Getty Images ($GETY): Is the Debt Priced for Perfection?

Weighing Bull and Bear Arguments Amid Near-Term Refinancing Needs

🚨 Connect with me on Twitter / Instagram / Threads | Estimated Read Time: 18 Minutes

This week, I’ll be reviewing Getty Images, a leading provider of licensed visual content with over 562 million digital assets. The company has $1.38 billion of debt outstanding, split between $1.08 billion of term loans due 2026 and $300 million of senior notes due 2027. Despite pulling its refinancing attempt in February, both the term loans and notes continue to trade near par, creating an interesting debate around refinancing risk.

While Getty maintains strong market positions in editorial and enterprise content, recent performance has shown some concerning trends in customer metrics and unit economics. In this post, I’ll examine whether current term loan / bond prices properly reflect both operational and refinancing risks.

Let’s dive in.

Situation Overview:

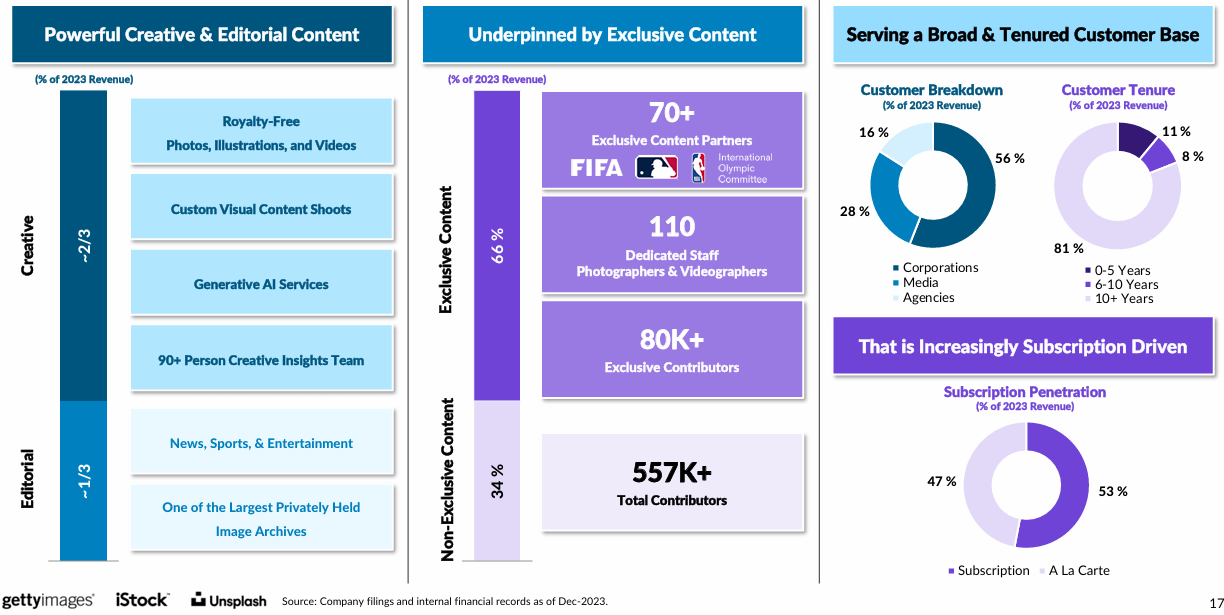

Founded in 1995 and headquartered in Seattle, Washington, Getty Images, Inc. (“GETY”) is a provider of visual content through its online marketplace platforms. The company operates 3 key brands—Getty Images (enterprise), iStock (SMBs), and Unsplash (creatives)—serving a diverse customer base including corporations (56% of revenue), media outlets (28%), and advertising agencies (16%). GETY has built one of the world’s largest repositories of licensed visual content, with 562+ million assets sourced from 557,000+ content contributors and partners worldwide. The company monetizes this content through both subscription-based (53% of revenue) and à la carte licensing models.

Recent Evolution & Corporate History

Getty’s journey to its current form has been marked by several ownership transitions. After going private in a $2.4 billion leveraged buyout by Hellman & Friedman in 2008, the company was subsequently sold to Carlyle Group in 2012. In 2018, the Getty family acquired Carlyle’s stake, maintaining significant control with their current 47.2% ownership position. The company returned to public markets in July 2022 through a SPAC merger with CC Neuberger Principal Holdings, which provided proceeds used to reduce leverage and retire preferred equity. The transaction valued the business at $4.8bn or 15.2x 2022E Adj. EBITDA.

Operating Performance & Business Model Transition

Since returning to the public markets, Getty has faced both structural and cyclical challenges. More recently, revenues have been impacted by Hollywood labor strikes and broader macroeconomic headwinds particularly impacting the agency segment. The company’s creative segment, representing ~63% of revenue, has shown particular weakness with a -2.4% y/y decline in Q2’24.

The company has also been actively transitioning from an à la carte licensing model toward a subscription-based approach, with subscription revenue now comprising 53% of total revenue, up from 29% in 2015. While this shift demonstrates progress in building recurring revenue, it has come with revenue per subscriber deterioration. Management attributes this decline to mix shift toward smaller e-commerce subscribers through iStock, though the magnitude suggests broader pricing pressure.

While annual subscribers have more than doubled to 282,000 from 129,000, total customer count has declined to 740,000 from 835,000 in FY’22. Moreover, paid download volumes remain stagnant at ~95mm annually since 2022 despite continued content library growth, raising questions about return on content investment. Recent quarters have shown some stabilization, with Q2’24 revenue growing 1.5% y/y (2.1% constant currency) as editorial recovered post-strike and Olympic/election tailwinds emerged.