Bloomin' Brands Inc. ($BLMN): Left for Dead, Stubbornly Alive

A look at the operational reality, balance sheet burden, and reset now underway.

🚨 Something new is coming. Join the early access list — limited spots.

This is what slow restaurant death looks like.

Zero differentiation. Zero momentum. Menu’s too big, margins too thin, and the consumer’s moved on.

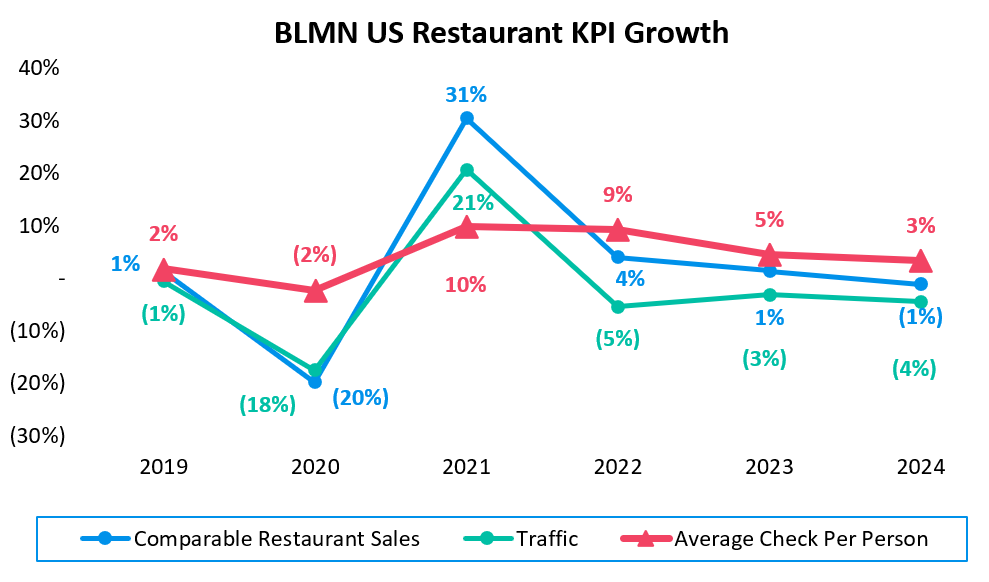

Bloomin’ isn’t in free fall, it’s in slow, painful decline. The comps are weak, the traffic’s worse, and the stores haven’t seen real capex in a decade. Outback used to mean something (remember Bloomin’ Onion?). Now it’s just another tired box on the highway, pushing bloated menus and pretending price hikes are a strategy.

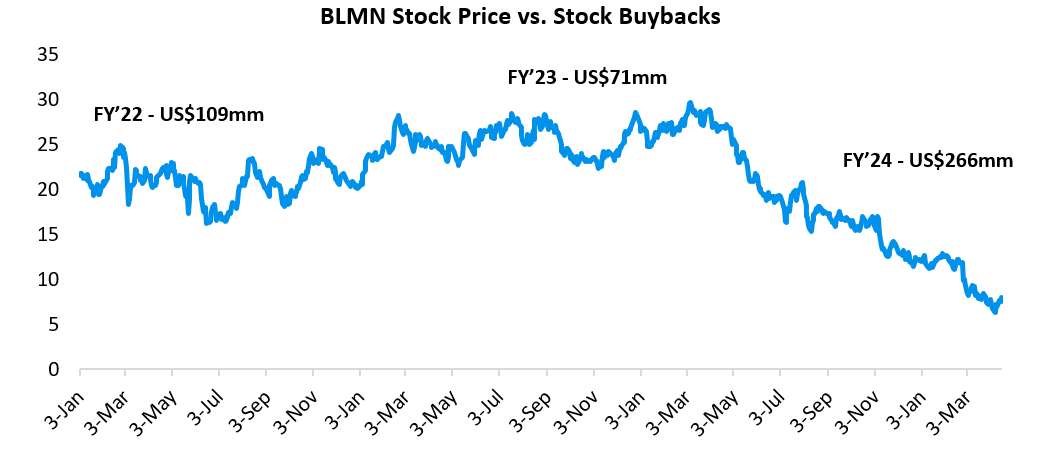

The brand lost relevance years ago. While Texas Roadhouse and LongHorn evolved, Outback doubled down on nostalgia and stopped listening. They jacked prices while doing absolutely nothing to improve the product. Then, management decided to use ~$450 million on share buybacks when they should’ve been fixing their restaurants.

The market response has been telling. Their senior unsecured notes now trade in the 80s, yielding nearly 10%+—not a crisis, but certainly not a vote of confidence.

The new CEO is currently in scramble mode. Cutting corporate heads, slashing menus, unloading Brazil. It’s not strategy. It’s triage.

And the clock’s ticking on four brands the market probably no longer needs.

I. Situation Overview:

Bloomin’ Brands operates 1,463 casual dining restaurants across four concepts that nobody’s excited about anymore. Their portfolio—Outback (55% of revenue), Carrabba’s (Italian mediocrity), Bonefish Grill (seafood identity crisis), and Fleming’s (expense account steakhouse)—is hemorrhaging traffic in a market that punishes anything but excellence.

The business model is straightforward but deeply unforgiving. Bloomin’ generates 95% of revenue from company-owned stores, making it uniquely exposed to the brutal math of casual dining: high fixed costs (labor, rent, insurance) create massive operating leverage where small traffic swings translate to outsized profit impacts. When traffic is up, margins expand quickly. When guests stop showing up? The P&L collapses just as fast.

Post-COVID, Bloomin’ looked like a comeback story. 2023 revenues hit $4.6bn, EBITDA peaked at $560mm, and comps were positive across most brands. Outback (+1.1%) and Carrabba’s (+3.9%) were leading. The company posted ~16% margins—on par with competitors.

But management misread the moment. They treated a sugar high as a sustainable trend and spent ~$450 million on buybacks instead of fixing operations.

Then the real world came back.

Menu bloat, declining food quality, staff turnover, and weak digital execution all collided at once. Competitors like Texas Roadhouse doubled down on simplicity, throughput, and value. Bloomin’ hiked prices and crossed its fingers.

The cracks began forming immediately. While Texas Roadhouse and Chili’s anchored consumer expectations with consistent value offerings, Bloomin’ dawdled with its promotional response. Menu prices climbed 3-6% annually without corresponding improvements in food quality or service experience. The predictable result? Collapsing traffic.