HY Market Weekly Minutes: Rally Hits Speed Bump (May 27, 2025)

A Brief Recap of Last Week's High Yield Market Performance

🚨 Connect with me on Twitter / Threads / Instagram / Bluesky / Reddit (*new*)

❗Prices are going up June 6. If you’re thinking about subscribing, now’s the time to lock in the current rate before it increases.

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list (limited spots).

And just like that, the music stopped.

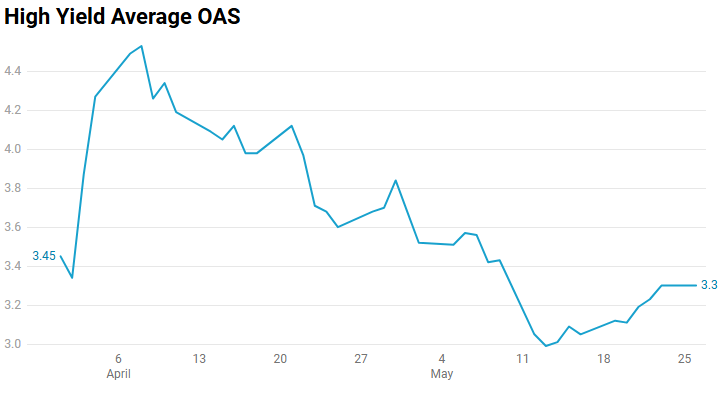

High yield snapped its five-week winning streak with a -0.47% decline as renewed tariff fears sent investors scrambling for the exits. The rally that had investors feeling invincible came to an abrupt halt when trade tensions reignited late in the week, pushing spreads 25bps wider to 330bps and reminding everyone that geopolitical risks were never truly off the table.

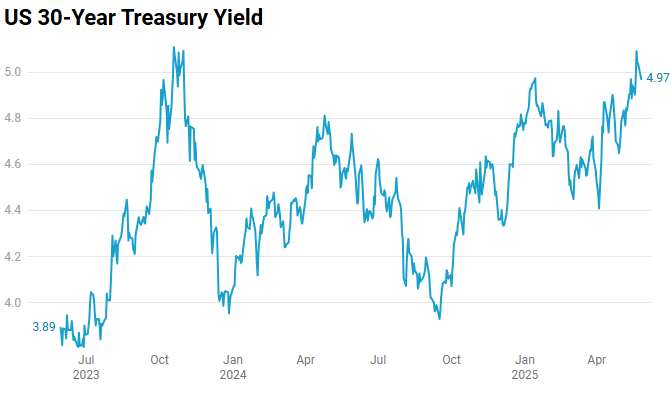

The technical damage was selective but meaningful. CCCs bore the brunt of the punishment, tumbling -0.74% for the week while BBs showed more resilience with a -0.40% decline. Lower-quality credits that had led the recent surge suddenly found themselves abandoned as investors rotated back toward quality. In addition, 30-year treasury yields came within 3bps of taking out their October 2023 highs, threatening levels not seen since mid-2007.

But here’s what’s remarkable about this selloff: the primary market completely ignored the secondary market turbulence, with 9 deals totaling nearly US$10 billion pricing ahead of Memorial Day weekend. Flutter and Teva successfully tapped the market with strong investor appetite, pricing at attractive sub-6% yields of 5.875%, while even names like Sabre cleared deals despite recent volatility. When issuers can still execute $2+ billion cross-border financings during a risk-off week, you know demand remains robust.

The disconnect between primary and secondary tells the real story here. While bonds were getting marked down in the secondary, the new issue calendar was firing on all cylinders with multiple upsizes and tight pricing across the board. This isn’t what a broken market looks like. Instead, it suggests investors are using volatility as an opportunity to get involved in fresh paper at better levels, even as they trim existing positions. The holiday timing may have amplified the moves, but the underlying bid for quality new issues never wavered.

This wasn’t panic selling, it was profit-taking with a reality check. With spreads having retraced all of April’s volatility and the HY index standing right where it was before the April 2nd tariff announcement, the market is essentially back to square one. The question now is whether last week’s weakness marks a healthy consolidation or the beginning of something more concerning.