger sponsor dividend and trade up on the break, risk appetite is alive and well for anything outside the blast radius.

On the IG side, Alphabet raised $20 billion in a single week and tacked on a 100-year sterling bond. The big five hyperscalers have already issued more debt this year than in any full calendar year prior to 2025.

And then there’s AI infrastructure, where I think demand has crossed the line from strong to potentially reckless. Tract Capital priced nearly $4 billion of junk bonds to build a data center in Nevada leased to Nvidia. The borrower is an SPV with no operating history. The building doesn’t exist yet. Orders came in strong, the coupon tightened, and the oversubscription was used to reduce the equity contribution. This follows Cipher Mining doing back-to-back billion-dollar offerings for AWS and Google-leased facilities, and Applied Digital raising money for CoreWeave. Every deal massively oversubscribed. Every deal tightening. Every deal seeing reduced equity cushions because demand allows it.

Let me be blunt about this. You’re lending against a building that doesn’t exist, secured by a single asset leased to a single tenant. And the oversubscription allowed the sponsor to take equity out of the project. The tenants are real. Nvidia and AWS aren’t going anywhere. But there’s also construction risk, technology obsolescence risk, or the possibility that the AI capex cycle looks different in three years than it does today. What’s the recovery on a half-built data center in the Nevada desert? Nobody buying this paper is asking that question, and that’s exactly the problem.

The primary market is functioning beautifully for credits outside the AI disruption zone. Almost too beautifully.

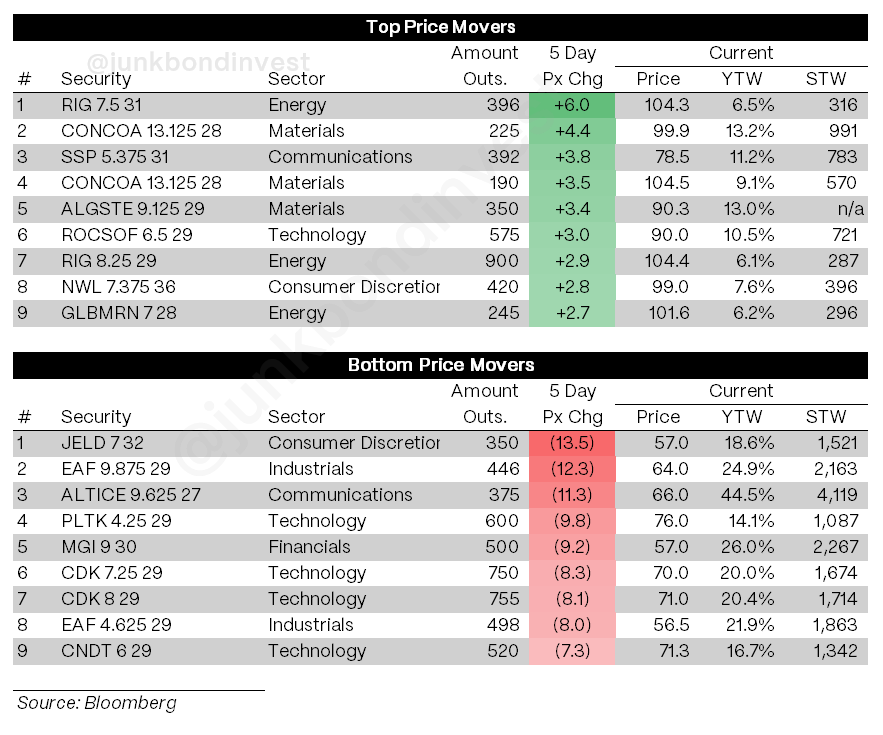

In secondary, anything with AI risk or idiosyncratic hair is getting repriced.

The flip side is brutal. Pagaya’s debut HY offering has been in freefall since pricing, now trading in the mid-80s at a yield north of 13%. Block Communications priced during the week and promptly cratered.

But the AI narrative is where the real damage is. Insurance brokers got hammered. All because of fears that AI might disintermediate the insurance distribution chain. Think about what these companies actually do. They place complex commercial and specialty programs for corporate clients. They’re not selling auto insurance through an app.

But credit doesn’t care about nuance when the narrative catches fire, and right now “AI disrupts financial services” is burning through every broker name regardless of business mix. There’s probably money to be made on the other side of this trade if you have the stomach for it.

AI disruption is a credit event that doesn’t look like a credit event.

The market’s instinct to draw a hard line between AI-exposed and AI-insulated isn’t irrational. But I think most investors are missing how deep this goes.

Every mental model for credit stress starts with the same assumption: the economy weakens, revenues fall, companies can’t service debt, defaults rise, spreads blow out. The entire risk management apparatus is built around this chain. Every stress test. Every scenario analysis.

What’s happening now is different. AI is scrutinizing the earnings power of specific business models while GDP grows north of 2% and unemployment sits at 4.3%. The economy is fine. Specific borrowers may not be.

Think about how credit stress usually works. Energy blows up, the banks that lent to energy follow, risk appetite contracts, everything widens. It’s broad. It’s correlated. You can see it in the index. You can hedge it with macro tools. You can wait for the cycle to turn.

What AI is doing is nothing like that. It’s surgical. It’s picking off business models one by one based on how exposed their revenue streams are to automation. A vertical SaaS company with 90% recurring revenue was the safest credit in the portfolio two years ago. Today it might be the most vulnerable. It’s a structural repricing of what recurring revenue is actually worth when switching costs collapse.

And it’s spreading fast. It started with pure-play software. Then insurance brokers, wealth managers, CRE lenders, logistics companies. Each wave catches a new cohort off guard. Each new sector that gets caught was one that investors assumed was safe the week before.

Here’s why this is so hard to get ahead of. The revenue erosion from AI competition doesn’t show up as a cliff. It shows up as slower growth, then margin pressure, then cash flow deterioration. By the time it’s visible in the reported financials, the bonds have already repriced. CDX won’t help you because it’s dominated by names that aren’t affected. The rating agencies won’t save you because they’re reactive by design. And the quarterly earnings that your credit model is built on are going to be the last thing to reflect what’s actually happening.

This is why the index stays tight while individual names blow out. The economy isn’t breaking. Specific business models are under scrutiny. Most portfolios aren’t built for credit losses that don’t correlate with macro weakness. And the places where this exposure is most concentrated are the places where it’s hardest to see.

In private credit, the visibility problem is real.

Bloomberg did a deep dive last week that should make every BDC investor uncomfortable. They reviewed thousands of holdings across seven major BDCs and found at least 250 investments worth more than $9 billion that weren’t labeled as software, even though the companies themselves, their PE sponsors, and other lenders all describe them as software businesses.

Pricefx, whose homepage says “The #1 Leading Pricing Software” a dozen times, is classified as “business services” by Sixth Street.

Blue Owl classifies the same company as “chemicals” in one fund and “software” in another. Their explanation: “Each of our funds has a different investment strategy, so the industry classifications can differ.” The same loan. The same company. Different sector. Come on.

Barclays estimates software makes up about 20% of BDC portfolios. Given what Bloomberg found, the real number could be meaningfully higher. If AI disruption forces marks lower, losses scatter across multiple sector buckets, making stress look more dispersed than it is. Opacity masquerading as diversification.

This is happening before AI disruption has meaningfully hit private credit earnings. The 2020-21 vintage loans were underwritten at peak multiples with covenant-lite structures in a pre-AI world. If those business models come under sustained pressure, the question isn’t whether there will be losses. It’s whether you’ll see them in real time, or whether they’ll surface gradually through PIK amendments, restructurings, and marks that lag reality by quarters.

If you want to go deeper on how BDC portfolios are actually constructed and where the risks sit, I’ve written a series of BDC primers that break down the mechanics in detail.

Upcoming Events

The Wharton Restructuring and Distressed Investing Conference is February 20 at The Plaza Hotel in NYC. Use code “JBI-FREE” for 10% off. Let me know if you’re attending.

In leveraged loans, the structural bid is masking the signal.

The loan market has its own version of this problem, and it’s more structural than cyclical.

CLOs are the biggest buyers of leveraged loans. When a CLO gets created, someone buys the equity, the riskiest piece that absorbs first losses. Historically, that was an independent third-party investor doing their own math. If the economics didn’t work, they walked. The deal died. Companies had to offer better terms. That feedback loop kept the market honest .

Now, the vast majority of CLOs launch with the manager retaining half or more of the equity, up from less than a fifth a decade ago. Managers raise captive equity funds from pensions and sovereigns, then use that capital to buy the equity in their own deals. No independent buyer needed.

The CLO arb has been at multi-year lows for over a year. Issuance is at all-time highs. Those two facts coexist because the independent quality check has been weakened. Managers earn fees on AUM regardless of equity performance. More deals, more fees. The incentive to walk away from unfavorable math isn’t what it used to be.

I’ll say it plainly: captive equity replaces an independent buyer with a conflicted one. That doesn’t mean every deal is bad. But the market’s natural kill switch for marginal deals has been dulled, and the consequences flow through the entire loan market. CLOs keep printing, loan demand stays elevated, spreads stay tighter than they should be. Layer on 16% software exposure skewed toward lower-rated 2020-21 vintages with weak structures, and you’ve got a structurally supported bid sitting on top of concentrated sector risk.

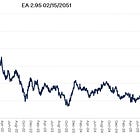

The EA defeasance play should be on every IG investor’s radar.

If all of this sounds like a leveraged credit problem, the IG market has its own situation developing, and frankly it’s the one that could have the broadest market implications. I wrote about defeasance risk back in October as a sleeper issue in IG. It’s not a sleeper anymore

Electronic Arts agreed to sell itself to Silver Lake, Kushner’s Affinity Partners, and Saudi Arabia’s PIF for $55 billion. Largest LBO on record. The sponsor group then launched a tender for EA’s bonds at well below par: roughly 90 cents on the near-dated paper, around 73 on the long bond.

If bondholders say no, the sponsors will invoke a defeasance provision buried in the docs since 2021. Buy Treasuries, pledge the coupon stream against the bonds, walk away from every other obligation. Including the change-of-control put at 101 that bondholders assumed was their protection in exactly this scenario.

Bondholders are organizing with Akin Gump to fight it. The legal question: is a change-of-control put a “covenant” (which defeasance extinguishes) or a “payment obligation” (which it wouldn’t)? Nobody knows. Nobody has tried this at scale before.

If the sponsors pull this off, every PE firm in the country is going to have their lawyers screening IG bond docs for defeasance provisions by the following Monday. Find targets. Buy the company. Defease the bonds. Skip the put. What was assumed to be a 101 recovery becomes 73 cents. IG has operated for decades on the assumption that change-of-control protections are reliable. That assumption is being tested right now. Worth checking whether any names in your book carry similar language.

The macro ties it together.

The market is pricing a terminal Fed rate around 3%. Financial conditions at their easiest since April 2022. Fiscal policy at historically stimulative levels. 175 bps of cuts already delivered. And the economy just printed solid jobs numbers with unemployment falling.

This is roughly the same terminal rate priced when everyone thought the labor market was collapsing last September. Something doesn’t add up.

The pain trade for 2026 may not be recession. It could be reacceleration that forces rates higher while AI disruption simultaneously pressures a subset of credits. Your BB book holds up because strong companies perform in a growing economy. But total return suffers as the rate move hits you on price, and your single-B software exposure gets disrupted by the same capex boom driving GDP growth.

Here’s the connection I keep coming back to: the rate risk and the AI disruption risk aren’t separate. The massive AI capex boom driving reacceleration is funding the very tools that pressure software margins. They compound. And tight index spreads make you feel safe the entire time.