Weekend Minutes: HY Market Recap (September 22, 2024)

A Recap of Last Week's High Yield Market Performance

🚨 Connect with me on Twitter / Instagram / Threads | Estimated Read Time: 5 Minutes

💡 Got a job post? I’m open to having you publish— drop me a message!

The high yield market kicked into high gear last week with a surge in activity following the Fed’s 50bps cut, helping to spark a rally in high yield bonds—the strongest performance since May 2024. This decision had a widespread impact, influencing everything from new issuance to sector-specific performance. The communications sector, in particular, staged an impressive comeback, while CCCs continued their streak of outperformance. Let’s dive in!

Weekly Performance Recap: Fed Cut Sparks Rally

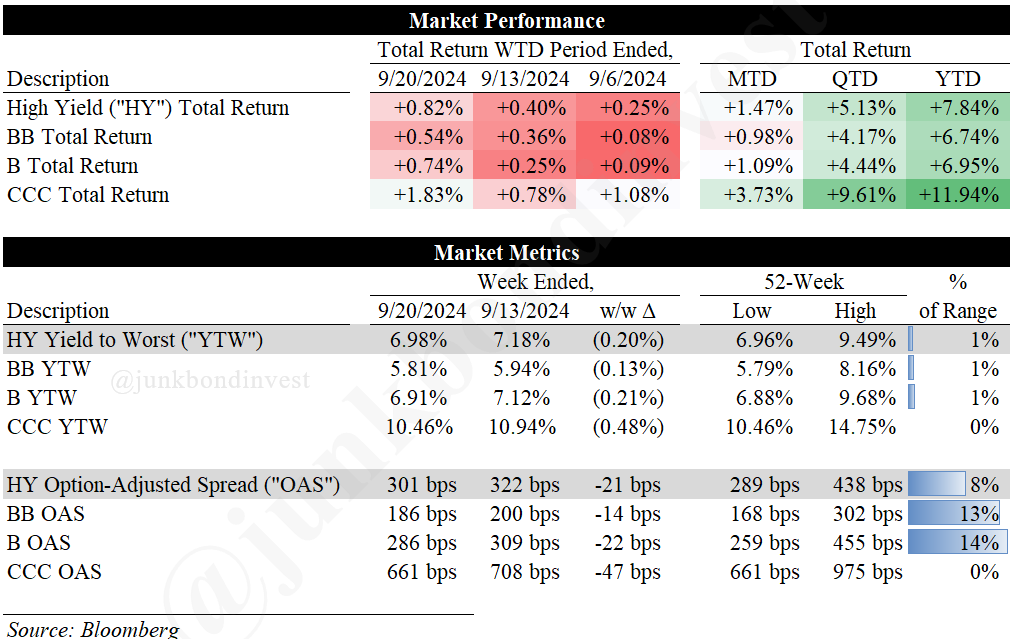

For the week ended September 20th, the high yield market delivered robust performance, with the index returning an impressive +0.82%. This positive momentum built upon gains from the previous week, pushing MTD returns to +1.47% and YTD returns to a solid +7.84%. On a risk-adjusted basis (Sharpe Ratio), HY credit now leads all other assets classes YTD.

Breaking down performance by ratings category:

BBs returned +0.54%, bringing YTD returns to +6.74%

Bs returned +0.74%, with YTD returns now at +6.95%

CCCs continued their impressive run, returning +1.83% for the week and pushing YTD returns to an eye-catching +11.94%

The persistent outperformance of CCCs is particularly noteworthy, with the rating category now outperforming by the widest margin since December 2019.

Noteworthy Market Metrics:

The overall HY YTW decreased 20bps to 6.98%, reaching its lowest level since June 2022

Spreads tightened by 21bps to 301bps, now sitting just 8% above their 52-week lows of 289bps

High yield primary issuance volumes reached $5.4 billion across 6 issuers, down from $12.3 billion the previous week but still robust

September’s issuance has already hit $29.9 billion, far surpassing the $19.6 billion seen in the same period last month

The telecom sector led weekly returns with a remarkable +4.0% gain, followed closely by cable/satellite at +4.7%.

Primary Market Activity

The post-Labor Day period continued to see robust primary market activity, with volumes reaching $5.4 billion across 6 issuers. While this marks a decrease from the previous week’s $12.3 billion, it still represents significant issuance for mid-September. September’s total issuance now stands at ~$30 billion, far surpassing the $20 billion seen in the same period last month. YTD issuance sits at $245 billion, significantly outpacing the $134 billion seen in the same period last year.

Refinancing activities continued to dominate the use of proceeds, but there was also a notable presence of M&A and dividend recaps. Several of last week’s transactions were also opportunistic drive-bys, highlighting the favorable market conditions for issuers. Most new issues traded well post-closing, with some notable outperformers.

Standout Transactions:

Royal Caribbean Cruises’ (Ba2/BB+) $1.5 billion offering of 7-year senior unsecured notes priced at par to yield 5.625%. This deal, upsized from an initial $1 billion, represents the lowest new-issue yield in the HY market since April 2022

Alpha Generation’s (B2/B+) $1 billion offering, upsized from $800 million, of 8-year senior unsecured notes priced at par to yield 6.75%. The notes traded up to 101.5 post-issuance.

Aethon United's (B3/B) $1 billion drive-by offering of 5-year senior unsecured notes priced at par to yield 7.5%. The notes traded up slightly to 100.5 post-issuance.

These transactions underscored the continued appetite for high yield debt across various sectors and credit qualities. The success of deals with aggressive structures or dividend components, such as Alpha Generation, suggests that the balance of power in the market may be shifting back towards issuers (ugh!). However, the strong performance of most deals in the secondary market also indicates robust investor demand, even at tighter spreads.

Secondary Market Dynamics

The secondary market saw brisk activity as investors digested both the Fed’s rate decision and a slew of economic data. High yield bond prices rallied and spreads tightened as the Fed kicked off its first interest-rate easing cycle in four years with an aggressive half-point cut.

Stronger-than-expected manufacturing numbers and another drop in jobless claims triggered a selloff in Treasuries, sending long-term yields higher. This created an interesting dynamic where lower-quality credits, particularly in sectors like telecommunications and cable/satellite, continued to outperform.

Notable Movers:

Bausch Health: The company’s bonds saw significant price action. This rally was fueled by a Financial Times report that several private equity firms were studying bids for Bausch + Lomb. The news sent Bausch + Lomb shares up as much as 13% on Wednesday

Looking Ahead

As we move forward, the market’s focus remains squarely on the Fed’s next moves. While the Fed delivered an outsized cut last week, it did signal a potential step down in the future pace of easing. The market is currently pricing in 74bps of cuts over the balance of the year. If economic data softens enough to warrant another large cut, it could lead to wider spreads by year-end.

The tension between rate cut expectations and lingering concerns about economic growth is likely to drive market volatility. This creates both risks and opportunities for investors, particularly as we approach the traditionally volatile period surrounding the U.S. presidential election.

With September issuance already at a four-year high and the market demonstrating resilience in the face of macro uncertainties, it’s clear that the high yield space is firing on all cylinders. However, the sustainability of this momentum will depend on a balance of factors, including economic data, Fed policy, and geopolitical developments.

Find the most recent JunkBondInvestor posts below

Disclosure: The information provided is for informational purposes only and should not be considered as investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release me from any liability. Seek professional advice tailored to your financial situation and objectives.