IDW Media Holdings

A microcap media business trading at its cash per share value

Situation Overview:

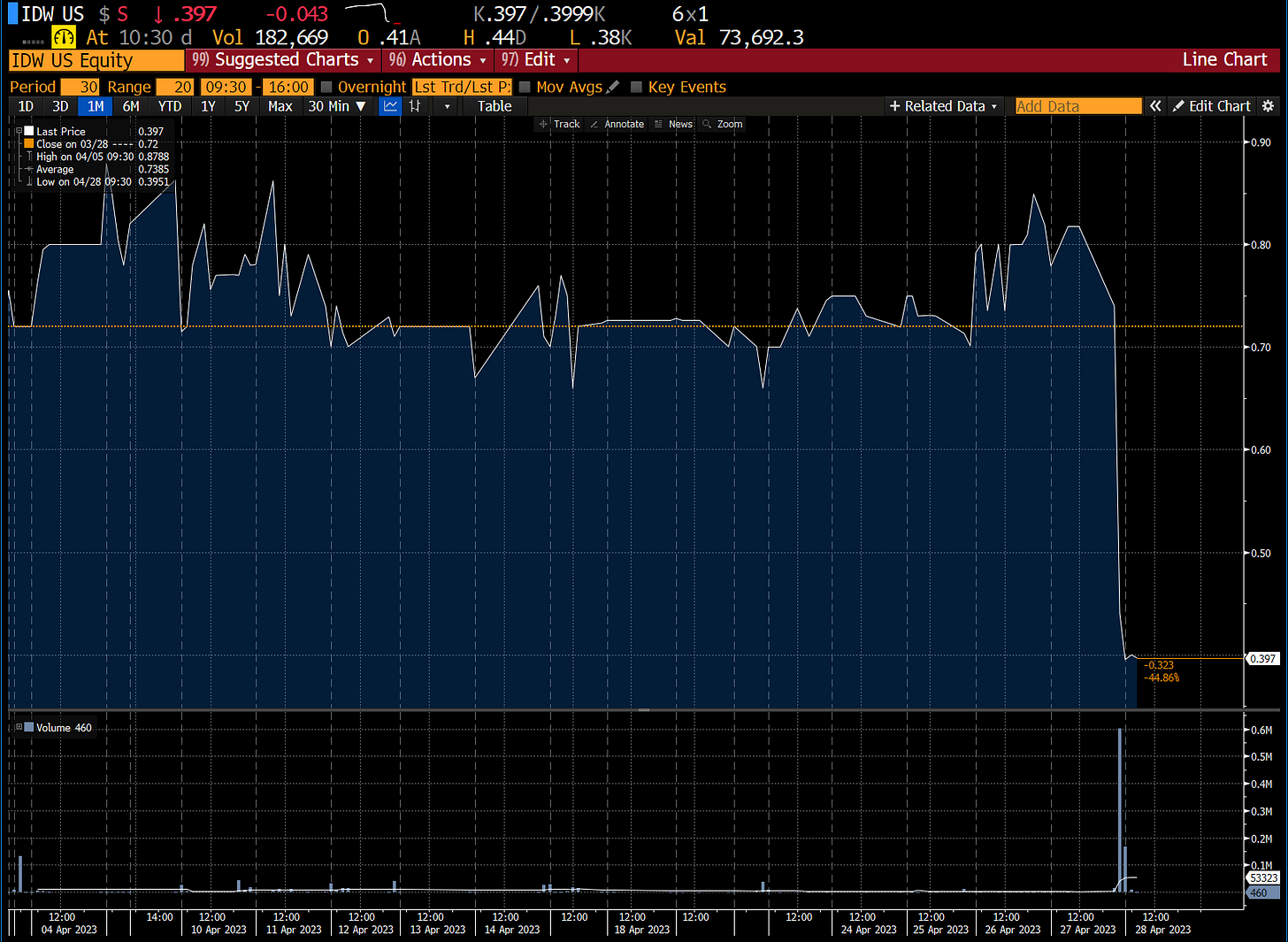

IDW Media Holdings (“IDW”) is a microcap publishing/media company currently listed on the NYSE. On April 27, 2023, the company surprised the market and announced it would voluntarily delist trading of its Class B shares. In addition, IDW announced a 39% reduction of its current workforce (28 employees) and the replacement of its current CEO/CFO. The current CEO will be replaced by Davidi Jonas, the son of the primary and controlling shareholder, Howard Jonas.

Unsurprisingly, this news precipitated a significant drop in the company’s stock price with IDW 0.00%↑declining over 40% to ~$0.40/share in just two trading sessions. The company’s BoD determined going dark was the best path due to expected cost savings and given the company’s inability to realize any benefits from a continued listing.

Despite the barrage of negative news, I think the stock looks cheap at current prices. At current trading levels, the stock is trading near its cash per share value. There is no debt and pro forma for enacted cost savings initiatives, IDW should be close to cash flow breakeven.

Current Valuation:

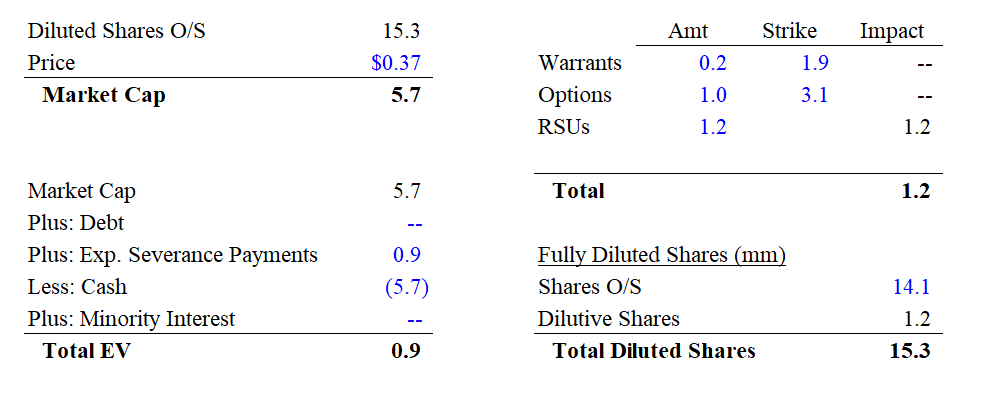

Per the most recent 8-K filing (here), IDW had $5.7mm of cash as of April 28, 2023. This is before any severance payments or related costs which IDW estimates to be $0.9mm. Net of these payments, IDW should have roughly $4.8mm of cash on its balance sheet.

Conservatively adding 1.2mm of unvested RSUs, the company’s total share count stands at 15.3mm today. At a stock price of $0.37/share, IDW’s market cap totals just $5.7mm. As there is no debt, today’s stock price implies an enterprise value of less than $1mm!

Company Overview:

Founded in 1999, IDW is a pure-play IP publishing/media business, operating in two divisions (1) publishing and (2) entertainment.

Publishing: The company's publishing division, IDW Publishing (“IDWP”), prints/produces comics (both original and licensed). Each year, the company produces 20-30 new originals and publishes over 750 comics/graphic novels. IDWP has won numerous awards in this domain. Print sales are a consistent source of revenue for the business with relatively steady revenue performance and account for the majority of the company’s gross profits. Net of SG&A, the business is roughly breakeven.

Entertainment: The Company’s entertainment division (“IDWE”) develops and produces television shows based on its owned comic book IP. Some of these shows include Wynonna Earp, V-Wars, October Faction, and Locke & Key. IDW’s focus on IP ownership provides a long-term advantage, as its comics and graphic novels can be leveraged across multiple media platforms, including film, television, and streaming services. Revenues here are less predictable and fairly lumpy as IDWE only recognizes revenue when shows are delivered. To date, the company has seen some moderate success (3 TV series have resulted in more than 1 season). The company currently has between 9 and 12 projects they are working on but it is not clear whether those will generate meaningful revenue during this year.

IDW's business strategy is to (1) publish comics and graphic novels; (2) develop its comic book IP into entertainment vehicles for streaming services, TV shows and other platforms; and (3) move into new sectors where they can monetize its IP with a focus on digital and direct-to-consumer. Below is a simple chart which visualizes their strategy.

To date, IDW’s comic book IP has not translated to tremendous TV/streaming success. While the company’s best production (Locke and Key) received some decent reviews (imdb), the show was ultimately cancelled by Netflix after 3 seasons. Whether they’ll have hits in the future is anyone’s guess; however, I do think they have the ingredients to potentially be successful. The company’s comic book library comprises over 100 original titles and has another 40+ original titles at various stages in the development pipeline. In addition, the company is currently at various stages in greenlighting 9 to 12 new TV shows. Below is what they disclosed in their latest quarterly filing. Some of these looks promising (such as Earthdivers) but hard to say whether these will amount to anything.

Financial Summary:

Unsurprisingly, the company does not consistently make profits. Over the last 8 quarters, cumulative EBITDA has amounted to -$5.5mm. FCF is better due to a release of working capital in the quarter ended August 31, 2021.

That being said, pro forma for enacted cost saves, the company is roughly breakeven assuming they can achieve revenues similar to those observed over the last 2 years. IDW should also save some money from not filing with the SEC. As there is minimal CapEx in the business, I think the company can be close to cash flow breakeven going forward.

What’s the Upside?

IDW is a company that generates over $30mm of revenues and ~$16mm of gross profit. The company sits on some award-winning comic book IP, which it has translated to streaming product. And today, you can buy the company for ~$1mm.

Forecasting this company’s financials and trying to value it is a fool’s errand at this point in time, especially as the company will unlikely trade anywhere near fundamentals after de-listing.

So what are we actually playing for? I view this as a perpetual call option on the company having a major streaming hit based on its owned comic book IP. In that scenario, it’s quite possible this is a multi-bagger, particularly if this begets a mainstream streaming franchise such as Stranger Things. The hope is the company doesn’t burn any much more cash and need to raise dilutive capital.

What’s the blue sky scenario? Well, it took indie studio, A24, 10 years to be in a position to win 6 awards. Last year, the company was valued at $2.5 billion (link). Yes, that’s billion with a B. One can always dream!

Conclusion:

Is this stock a buy? Probably not.

Could the stock work? Maybe but not anytime soon.

What are we playing for? At an EV of <$1mm and a market cap that approximately equates to cash, your upside/downside looks attractive

Why are you even bothering to look at this? Howard Jonas and his son (new CEO) own 28% of the common equity. Howard Jonas’ track record of creating tremendous value is not to be ignored. For example, he famously acquired spectrum out of bankruptcy and flipped it to Verizon in 2018 resulting in a 35x (see below). You can read more about him here.

Will I buy the stock? I will probably wait until they get de-listed and trading volumes settle. What’s important to note is the company historically traded OTC and was only uplisted to the NYSE in 2021. While the de-listing may cause some technical selling pressure, I don’t think this necessarily makes the stock un-investable. At today’s price, the stock is trading at its all-time lows.

Risks:

Microcap that will be de-listed. Trading volumes may not reflect anything close to fundamentals. You may be unable to exit your position. The stock will be extremely volatile and may decline materially from current levels regardless of financial performance.

Controlled company. This is a controlled company. The new CEO is the son of the largest shareholder. The business is not necessarily operated for the benefit of minority shareholders and the stock has only gone down since going public.

Execution/cash burn. If the company continues to burn cash, the company may cease as a going concern and/or need to raise dilutive capital, something that the company has done historically.

Great read, thanks for sharing! Ill keep an eye on the stock.