Lamb Weston ($LW): Paying for Their Sins

Performing BB, maturities start in ’28, but price/mix and International still scream “concessions.”

🚨 Connect: Twitter | Threads | Instagram | Reddit | YouTube

Note: Starting January 15, 2026, subscription prices will be increasing. Anyone who subscribes before then will be locked into today’s pricing indefinitely.

Fintwit loved this name. Frozen fries. Four companies control 95% of North American production. You buy potatoes, you freeze them, you ship them to McDonald’s. Boring compounder. Oligopoly pricing. The kind of setup where you’d have to actively try to lose money.

Then management found a way to screw it up and the stock got cut in half.

Now everyone’s fighting about whether it’s cheap. Equity guys are pounding the table, arguing about what margins look like when execution normalizes. Value trap or generational buy? The debate rages on every time the stock moves a dollar.

I figured it was worth taking a look from the credit side. Not because the bonds are flashing red. They’re not. This is a tight BB capital structure with modest leverage and no near-term maturities. But credit analysis has a way of cutting through the noise. Equity investors get to dream about what a business could earn. Credit investors have to focus on what it’s actually earning, and whether that’s enough to cover the obligations. Sometimes that’s a useful lens on a name everyone else is arguing about.

So let’s see what the bonds are saying about Lamb Weston.

Situation Overview:

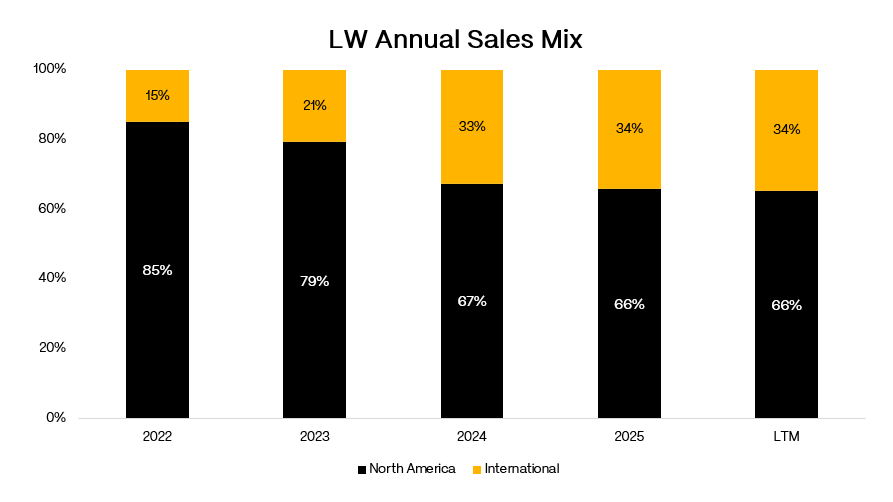

Lamb Weston is a frozen potato processor. Buy potatoes, turn them into fries, sell to QSRs, restaurant chains, foodservice distributors, retail. North America is 2/3rds of sales, international the rest.

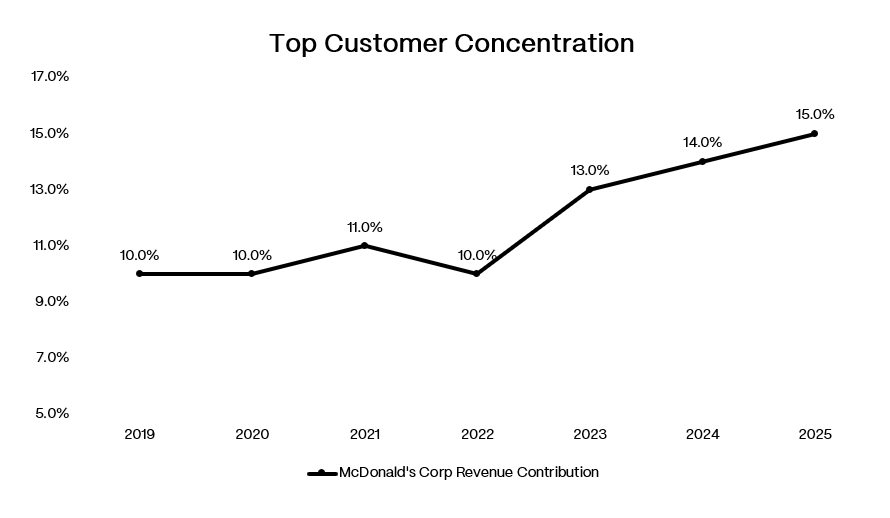

McDonald’s alone is ~15% of revenue.

The business model is basically this: keep plants full, run them efficiently, manage potato and manufacturing costs, and maintain enough commercial leverage to price through inflation. North America is an oligopoly. LW, McCain, Cavendish, and Simplot control over 95% of production, which supports rational pricing when things are normal. But the model punishes you fast when execution slips or the industry gets long capacity.

And execution slipped.

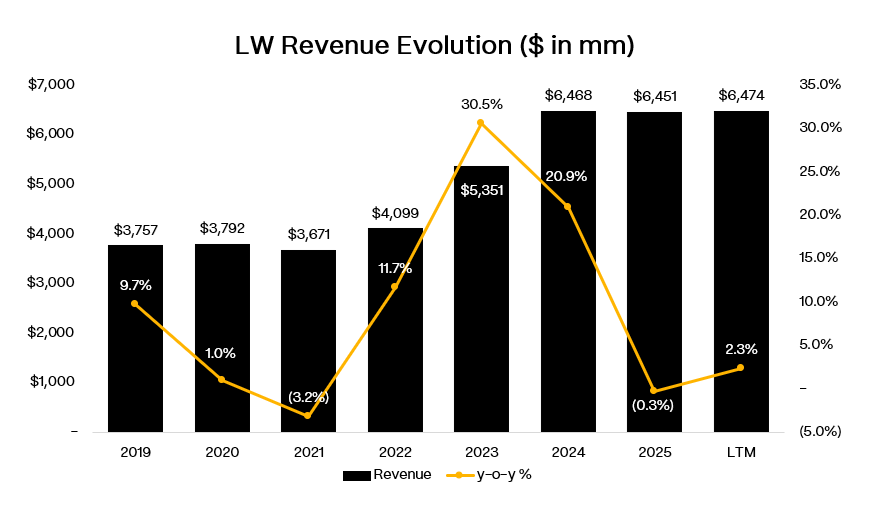

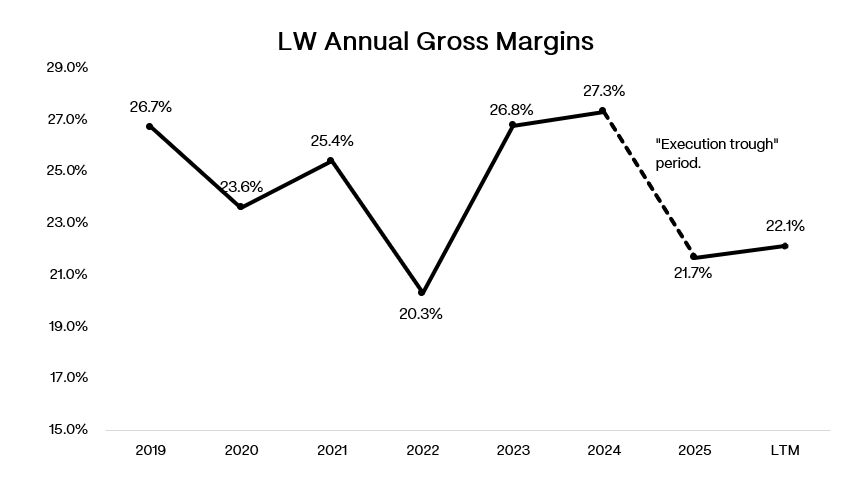

The company is coming out of a self-inflicted execution trough that started in FY’24 and bled through FY’25.

A messy ERP transition disrupted planning and fulfillment, a product recall hit the quality halo, and broader operational miscues impaired service levels. The commercial fallout was predictable, order fill/OTIF and quality issues caused customers to diversify or shift volume, and LW moved into win-back mode, leaning on commercial concessions to recover business while trying to rebuild retention and quality back toward historical norms.

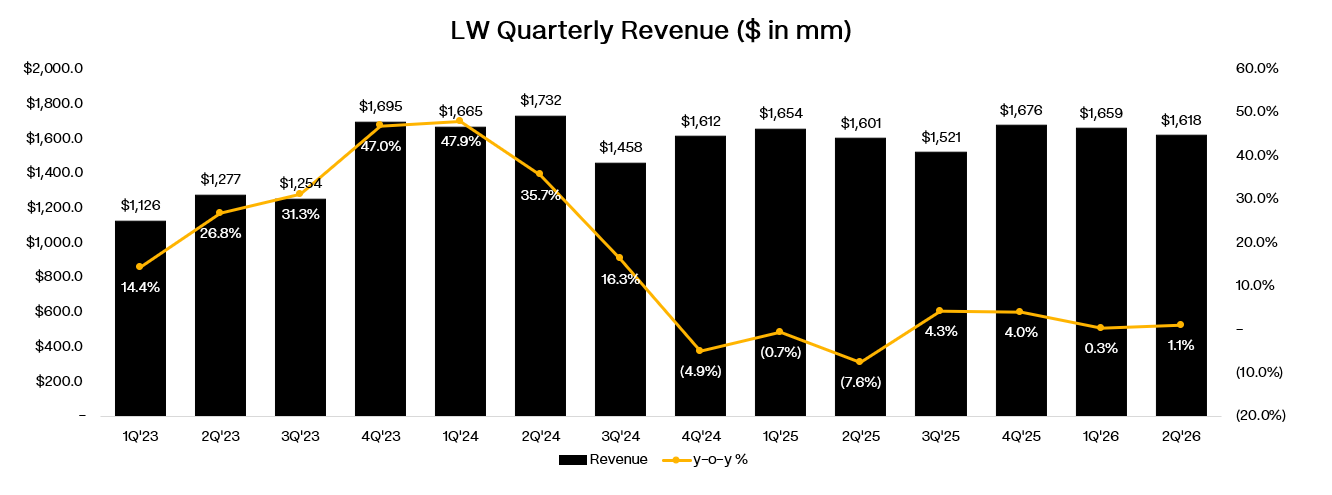

The last few quarters have been choppy, a soft patch, a snapback, another relapse, and now stabilization that still isn’t monetizing cleanly.

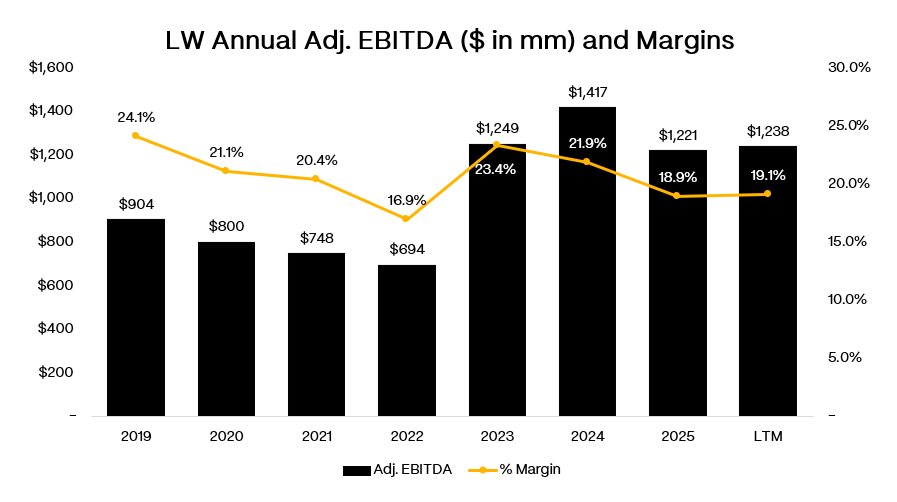

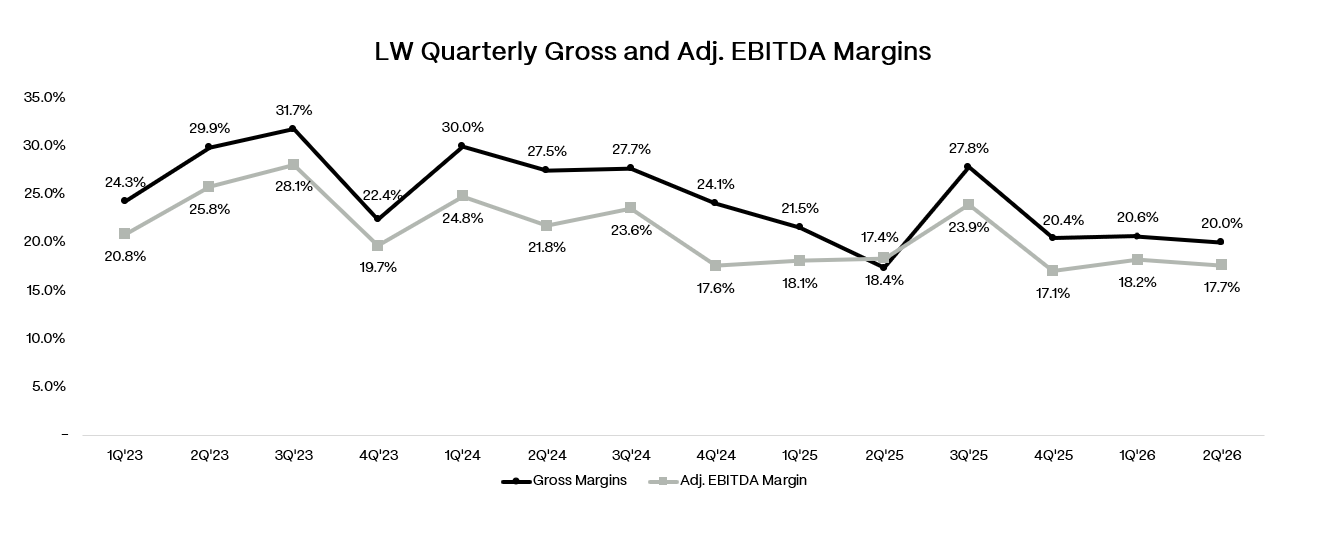

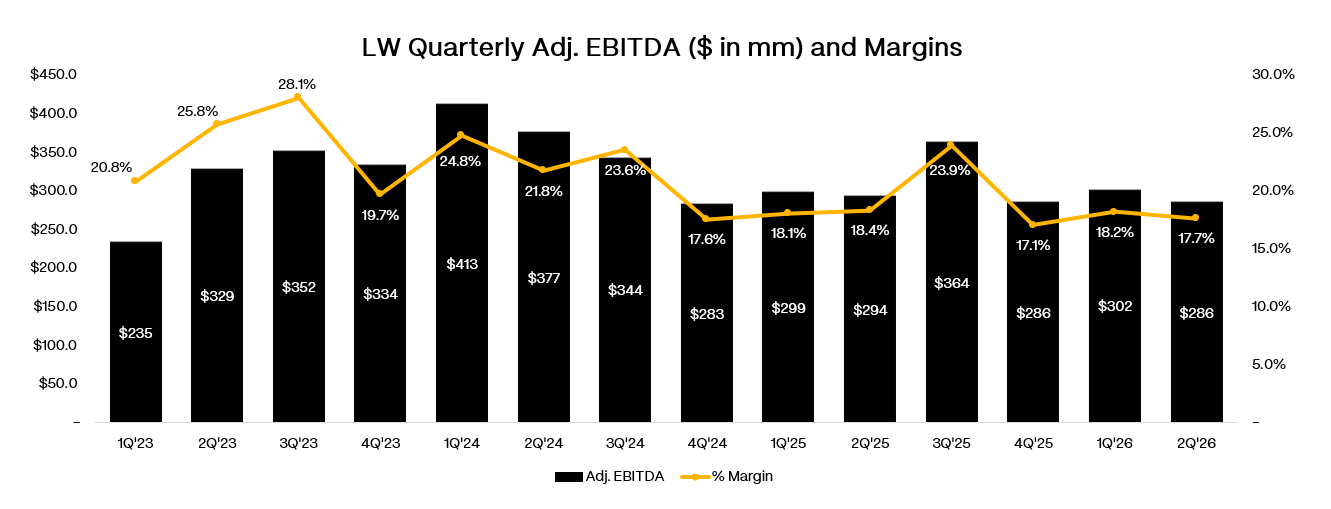

Fiscal 1Q’25 and 2Q’25 were the “weak execution” phase and Adj. EBITDA was roughly $300mm which is what it looks like when you’re still absorbing disruption, fighting to normalize service, and using commercial actions to stop the bleeding. 3Q’25 was the bounce, gross margin jumped to 27.8% and Adj. EBITDA to $364mm. But it did not hold. 4Q’25 rolled back over, gross margin fell to 20.4% and Adj. EBITDA to under $300mm, reinforcing that this is not a smooth normalization story.