Spanish Broadcasting System Inc. ($SBSAA)

An absolute #shitco...and I like it.

Executive Summary:

Spanish Broadcasting System Inc. (“SBSAA”) is a niche radio operator that focuses exclusively on Spanish-language content for Hispanics in the US. The stock has been in a standstill for the last 4 years as the company defaulted on its debt in 2017 and has been in an intense legal battle with a group of Series B preferred equity holders ever since. On top of that, COVID severely impacted advertising demand last year and radio broadcasters saw significant declines in their revenues across the board. Despite these unique circumstances, the equity of SBSAA skyrocketed last month (up ~10x YTD) as the company (i) announced the successful refinancing of its existing and long-overdue debt and (ii) as part of the refinancing, settled with its litigating preferred equity holders. Even though the stock is up nearly 10x from its lows, I think the stock can still be another 3-5x from here, if not more. The situation has been massively de-risked and the equity now presents a highly convex and asymmetric investment opportunity. The remaining opportunity exists because there remains some uncertainty around the pro forma share count. I believe pro forma dilution will be minimal (<25%) and expect this to be confirmed when the company files its 2020 annual report next month.

Note that this stock is not for the faint of heart. SBSAA trades very thinly OTC on Pink Sheets. Trading volume is only ~$30k/day and volatility is very high. This is not suitable for funds given size/volume. Indicated prices may not be executable. Invest at your own risk.

Situation Overview:

The company was founded in 1983 by the father of the current CEO/chairman and largest shareholder, Raul Alarcon Jr. (43% of economic and 85% voting interest in the company).

In 2003, the company issued $90mm of 10.75% preferred equity. For a while, they paid dividends but as the broader industry experienced secular headwinds, SBSAA discontinued payment and the balance accrued to $192mm.

In 2012, the company issued 5-year 12.5% secured bonds to refinance its existing credit facilities. This was incredibly high even for that time, largely because of the sizeable preferred equity obligation that remained unaddressed.

In 2017, the company was unable to refinance its debt as it was prohibited technically by the Series B preferred equity docs. More color can be found here (link). While the company was technically in default of its secured debt, it continued to pay interest in-full and on-time. Bondholders (majority owned by PIMCO) were happy to receive such exorbitant coupon payments while the company sought to work out a deal with its Series B preferred equity holders. While the bondholders could have in theory foreclosed on the business, PIMCO was in the driver’s seat and this is not really their investment mandate—more color here (link). They also likely had no incentive to own/operate the business. I also believe management here is pretty entrenched in their relationships and removing them would’ve been value destructive. Not to mention, there likely would’ve been a long and costly valuation fight amongst the various stakeholders.

For the last 4 years, there has been an intense legal battle between the company and this group of litigating Series B preferred equity holders with little progress being made. Notably, these litigious holders were mainly hedge funds that had purchased these prefs from Lehman below par. Here’s an investor letter from one of the owners for reference (link).

During this period, the company’s market cap was <$5mm given the high uncertainty around the resolution of the litigation AND the fact that its very high and expensive debt load was past maturity and technically in default. To save some money during COVID, the company deregistered its shares in 2Q-20 and now only posts its financials on its website.

I hope I have not scared you off just yet! Despite this negative fact pattern, the company’s prospects have drastically changed over the last month and the future looks incredibly bright:

First, the company finally completed its long-anticipated debt refinancing. The company issued $310mm of new bonds (closed on February 17th) and used the proceeds to repay all of the outstanding and overdue 12.5% secured bonds due 2017. The company was also able to lower its interest expense despite the increased debt quantum and it is no longer in default. The pro forma capital structure is very simple and clean. In total, the company reduced its contractually-senior obligations by $132mm AND extended the option value of the equity by 5 years as a result of these transactions. See below the estimated pro forma capital structure and related sources and uses (source).

Second, as part of the recapitalization transactions, the company completely eliminated the massive $192mm preferred equity obligation, which was senior to the common equity. In its settlement with preferred equity holders, the holders will get up to a $68mm cash payment and receive some portion of the equity. There remains some ambiguity around pro forma share count. As per the 3Q-20 filing (pre-settlement), the company had 7.3mm shares outstanding comprising 4.2mm Class A shares, 2.3mm Class B shares, and 380k Series C Preferred Stock (which converts to 760k Class A shares). Traditionally, preferred equity is senior to common equity and should get full recovery ahead of equity in theory. However, I believe the company was able to negotiate a sweet-heart deal that gave them minimal dilution— I believe these Series B preferred equity holders will get less than 25% of the pro forma equity:

Current laws require FCC approval for greater than 25% of foreign investment in a US entity that controls, directly or indirectly, a US radio licensee. The Series B preferred equity was notably held by several hedge funds including Canadian investment firms Ravensource, Stornoway, and Westface as well as several Cayman Island-domiciled entities. If these holders were to get >25% of the diluted equity, they would need to go through an approval process with the FCC, which would take some time. However, there have been no relevant filings on the FCC docket since June 2020 (link). I think what we can infer from this is that the Series B preferred equity holders got <25% of the pro forma equity. This means there is probably <9.7mm (7.3mm / 75%) of pro forma shares outstanding, implying a market cap of ~$20-25mm. If this is true, this is an incredible win for the common equity seeing as >$100mm of senior capital was eliminated and equity dilution has been quite minimal.

Third, I believe we have seen the worst of COVID already and that LTM EBITDA has troughed. Revenues/EBITDA have continued to improve sequentially from 2Q-20, which was down an eye-popping 58% y/y. Q4 is now pacing to be down only 13% y/y and we should see positive y/y comps come 2Q-21. I think the company should be able return to normalized EBITDA levels of ~$50-55mm by mid-2022, if not earlier. Unlike its radio peers, SBSAA was growing organically pre-COVID at a ~3% CAGR. Coupled with permanent cost cuts of $3-4mm made in 2020, there is upside in EBITDA levels going forward.

Lastly, I want to stress that the company demonstrates characteristics of being “anti-fragile” seeing that not even (1) very expensive, double-digit debt, (2) a massive, multi-year litigation w/ preferred equity holders, or (3) COVID could take down this company. And not only has it survived, it was able to grow the business organically (pre-COVID) despite these unique circumstances.

Current Capitalization / Historical Financials:

Investment Thesis:

Over the past month, I believe the equity has been substantially de-risked given the recent recapitalization transactions. While still highly levered, the company generates solid FCF and profitability should only improve from hereon. SBSAA also has ample time to demonstrate this as the next debt maturity is in 2026. With the litigation behind him, the company’s CEO, who has strong skin-in-the-game as the largest shareholder, has strong incentive to increase investor coverage of SBSAA seeing as he stands to personally benefit greatly.

As leverage is high at 93% LTV, there is significant convexity in the equity with potential for this to be a multi-bagger—there is a real path to a $100mm market cap in a few years time. I believe the stock remains mispriced for several obvious reasons:

Complicated situation / checkered company history. The company has technically been in default since 2017. A cursory review of this situation would raise the obvious question as to why the equity should have ANY value if the company defaulted on its debt. Add a messy and prolonged litigation to the mix and this becomes a no-go zone for most investors.

Microcap stock that trades OTC/Pink Sheets. This is a de-registered company whose stock trades OTC on Pink Sheets. It’s highly illiquid, has limited trading volume, and is massively volatile. For example, despite the recent runup, there have only been 859 trades in February 2021 representing ~$2mm of total notional value. No institutional investor is touching this with a 10-foot pole. The buyers here are likely only retail. This of course may change if the company registers and relists on a major US exchange.

Incorrect reported capitalization. BBG and CapIQ have the EV completely wrong. It is not $821mm or $450mm. It’s closer to $330mm. This is the same valuation the company had in 2007. To save money during the pandemic, the company stopped filing w/ the SEC post 1Q-20, so none of these financial aggregation services have up-to-date financials.

Share count/dilution uncertainty. There remains some ambiguity regarding final pro forma share count post the recent recapitalization transactions. As described above, I believe the share dilution will be less than 25%.

Concentrated ownership / family-controlled business. This is a family-owned and controlled business. Raul’s track record (as demonstrated by the stock price) is poor. However, with a clean balance sheet and a line of sight towards equity value creation, I think Raul will have strong impetus to drive the stock up over the next several quarters/years, seeing as he stands to benefit greatly from that.

Potential Catalysts:

2020 annual report confirming pro forma capitalization

Re-listing on major exchange

M&A. Sale to strategic or acquisition of competitor (e.g., Univision, Entravision).

Debt paydown + refinancing (~10% of debt can be repaid over the next 2-years w/ estimated LFCF).

Monetization of real estate or spectrum assets

Sales of TV segment/stations

Small dividend/share buyback announcement (unlikely)

Valuation:

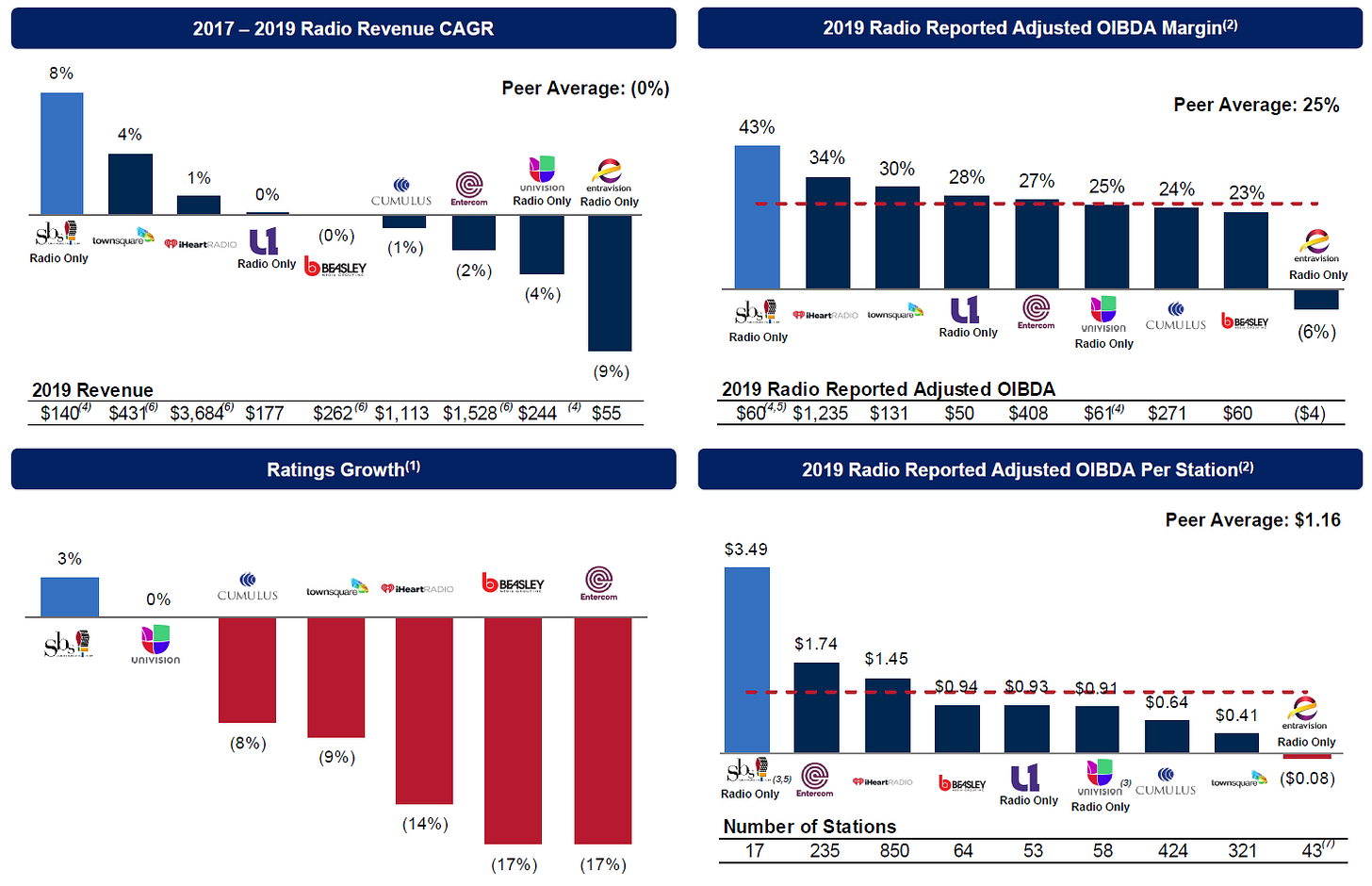

Radio names trade in the 6-8x EBITDA range (on 2019A “normalized” pre-COVID EBITDA). While SBSAA is one of the more levered names, the underlying business has some favorable attributes which might warrant a premium multiple. For example, the company (i) has shown organic growth, ahead of the slight decline of the broader industry, (ii) has best-in-class EBITDA/FCF margins, (iii) benefits from demographic tailwinds, and (iv) owns high quality assets in large markets (NYC, LA, MIA). On an unlevered basis, SBSAA is one of the cheapest publicly traded radio companies.

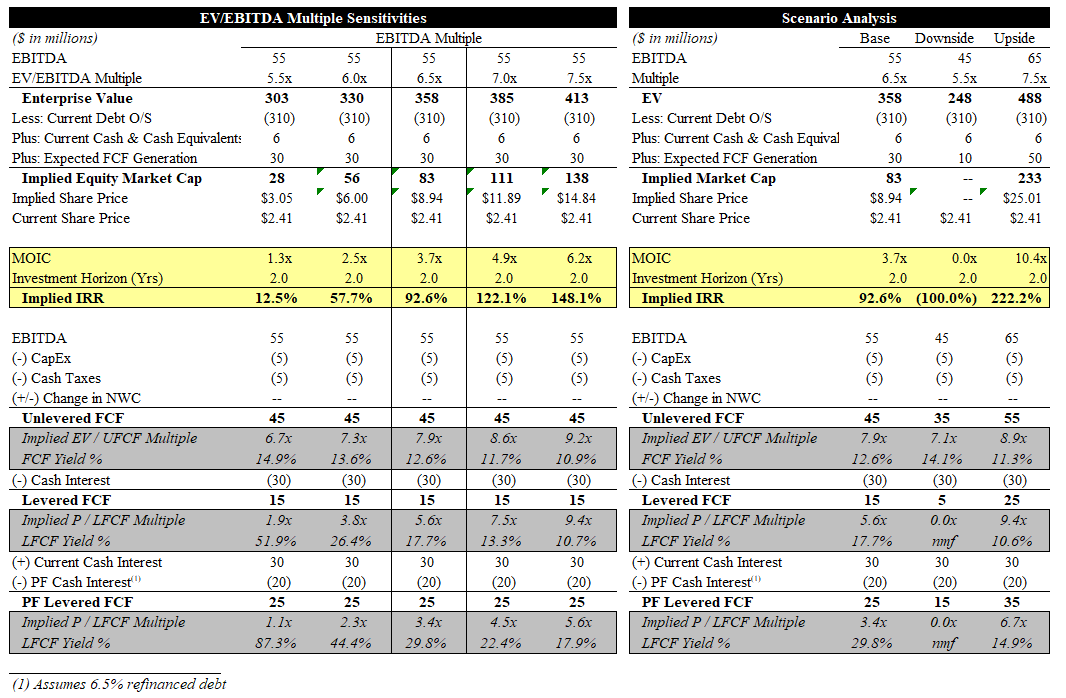

Below I’ve outlined some sensitivities which show just what kind of upside there potentially exists in the equity. Because of the high leverage, very slight movements in EBITDA and/or multiple will drastically move the equity of SBSAA in either direction. With the litigation behind them, management should be able to focus their attention on growing the business, beyond the cyclical recovery.

While the current interest burden remains high, SBSAA should be able to generate positive levered FCF which can be used to pay down debt. The combination of revenue recovery, EBITDA stability, and steady FCF generation should position the company to refinance its debt in 2 years, which is when the current non-call period ends. At 9.75%, the new bonds are well wide of market and other radio credits. If the above plays out as expected, the company should be able to refinance the debt 300bps tighter (assuming credit markets remain receptive), which should allow for even greater LFCF generation, all of which would be accretive to the equity. On such a pro forma basis, the company could be generating ~$25mm of LFCF or 1x today’s market cap!

With all this being said, you may ask yourself, is it too late to buy when the stock is up 10x? Despite the recent runup, this only translates to only $18mm of incremental enterprise value. If you believed the preferred equity was previously fully covered, that would mean the equity today should be worth at least $14.9/share or nearly 6x today’s price of $2.41/share. Compared to many other hard-impacted COVID names (e.g., cruises, airlines, etc.), SBSAA has NOT had to raise incremental debt or equity as FCF burn has been minimal.

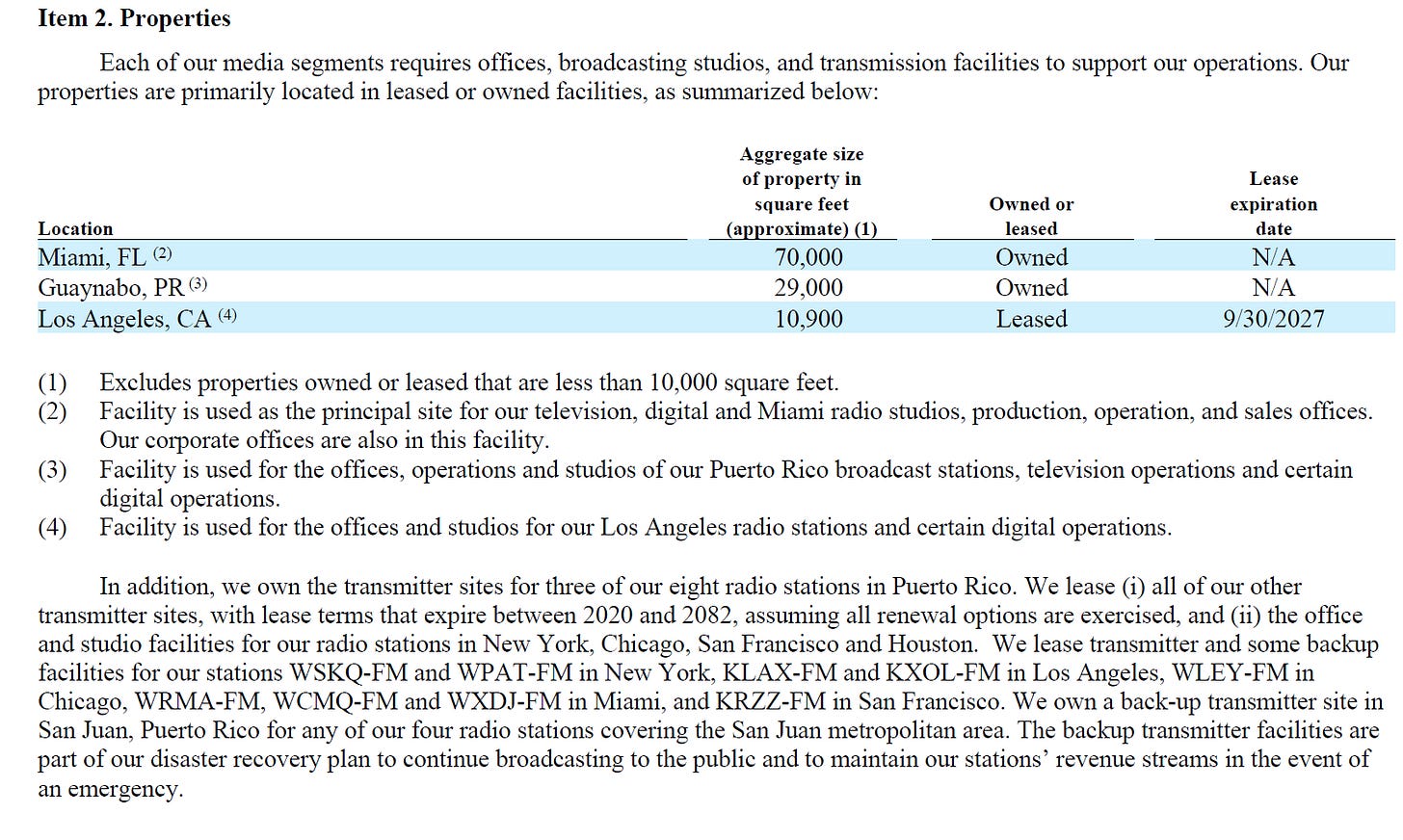

SBSAA also has some hard assets which it could potentially monetize. I don’t expect them to do so nor do I ascribe much value (maybe $5-15mm). However, they could be sources of liquidity in a downside scenario.

Company Overview:

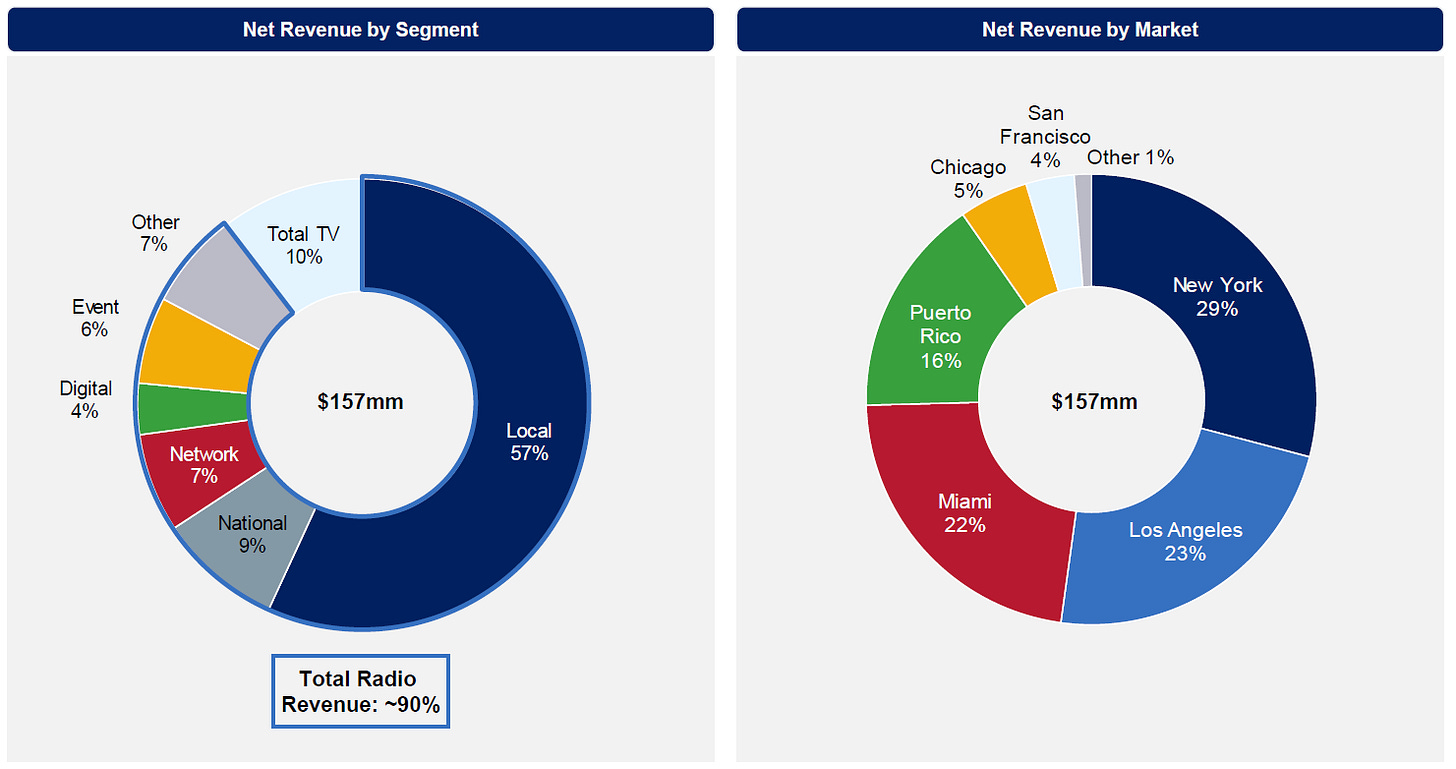

Founded in 1983 by the father of the current company chairman/largest shareholder (Raul Alarcon Jr.), SBSAA is a small, niche radio operator focused on Spanish language content for the US Hispanic market. The Company owns 17 radio stations in 6 US markets including the #1 Spanish-language radio station in the US—WSKQ in New York (link). The company also owns 5 TV stations in Florida and Puerto Rico, reaching ~21mm households. Nonetheless, radio revenues account for 90% of the company’s total revenues. To a smaller extent, the company has a live-entertainment business (40+ events per year pre-COVID and ~$10mm of revenue) and a radio app called, LaMusica. The company has recent investor presentation on their website which outlines its business in greater detail (link); I’ve re-pasted a few relevant slides below:

Things I Like About This Company:

A few items that stuck out from the company’s recent investor presentation:

Favorable demographic trends. The US Hispanic population is growing faster than the average with 21% growth over the last decade. While US Hispanics account for 19% of the US population and 11% of the buying power (2019), they only attract 5% of total ad spend ($9.4bn). As we have seen in the most recent election, US Hispanics are playing a larger role in elections. SBSAA’s nexus to Florida, a battleground state, makes them a good candidate for incremental political ad spend (2020 was a record political year for SBSAA).

Best-in-class operational performance. Whereas the rest of the traditional broadcast radio industry has seen slight declines in their core broadcast radio revenues, SBSAA has actually been able to grow organically. SBSAA also has best-in-class EBITDA/FCF margins, significantly higher than almost all of its peers. I attribute this mostly to them being located in very large markets (vs. peers whose smaller radio stations dilute margins) and their niche but growing Hispanic market focus (increasing ad $ spend). Additionally, the company is also either #1 or #2 ranked in all of its markets.

Solid unlevered FCF generation. Despite a smaller revenue base, the company generates about $40mm of unlevered FCF. Historically, this has been entirely offset by interest expense. I do not think there are many companies that can survive 4 years paying 12.5% coupon debt at ~90% LTV! The fact that they have been able to pay nearly $130mm of cash interest over the last 4 years makes me more comfortable that there is real FCF generation here (vs. highly adjusted figures).

Hispanic management team. The majority of SBSAA’s workforce is Hispanic unlike some of its competitors. I think this gives them an edge in understanding the markets/audiences that they serve.

Industry:

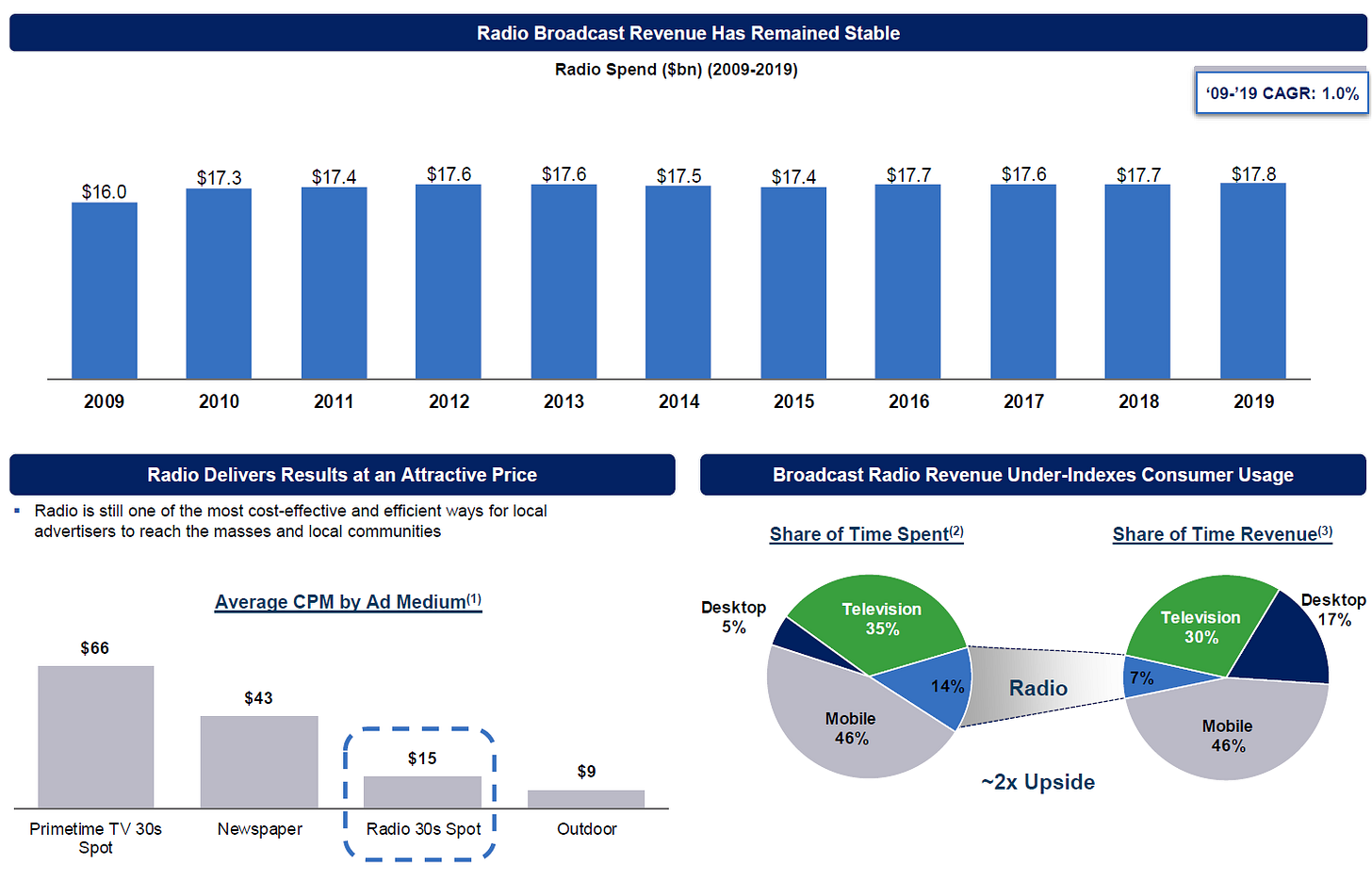

Contrary to initial perceptions, radio has remained relatively stable despite the rise of newer and better audio mediums (Spotify, Apple Music, etc.). While this of course might change in the future, I think the decline will be slow and predictable largely because radio is (1) free for users to access, (2) a cheaper medium for advertisers, (3) and is readily available in almost all cars, which makes it very easy to use/access. SBSAA’s core underlying demographic trends should also help offset any broader industry headwinds.

Risks

Highly levered equity that may be worthless if the company cannot de-lever and refinance its debt.

The company recently refinanced its debt and now does not have any maturities prior to 2026. Current liquidity is solid and pro forma levered FCF should be positive ~$10-15mm per annum.

Secular declines in radio.

Despite the introduction of new digital mediums, industry decline has been much more stable than expected. The company also benefits from secular demographic tailwinds which should help offset this. SBSAA has been growing organically pre-COVID.

Family-owned and controlled company that may not care about share price.

When Raul’s (CEO) equity was out of the money, he did not have an incentive to drive stock price up and instead, resorted to paying himself a huge salary/bonus. Post the recent recapitalization, he can make a lot more money by growing the business and getting access to a public market equity float.

Like the pitch, any updates on this? why is EBITDA continuing to come in so much lower in 2022? Much closer to $25m vs. 55m :(

great analysis, thanks for sharing!