Weekend Minutes: US HY Market Recap (October 11, 2024)

A Brief Recap of Last Week's US High Yield Market Performance

🚨 Connect with me on Twitter / Instagram / Threads | Estimated Read Time: 4 Minutes

💡 Got a job post? I’m open to having you publish— drop me a message!

The US HY market took a breather last week, as investors grappled with a hotter-than-expected CPI print and a surprise spike in jobless claims. September’s core CPI rose +0.3% m/m, above the +0.2% consensus, while initial jobless claims jumped to 258,000—their highest level since August 2023. This combo of data sent Treasury yields climbing and put pressure on HY bonds, particularly rate-sensitive BBs. Despite the short-term hiccup, the market’s YTD performance remains solid at +7.49%, showcasing resilience in the face of persistent inflation concerns and an increasingly murky economic outlook. Let’s dive into last week’s action 👇

Weekly Performance Recap

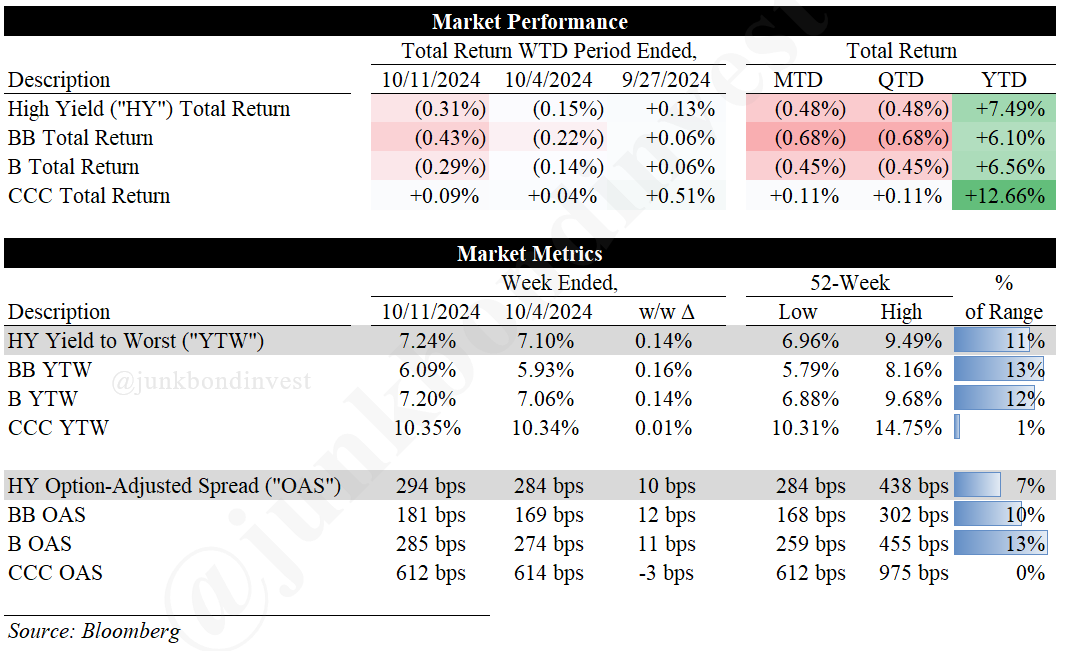

For the week ended October 11th, the HY market saw a modest decline, with the overall index returning -0.31%. Despite this decline, YTD returns remain robust at +7.49%, underscoring the market’s resilience in 2024.

Breaking down performance by rating category:

BBs declined -0.43%, bringing YTD returns to +6.10%

Bs declined -0.29%, with YTD returns now at +6.56%

CCCs bucked the trend, returning +0.09% for the week and pushing YTD returns to an impressive +12.66%

The continued outperformance of CCCs is particularly noteworthy, as they extend their lead over higher-rated credits, highlighting the market’s current appetite for risk.

Noteworthy Market Metrics:

The overall YTW for the HY market increased by 14bps to 7.24%, reaching its highest level in recent weeks

Spreads widened by 10bps to 294bps, but remain well below their 52-week high of 438bps

CCC spreads tightened slightly by 2bps to 612bps, continuing to outperform their higher-rated counterparts

The percentage of bonds trading above par decreased to 36%, down from 29% a month ago

The MOVE index, a measure of interest rate volatility, spiked to 124, its highest level YTD

Primary Market Activity

Primary market activity remained steady last week, with volumes reaching $4.6 billion across 6 deals. While this marks a very slight decrease from the previous week, October’s month-to-date volume remains strong at ~$10 billion, marking a 3-year high for October supply.

Refinancing activities continued to dominate the use of proceeds, but there was also a notable presence of M&A-related financing. Several of last week’s transactions were opportunistic drivebys, highlighting the favorable market conditions for issuers.

Standout Transactions:

Cleveland-Cliffs’ $1.8 billion dual-tranche offering of senior guaranteed notes, upsized from $1.6 billion, to partially fund its Stelco Holdings acquisition

Patrick Industries’ $500 million drive-by offering of 8-year senior unsecured notes, upsized from $400 million, priced at par to yield 6.375%

Specialty Building Products’ $510 million offering of 5-year first lien notes, priced at par to yield 7.75%

Secondary Market Dynamics

Treasury yields climbed following the release of September’s CPI data, which came in slightly above expectations. This put pressure on high yield bonds, particularly in the BB segment, which is more sensitive to interest rate movements.

Notable Movers:

WW International (formerly Weight Watchers) bonds rallied sharply following the company’s announcement of offering compounded GLP-1 products

Roblox Corp. bonds slumped after Hindenburg Research published a critical report, with its 3.875% 2030 notes tumbling around two points before rebounding slightly

New Fortress Energy bonds extended their recent run-up, boosted by CEO Wes Edens’ significant share purchase

Looking Ahead

As we enter earnings season, investors will be closely watching for signs of corporate health and guidance amid the tension between solid YTD performance and emerging economic headwinds. Upcoming Q3’24 earnings could provide insights into the impact of higher rates on corporate profitability, potentially swaying market sentiment.

That said, the HY bond market continues to show resilience despite rising rate volatility and Fed-related uncertainty, with higher yields fueling demand and driving some segments to their tightest levels since 2000. However, the approaching US election adds another layer of complexity, as spreads historically tend to widen in the weeks leading up to such events.

Looking ahead, the high yield market faces a delicate balance between strong technical factors and macro uncertainties. Investors should remain alert to potential spread widening catalysts (e.g., the election) while also being prepared to capitalize on attractive entry points.

Until next week, JBI.

Find the most recent JunkBondInvestor posts below

Disclosure: The information provided is for informational purposes only and should not be considered as investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release me from any liability. Seek professional advice tailored to your financial situation and objectives.