The Hidden Value in Vroom's ($VRM) Bankruptcy

How shareholders survived Chapter 11 and what their equity might be worth now

Connect with me on Twitter | Estimated Read Time: 14 Minutes

When companies go bankrupt, shareholders usually get wiped out. That’s just how it works. The creditors take control, the stock goes to zero, and retail investors are left holding the bag.

But something different just happened at Vroom.

The company filed Chapter 11 with ~$290 million in convertible notes outstanding, and somehow shareholders kept ~7% of the reorganized company (pre-dilution). In 2025’s restructuring landscape, that’s about as rare as a profitable tech IPO.

Think back to 2012 when Vroom launched. The pitch was simple: buy used cars from customers nationwide, recondition them, then sell them online with home delivery. No dealerships, no haggling, just point, click, and get a car delivered to your door.

By June 2020, this seemed like a perfect pandemic play. Vroom raised $470 million in its IPO at $22 a share. The stock doubled on day one. By August, they were trading at $75. Not too long after, the company bought CarStory for AI analytics, then UACC for auto lending.

But the original e-commerce model proved brutally flawed. Vroom had to pay for significant reconditioning, transportation, storage, and marketing. Every car they sold meant more infrastructure, more overhead, more capital tied up in inventory. They were basically running a negative margin airline for cars.

So when used car prices normalized, interest rates shot up, the capital-intensive e-commerce operation imploded. When they couldn’t extend their vehicle financing past March 2024, the endgame began.

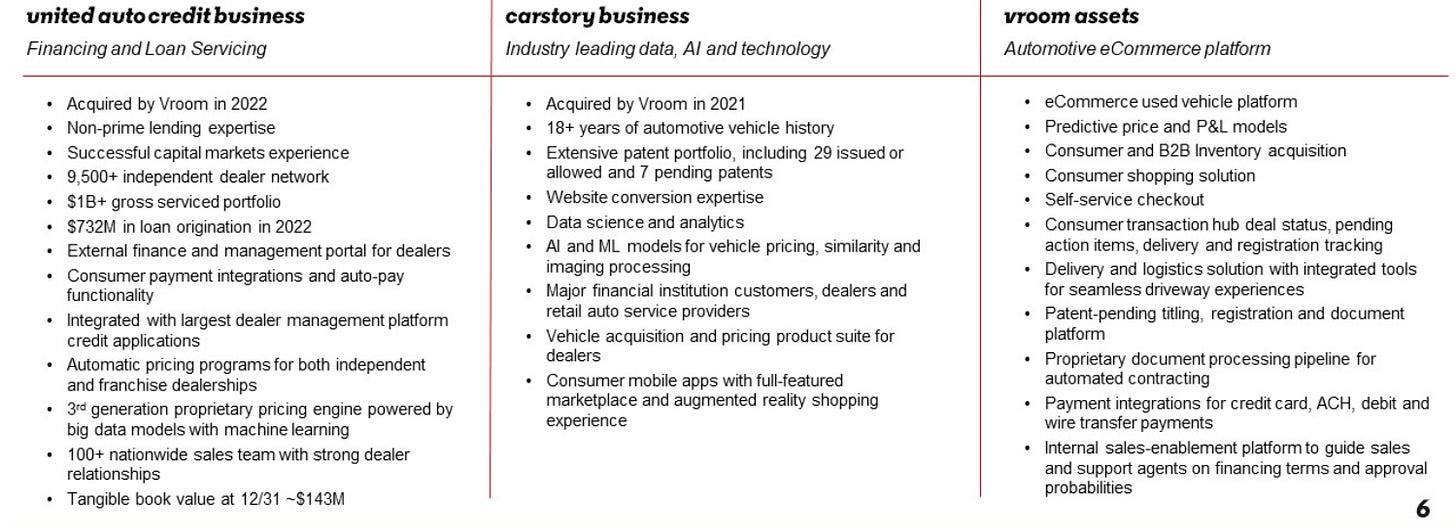

But here’s what everyone’s missing: underneath that sinking e-commerce business sat two actual operations—UACC’s lending platform with its $1.1 billion portfolio and CarStory’s analytics covering 240 million vehicles. UACC has relationships with 6,300 dealers and a proven lending business. CarStory has AI-powered analytics that could transform how cars are valued and financed.

The mainstream press is stuck on another “digital retailer fails” story, but that’s missing the point. What emerged from bankruptcy isn’t a car company—it’s an auto finance operation with a massive automotive dataset.

You don’t see many companies completely reinvent themselves through Chapter 11. Most just die or emerge as smaller versions of their former selves. But Vroom isn’t even playing the same game anymore. They’re not competing with Carvana or CarMax—they’re doing something entirely different.

But here’s where it gets really interesting...