Salem Media: A Perfect Brew of Bonds and Equity ($SALM)

No Witch Trials Required!

Executive Summary:

Salem Media (“SALM”) is a publicly-traded Christian radio broadcaster and a prime example of an over-levered microcap given its $44mm market cap behind $233mm of debt (8.9x LTM EBITDA or 90% LTV). The company however is in a relatively solid position with no debt maturities prior to 2024 and decent liquidity at $25mm. Importantly, SALM generated FCF every quarter during 2020 despite it exposure to highly cyclical ad revenues and outperformed its radio peers given the company’s sticky “block programming” revenues (described further below).

Without any liquidity concerns, I view SALM equity as a cheap 3-year call option which could easily double, if not more. Going long the equity aligns you with mgmt/controlling founders who collectively own 41% of the equity (majority of the voting interest) and who have historically distributed all excess cash flows to shareholders ($6-7mm per annum or a ~14% yield). Importantly, there are a few near-term catalysts (e.g., asset sales, re-financing, dividend re-instatement) which make this an actionable investment now. Given the relatively concentrated equity ownership, these potentially positive catalysts could also result in tremendous upside volatility as we last saw in July 2020.

The business is admittedly challenged aside from general cyclicality (e.g., declining religious affiliation/listenership). Combating this trend is challenging but I think (i) the decline is rather gradual and (ii) mgmt has an opportunity to pivot the business into becoming more of a conservative news outlet or re-invest the CFs in other areas. Nonetheless, to hedge this risk, I recommend financing an equity purchase by shorting SALM’s secured bonds in the mid/high 90s. This trade should limit your downside yet still preserve massive upside optionality at a medium cost of carry.

Capitalization:

Company Overview:

Salem Media (“SALM”) is a niche media business focused primarily on Christian and conservative content. The bulk of its revenues/profitability is derived from its ownership of various radio stations across the US. The company also has a collection of various digital properties as well as a small publishing business. The company operates under 3 different segments:

Broadcasting (75% of revenues). The company owns 99 radio stations (link) across 37 US markets with over 3,100 radio affiliates. Approximately 40% of its broadcasting revenues are tied to block programming paid by local pastors/religious organizations. These customers do not have many alternatives and are generally price inelastic. The company’s top 10 customers have remained relatively constant and have averaged more than 30-years on the air. Unlike SALM’s radio peers, this source of revenue is non-cyclical and fairly sticky (90%+ renewal rates). The majority (67%) of SALM’s radio stations operate in the AM frequency.

Digital (16%). The company owns a collection of various digital media properties (websites/apps) comprising Christian-themed content such as GodTube.com and Christianity.com, conservative-themed content such as RedState.com, and even financial/investment content such as DividendInvestor.com.

Publishing (8%). The company publishes print and eBooks that focus on Christian/Conservative content.

Investment Thesis:

Financial performance has faired better than expected. Unlike many other business that have been hit hard by COVID, SALM has (1) generated FCF every quarter and (2) demonstrated growth in Q3 with EBITDA up 7% y/y.

SALM generated $19mm of FCF (OCF - Capex) year to date. The company’s annual capex and cash interest burden is low at $23mm and adequately covered by even trough earnings.

Compared to its radio peers, SALM was not hit as hard given its non-cyclical block programming revenues. Whereas top operators (e.g., IHRT, ETM, CMLS) saw revenues in 2Q-20 decline by 50%+, SALM correspondingly saw programming revenues contract 20% over the same period. In the last quarter, revenues were down only 5% (political ad spend has helped) and EBITDA actually increased 7% y/y. The company provided some insight into 4Q, saying October revenue was up around 3%.

Catalysts on the horizon. There are a few actionable catalysts in the near-term that could help de-lever the balance sheet, improve FCF, and drive a re-rating in the equity:

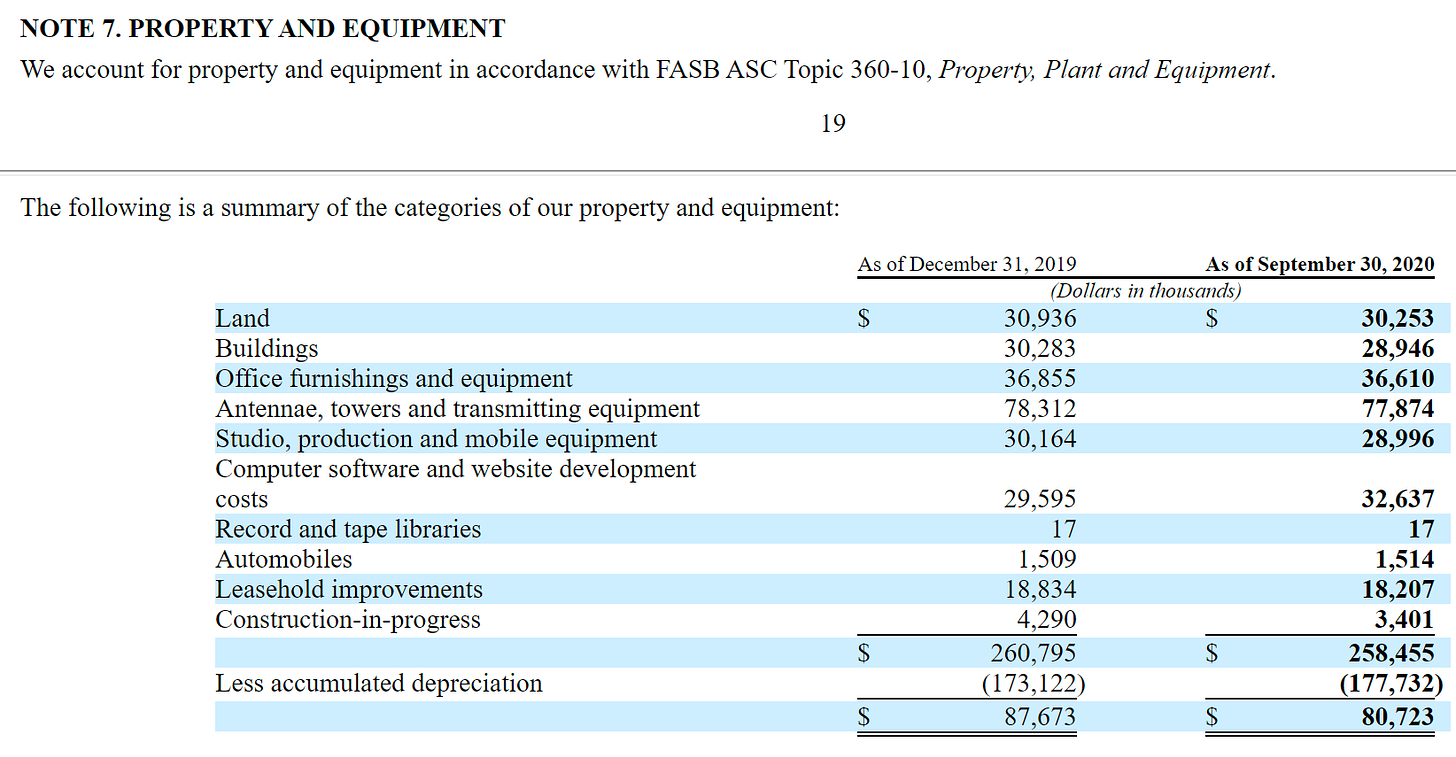

Asset sales: The company has some valuable real estate/tower assets which it could monetize. For example, SALM owns a 46,000 sq. ft office building in Camarillo, California (link), a 43,000 sq. ft. office building in Dallas, Texas (link), as well as various other buildings in Hawaii, Tampa, and South Carolina. I have not done an in-depth, asset-by-asset valuation of the underlying but my rough math suggests these assets could be worth $20-30mm in aggregate. In addition, the company owns 44 towers (including underlying land) outright. In 2020, Cumulus Media monetized its tower portfolio for $850,000/tower. If we apply this same multiple, a sale of its owned tower portfolio might result in ~$40mm of cash proceeds (nearly equivalent to today’s market cap). While the the company has talked about asset monetization in the past, I think a tower sale is much more likely given the current weakness in commercial office space.

Refinancing. If the company successfully completes the asset sales mentioned above, I would expect the proceeds to pay down debt. The company’s bonds are callable at 101.7 in Jun-21 and at par in Jun-22. A combination of asset sales/debt paydown plus improvement in financial performance should drive debt spreads lower. A 6.75% coupon is well wide of market for secured HY paper for a performing company. If SALM can pay down debt meaningfully and demonstrate EBITDA growth over the next couple quarters, I think the company will be in a good position to refinance its bonds, especially seeing how accessible the HY markets are currently (see Beasley Broadcast / Urban One for example). Cash interest savings from a refinancing are very tangible for a company as levered as SALM. Incremental FCF would mean greater ability for the company to further pay down debt, invest in the business, or return capital to shareholders, all of which should be fairly accretive to the equity.

Dividend re-instatement. In addition to asset sales and a potential refinancing, I think the other catalyst here is a re-instatement of a dividend. As per the bond indenture, the company can start paying a dividend at <6.0x net leverage. The company has historically paid out almost all of its excess cash ($6-7mm) to shareholders, translating to a 14-16% yield to shareholders on today’s market cap. As mgmt/founders represent a significant portion of the economic equity interest, I think it’s a fair assumption that mgmt will reassume the dividend payment as soon as practically possible. Interestingly, if we run-rate 3Q-20 EBITDA, the company should already be below <6.0x if profitability holds over the next 9 months.

Business faces headwinds however. Nonetheless, financial deterioration is admittedly a risk seeing as EBITDA had been declining pre-COVID ($46mm in 2017 vs. $37mm in 2019). At its core, the issue here is a shrinking audience. While radio listenership has been slightly declining due to a proliferation of new digital mediums, SALM has also seen the negative impacts of declining Christianity/religious affiliation in the US. In addition, SALM has heavy exposure to AM radio frequency. Compared to FM, AM tends to carry more noise and requires a stronger signal. Not only does SALM need to convince potentially new listeners to tune into radio, it must also convince them to tune into AM frequencies.

I believe the business will survive the current cyclical downturn in ad revenues but there is no guarantee that financial performance will remain stable thereafter. In addition to the “high” leverage, the bonds are disadvantaged due to the high degree of intercompany payments, key man risk (gives mgmt/equity more negotiating leverage), and generally permissive credit docs, all of which would make a restructuring potentially tricky and importantly, recoveries lower for debtholders.

Given this dynamic, I think going long the stock and short the bonds results in a solid upside/downside. Sensitivity around negative publicity, key man risk, and a relatively small capital structure should mitigate against aggressive investors buying up the bonds and taking action for the benefit of creditors. If the company is able to turn itself around, de-lever a bit, and successfully refinance its debt at cheaper rates, the equity can be a home run given how levered it is. What’s interesting about this setup is the illiquid float/concentrated equity ownership (with mgmt/founders owning the majority) coupled with several near-term catalysts which could result in massive price appreciation.

Illustrative Returns:

At a 1:1 short bonds/long equity ratio, I think the downside (however unlikely) is ~60% (vs. ~100% in equity-only position). You should be able to hedge out most of your downside at a 3:1 ratio. At this ratio you might make a small return in the base case (given the relatively high cost of carry) but will still benefit from uncapped upside.

Key Risk:

Significant related party transactions/interests. Even though mgmt owns 41% of the equity ($25mm at today’s share price), they collect ~$2mm in annual comp AND extract additional value in the form of related party transactions such as leasing owned real estate (as well as privately owned jets) to the company.

What’s the implication of this? First of all, I think this means an adversarial restructuring would be very difficult and contentious between credit/equity investors given mgmt’s various competing interests. Creditors here will NOT want to own the business OR replace mgmt given the key man risks and their intertwined business interests. As such, I think creditors would be incentivized to proceed with an orderly restructuring whereby mgmt remains in place and restrikes their MIP. This would allow them to keep their various related business interests as-is AND give them an opportunity to be made whole again (subject to performance hurdles). Sadly, I think minority equity investors would probably get screwed in this situation. My point in all of this is merely owning the equity doesn’t 100% align you with mgmt and that they can still come out better even if the existing equity is wiped out.

SALM discontinued their dividends; does that change your view on the company?