Weekend Minutes: HY Market Recap (October 4, 2024)

A Brief Recap of Last Week's High Yield Market Performance

🚨 Connect with me on Twitter / Instagram / Threads | Estimated Read Time: 5 Minutes

💡 Looking to fill a job vacancy? Publish your listing in this weekly e-mail—drop me a message!

The high yield market experienced a week of consolidation, taking a breath after September’s frenetic pace. Despite a slight pullback in new issue volumes, the market demonstrated resilience, with spreads tightening and the energy sector outperforming.

This lull in primary issuance comes on the backs of a remarkably robust September, which saw high yield bonds extend their winning streak to 5 consecutive months. Adding to the mix, the start of the week coincided with Rosh Hashanah, which likely contributed to subdued trading volumes and may have influenced the timing of new deals.

Nonetheless, the market’s resilience in the face of persistent inflation concerns and geopolitical tensions has been noteworthy. This mix of recent market strength, seasonal factors, and economic uncertainty has set the stage for what promises to be an intriguing 4Q’24. Let’s dive in 👇

Weekly Performance Recap

For the week ended October 4th, the high yield market experienced a modest decline, with the overall index returning -0.15%. This follows a strong September which extended its streak of positive monthly returns to five, bringing YTD returns to an impressive +7.82%.

Breaking down performance by rating category:

BBs returned -0.22%, bringing YTD returns to +6.56%

Bs returned -0.14%, with YTD returns now at +6.87%

CCCs bucked the trend, returning +0.04% for the week and pushing YTD returns to +12.56%

Noteworthy Market Metrics:

The entirety of the negative return last week was due to base rate movements as HY spreads tightened by 15bps to 284bps

The energy sector led performance, showing the most spread narrowing among all sectors

Primary Market Activity

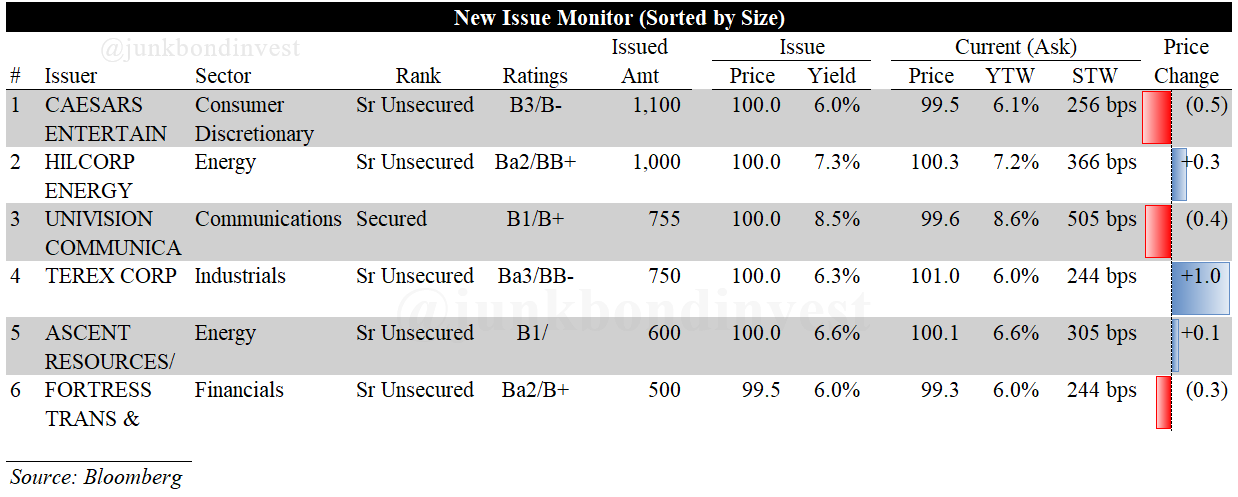

Primary market activity slowed considerably, with $4.7 billion pricing across 6 deals. This represents a significant decrease from the prior week and an even sharper decline from September’s very active market.

This slowdown in issuance can be attributed to several factors, including anticipation of key economic data releases and a general pause following September’s robust activity. While refinancing activity continues to dominate, we’re seeing an uptick in M&A-related financing.

Standout Transactions:

Caesars’s $1.1 billion offering of eight-year senior unsecured notes, upsized from $1 billion, priced at par to yield 6%. Proceeds will be used to partially redeem the company’s senior notes due in 2027.

Hilcorp Energy’s $1 billion offering, upsized from $800 million, of senior unsecured notes due 2035, priced at par to yield 7.25%.

Terex Corp’s $750 million 8-year senior unsecured notes at 6.25% to fund an acquisition.

Secondary Market Dynamics

The secondary market showed mixed activity this week as investors processed new economic data and geopolitical events. Energy credits outperformed on rising oil prices, while consumer non-cyclicals lagged.

Notable Movers:

Dish Network/DirecTV: Dish Network bonds rallied sharply on news of its merger agreement with DirecTV.

New Fortress Energy: Bonds rallied after creditors agreed to swap existing notes for new debt.

Looking Ahead

The coming weeks promise a data-rich environment that could significantly shape market sentiment. All eyes are on the upcoming CPI release which will closely be watched for hints on the trajectory of interest rates.

Recent comments from Powell suggesting inflation is on a “more sustainable path” have provided a glimmer of hope, but Friday’s stronger-than-expected jobs report (254,000 jobs added vs. 159,000 expected) has muddied the waters. This robust labor market data could potentially push back expectations for rate cuts, keeping the “higher for longer” narrative alive.

On the technical side, the market appears well-supported. The recent slowdown in new issuance, coupled with steady inflows to high yield ETFs, creates a favorable supply-demand dynamic. This technical backdrop could provide a cushion against potential vol stemming from any macro surprises.

Sector-wise, opportunities may be emerging in areas undergoing structural changes. The telco sector, in particular, bears watching as consolidation trends continue to reshape the landscape. Recent merger announcements could be harbingers of further M&A activity on the come.

However, with spreads hovering near multi-year tights, selectivity remains key. The dispersion between BB and CCC performance suggests that investors are still differentiating based on credit quality, a trend that’s likely to persist given the uncertain economic outlook. While the macro picture remains unclear, the resilient labor market should be supportive for primary activity over the coming weeks.

Find the most recent JunkBondInvestor posts below

Disclosure: The information provided is for informational purposes only and should not be considered as investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release me from any liability. Seek professional advice tailored to your financial situation and objectives.

Thank you, that weekly note is so helpful. Do you also look at converts? Would be awesome to have new CB issuances in there as well.