Navigating Through Debt: Diversified Healthcare Trust's ($DHC) Approach to Capital Structure Management

From Pandemic Pressures to Merger Moves: A Deep Dive into DHC's Operational Overhaul and Balance Sheet Strategies

Situation Overview:

Intro

Formed in 1998, Diversified Healthcare Trust (“DHC”) is a mid-sized healthcare REIT that owns a portfolio of medical office/life science buildings (MOB), senior living communities (SHOP), and wellness centers. The REIT is externally managed by The RMR Group.

As of September 30, 2023, DHC’s portfolio spanned 376 properties in 36 states, housing around 500 tenants over 9 million square feet dedicated to life science and medical offices, along with over 27,000 senior living units.

Navigating Through the COVID Pandemic

Prior to the pandemic, the company’s senior housing portfolio was struggling due to operational issues as well as general industry oversupply. Moreover, the renegotiation of lease terms with its largest tenant in 2019 severely affected its credit profile, leading to multiple downgrades in its credit ratings. These issues were exacerbated during COVID, when occupancy declined materially. In addition to decreased senior housing demand, DHC saw high operational costs driven by inflation and staffing retention issues. As a result, the company’s SHOP net operating income (“NOI”) plummeted from over $200 million in 2019 to less than $10 million in 2022. Mitigating this somewhat was DHC’s medical office/life sciences portfolio which benefited from relatively higher occupancy and lower tenant turnover.

Slow Recovery and Cost Pressures

DHC’s senior housing segment has seen a significant drop in cash flow since 2020, compounded by difficulties stemming from the COVID-19 pandemic. Although there has been some improvement in performance more recently, the recovery rate has only been gradual. While the labor environment has showed improvement, with a reduction in wage pressures, the company is still dealing with rising insurance premiums and staffing shortages. DHC intends to counterbalance increased labor costs with rate hikes, although such increases typically lag behind the rising expenses. In addition, DHC has spent considerable capex aimed at enhancing occupancy, pricing, and cost efficiency.

Debt Challenges

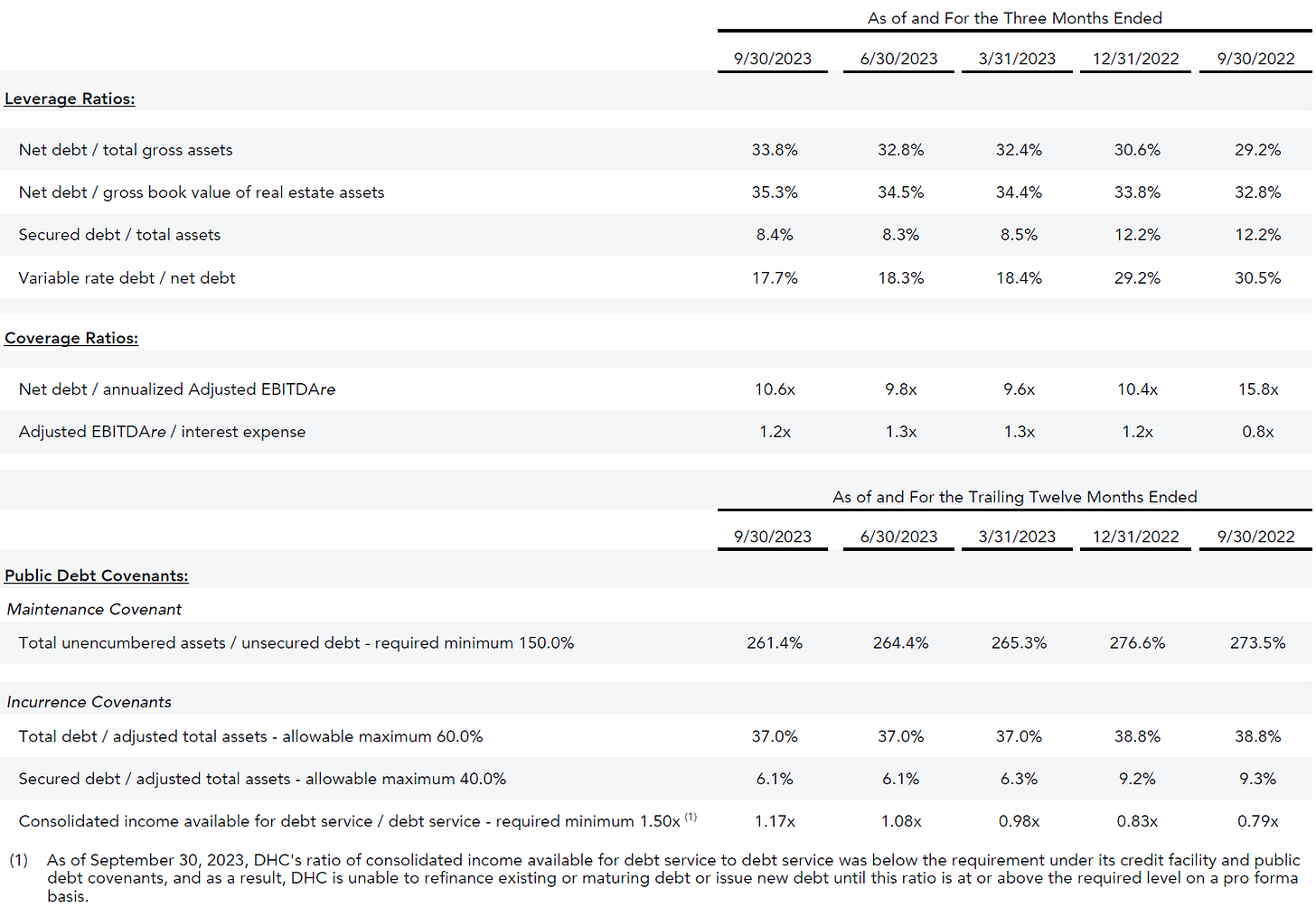

As a result of these challenges, the company’s NOI remains depressed, resulting in an unsustainable credit profile. In 2022, net leverage peaked at 15.8x, only slightly recovering to 10.6x by the end of 3Q’23. Importantly, the company remained out of compliance with its debt service incurrence covenant which barred it from issuing any new debt.

Normally, these issues would not be THAT significant of a problem if earnings were expected to eventually recover. However, DHC faced a sizeable maturity wall in the near-term.

All of these considerations weighed heavily on the company’s unsecured notes which traded as low as 55 cents in December 2022.

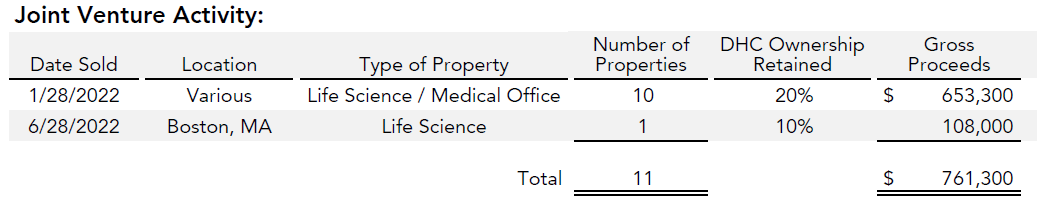

Due to its legacy status as an IG-rated credit, DHC’s real estates assets were almost entirely unencumbered. To help address its upcoming maturities, the company conducted assets sales to pay down debt. While this helped, it was not enough to address the maturity wall entirely.

Proposed Merger

In order to regain compliance with its incurrence covenants and refinance its near-term debt, DHC announced a merger proposal on April 11, 2023 with OPI. You can find my recent write-up on OPI below.

The merger was aimed at benefiting both parties by addressing DHC’s covenant limitations and providing OPI with diversification amid office sector challenges. While receiving unanimous board approval, the merger faced significant opposition from major shareholders who believed it substantially undervalued DHC, particularly its senior housing segment. Despite the strategic intentions, on September 1, 2023, the merger was called off after the proxy voting agencies all recommended a vote against the merger.

New Debt Transaction

Facing imminent debt maturities, the company enlisted B. Riley to help address its balance sheet. On December 22, 2023, DHC announced the closing of a financing transaction that would address its upcoming debt maturities with new secured bonds. The company cleverly issued bonds with a 0% coupon that would accrete 11.25% annually, which immediately brought it back into compliance with its incurrence covenants.

Uncertain Future but Significant Optionality

Although there has been some occupancy improvement in the worst-performing assets, expectations for significant recovery in these properties are tempered by anticipated slow and unpredictable progress. Complicating matters, DHC’s liquidity is limited, exacerbated by substantial investments in improving its SHOP assets to enhance competitiveness. Without adequate cash reserves or access to a revolving credit facility, DHC’s ability to sustain a business turnaround could be significantly compromised.

Despite the operational challenges, DHC continues to hold a significant amount of unencumbered assets. According to the company’s 9/30 filings, the book value of these assets exceeded $6bn. With covenants back in compliance, this should give DHC considerable flexibility in managing its balance sheet.

In the following section, I’ll review the capital structure and financials, assess key covenant considerations, and provide my preliminary opinion on the relative value within the capital structure post the recent financing transactions. Whether you’re looking at the debt or equity, this post will provide you with key information needed to make a more informed judgement call.

Disclosure: The information provided is for informational purposes only and should not be considered as investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release me from any liability. Seek professional advice tailored to your financial situation and objectives.