Wolverine World Wide ($WWW): Betting the Balance Sheet on Merrell and Saucony

Smaller Company, Simpler Credit Story

🚨 Connect: Twitter | Threads | Instagram | Reddit | YouTube

Focus is hard.

Everyone says they want it, but almost nobody actually does it. Because focus means killing things, admitting mistakes, shrinking the empire.

Wolverine World Wide actually did it. Maybe.

For years they collected footwear brands. Sperry. Keds. Hush Puppies. Work boots. Kids lines. Licensing deals. A little bit of everything for everybody, which usually means not enough of anything for anyone.

But management finally pulled the plug and sold the underperformers, exited weak channels, and took the proceeds to attack the balance sheet. What’s left is Merrell and Saucony. Hikers and runners, two brands, two categories, real customers who need the product.

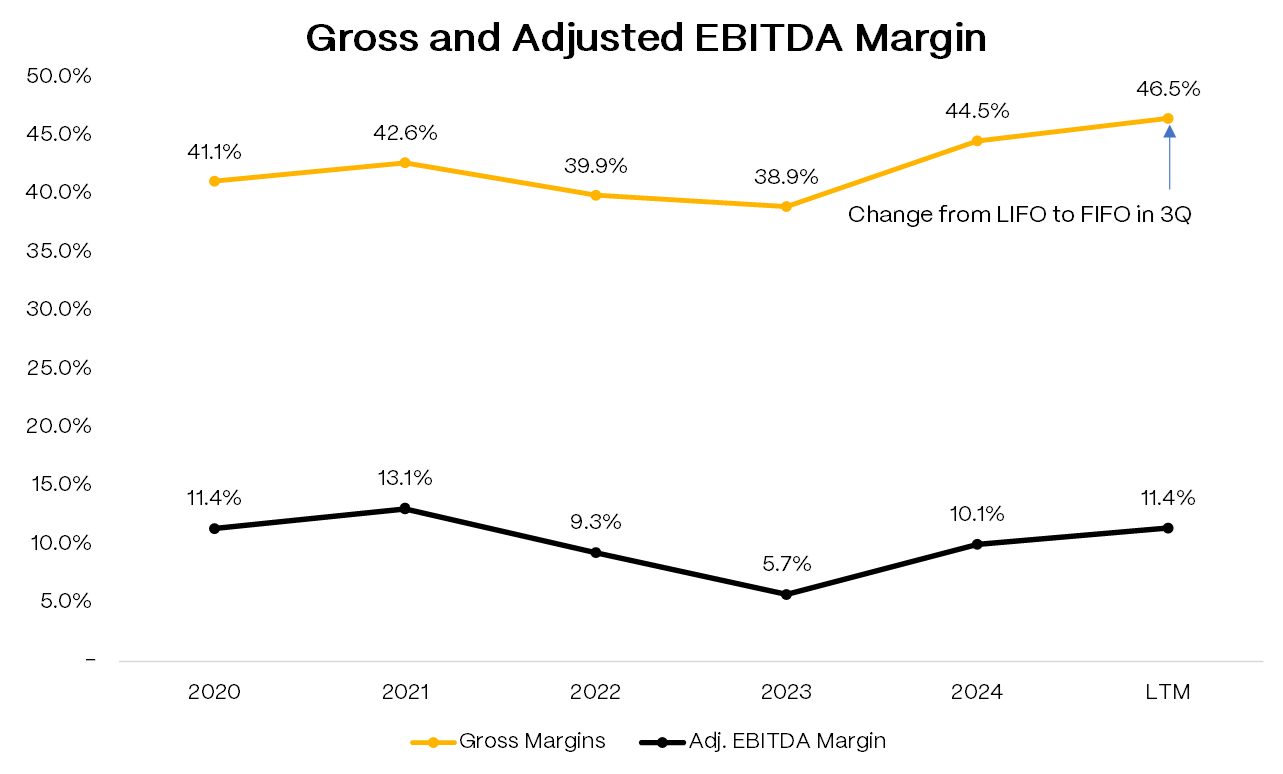

Revenue shrank from $2.68 billion to $1.75 billion in that period, and that’s what everyone sees. The other part is gross margins expanded 800 bps, net debt got cut nearly in half, and free cash flow turned positive.

Different company now. Smaller and simpler, with the strategic cleanup mostly behind it. The question is whether the new model holds up.

Situation Overview

Wolverine World Wide (“WWW”) makes shoes. Hiking boots, running sneakers, work boots. If you’ve laced up a pair of Merrells on a trail or run a marathon in Sauconys, you’ve bought their product. The company trades on the NYSE with $1.4bn market cap and sits in that middle ground between the mega-brands (Nike, Adidas) and the pure specialty players.

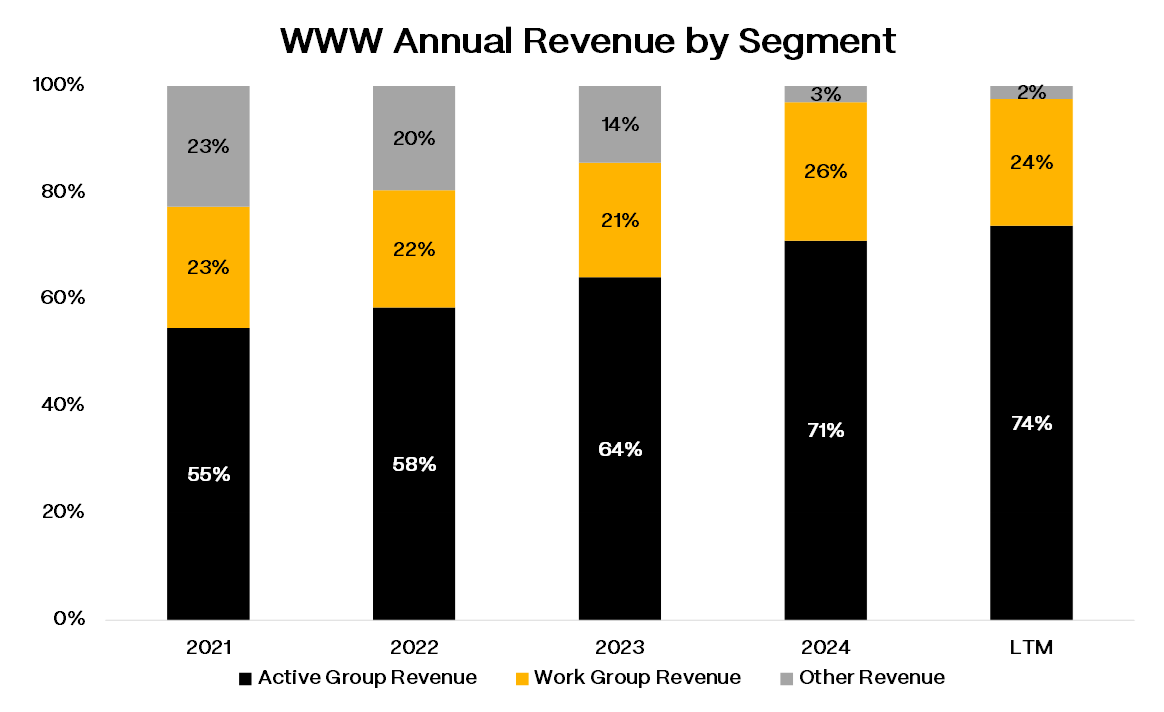

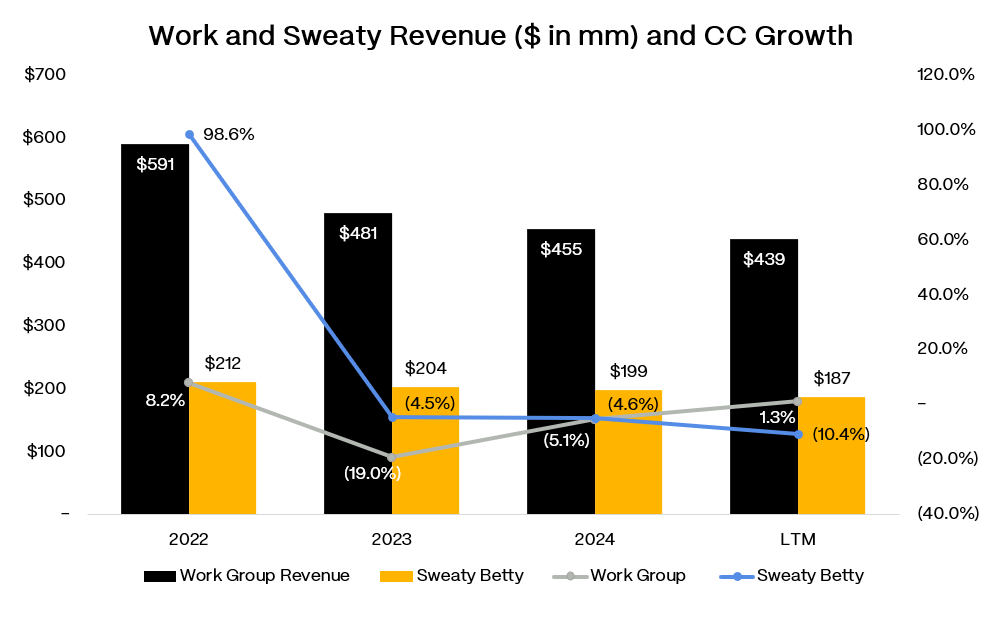

WWW reports in three segments: Active ($1.37bn LTM), which houses Merrell and Saucony; Work ($439mm), built around the Wolverine boot franchise selling into industrial and safety channels; and Other brands/licenses ($46mm). There’s also Sweaty Betty, an athleisure apparel business tucked into Active that the company is still figuring out what to do with.

Two years ago this was a different company. Management ran a “house of brands” strategy that included Sperry, Keds, Hush Puppies, Wolverine Leathers, and a bunch of kids formats. All of it is gone now. These were structurally low-return businesses, over-indexed to dying U.S. department stores or too small to justify management attention. The proceeds went to debt paydown and inventory cleanup. Revenue dropped from $2.68bn in FY’22 to $1.75bn in FY’24. That was the plan.

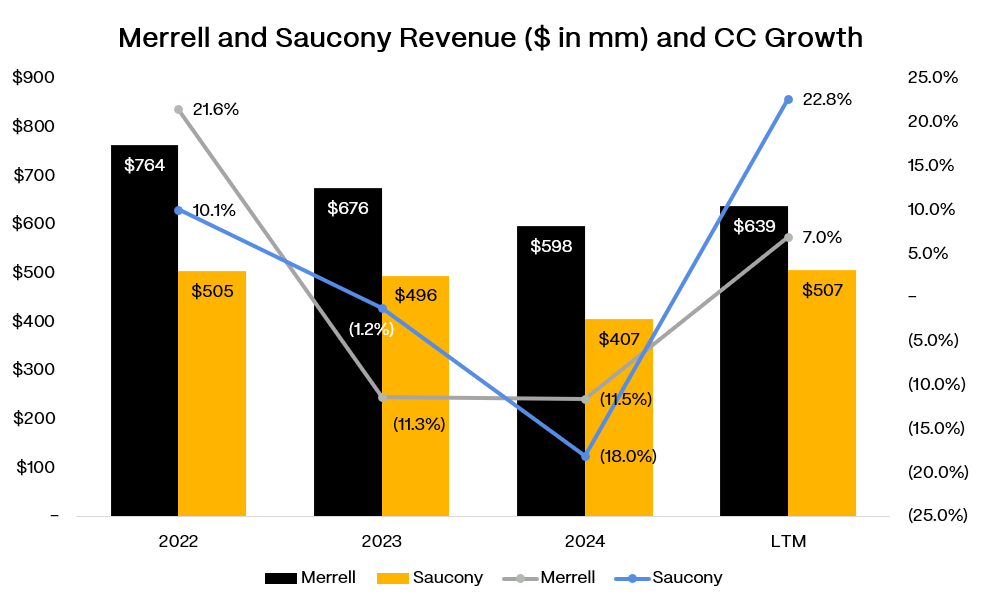

What remains is a $1.85bn business where Merrell and Saucony generate $1bn+ in revenue and most of the gross profit. Merrell has returned to mid-to-high single digit growth.

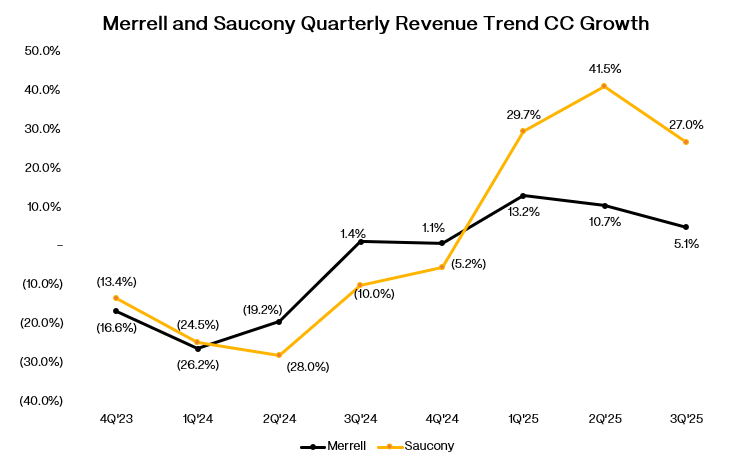

New product is landing (Moab updates, Speed/Agility lines), inventories are clean, and the brand is taking share in hike/outdoor. Saucony is the real growth driver. The brand is comping +25-30% driven by core run styles (Ride, Guide, Triumph, Hurricane) and an expanding lifestyle business that’s adding 1,300 wholesale doors in FY’25.

Management is already pruning underperformers and expects door growth to slow in 1H’26, but brand momentum is strong. Work is guided down high-single digits in FY’25. Sweaty Betty is comping negative as weaker U.S. locations close and focus shifts back to EMEA. Nobody is pretending these are growth engines.

Margins have recovered sharply from the FY’23 trough. Gross margins bottomed at 39%, recovered to 45% in FY’24, and are running at 47% in FY’25 YTD. Mix shift toward Active, lower promotions, and product cost savings drove most of it. A 3Q’25 switch from LIFO to FIFO on certain U.S. inventory inflates the headline number somewhat, but the underlying improvement is real. EBITDA margins have moved from mid-singles to roughly 10% on FY’25 guidance. Management’s long-term framework calls for 45-47% GMs, mid-teens EBIT, and $150mm+ operating cash flow. They’re not there yet.

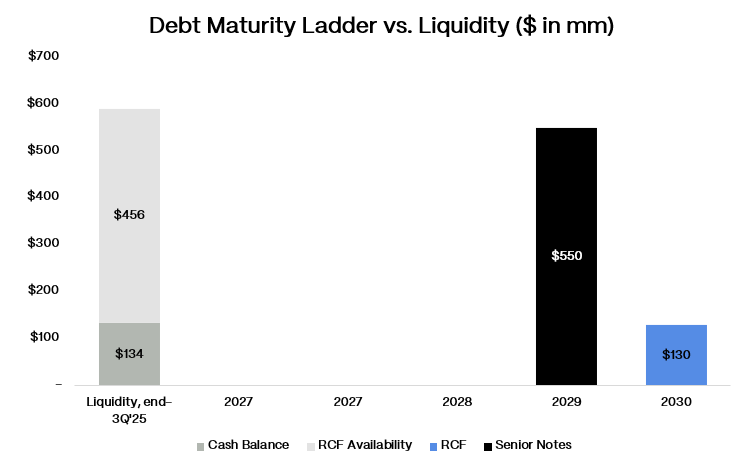

The capital structure is simple comprising $550mm in 4.00% senior unsecured notes due August 2029 and a $600mm secured revolver maturing September 2030 ($456mm currently undrawn). No term loans, no other bond tranches, nothing else to refinance before the 2029s come due.

At 3Q’25 the company had $680mm total debt, $134mm cash, and $212mm of LTM EBITDA. That works out to 3.2x total leverage, 2.6x net, and mid-single digit interest coverage.

One legacy issue worth flagging: the company carries a $30mm environmental liability from PFAS contamination at a former Michigan tannery. PFAS chemicals from old leather-processing operations ended up in local groundwater, triggering regulatory action and class-action settlements. Cash outflows run low single-digit millions annually over an extended period, partially offset by a settlement from a former chemical supplier. It’s reserved, it’s known, but it’s another drag on FCF.

Tariffs are the macro risk everyone is watching. Unmitigated exposure is $10mm in FY’25 and $65mm annualized starting in FY’26, concentrated in China-sourced product. China’s share of sourcing has already dropped from 50%+ to mid-teens and should be near zero by FY’26 as production shifts to Bangladesh, Vietnam, and Indonesia. FY’25 guidance (47.1% GMs, 8.9% EBIT) suggests this year’s tariff hit is largely absorbed through pricing, mix, and cost actions. FY’26 will depend on how fast mitigation lands.

The credit conversation has changed. Two years ago it was about solvency and near-term refinancing risk. Now it’s about the pace of de-leveraging and whether Merrell and Saucony can sustain momentum while tariffs bite and Work/Sweaty Betty continue to shrink.

The debate now is not whether WWW survives but whether the 4.00% 2029s still offer enough spread for what could go wrong.