Skillz ($SKLZ): Anatomy of a Slow Burn

How a once-hyped mobile gaming platform became a case study in balance-sheet endurance

🚨 Connect: Twitter | Threads | Instagram | Reddit | YouTube

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list (limited spots).

You’ve seen the ads. Play games. Win cash.

Most of them are shady and look something like this. Solatire, bingo, pool, whatever. Someone had to create this space though. That was Skillz. They built it from nothing. Got it regulated. Went public. Valued at $3 billion at the peak.

Now their market cap hovers around $100 million.

Sales down over 30% last year. They’ve got about 146,000 paying users left. And Google won’t let them in the Play Store because real-money gaming makes platforms nervous.

Here’s what’s interesting though. They’re sitting on $229 million in unrestricted cash. They’ve also got $130 million in debt maturing next year. High yield bonds trading near par with a 10.25% coupon. And they haven’t refinanced yet.

That should tell you something.

The question is what happens next. Do they pay it off with cash and keep burning? Do they somehow refi in this redhot credit market? Or does private credit come in with one of those “capital solutions” because they need to deploy capital?

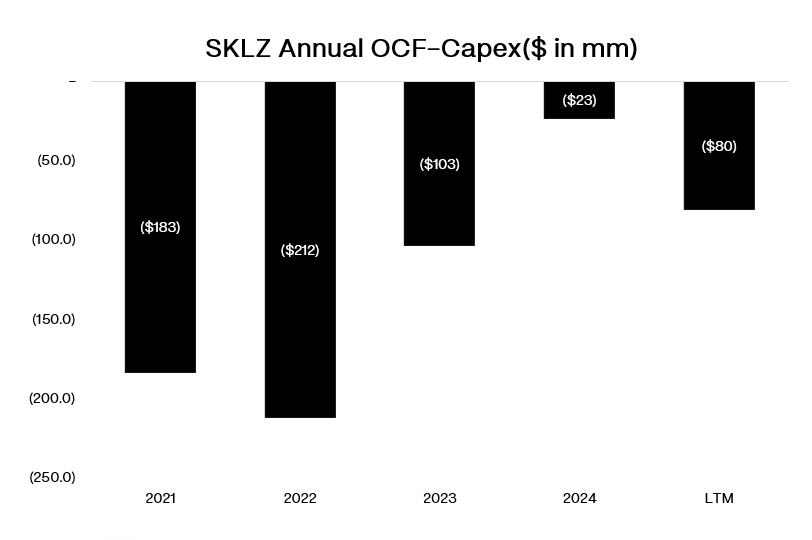

Skillz probably has less than two years of runway if nothing changes. After that, they’re out of time…and options.

I. Situation Overview:

Skillz is one of those companies that feels like a relic from the SPAC era. A good idea that never quite figured out how to be a business. Founded in 2012, based in San Francisco, they basically invented the concept of competitive, real-money gaming on mobile. You don’t play Skillz games; you play on Skillz. Third-party developers plug into the platform, users put up cash, and Skillz handles the matchmaking, scoring, and payouts. The company went public in 2021, at the peak of the mobile gaming gold rush. At its height, it was worth more than $3 billion.

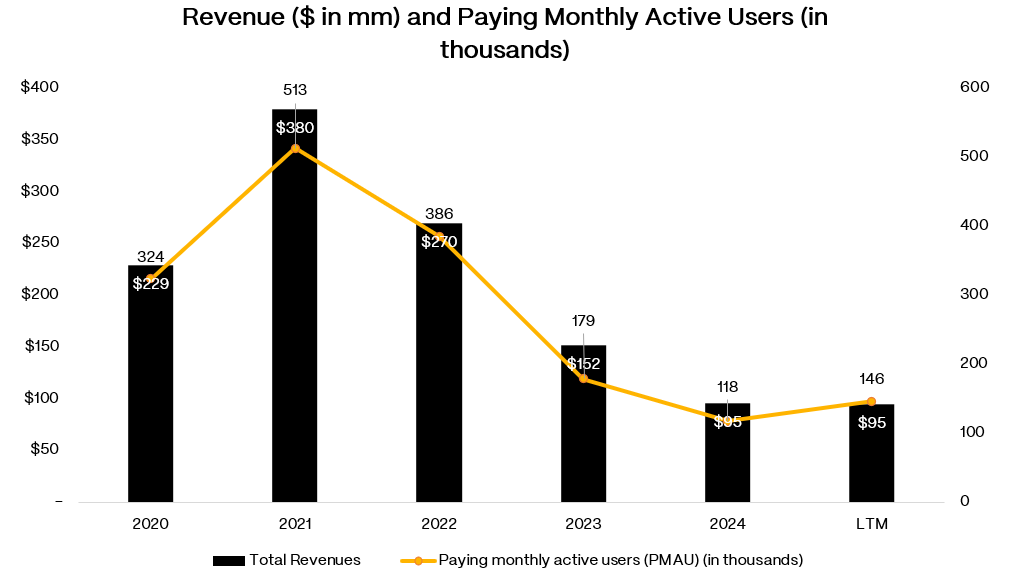

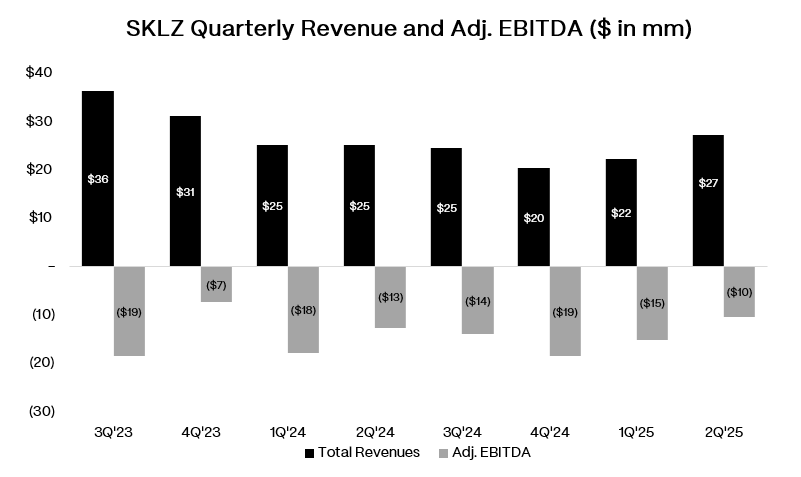

Now? It’s market cap sits at around $100 million, and shrinking. The boom turned into a bust, and the business hasn’t found the floor yet. Q2’25 revenue was $27 million, down roughly 80% from peak, and it’s not just fewer people playing…it’s that the ones still around are spending less. Paying users cratered from over 500,000 to just 146,000, and even those users are playing fewer games.

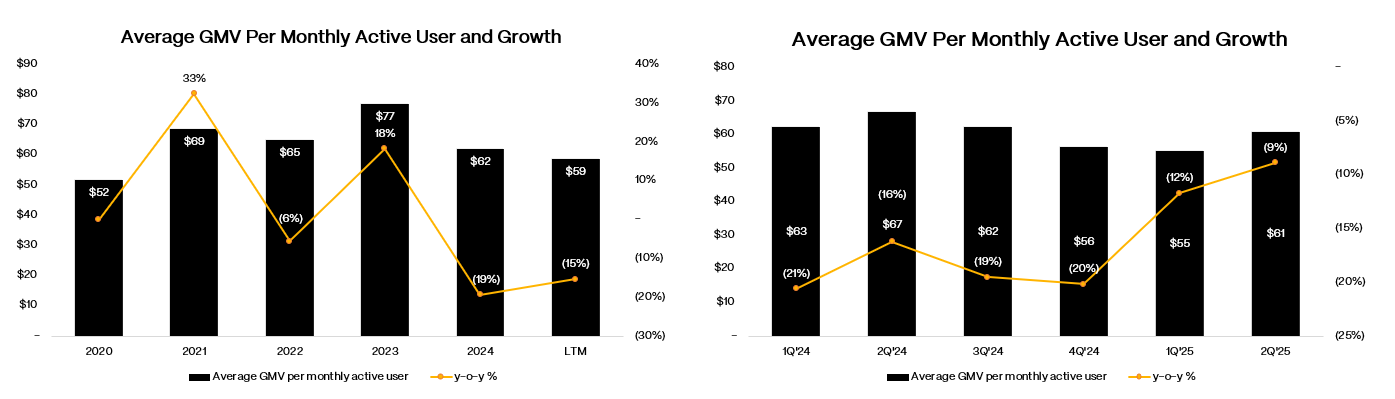

The more telling metrics show the same pattern. Average GMV per MAU continues to fall, signaling weaker engagement even among the core base.

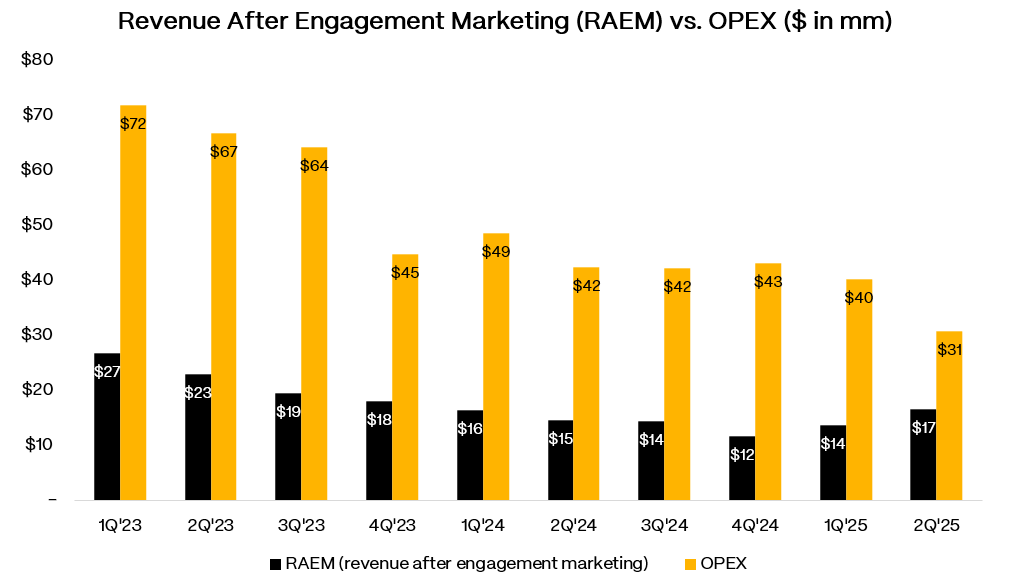

Revenue after engagement marketing (the number that actually matters once you strip out promos and prize pools) was just $17 million in 2Q’25, still not meaningful enought to cover overhead.

And while management likes to point out that EBITDA losses have “narrowed” to -$10 million in Q2’25, that’s still deeply negative.

So what went wrong? Some of it’s Skillz. Some of it’s the environment. Apple’s 2021 App Tracking Transparency policy basically nuked the mobile ad model that fueled this entire ecosystem. You can’t target users across apps anymore unless they opt in, and almost nobody does. Overnight, customer acquisition costs spiked. That hurt everyone in mobile gaming, but it was fatal for a platform like Skillz, which depended on cheap, repeatable acquisition to feed its tournaments. Then there’s Google. They still refuses to allow real-money gaming apps in the Play Store. That means Android users have to go through a web browser to play, which kills conversion. Add in new, aggressive competitors like Papaya Gaming, Voodoo Games, and AviaGames, and the funnel just broke.

Management’s answer? Another “turnaround.” Depending on how you count, this is probably the third one. The new plan has four pillars:

Platform Innovation – new loyalty programs, instant ACH withdrawals, and something called “Skillz Arcade,” a single app meant to house multiple games.

Content Investment – a $75 million Developer Accelerator Program to bribe new studios into building fresh titles.

Cost Reduction – move headcount to Las Vegas and Bangalore, cut opex, get burn down to ~$8 million per quarter (excluding one-offs).

Marketing Optimization – focus on reactivating existing users instead of spending big to acquire new ones.

The immediate progress mostly comes from cutting costs, not growing revenue. That’s fine for optics, but you can’t shrink your way to scale. Eventually, the business has to grow again or at least stop bleeding users faster than you can replace them.