Crisis at the Corner Office: Decoding the Distressed Debt Dilemma at Office Properties Income Trust ($OPI)

An overview of OPI's current situation and potential levers at its disposal

Situation Overview:

Office Properties Income Trust (“OPI”) is an externally-managed, Maryland-based Real Estate Investment Trust (“REIT”) specializing in owning and managing a portfolio of US office properties, mainly leased to single tenants. As of September 30, 2023, the company’s portfolio included 154 properties, covering over 20.7 million square feet across 30 states, with an occupancy rate of 89.9%. The property portfolio is leased to 263 tenants, with the US government as the largest, contributing about 20% of rental income.

In recent years, OPI has faced numerous unforeseen market challenges. The rise of remote/hybrid work environments, spurred by the COVID-19 pandemic, significantly decreased demand for traditional office space, impacting OPI’s occupancy rates and rental income. More recently, economic uncertainty has led to cost-cutting measures by companies, resulting in additional demand pressures. These resulting revenue declines have led to higher leverage which has now become problematic due to rising interest rates. The combination of these factors has contributed to a severe decline in OPI’s stock prices which has declined >80% in the last 4 years and 65% in the last year alone.

In an attempt to halt some of these industry-wide pressures, in April 2023, OPI and Diversified Healthcare Trust (“DHC”) announced an all-share merger, intended to benefit both companies, financially and strategically. However, on September 1, 2023, the companies mutually agreed to terminate the merger due to significant opposition from various DHC equity and debt investors who believed the merger undervalued DHC.

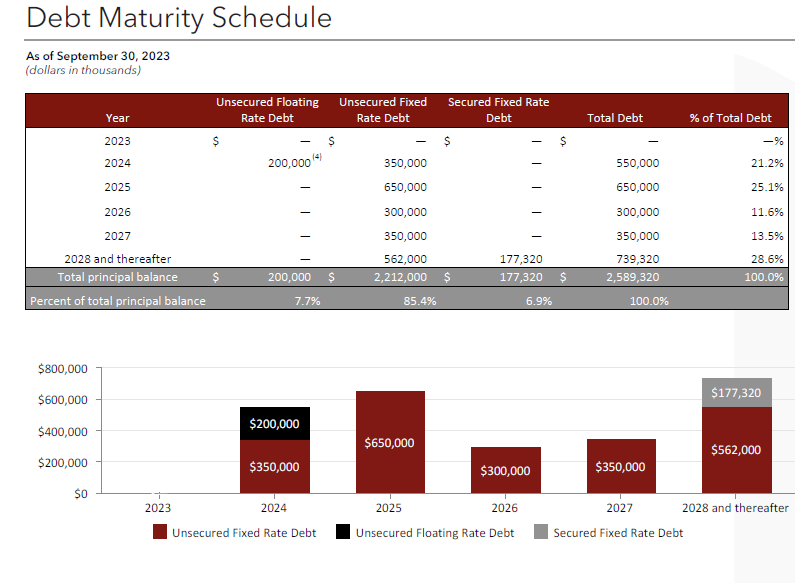

With the merger behind them, OPI now faces several upcoming debt maturities it must either refinance or pay down with cash. Specifically, the company has a $200 million unsecured revolver due in January 2024 and a $350 million unsecured bond maturity due in May 2024. While debt maturities are somewhat staggered beyond that, nearly 46% of the company’s total debt is set to mature in the next two years.

Currently, the company sits on just $24 million of cash and will require external financing to address these near-term maturities. Due to its legacy as an investment grade company, practically the entirety of the company’s property portfolio is unencumbered ($177 million of secured debt outstanding). With the unsecured refinancing market currently closed to the company, OPI has been forced to either (i) sell its properties or (ii) encumber them with secured debt in order to shore up liquidity. Since 2022, the company has sold 27 assets for nearly $250 million in sale proceeds and raised mortgage debt against 7 properties for total proceeds of $177 million.

Despite these positive liquidity events, the company’s unaddressed near-term maturities coupled with high leverage (>8x) in a challenged sector have kept investors on the sidelines. The company’s capital structure continues to trade at distressed levels, with longer-dated unsecured bonds trading in the low 60s, implying yields of 16-19%.

In the following sections, I will review the company’s capital structure, covenants, and financial performance and provide some preliminary views on where in the capital structure I find (or don’t find) OPI most interesting.

Disclosure: The information provided is for informational purposes only and should not be considered as investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release me from any liability. Seek professional advice tailored to your financial situation and objectives.