Weekend Minutes: HY Market Recap (September 15, 2024)

A Brief Recap of Last Week's High Yield Market Performance

🚨 Connect with me on Twitter / Instagram / Threads | Estimated Read Time: 6 Minutes

💡 Got a job post? I’m open to having you publish— drop me a message!

🚀 We’re expanding! Interested in part-time or internship opportunities? Get in touch!

The high yield market kicked off September with a burst of activity, living up to its reputation as one of the busiest months for primary issuance. Last week saw a flurry of new deals, with volumes nearly doubling from the previous week and including several dividend recaps (we are SO back!). The telco sector also staged a notable comeback, reclaiming a significant portion of its YTD underperformance. This sector-specific rally, driven in part by M&A speculation and positive corporate news, serves as a reminder of the potential for rapid shifts in sentiment. Meanwhile, the market grappled with mixed economic signals, as slightly hotter-than-expected inflation data was offset by mounting expectations for Fed cuts this week. Let’s dive in!

Note: I’ve moved this update to Sunday night to ensure it reaches you ahead of the typical Monday morning e-mail deluge. Let me know if you have any feedback.

Weekly Performance Recap

The week ended September 13th saw the high yield market deliver solid performance, with the overall index returning a robust +0.40%. This positive momentum, building on the previous week’s gains, came despite flat credit spreads, as the tailwind of falling Treasury yields provided a supportive backdrop. The overall YTW for the HY market decreased 6bps to 7.18%, reaching its lowest level since June 2022.

Breaking down performance by rating category:

BBs returned +0.36%, bringing YTD returns to +6.17%

Bs returned +0.25%, with YTD returns now at +6.16%

CCCs continued their impressive run, returning +0.78% for the week and pushing YTD returns to +9.93% (let’s get this to double digits!)

The persistent outperformance of CCCs is particularly noteworthy. However, as mentioned in my prior e-mails, there remains significant dispersion within the CCC space, with a stark bifurcation between performing and distressed credits.

Noteworthy Market Metrics:

HY primary issuance volumes surged to $12.3 billion across 18 tranches, nearly doubling last week’s $7.6 billion and marking the busiest week since mid-May.

September’s issuance has already reached $22.7 billion, accounting for 65% of last September’s total volume in just two weeks.

The % of bonds trading above par increased to 40%, up from 35% a month ago.

The telecom sector led weekly returns with a remarkable +3.1% gain, followed closely by cable/satellite at +2.2%.

Compression between rating categories continues, with the yield gap between BBs and CCCs narrowing to 509bps, its tightest level since November 2023.

Primary Market Activity

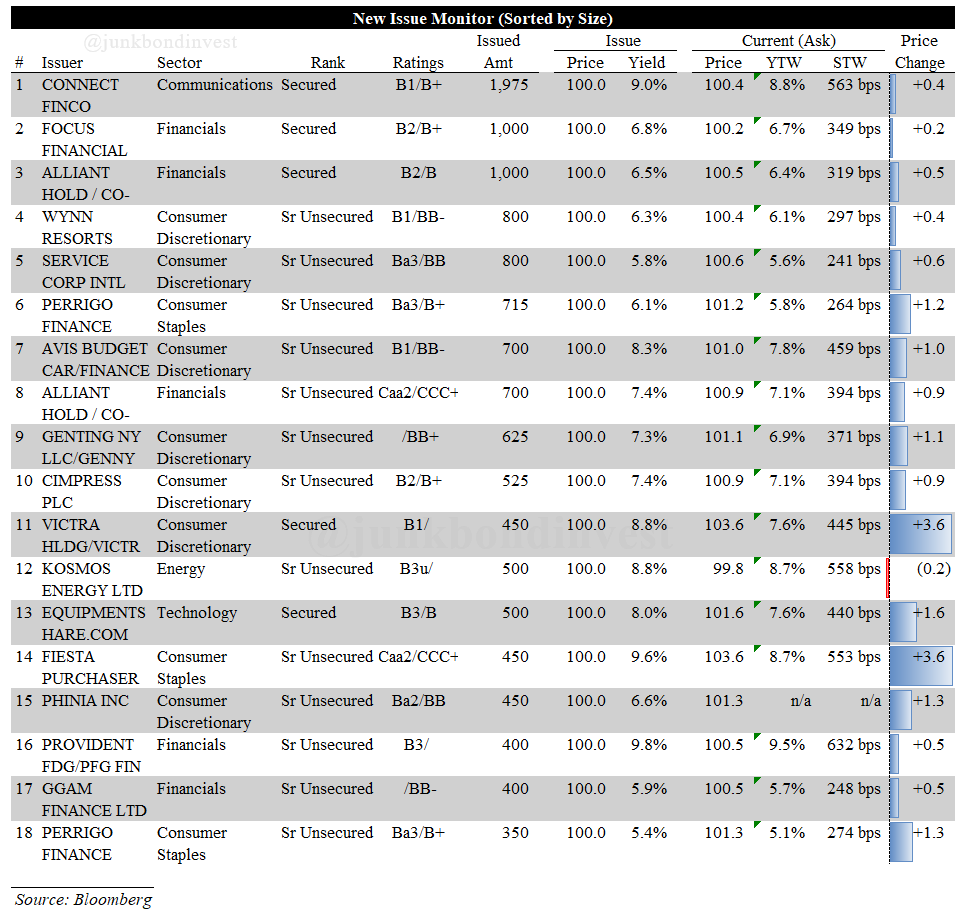

The post-Labor Day period saw an exceptional surge in primary market activity, with volumes reaching $12.3 billion across 18 tranches. This robust issuance was fueled by lower borrowing costs and pent-up demand from the late summer period. Companies are aggressively tapping the market ahead of potential volatility surrounding the upcoming U.S. election and this week’s Fed meeting.

Refinancing activities dominated the use of proceeds, but there was also a notable increase in M&A and dividend recaps. Six of last week’s deals were opportunistic drive-bys, highlighting the favorable market conditions for issuers. All but one new issue traded well post-closing with notable outperformance by Victra and Shearer’s Foods.

Standout Transactions:

Viasat Inc (B1/B+) upsized its offering to $1.975 billion from $1.25 billion of 9% five-year senior secured notes. The deal priced at the tight end of talk.

Focus Financial Partners (B2/B+) placed $1 billion of 6.75% seven-year senior secured notes, upsized from $700 million. Proceeds will be used to repay existing debt and fund a $550 million dividend.

Alliant Holdings priced a dual-tranche offering consisting of $1 billion B2/B 6.5% senior secured notes due 2031 and $700 million Caa2/CCC+ 7.375% senior unsecured notes due 2032. Proceeds will fund the redemption of certain shareholders.

Perrigo Finance (Ba3/B+) priced a $1.1 billion dual-tranche offering of eight-year senior unsecured notes, with $715 million yielding 6.125% and €350 million yielding 5.375%.

These transactions, spanning a range of credit qualities and purposes, paint a picture of a primary market firing on all cylinders. The success of these deals, particularly those with more aggressive structures or uses of proceeds, suggests that investor demand remains robust even at the riskier end of the spectrum.

Secondary Market Dynamics

The secondary market exhibited robust activity levels, with trading volumes surging approximately 15% above YTD averages. A key focus for investors last week was digesting the latest economic data releases, particularly the Consumer Price Index (CPI) and Producer Price Index (PPI) figures. Both indicators came in slightly above expectations but continued to show a general trend of waning inflationary pressures. This nuanced picture has intensified debate around the Fed’s next move, with the market now divided on whether to expect a 25 or 50bps cut at the upcoming meeting.

The high yield market demonstrated remarkable resilience in the face of traditionally weak seasonal trends for September. While credit spreads remained flat, falling Treasury yields resulted in positive total returns across the rating spectrum. This dynamic created an interesting backdrop where lower-quality credits, particularly in sectors like telecommunications and cable/satellite continue to outperform.

Notable Movers:

Viasat: United Airlines announced it will begin offering free in-flight Wi-Fi to passengers using SpaceX’s Starlink service starting in 2025, making it the latest airline to adopt Starlink’s high-speed internet. This move is part of a broader industry trend where airlines such as Delta, JetBlue, and American Airlines are increasingly offering complimentary internet to meet passenger demand. For Viasat, this development is credit negative as it heightens competition in the aviation connectivity market.

As we look ahead, investors remain intensely focused on this week’s Federal Reserve meeting. The debate over whether the central bank will cut rates by 25 or 50 basis points has intensified, with implications that extend far beyond the immediate rate decision. The tension between rate cut expectations and lingering concerns about economic growth is likely to drive market volatility, creating both risks and opportunities for investors.

Find the most recent JunkBondInvestor posts below

Disclosure: The information provided is for informational purposes only and should not be considered as investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release me from any liability. Seek professional advice tailored to your financial situation and objectives.