Oracle ($ORCL): Heads I Win, Tails You Lose, $100bn+ on the Hook

Oracle's AI pivot is reshaping the credit. The question is who's carrying the risk

🚨 Connect: Twitter | Threads | Instagram | Reddit | YouTube

Everybody wants to be an AI company now.

Doesn’t matter what you were before. Doesn’t even matter if it makes any sense. The stock price lives in AI, so that’s where you go. Slap some GPUs in a data center, sign a deal with OpenAI, and suddenly you’re not a legacy software vendor anymore. You’re an AI infrastructure play. Multiple expansion. CNBC hits. The whole thing.

Oracle is playing this game harder than almost anyone. And somebody has to pay for it.

That somebody is bondholders.

The equity gets the AI optionality. The sizzle. The multiple. If this works, shareholders make a fortune. If it doesn’t, well, at least they tried.

Bondholders get to fund tens of billions in capex, watch free cash flow go deeply negative for years, and collect mid-tier investment grade spreads for the privilege. All while management tells you they’re “committed to maintaining investment grade ratings.” No leverage targets. No timeline for when cash flow turns positive. Just trust us.

The Street still treats this like a boring, durable software company that decided to spend aggressively for a few years. Temporary pain, long-term gain. The backlog is massive. The contracts are non-cancelable. What’s the problem?

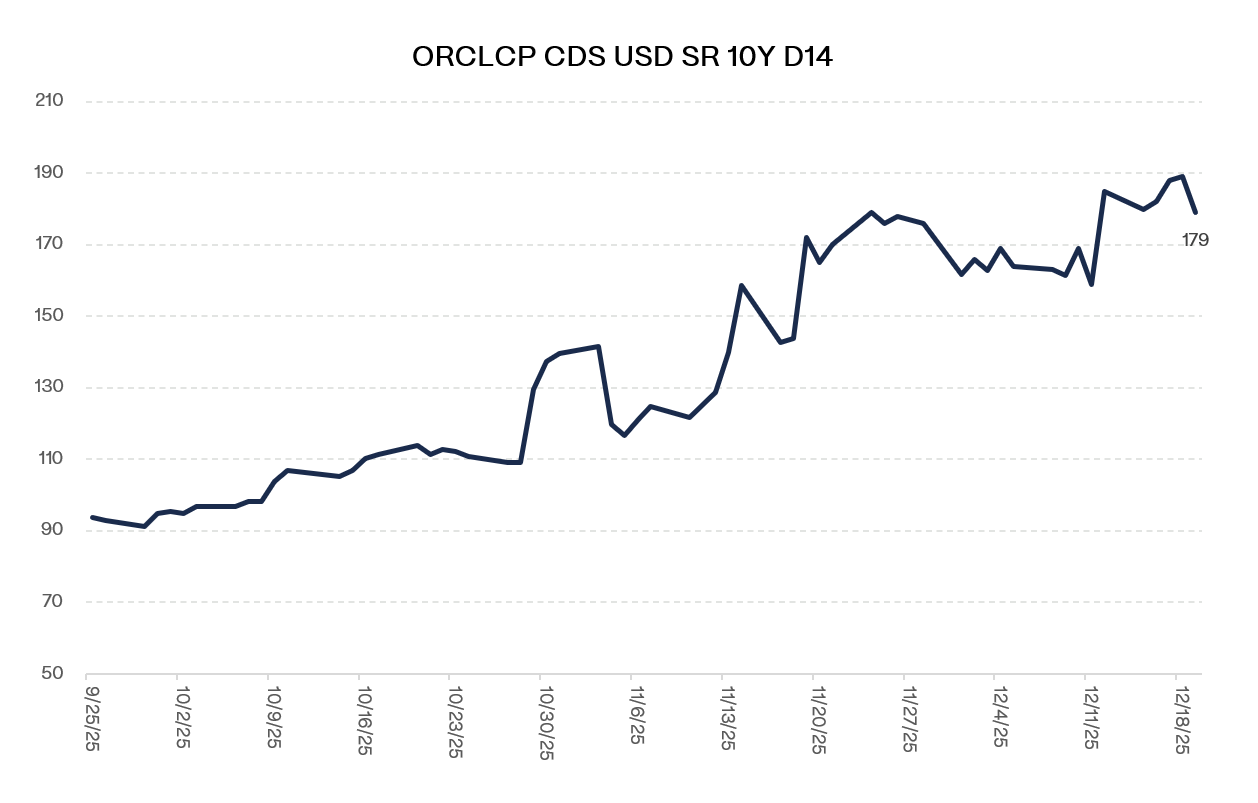

The problem is that credit doesn’t work like equity. In credit, timing matters as much as magnitude. Duration of pain matters. Rigidity of commitments matters. And whether the market has started to price that risk or not, the only question that matters is compensation. Cash spreads have already moved; CDS is 85 bps wider in three months. The debate now: are you being paid enough to own it?