National Cinemedia filed bankruptcy...and the equity looks interesting $NCMI

And it's not a Reddit / WSB YOLO bet!

On April 11, 2023, National Cinemedia, LLC filed for Chapter 11 bankruptcy protection. You can find the bankruptcy docket with all the filings here. I wrote about the company back in 2020 and while the thesis didn’t play out at all, the writeup should give you good overview of the business. See below.

While I haven’t explicitly followed the company since 2020, the huge runup in the stock this week prompted a second look. And despite the rally, there still seems to be some juice remaining in the NCMI 0.00%↑ equity!

There also seems to be much investor confusion as it relates to the stock price movement. The top tweets on Twitter actually have no understanding of the situation. Rather, price movement seems to be blamed on bankruptcy itself which the WSB / Reddit “YOLO” crowd seems to favor buying!

Let’s set the record straight. As part of the restructuring support agreement (“RSA”), all funded debt ($1.15bn) is to be equitized. In a restructuring, lenders typically get paid ahead of equity holders. However, this is where details and structure matter. The entity that filed Chapter 11 is NCMI, LLC (“OpCo”). This is where all of the funded debt resides. NCMI, Inc. (“HoldCo”) is the holding company that owns units in OpCo. HoldCo publicly trades on the Nasdaq exchange. Ignore the ownership percentages (as they are stale figures) but the org chart below should give you a high level overview of the structure.

Importantly, as part of the contemplated restructuring, HoldCo will receive 13.8% of the post re-org equity in lieu of a $15mm capital contribution - see below. This means that the equity at HoldCo is NOT a zero like one might typically expect.

So the question then begs, is NCMI equity cheap despite the massive rally in the stock? Let’s have a look.

The first question is what is the right share count to use. As per the latest 10-Q, we see a share count of 82mm as of November 3, 2022.

However, some of the founding members converted their OpCo units into HoldCo stock since then. As per an April 10 13G filing, pro forma shares outstanding is 181mm. At $0.44/share, this gets me roughly an $80mm market cap. I’m not sure what pro forma cash will be so to be conservative, let’s assume $0. Since HoldCo will get 13.8% of the new equity in OpCo, an $80mm market cap at HoldCo implies a $577mm valuation as there is no debt/excess cash remaining at OpCo ($80 / 0.138). Now that we’ve established a base valuation, let’s move onto the financials.

Pre-COVID, the company was consistently generating $200mm+ of EBITDA. This was obviously impacted by the shutdown of theatres plus changes in the theatrical release schedule.

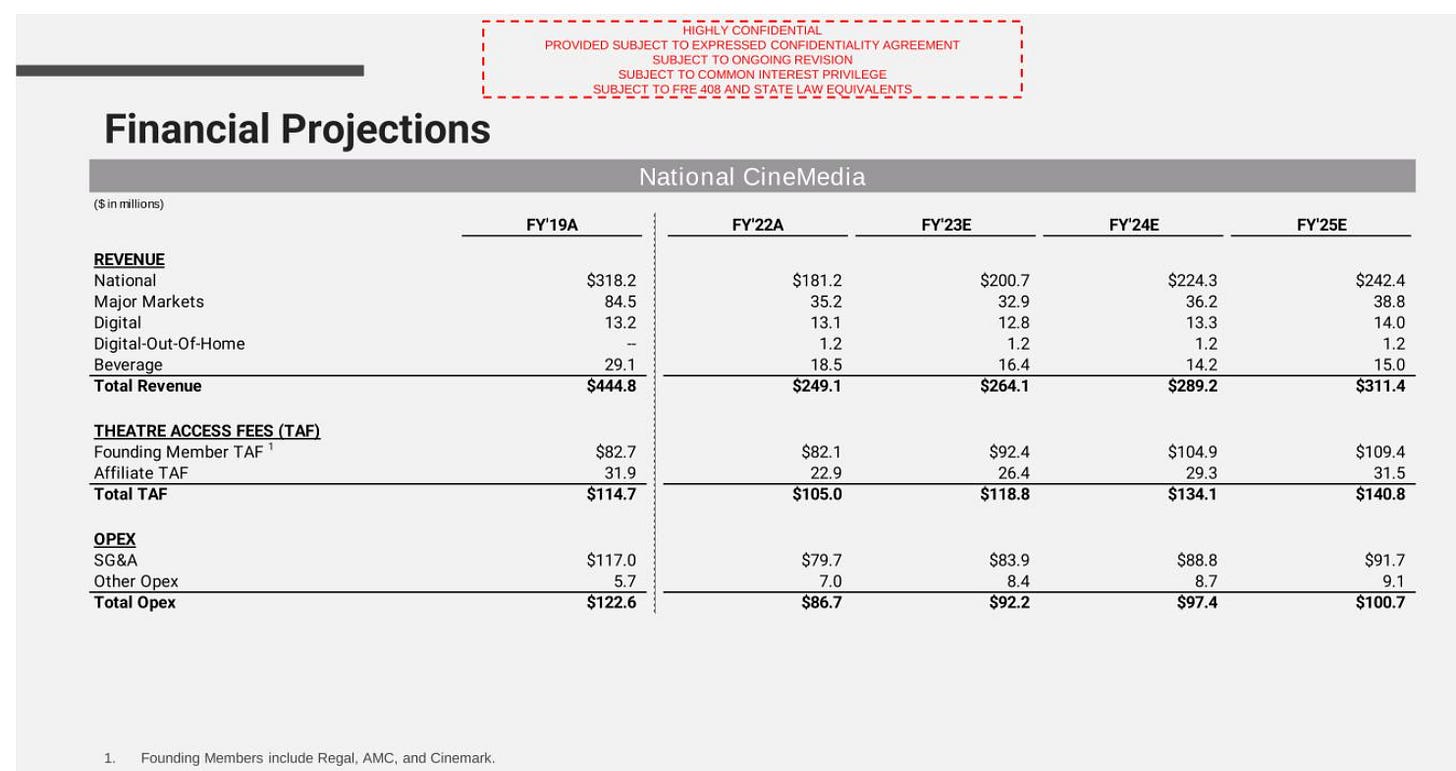

Today, management provided projections in the cleansing materials that were filed with the SEC. These are likely sandbagged but should provide a base to extrapolate from. Why do I think these estimates conservative? Well, the Company just did $42.1mm of EBITDA in 4Q-22 so I’ll leave you with that.

The company also provided some additional cash flow data which is relevant for purposes of modeling out cash flows. Now, let’s put all of this together.

Here’s a quick and dirty valuation. Based on the company’s projections for 2023, the company could produce enough FCF to generate close to an 8% dividend yield.

While this is not exactly super cheap in the context of today’s interest rates, I think these are using fairly conservative projections. Should the company get back to even 60% of 2019A EBITDA levels, the equity still has considerable upside even after the massive runup.

EBITDA recovery to pre-COVID levels isn’t necessarily a forgone assumption as the company’s projections are highly driven by theatre attendance. For example, a 10% increase in attendance could result in EBITDA closer to $85mm by 2025.

In addition, there are several contracts/leases that the company may reject in bankruptcy which could improve profitability further.

In conclusion, the recent run-up in the stock can be supported by fundamentals. In fact, there is a scenario where the stock can be worth 2-3x today’s price. Whether the risk/return meets your thresholds is a different question and one that warrants further due diligence.

Key Risks

Restructuring Completion / Confirmation. The restructuring plan needs to be confirmed by bankruptcy courts in order to be effectuated. The current deal is far from being confirmed but already has 2/3rds secured creditor support. Milestones dictate that the plan is confirmed 105 days from filing and effective no later than 60 days after that.

Recession. The company’s revenues are highly cyclical and will cycle with the broader US economy. If we have a prolonged downturn, the company’s ability to grow EBITDA may take a longer time. That being said, the company’s projections are fairly conservative and still well below pre-COVID levels.

Incorrect analysis. This is a quick and dirty analysis based on a preliminary review of publicly available materials. Certain figures may be inaccurate so I encourage you to do your own due diligence.

Hi thanks for the write up. How sure are you about that shares o/s figure? 10-K filed today gives PF figures, $2.3m cash so you were bang on there, but says 82m PF shares o/s. Makes a big difference in terms of current creation multiple.

Interesting. I had figured it was just making a new class like your standard BK. Guess not. A lot of parts still unanswered but all good research starts with a foundation that shakes your normal understanding.