Stem, Inc. ($STEM): Assessing the Company's "Busted" Convertible Bonds

Harnessing AI for Energy: Stem Inc's Risky Bet on Borrowed Time

Follow me on Twitter / Instagram 🚨 Read time below = 18 minutes 👇 We are hiring (part-time/internships), contact me for more information.

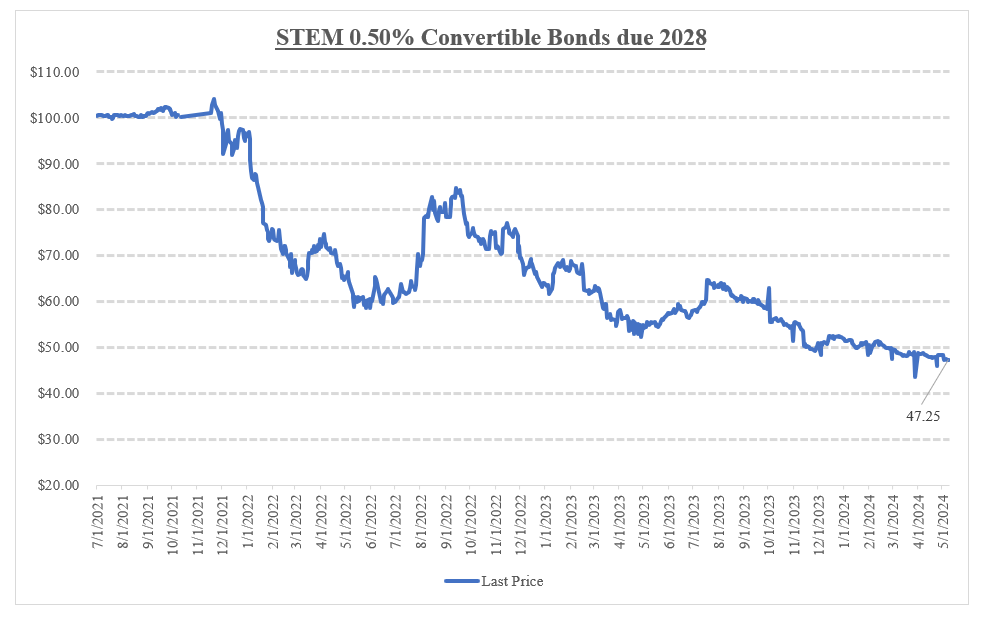

In this week’s post, I review Stem Inc., a company that one of my subscribers asked me to review a while back. Interestingly, Stem has become somewhat of a meme stock, complete with its own dedicated subreddit. The company recently reported earnings on May 2, resulting in the stock dropping nearly 40% in the days that followed and prompting me to finally take a closer look. What caught my eye in particular was the company’s small-issue convertible bonds which are currently quoted in the ~40-50 cent zip code. In this post, I’ll dive deep into Stem’s situation and try to determine if there’s any value to be found in these distressed convertible bonds.

Situation Overview:

Stem Inc. (“Stem”) is a company that provides “AI-driven” energy storage solutions, helping customers optimize energy use and costs. Headquartered in San Francisco, the company sells a suite of hardware, software, and services but its core offering is its Athena software platform, which uses software to automatically switch between battery power, onsite generation, and grid power.

Stem has grown rapidly over the last few years, increasing revenues 10-fold from $36 million in 2020 to $462 million in 2023 and its “contracted backlog” from under $200 million to over $1.6 billion. While the company considers itself a software and services provider, a large majority of its revenue today (~85%) is still derived from low-margin hardware sales. Importantly, Stem does not produce its own hardware but rather sources its from OEMs, which it then sells to customers. The company went public via a SPAC in April 2021—this fact alone speaks volumes about the quality of the business.

The company’s hardware sales are typically large, front-of-the-meter (FTM) battery storage projects that Stem jointly develops with partners and then seeks to layer on its higher-margin Athena software platform and other professional services like maintenance under long-term contracts. Stem receives payment upfront upon delivery of these systems but these FTM projects generate low-margin hardware revenue, while the higher-margin software/service revenues are recognized over a 10-20 year contract.

The company’s rapid revenue growth has been largely driven by the shift in its business model towards FTM utility-scale deployments and associated changes in revenue recognition, resulting in hardware revenues far outpacing the growth in software and services. However, as hardware has increasingly become commoditized, customers are showing a preference for purchasing directly from OEMs to avoid the markup that Stem charges on its hardware deliveries.

Despite the company’s impressive revenue growth, profitability (unsurprisingly) has remained illusive. Both EBITDA and FCF remain substantially negative with concerns growing around Stem’s ability to scale its higher-margin software/services revenues. Moreover, the company’s aggressive use of bookings and backlog as key performance indicators has also raised questions, as these figures include contracts without binding purchase orders that can be cancelled at any time.

More recently, the company meaningfully missed its original 2023 revenue guidance of $550-600 million (vs. $462 million in actual 2023 revenues) and gross margins continued to be pressured due to low-margin hardware sales. Stem also posted another year of negative EBITDA(-$19 million), although this marked an improvement from -$46 million in 2022. Management expects Stem to turn EBITDA positive in 2H’24 and generate positive cash flow in 2025.

From a capital structure perspective, Stem ended 1Q’24 with $113 million of cash/cash equivalents against $602 million of debt (comprising primarily 2 tranches of convertible bonds). While the Company’s liquidity position appears adequate for now, the unexpected $200 million “green” 4.25% convertible note offering in March 2023 raised some eyebrows, particularly given the stock was trading at 52-week/all-time lows at the time. Management stated proceeds would go towards repurchasing existing convertible notes at a discount and funding working capital needs, but many viewed this as a sign of potential cash flow pressures.

Lack of profitability/FCF burn, slower than expected ramp in software/service revenues, and an increasingly competitive operating environment have weighed negatively on both the company’s stock and bonds prices. The company’s two tranches of convertible bonds currently trade in the 40 cent zip code, yielding ~20%.

While Stem may be well positioned to benefit from the exponential growth in U.S. energy storage deployments (expected to reach 400 GWh by 2030), the next 12-18 months will be important in demonstrating its ability to drive profitable growth. With the stock -97% from its post-SPAC highs and bonds yielding 20%+, Stem will need to start showing more tangible progress on software adoption, margin expansion, and cash flow generation to restore credibility with investors. If successful, the company has a long runway for growth in the AI-powered energy storage market. However, if operational challenges persist, Stem may need to explore strategic alternatives.

Disclosure: The information provided is for informational purposes only and should not be considered as investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release me from any liability. Seek professional advice tailored to your financial situation and objectives.