HY Market Weekly Minutes: All Eyes on Fed and Election (November 1, 2024)

A Brief Recap of Last Week's High Yield Market Performance

🚨 Connect with me on Twitter / Instagram / Threads | Estimated Read Time: 5 Minutes

The high yield market ended October with a remarkable display of resilience. Despite Treasury yields surging to multi-month highs and a jobs report showing just 12,000 new positions added in October (vs. 223,000 in September), spreads actually compressed to reach 275bps. Moreover, CCCs continued their impressive winning streak, notching their 6th consecutive month of gains and extending their YTD lead as the best performing asset class in US fixed income.

The technical backdrop remains particularly compelling. October issuance totaled $23.8 billion—the busiest October since 2021—yet the market easily absorbed the supply wave. Even more telling: Garda World successfully placed $1 billion of CCC-rated paper at 8.375%, inside initial whispers and with $4 billion of orders. When a CCC-rated issuer can upsize a deal and price through guidance with 4x oversubscription, it says volumes about the market’s risk appetite.

As we head into a pivotal week with both the FOMC meeting and presidential election, the market faces its sternest test yet. With Treasury volatility (i.e., MOVE index) hitting YTD highs and prediction markets showing a tightening race, we’re about to find out if this resilience can hold.

Let’s dive in.

Weekly Performance Recap

For the week ended November 1st, the high yield market stabilized after October’s volatility, with the overall index returning a modest +0.02%. More notably, option-adjusted spreads (OAS) compressed 10bps to 275bps.

The week’s performance came against a remarkable economic backdrop: October nonfarm payrolls shocked to the downside at just 12,000 jobs (vs. expectations of 100,000), marking the smallest gain since late 2020. However, markets largely looked through the weakness, attributing much of it to temporary factors like hurricane disruptions and the Boeing strike.

Breaking down performance by rating category:

BBs declined slightly at -0.09%, bringing YTD returns to +5.86%

Bs managed a small gain of +0.01%, with YTD returns at +6.58%

CCCs continued their remarkable run with +0.24% for the week and an impressive YTD return of +13.55%

Primary Market Activity

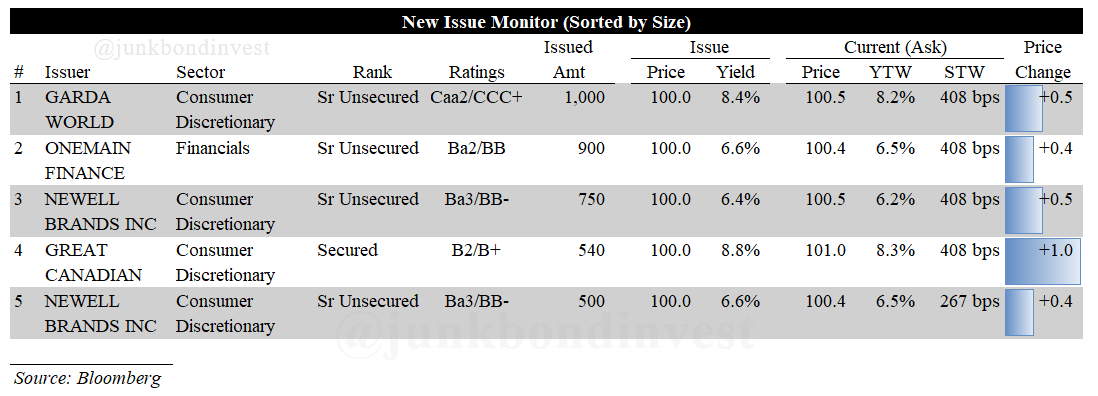

The primary market downshifted this week with five deals totaling $3.69 billion, as both issuers and investors positioned themselves ahead of this week’s crucial FOMC meeting and presidential election.

Standout Transactions:

Garda World Security came to market with a $1 billion offering of Caa2/CCC+ eight-year senior unsecured notes, pricing at par to yield 8.375%. The deal, which will help fund the acquisition of Stealth Monitoring, saw robust demand with over $4 billion in orders

OneMain Finance placed $900 million of Ba2/BB 4.5-year senior notes at par to yield 6.625%, upsized from an initial $500 million target

Newell Brands executed a $1.25 billion dual-tranche offering (upsized from $1 billion), with a $750 million 6.375% six-year tranche and $500 million 6.625% eight-year piece

Great Canadian Gaming priced $540 million of B2/B+ 8.75% senior secured notes due 2029, upsized from $400 million

Secondary Market Dynamics

The secondary market saw significant positive moves in two key names this week, highlighting how sector-wide strength and company-specific catalysts can drive performance even in an uncertain macro environment.

CSC Holdings (Altice USA) bonds staged an impressive rally following stronger-than-expected Q3 results from industry peers Charter Communications and Comcast. Both cable giants reported resilient broadband subscriber trends and improving ARPU, helping ease sector-wide concerns about competitive pressures and cord-cutting headwinds. The positive read-through sparked renewed optimism in cable credits, particularly benefiting Altice USA’s paper given its higher leverage and recent underperformance versus peers.

Bausch Health’s bonds surged across the capital structure after the company delivered its sixth consecutive quarter of year-over-year growth and raised guidance. Beyond the strong operational performance, market participants are increasingly optimistic about potential progress on the Bausch + Lomb separation, which analysts view as a key catalyst for unlocking shareholder value. The combination of improving fundamentals and potential strategic actions has helped drive a notable re-rating of the company’s credit profile

Looking Ahead

The market faces what could be its most consequential week since the summer of 2024. With the Fed widely expected to deliver a 25bp cut and prediction markets showing an increasingly tight presidential race, volatility appears inevitable.

The employment data has particularly muddied the waters. While the headline 12,000 jobs added seems alarmingly weak, the underlying data presents a more nuanced picture—the unemployment rate held at 4.1% while average hourly earnings rose 0.4%, suggesting continued labor market resilience beneath the temporary disruptions.

Technical signals present a mixed bag. High yield funds reported outflows for the week, their first significant withdrawal in months. However, with October’s $23.8 billion issuance easily absorbed and CCCs outperforming for 6 straight months, there’s little evidence of broader risk aversion.

The election adds another layer of complexity. Markets appear to be pricing in growing odds of a Republican sweep, which some analysts estimate could drive Treasury yields higher on fiscal expansion expectations. The combination of election uncertainty and monetary policy shifts could finally test the market’s remarkable spread compression.

After shrugging off most challenges in 2024, high yield faces its biggest test yet. With spreads at near post-GFC tights, Treasury volatility at YTD highs, and two potentially market-moving events ahead, maintaining this balance will require continued fundamental strength to offset any technical wobbles.

Get ready—this could be the week that defines the rest of 2024.

Jobs in Credit:

💡 Have a job opening you’d like to share here? Shoot me a message.

Find the most recent JunkBondInvestor posts below

Rivian Automotive’s ($RIVN) Busted Convertible Bonds: High-Stakes Opportunity in a Crowded EV Market

Disclosure: The information provided is for informational purposes only and should not be considered as investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release me from any liability. Seek professional advice tailored to your financial situation and objectives.