Intrum AB ($INTRUM): Debt Collector With Debt Problems

Reviewing Intrum's Potential Strategies for Handling Upcoming Debt Maturities

Reading time = 23 minutes 🎯 Follow me on Twitter 🚨 Send me your anonymous feedback here. JunkBondInvestor is looking for experienced credit analysts, reach out if interested.

Situation Overview:

Capital-Intensive European Debt Collector

Headquartered in Stockholm, Sweden, Intrum AB (“Intrum”) is a European credit management services company, specializing in debt collection, debt purchasing, and other related services. With operations in 21 European countries, Intrum’s core business involves acquiring non-performing loan (“NPL”) portfolios from financial institutions and collecting on those debts, as well as providing third-party debt collection services (i.e., “servicing”) on behalf of banks and other clients. As of FY’23, the company reported revenues/income of SEK 20.0 billion, cash EBITDA of SEK 13.1 billion, and had a portfolio carrying value (ERC) of SEK 76.1 billion.

Intrum’s business model has historically relied on a combination of debt purchases using its own balance sheet (the “Investing” segment) and capital-light servicing revenues (the “Servicing” segment). This hybrid approach allowed Intrum to drive growth by deploying capital into NPL portfolios during times of market dislocation while also benefiting from the annuity-like cash flows of its servicing contracts. However, the capital intensity of the debt purchasing business resulted in Intrum accumulating a sizeable debt burden, with gross debt of SEK 60.8 billion and net leverage of 4.4x as of 4Q’23.

High Leverage, Upcoming Maturities, & Operational Underperformance

The company’s elevated leverage, upcoming debt maturities, and worsening collections performance have put Intrum in a difficult position over the past year. Debt purchasing yields have been pressured by increasing competition and rising funding costs, with Intrum’s portfolio investments declining from SEK 7.4 billion in 2022 to just SEK 5.4 billion in 2023. At the same time, the company faces SEK 7.5 billion of debt maturities in 2024 and another SEK 14.0 billion in 2025, despite limited access to bond markets at economical yields. While Intrum had previously indicated it could address near-term maturities through liquidity on hand, most investors viewed some sort of liability management exercise as inevitable.

Asset Sale Announcement, Debt Tender Offer, & Advisor Engagement

Those concerns came to a head in January 2024 when Intrum announced an agreement to sell SEK 11.5 billion of NPL portfolios (15% of ERC) to Cerberus at a company-stated 2% discount to book value. The transaction is expected to generate SEK 8.2 billion of net proceeds upon closing in 2Q’24 while reducing Intrum’s ERC and cash EBITDA by ~20%. Management stated the proceeds would be used for debt reduction, providing an immediate liquidity injection but also raising questions about the quality and collectability of Intrum’s remaining portfolios (i.e., did Cerberus “cherry pick” the best assets?) Shortly after, in February 2024, Intrum conducted a €51.3 million debt tender offer (~SEK 600 million), buying back a portion of its 2025 and 2027 bonds in the process.

The timing of the transaction—following weeks of widening bond spreads and a nearly 50% drop in the share price—as well as its modest size was viewed by many as a signaling exercise as just one month later (March 2024), Intrum disclosed it had appointed advisors to evaluate balance sheet solutions, implying a more comprehensive debt restructuring was on the horizon.

1Q’24 Earnings Results

On April 24, 2024, Intrum reported mixed 1Q’24 results that fell short of expectations in some key areas. While adjusted revenues came in-line with consensus, a 3% miss on adjusted EBIT highlighted ongoing pressure on margins and costs, particularly in the Servicing segment. The Cerberus deal remained on track to close in the next 1-2 months (pending final regulatory approvals), but there is still limited excess liquidity to address the upcoming 2024-2025 maturity wall (SEK 7.5bn and SEK 14.0bn, respectively). All in, it was a challenging quarter that did little to assuage investor concerns around Intrum’s operational trajectory and balance sheet.

On the earnings call, management provided few incremental details on its ongoing capital structure discussions, noting only that dialogue remains “constructive and solutions-oriented.” With the clock ticking down to a SEK 576 million maturity in June and a SEK 5,405 million maturity in July, more substantive updates are expected in the coming weeks as advisors hash out the framework for a deal.

With the stock trading at all-time lows (implying just a ~5% equity cushion), the lack of visibility on Servicing margins, high financial leverage, and looming maturity wall are expected to keep equity/bond prices under pressure, particularly if restructuring negotiations start to drag on.

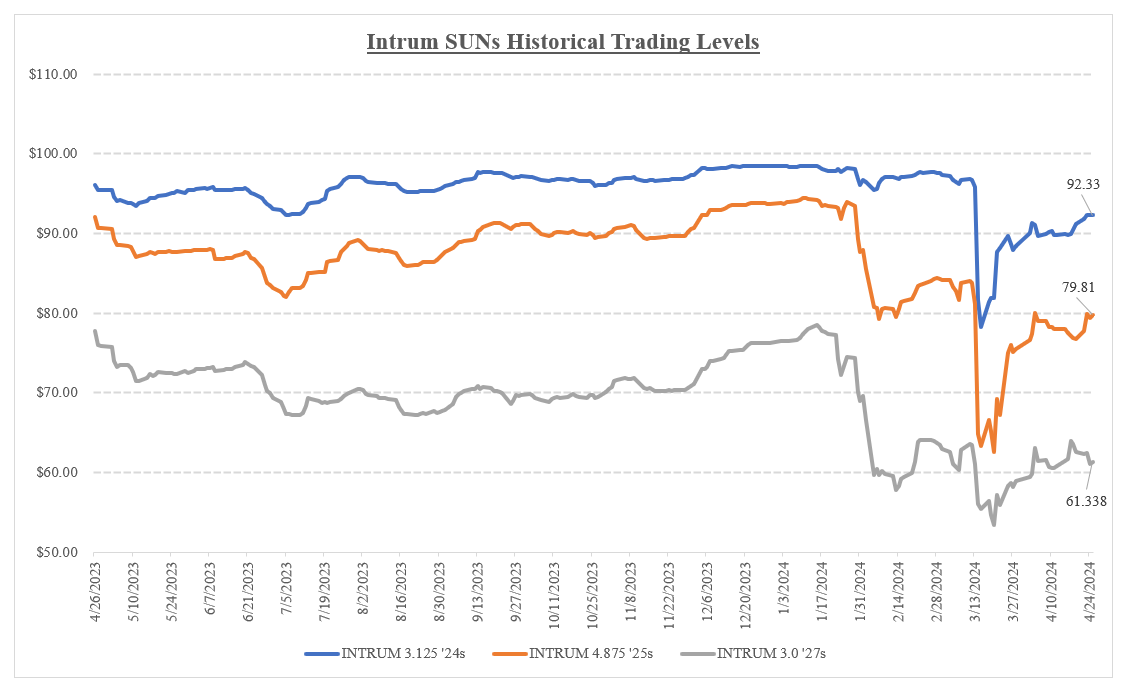

Nonetheless, the situation currently remains highly fluid, with Intrum’s bonds trading at heavily distressed levels. The company’s 2024 notes are quoted in the low 90s while 2025-2028 maturities trade at 60-80 cents, implying investors expect significant principal haircuts/debt priming. There is still much uncertainty around how a restructuring would be effectuated (amendment vs. exchange), the treatment of various creditors (secured vs. unsecured), and the company’s long-term business plan. Intrum has said it is exploring all options to shore up its balance sheet, including maturity extensions, new capital (debt and/or equity), asset sales, and cost reductions in order to accelerate its transition towards a capital-light model.

On March 25, 2024, Bloomberg reported Intrum’s bondholders had split into different groups based on their varying interests and the maturities of the notes they hold, with one group of 2024 and 2025 bondholders hiring its own financial adviser. If an amenable deal cannot be reached, a more draconian restructuring (potentially including Swedish bankruptcy) may be on the table, although this seems unlikely given the desire from all stakeholders to preserve “going concern” value. While the range of outcomes remains wide, one thing is clear—Intrum’s situation has reached an inflection point and the coming months will be critical in charting its course forward. In the following section, I’ll explore the realm of the possible including my views on how the situation plays out next and how I would accordingly be positioned.

Note that as with all my prior write-ups, this analysis is 100% based on public information only. I am not involved in the capital structure and am NOT aware of the contents of any negotiations between bondholders groups and the company. I have no position whatsoever and this write-up is purely based on my best guess looking outside in. This is a fairly complex and fluid situation with multiple other considerations that must be evaluated in conjunction with fundamentals. I am not privy to any discussions with holders or market participants involved in the capital structure.

Disclaimer: The information provided is for informational purposes only and should not be considered as investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release me from any liability. Seek professional advice tailored to your financial situation and objectives.