HY Market Weekly Minutes: High Yield Stages a Comeback...But Who's Really Buying? (April 28, 2025)

A Brief Recap of Last Week's High Yield Market Performance

🚨 Connect with me on Twitter / Threads / Instagram / Bluesky

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list — limited spots.

The headlines are loud, but the real story is happening quietly in credit.

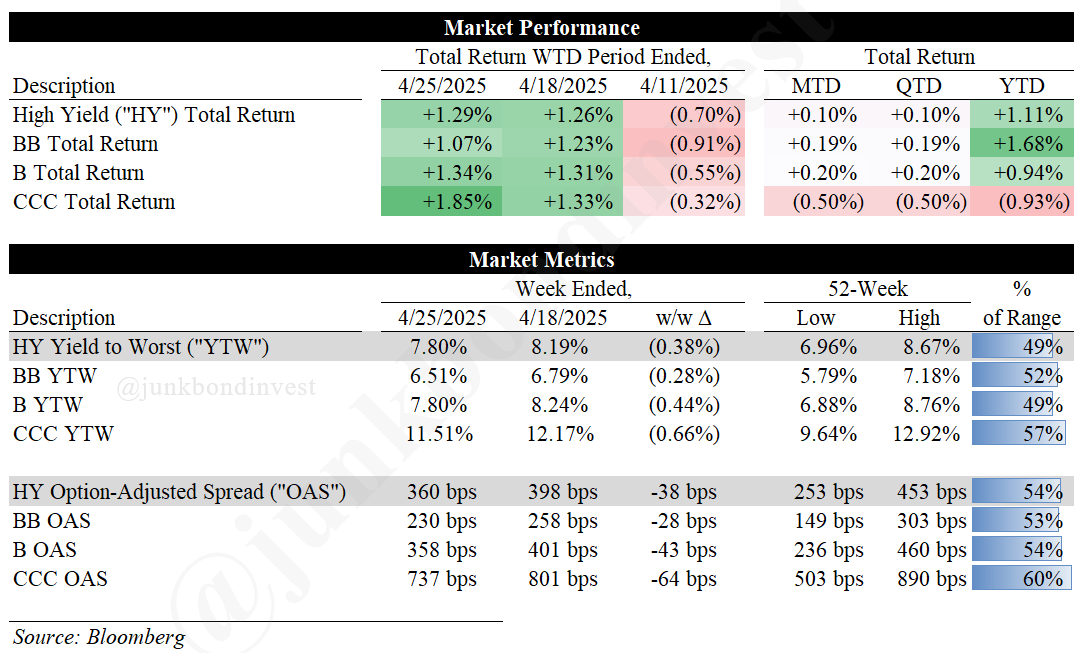

As equity markets whipsawed on Powell-related drama, high yield delivered another impressive week with the index returning +1.29% as spreads tightened a remarkable 38bps to 360bps and yields held steady at 7.80%. This counter-intuitive strength has pushed YTD performance to +1.11%, confounding those who predicted lasting damage from the tariff saga.

The compression across ratings was even more striking. The BB-BBB basis tightened 19bps to 113bps while the B-BB gap narrowed 15bps to 127bps, suggesting investors are increasingly comfortable moving down in quality despite lingering economic concerns. Even more telling: CCCs outperformed with a +1.85% return vs. +1.07% for BBs, completely inverting the flight-to-quality trade that dominated early April.

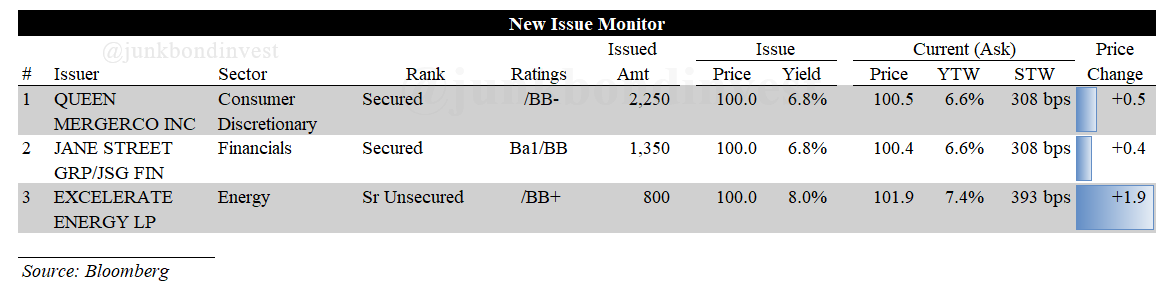

Primary markets cautiously reopened with three BB deals pricing for $4.4 billion, all generating strong demand that allowed for upsizing and pricing at the tight end of talk. Jane Street brought $1.35 billion secured notes at 6.75%, QXO priced $2.25 billion secured notes at 6.75% for its Beacon Roofing acquisition, and Excelerate Energy issued $800 million unsecured notes at 8.00%. Every deal traded up in secondary—a powerful signal that cash remains on the sidelines waiting for opportunities.

The coming week brings critical data points that could either validate or crush this nascent recovery. Q1 GDP on Wednesday will likely show barely any growth, while Friday’s jobs report could provide the first real evidence of tariff impacts on hiring. Add in Thursday’s manufacturing ISM expected to show deeper contraction and investors will soon know whether credit’s relative strength was prescient or premature.

Weekly Performance Recap

The numbers tell a compelling story of a market regaining its footing:

High yield returned a robust +1.29%, bringing MTD performance to +0.10% and maintaining YTD at +1.11%

BBs gained +1.07%, improving YTD returns to an impressive +1.68%

Bs outperformed at +1.34%, pushing YTD returns into positive territory at +0.94%

CCCs led the rally at +1.85%, though still negative MTD (-0.50%) and YTD (-0.93%)

The technical picture improved dramatically:

Overall index yields plunged 38bps to 7.80%, now at just 49% of their 52-week range

Spreads tightened 38bps to 360bps, sitting at 54% of their 52-week range

B yields fell 44bps to 7.80%, the largest drop across quality segments

CCC yields dropped 66bps to 11.51%, with spreads tightening an impressive 64bps to 737bps

Most sectors participated in the rally, though with notable dispersion. Basics (+1.5%), and Consumer Non-Cyclicals (+1.5%) led the market higher, while Utilities (+0.9%) and Financials (+1.2%) lagged. This suggests investors are becoming more selective about sector exposure rather than simply embracing or avoiding risk across the board.

Primary Market Activity

The primary market showed legitimate signs of recovery with three deals totaling $4.4 billion pricing last week, all receiving strong demand and trading up in secondary:

QXO (Ba3/BB-) priced $2.25 billion of 7NC3 senior secured notes at 6.75%, upsized by $250 million and pricing at the tight end of talk to fund its Beacon Roofing acquisition

Jane Street (Ba1/BB) priced $1.35 billion of 8NC3 senior secured notes at 6.75%, upsized by $350 million and pricing in-line with talk

Excelerate Energy (NR/BB+) priced $800 million of 5NC2 senior notes at 8.00%, at the tight end of talk to fund an acquisition and refinance existing debt

This activity marks a significant shift from prior weeks’ primary market paralysis. The all-BB composition of last week’s calendar underscores the continued cautious approach, with deals concentrated in secured paper where possible.

While hardly back to normal volumes, the successful execution and secondary performance suggest the window is beginning to reopen for higher-quality issuers. The pipeline is expected to build gradually with $4 billion projected for this week if market conditions remain stable.

Secondary Market Dynamics

The secondary market showed continued improvement last week, with cash closing up +1-2 points as the market gained stability after the 90-day tariff pause announcement.

The most significant single-name story was Saks Global (SAGLEN), whose 11% 2029 notes plummeted 7.5 points after the company disclosed it was “prudently” evaluating balance sheet strengthening opportunities, including a potential FILO loan. The bonds now trade in the 60s before even paying their first coupon, highlighting the market’s continued skepticism toward highly-leveraged retailers despite the broader rally.

Looking Ahead

The market faces a crucial test this week with several potential catalysts that could either sustain or derail the recent recovery:

Q1 GDP on Wednesday is forecast to show the weakest growth since 2022, primarily due to the massive import surge ahead of tariffs that will severely impact net exports despite decent consumer spending

ISM Manufacturing on Thursday is expected to deteriorate further to 48.0 from 49.2, as regional Fed surveys already show significant weakness across the New York, Philadelphia, and Richmond districts

April Jobs Report on Friday will provide critical insight into whether employment growth is maintaining its modest pace or beginning to show more significant weakness from tariff uncertainty

The stark contrast between still-decent hard data and collapsing sentiment measures creates a particularly challenging environment for investors. As the Fed’s latest Beige Book noted, economic activity remains little changed across districts, but uncertainty around international trade policy is weighing heavily on firms’ ability to plan. Manufacturing surveys show businesses taking a “wait-and-see” approach to hiring and capital expenditures until trade policy clarity emerges.

This week’s earnings will also provide crucial insights, particularly with a heavy concentration of mega-cap technology companies reporting. While these firms have limited direct high yield exposure, their outlook on consumer demand and supply chain disruptions will help shape broader market sentiment.

The path forward likely depends on whether economic data begins showing more significant deterioration. If this week’s data holds up reasonably well, the credit rally could extend further given attractive absolute yields and strong technical factors. However, if we see major downside surprises, particularly in employment, the market may quickly reassess its recent optimism despite the compression already achieved over the past two weeks.

Find the most recent JunkBondInvestor posts below

Disclosure: The information provided is based on publicly available information and is for informational purposes only. While every effort has been made to ensure the accuracy of the information, the author cannot guarantee its completeness or reliability. This content should not be considered investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release the author from any liability. Always seek professional advice tailored to your financial situation and objectives.