Credit Weekly: Distressed Tech Debt Hits Three-Year High (February 9, 2026)

Software Loans Bleeding, Primary Staying Selective

🚨 Connect: Twitter | Instagram | Reddit | YouTube | Job Board

TL;DR

High yield +0.11% after spreads hit 275 bps Thursday before Friday’s bounce. Anthropic triggered another software selloff. $17.7 billion of tech loans dropped to distressed levels over four weeks, the most since October 2022. McAfee and ION hit all-time lows. Primary slowed to $5.2 billion; Cipher’s Amazon-backed deal was heavily oversubscribed ($13bn+ orders). BDC marks have not caught up to the 15% drop in public software. Payrolls Wednesday. CPI Friday.

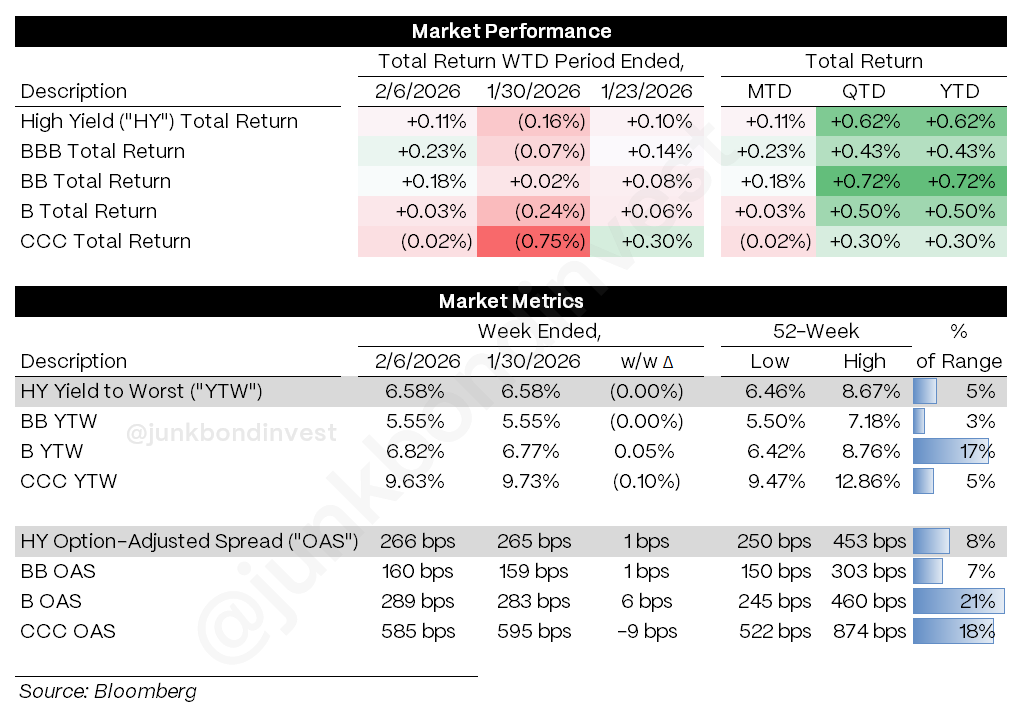

High yield spreads touched 275 bps on Thursday, the highest in seven weeks, before a Friday rally pulled them back to 266 bps. The week ended at +0.11% but the path was brutal.

The catalyst was another wave of AI disruption fears. Anthropic’s Claude Cowork release put fresh pressure on legacy software, and the Nasdaq had its worst three-day stretch since the tariff selloff in April. Weak labor data added to the risk-off tone: job openings at the lowest since September 2020, weekly claims higher, Challenger reporting the biggest January layoff announcements since 2009. But software was the accelerant.

Software credit remained the epicenter. Tech spreads widened another 8 bps to 419 bps. More than $17.7 billion of US tech company loans dropped to distressed trading levels over the past four weeks, per Bloomberg, the most since October 2022. The total tech distressed pile now sits at roughly $46.9 billion, dominated by SaaS companies that now look vulnerable to AI displacement.

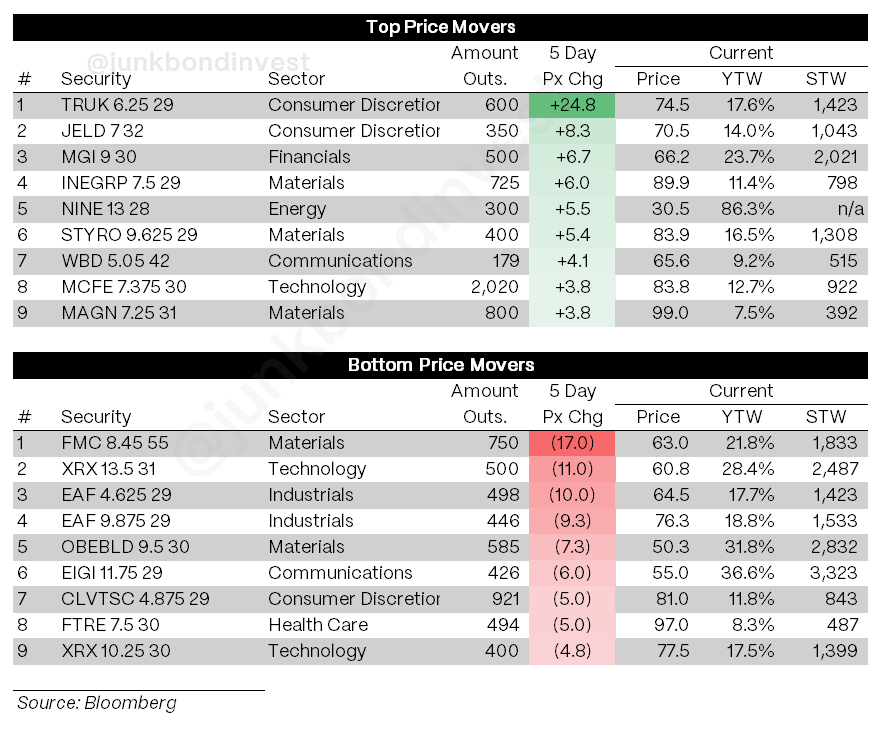

The secondary moves in individual names were brutal. For example, McAfee’s 7.375% 2030 notes dropped to an all-time low of 78.5, yielding roughly 14.6%. Others faired similarly. These are not small positions in leveraged finance portfolios.

Weekly Performance Recap

High yield returned +0.11%. Spreads widened 1 bp to 266 bps. The intraweek range told a different story. Spreads hit 275 bps Thursday, the widest since late December, before retracing 9 bps on Friday. The VIX spiked to its highest since November.

Technology remained the worst-performing sector, widening 8 bps to 419 bps, the third-widest spread in the index. Capital goods and other industrials also posted negative month-to-date returns. Energy outperformed.

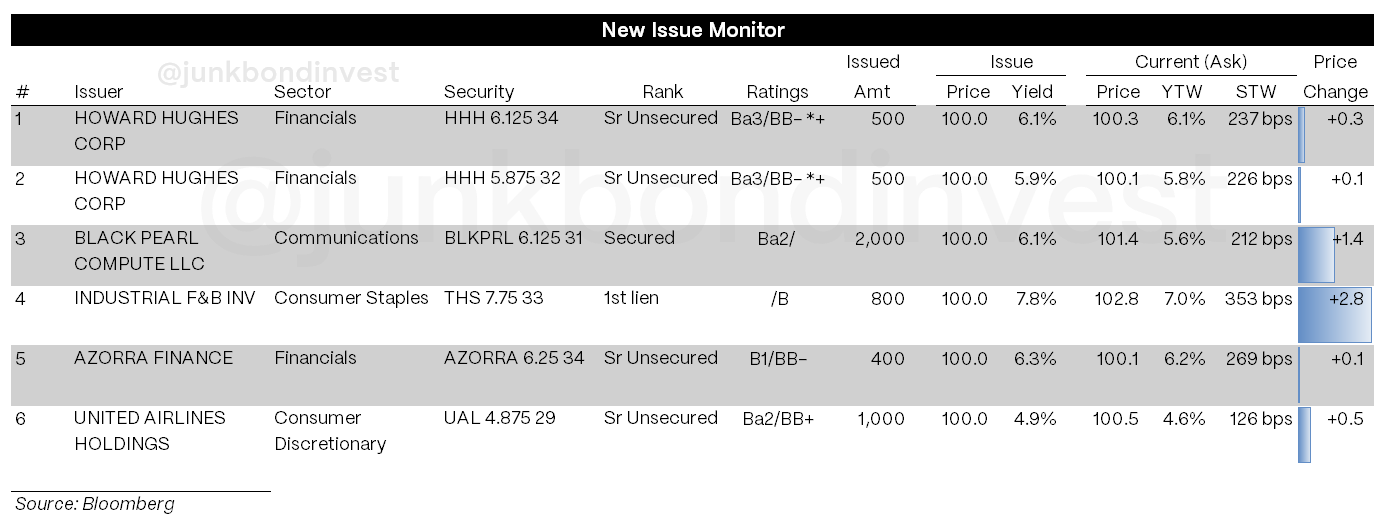

Primary Market Activity

Volume slowed to $5.2 billion across 5 deals. Half the deals that priced widened from initial price talk.

Cipher Mining priced $2 billion of 5-year secured notes through subsidiary Black Pearl Compute at 6.125%, tight to guidance. The deal was backed by an Amazon data center contract. It traded up to 101.375. This is the first high-yield data center deal directly facing an IG hyperscaler, pricing tighter than Meta’s IG data center deal last year.

United Airlines returned two weeks after its last deal. The $1 billion 3-year bullet priced at 4.875%, the first high-yield four-handle since early 2022. The week-old 5.375% 5-year notes were trading at 101 by the time the new deal priced.

TreeHouse Foods upsized its LBO financing to $800 million from $550 million and priced at 7.75%. The bonds traded up to 102.125.

Secondary Market

More than $17.7 billion of US tech company loans dropped to distressed trading levels over the past four weeks, per Bloomberg, the most since October 2022. The total tech distressed pile now sits at $46.9 billion. SaaS companies dominate, particularly those focused on admin, data analytics, and back-office functions where switching costs are low and AI can automate directly.

The legal services providers got hit after Anthropic’s releases raised questions about AI replacing document review. Healthcare software too are in focus as investors weigh disintermediation risk.

Away from software, the picture was more mixed. Charter bounced 3.5 points on lower capex guidance. xAI’s 12.5% secured notes hit a new high of 113.75 on SpaceX merger news.

Cyclical credits tightened. Chemicals, transports, housing all outperformed. The rotation out of asset-light into asset-heavy is accelerating.

Private Credit

The divergence in how managers are positioning tells you where this is headed.

Apollo cut software exposure from roughly 20% to around 10% last year. They repositioned. Blue Owl’s Marc Lipschultz insisted there are “no red flags, no yellow flags, largely green flags” on $25 billion of software exposure. Ares’ Mike Arougheti said “the narrative is wrong.” KKR’s Scott Nuttall said their “level of anxiety is pretty low.”

The problem: the 15% drop in public software equities this month is not yet in BDC net asset values. Private marks lag. That hit shows up in late February and March. Investors know it is coming but cannot see it yet. That is why BDC equities are selling off now, trading through book in anticipation of writedowns not yet disclosed.

Sponsors are preparing for what comes next. Thoma Bravo added a provision to a $1.2 billion loan backing its Vitech acquisition requiring lenders to self-report any coordination attempts within three business days or forfeit voting rights. The clause is designed to kill creditor unity before a restructuring even begins. Sponsors are using loan documentation to prevent creditors from talking to each other.

I put out a primer on BDCs this weekend (see below). Part 2 drops Tuesday. Don’t miss it.

Looking Ahead

The bifurcation within credit is the story. Cipher’s Amazon-backed deal was heavily oversubscribed at 6.125% while McAfee and ION hit all-time lows. The market is picking AI infrastructure winners and legacy software losers in real-time.

And sponsors are stuck. Strategic buyers are cautious. IPO windows for leveraged issuers is not great. Secondary sales mean taking marks nobody wants to take. So the debt stays outstanding, the maturities get pushed, and the carry that looked attractive becomes a trap.

Even where fundamentals hold, sentiment has turned. The market has decided AI changes competitive dynamics for enterprise software. Once that perception takes hold, it is hard to reverse. Every earnings call becomes a referendum on AI risk. The burden of proof has shifted onto companies to prove they are not being disintermediated.

Primary execution is the canary. Half the deals this week widened from pricing. One got pulled. The bid is there for infrastructure and consumer defensives. It is not there for sponsor-backed software.

Payrolls Wednesday. CPI Friday. Retail sales Monday.

Spreads at 266 bps with $46.9 billion of tech loans in distress, extension risk building, and BDC marks lagging reality is not a comfortable tape. The credits that are fine will stay fine. The ones with questions are getting no benefit of the doubt.

Upcoming Events

The Wharton Restructuring and Distressed Investing Conference is February 20 at The Plaza Hotel in NYC. Given this week’s theme, the timing feels apt. Use code “JBI-FREE” for 10% off. Let me know if you’re attending.

Early Access List

Something new is coming. Built for people who actually care about credit. If you want a first look before it opens up, join the early access list.

Find the most recent JunkBondInvestor posts below

Disclosure: The information provided is based on publicly available information and is for informational purposes only. While every effort has been made to ensure the accuracy of the information, the author cannot guarantee its completeness or reliability. This content should not be considered investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release the author from any liability. Always seek professional advice tailored to your financial situation and objectives.

Thanks for sharing this, always a valuable read. What stood out to me is how selective this feels rather than broadly risk-off. Aggregate spreads are still contained, but the market has clearly stopped subsidizing sponsor-backed software while continuing to fund asset-backed and infrastructure-type credits. The public/private mark gap you highlight feels like the key tension.

Curious whether you think continued primary bifurcation starts to change forward cash-flow assumptions for higher-yield structures, even without a wider spread blowout.