HY Market Weekly Minutes: Market Finds its Footing Ahead of Holiday as Rates Stabilize (November 22, 2024)

A Brief Recap of Last Week's High Yield Market Performance

🚨 Connect with me on Twitter / Instagram / Threads | Estimated Read Time: 5 Minutes

💡 Got a job post? I’m open to having you publish here— drop me a message!

The high yield market regained its composure last week, shrugging off recent volatility to deliver its first positive weekly return since early November. Spreads compressed another 8bps to 258bps—just 5bps away from recent tights—while the overall index gained +0.28% amid stabilizing Treasury yields and encouraging signs on the labor front. Initial jobless claims dropped to 213,000, their lowest level since May, suggesting October’s weak payroll print may have been more about temporary disruptions than fundamental labor market deterioration.

The technical picture remains very supportive despite approaching the typically quiet holiday period. US primary market activity remained robust with six deals totaling $2.5 billion, including R.R. Donnelly’s upsized CCC+ rated PIK toggle offering (the 3rd of the year) that highlighted investors’ continued appetite for risk. Even more telling—the deals priced this week saw an average price appreciation of nearly 1% in secondary trading, suggesting strong underlying demand persists even as spreads probe historical tights.

The macro backdrop is also evolving as markets digest both economic data and implications of Trump’s policy agenda. While deregulation hopes and strong economic prints have fueled risk appetite, pushing the HY index to near its tightest level in over 15 years—the incoming administration’s proposed 60% tariffs on Chinese imports and immigration restrictions could fuel fresh inflation pressures just as the economy shows signs of reaccelerating.

Let’s dive in.

Weekly Performance Recap

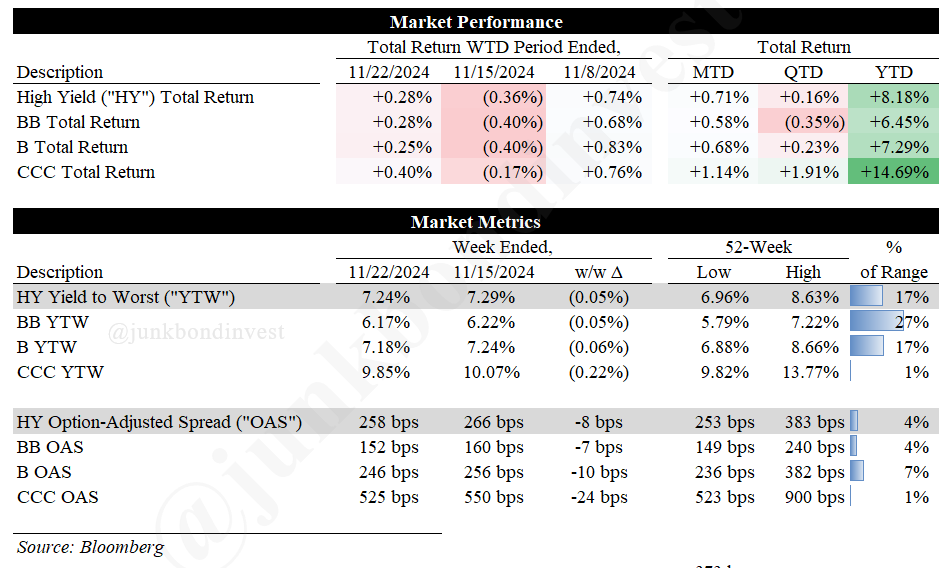

For the week ended November 22nd, the high yield market posted solid gains with the overall index returning +0.28%. This brings month-to-date returns to +0.71% and extends YTD gains to +8.18%. More notably, yields declined across the rating spectrum with the overall market yield dropping 5bps to 7.24% as Treasuries stabilized around 4.40%.

The market’s resilience was particularly evident in the continued compression of risk premiums. CCC spreads tightened an impressive 24bps to 525bps—near their lowest levels this year—while outperforming higher-quality bonds for the seventh consecutive month. The CCC cohort has now delivered a +14.69% YTD return, more than double the +6.45% return of BBs.

Primary Market Activity

US HY primary issuance remained active in last week’s holiday-shortened week with six deals totaling $2.5 billion (excl. non-US issuers). The market’s risk appetite was particularly evident in R.R. Donnelly’s $360 million CCC+ rated HoldCo PIK toggle offering, which was upsized from $300 million. The issuance window is expected to remain open early this week ahead of Wednesday’s GDP and PCE releases.

Notable transactions included:

Nova Chemicals placed $400 million of BB- rated senior notes at 7.0%

Select Medical executed $550 million of B1/B rated notes at 6.3%, downsized after upsizing its term loan

Deluxe Corp priced $450 million of secured notes at 8.125%, upsized from $400 million

R.R. Donnelly issued $360 million of PIK toggle notes with a 12% PIK/11% cash coupon at 95 OID

Secondary Market Dynamics

Trading activity remained constructive with notable idiosyncratic stories driving price action. Last week’s biggest mover was Spirit Airlines, whose bonds rallied ~20 points after its Chapter 11 filing as investors viewed the proposed reorganization favorably.

On the new issue front, trading activity remained constructive with the majority of new issues trading up in secondary markets despite historically tight spread levels. For example, Nova Chemicals’ bonds gained 1.5 points while Deluxe Corp’s new issue appreciated similarly, suggesting strong technicals persist even at current valuations.

The market appears increasingly focused on positioning for the incoming administration’s policy agenda. Manufacturing and industrial names have seen particular interest following the Empire Manufacturing Index’s surge to 31.2, while concerns around potential tariffs and immigration restrictions have started to influence trading in sectors with significant supply chain or labor market exposure.

Looking Ahead

Markets enter the final weeks of 2024 facing an intriguing mix of technicals and fundamentals. The HY market has delivered an impressive +8.18% YTD return with spreads approaching historical tights, yet forecasts suggest primary market activity could actually accelerate in 2025. High yield bond issuance could exceed $300 billion next year driven by increased M&A activity and a softer regulatory environment.

The economic picture also continues to evolve. While October’s weak payroll number initially sparked concerns, the latest jobless claims data suggests underlying labor market resilience. However, the Q2 Quarterly Census of Employment and Wages revealed potential downward revisions to employment growth that could signal more cooling ahead. This tension between growth momentum and labor market dynamics could influence the Fed’s December rate decision.

As spreads hover near post-GFC tights and Treasury volatility moderates, the market’s resilience will be tested by this changing macro backdrop. The next few weeks of economic data and policy signals should help determine whether current valuations can be sustained into year-end. Stay tuned.

Find the most recent JunkBondInvestor posts below

Disclosure: The information provided is for informational purposes only and should not be considered as investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release me from any liability. Seek professional advice tailored to your financial situation and objectives.