HY Market Weekly Minutes: Thanksgiving Lull Brings Light Volume as Spreads Hold Near Tights (November 29, 2024)

A Brief Recap of Last Week's High Yield Market Performance

🚨 Connect with me on Twitter / Instagram / Threads / Bluesky | Estimated Read Time: 5 Minutes

💡 Got a job post? I’m open to having you publish here— drop me a message!

The high yield market maintained its composure during the holiday-shortened week, as investors digested renewed tariff threats and positioned ahead of key economic data. Spreads widened 8bps to 266bps while the overall index gained +0.44%, highlighting the market’s resilience even as Treasury yields whipsawed on Trump’s latest trade proposals. The technical picture proved particularly robust heading into year-end, with November issuance totaling just ~$9 billion—the lightest monthly volume since July 2023.

The market’s stability was especially notable given the broader macro backdrop. Trump’s threats of 25% tariffs on Canada and Mexico sent ripples through rates markets. Yet high yield barely flinched, suggesting investors remain focused on strong corporate fundamentals and supportive technicals.

Primary market activity slowed to a crawl over Thanksgiving with just $450 million in volume via a single deal from Blackstone Mortgage Trust. The secured offering’s successful execution—pricing inside initial whispers and trading up post-pricing— highlighted persistent demand even as spreads drift off recent tights.

Let’s dive in.

Weekly Performance Recap

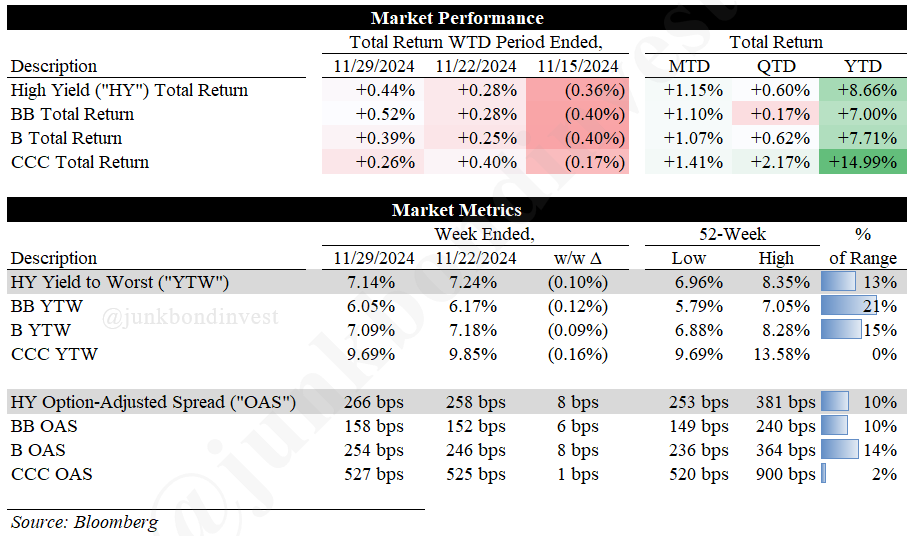

For the week ended November 29th, the high yield market delivered another positive return with the overall index gaining +0.44%. The market showed particular strength on Friday's shortened session, gaining +0.17% as yields closed 5bps lower. This brings month-to-date returns to +1.15% and extends YTD gains to +8.66%. Market yields declined across the rating spectrum with the overall yield dropping 10bps to 7.14%, defying broader market volatility.

Breaking down performance by rating category:

BBs outperformed with +0.52%, bringing YTD returns to +7.00%

Bs followed with +0.39%, with YTD returns now at +7.71%

CCCs lagged but remained positive at +0.26%, maintaining an impressive YTD return of +14.99%

The technical picture remains remarkably stable despite approaching year-end. High yield spreads sit at 266bps—near post-GFC tights—while CCC spreads hold steady at 527bps, just 7bps off their 52-week lows. November proved exceptionally strong for risk assets broadly, with the S&P 500 gaining 5.7%—its best month of 2024—while the Russell 2000 surged 10.8%.

Primary Market Activity

The Thanksgiving holiday brought primary issuance to a near standstill, with just one deal totaling $450 million marking the lightest weekly volume since late August. The lone transaction came from Blackstone Mortgage Trust, which placed $450 million of secured notes at 7.75%. The B+/B1/BB- rated five-year offering saw robust demand, pricing through initial whispers in the 8.25% area. More notably, the borrower simultaneously upsized its term loan component, highlighting strong appetite across the capital structure. Year-to-date issuance now stands at $269 billion, up 64% from the same period last year despite November’s holiday lull.

Secondary Market Dynamics

Secondary trading ended November on a high note, with strong performance across the new issue market—16 of 17 November deals trading above their clearing levels. The constructive tone came as Treasury yields rallied sharply, with both 2-year and 10-year yields dropping over 20bps on the week.

Looking Ahead

All eyes turn to Friday’s jobs report—a critical data point that could make or break the December FOMC meeting. Following October’s strike-impacted print of just +12,000 jobs, consensus expects a dramatic swing to +200,000 new positions while watching if unemployment edges up from 4.1%.

The Treasury market is already placing its bets. Rate cut expectations for December have jumped to 67% on the back of last week’s benign PCE print (+0.24%). This optimism has fueled a notable rally in rates, pushing the 10-year Treasury yield to six-week lows and beneath its closely-watched 200-day moving average.

Meanwhile, Fed commentary kicks into high gear this week. Powell’s Wednesday remarks headline a packed calendar, as markets hunt for clues on how the Fed balances sticky inflation against emerging cracks in the labor market. The combination of firm core PCE readings and mixed employment signals has left December’s policy path unusually clouded.

Despite November’s seasonal slowdown—marking a five-year low for monthly issuance—the technical backdrop remains remarkably supportive. Spreads continue to probe post-GFC tights while yields hold below 7.25%. Yet Trump’s surprise tariff proposals threaten to upend the inflation outlook just as economic momentum builds.

The year-end picture sets up a compelling test: can the market’s technical strength and solid corporate fundamentals continue to suppress spreads even as policy uncertainties mount? Between crucial economic data and a full slate of Fed speakers, the next few weeks should provide some answers. Stay tuned.

Jobs in Credit:

💡 Have a job opening you’d like to share here? Shoot me a message.

Find the most recent JunkBondInvestor posts below

Disclosure: The information provided is for informational purposes only and should not be considered as investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release me from any liability. Seek professional advice tailored to your financial situation and objectives.