HY Market Weekly Minutes: CCCs Lead Risk Rally as Oil Crashes and Primary Heats Up (May 5, 2025)

A Brief Recap of Last Week's High Yield Market Performance

🚨 Connect with me on Twitter / Threads / Instagram / Bluesky

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list — limited spots.

The reports of high yield’s demise were greatly exaggerated.

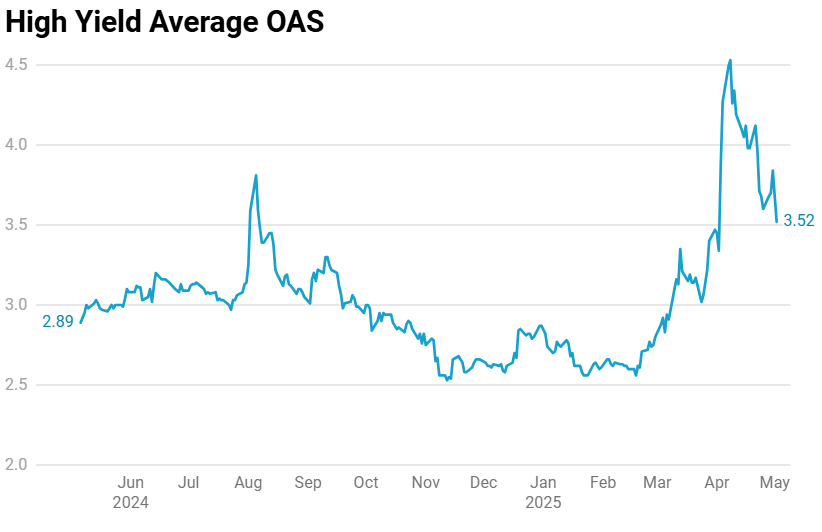

Just a month after the “Liberation Day” apocalypse sent investors fleeing, credit spreads have completed a stunning round trip, with spreads tightening 9bps last week to 352bps, just 100bps off the 1-year tights. So much for that market meltdown everyone predicted.

The plot twist no one saw coming? After months as market laggards, CCCs surged to the top of the performance leaderboard at +0.40% for the week, handily beating BBs (+0.25%) and Bs (+0.19%). When the market’s most vulnerable segment starts outperforming, it signals a fundamental shift in risk appetite the headlines are missing.

Primary markets delivered their own verdict, with four new deals not just clearing the market but pricing aggressively and three expanding their size mid-marketing. Even dividend-recaps are back on the table - a luxury reserved for only the healthiest markets.