HY Market Weekly Minutes: Risk-On Rally Hits New Gear as US-China Deal Sparks Four-Week Winning Streak (May 12, 2025)

A Brief Recap of Last Week's High Yield Market Performance

🚨 Connect with me on Twitter / Threads / Instagram / Bluesky

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list — limited spots.

The “dead cat bounce” crowd got it spectacularly wrong.

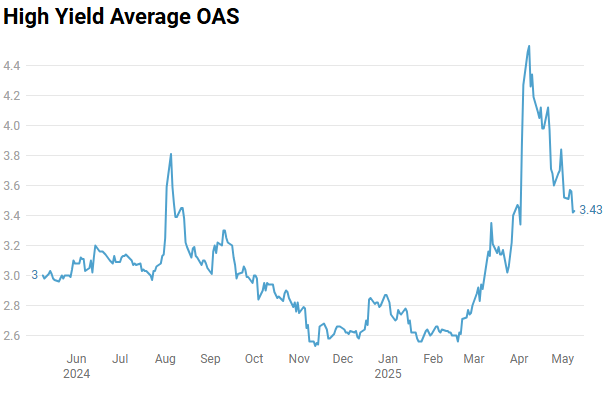

High yield bonds just completed their fourth consecutive weekly gain, crushing the notion this was just a technical rebound. We’re now sitting at spreads of 343bps, just 9bps wide of our Liberation Day levels. That’s a 100bps+ round trip executed with surgical precision.

The real revelation? CCCs absolutely torched everything with a 0.58% weekly gain. When the market’s most beaten-up sector outperforms by 40bps+, it’s telling you something the headlines aren’t. Meanwhile, primary markets exploded with $5.9 billion of deals, making last week the busiest in six weeks. Thursday alone saw $5.2 billion cross the line - the third biggest volume day of the year.

The catalyst was clear. News of the US-UK trade deal and impending China talks sent risks assets higher. Credit markets did what they do best when sentiment shifts: they sprinted. Credit spreads compressed 15bps Thursday in a single session as money stampeded out of Treasuries and into yield.

Here’s the question: Is anyone actually positioned for this speed of recovery? Because judging by the recent weeks’ price action, the answer is no.