The Skillz Conundrum: Between Innovation and Insolvency

Examining the Unsteady Path of Skillz Inc. from SPAC Stardom to High-Yield Hurdles

Situation Overview:

There was once upon a time when the high yield market regularly financed #shitco type companies, such as WorldCom and, later, WeWork. Today, many HY issuers are legitimate businesses, albeit with high leverage. Generally speaking, the overall quality of the market has significantly improved over the last decade, with companies like Netflix having joined the ranks. However, every once in a while, you will encounter a new issue from a company whose entire business model is in question. Skillz Inc. is one such example.

Intro

Founded in 2012, Skillz Inc. (“Skillz” or “SKLZ”) is a mobile gaming platform that enables casual players to compete and wager on simple games like Solitaire and Dominoes. Instead of relying on traditional in-game advertising or purchases for revenue, developers on Skillz’ platform monetize game content through a profit share on player entry fees. Skillz does not develop games itself but rather encourages third-party developers to join the platform by offering a share of the profits from the betting volumes generated by users participating/wagering in their games. The business model can be summarized as follows:

As illustrated below, the games on the platform are quite basic—think Zynga (i.e., flash games you probably played on the internet in the early 2000s). While these games are objectively garbage, at the peak, they did garner the attention of 2.4 million people during COVID with 610,000 of them converting to paying customers.

The company’s “innovation” lies in its system for matching players with opponents of similar skill levels. Having patented the idea, Skillz argues that this approach transforms the games into contests of skill rather than chance, allowing the company to navigate around sensitive gambling regulations. Despite this, Skillz remains banned from the Google Play Store app in violation of its policies.

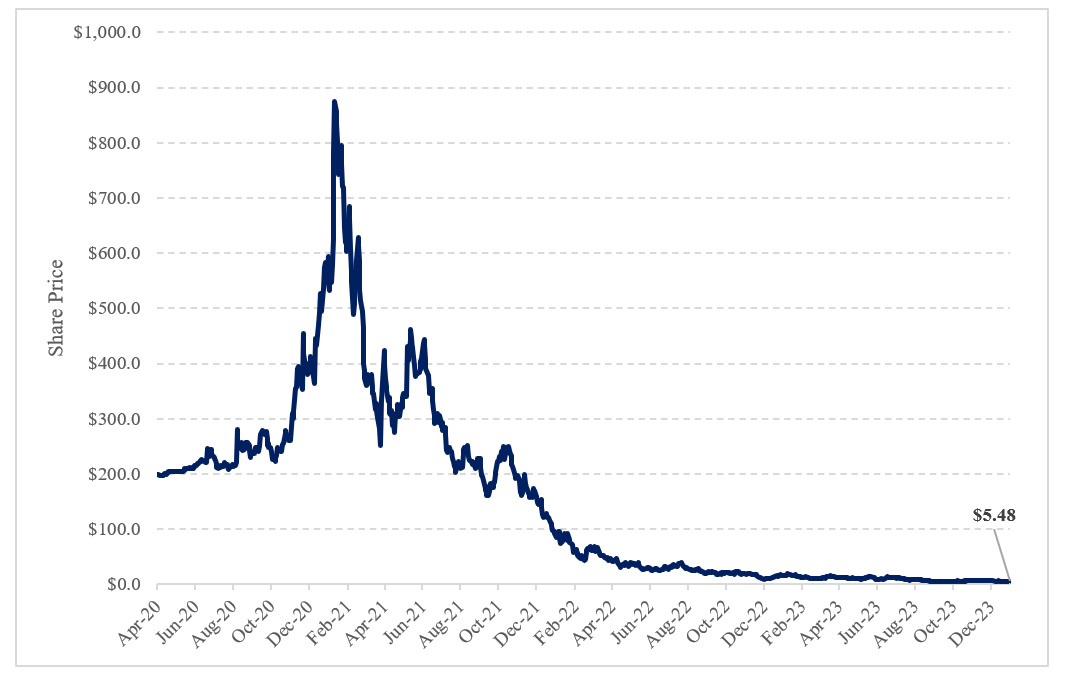

Going Public

In December 2020, Skillz went public through a SPAC (classic #shitco move) which valued the company at $3.5 billion. You can read the original investor presentation here. The company saw crazy price action following the COVID-19 pandemic on the backs of eSport/online gambling mania (the company went public shortly after Draft Kings). At its peak, Skillz’ stock reached a valuation of $16 billion, largely propelled by interest from ARKK/Cathie Wood, whose ownership of the stock (7% of the common equity) spurred speculative retail fervor and built a cult-like following on social media, akin to GME/AMC on a smaller scale. While publicly traded, Skillz remains controlled by CEO/Founder, Andrew Paradise, who holds all the outstanding Class B common stock which gives him >80% voting control of the business. In March 2021, Wolfpack Research released a critical short report on Skillz, much of which proved to be true. This also marked the beginning of the company’s precipitous stock price decline as illustrated below.

In late 2021, Skillz entered the HY market with its inaugural $300 million 1st-lien bond issuance, following an equity issuance/warrant exercise that raised over $500 million in cash proceeds and a $150 million acquisition of Aarki earlier that year. The bond, secured and carrying a double-digit coupon, was issued at a time when comparable maturity treasuries yielded just 1.25% (don’t we miss those times?). The initial spread of 1,033bps was particularly wide for a 1st-lien bond, clearly reflecting the high yield market’s skepticism about the business. Nonetheless, greed got to the best of credit investors and the bond was successfully placed.

Crash and Burn

Like many firms that went public via SPAC, Skillz has been a veritable “cash incinerator,” never achieving profitability in its entire existence and burning ~$500 million since 2019. Management justified this expenditure citing attractive subscriber unit economics. However, the company’s financials told a different story.

Post-pandemic, as user activity normalized and “gamblers” finally left their homes, Skillz began to lose active users. Almost every operating and financial metric has deteriorated since 2021. Furthermore, the company faced significant competition, with rivals effectively duplicating not only its games but its entire business model. Without exclusivity, interest from developers waned, resulting in fewer new games, and diminishing reasons for users to return to the platform. Competitors, offering nearly identical products, also provided more attractive terms and lower fees to both developers and customers. While at one point, the promise of a user/developer flywheel showed some promise, SKLZ appears to have lost all momentum.

Unable to sustain growth, Skillz shifted its focus to cost rationalization, particularly in customer acquisition and retention. The company also reduced its overhead by relocating some of its team offshore. All of this helped to improve EBITDA and FCF burn, although the company remains deeply negative in both areas. Unfortunately, the reduction in customer acquisition/incentives also led to a decline in active users. The company’s revised business strategy has been to focus on profitable customers with a much lower target payback period of ~6 months. This shift has been evident by the company’s increased average GMV among its paid MAU base.

Current State of Affairs

As of today, Skillz holds $340 million in cash and cash equivalents vs. a total debt balance of $130 million ($132 million if you included ~$2mm of finance leases). LTM FCF burn was approximately $100 million, implying the company has over three years of liquidity at current FCF burn rates. However, the decline in users, particularly paying users, shows no signs of stopping. Management anticipates EBITDA will turn positive in 2024 and claims to have six years of liquidity.

In 2Q’23, the company notably repurchased $160 million of its bonds (~53% of the tranche) in the secondary market for ~85 cents on the dollar, reducing its annual interest expense by $16 million. This helped the bonds recover from their lows in the mid-60s to the current price in the mid 80s. Despite this de-leveraging event, market participants currently ascribe negative value to the company’s operations seeing as the company’s cash balance is greater than the company’s debt and market cap combined! Finally, earlier this month, the company’s CFO resigned after serving less than two years. This ominously follows the departure of the Chief Accounting Officer back in March 2023.

Disclosure: The information provided is for informational purposes only and should not be considered as investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release me from any liability. Seek professional advice tailored to your financial situation and objectives.