Highway Holdings Limited ($HIHO): Hidden Gem or Just Another #Shitco?

Microcap or MicroCrap?

I recently received a Twitter DM on a company called Highway Holdings Limited (“HIHO”), a third-party contract manufacturer based in China/Myanmar. The company IPO’d in 1996 and currently trades on the Nasdaq stock exchange. Knowing me and my love for #shitco stocks, I thought it would be fun to have a quick look over the weekend.

Naturally, HIHO has a lot of characteristics of a #shitco microcap stock:

Today’s market cap is <USD$10 million

Only USD$60k worth of shares trade per day

The company’s operations are in China/Myanmar

Revenues were down 19% last year and are still 34% below what they were pre-COVID

These factors alone suggest to avoid this stock with a 10-foot pole. However, there were a few positive things that caught my eye upon a closer review:

The company holds a significant amount of cash at ~$7.2mm as of March 31, 2023. This implies a cash per share value of $1.63/share vs. a current stock price of $2.04. The company does not have any debt on its balance sheet so cash accounts for ~80% of today’s market cap.

Today’s implied enterprise value is only $1.8mm. This implies a 4.7x LTM EBITDA multiple or 2.2x based on FY2022A results.

Importantly, the company is not burning cash at the moment. While working capital seems to cause swings in FCF, the company has only burned ~$200k cumulatively since 2019.

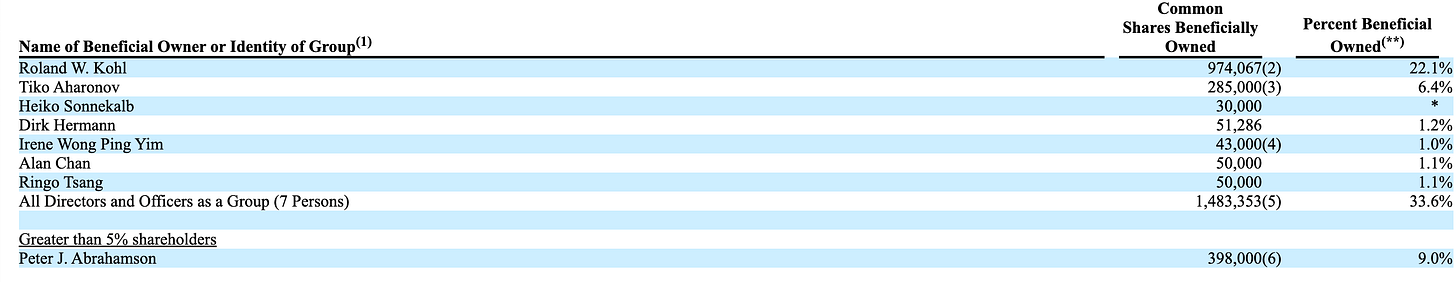

Insiders collectively own 34% of the company’s shares. The founder/chairman/CEO, Roland W. Kohl, is a German-national who owns 22% of the equity that equates to roughly $2 million at today’s prices.

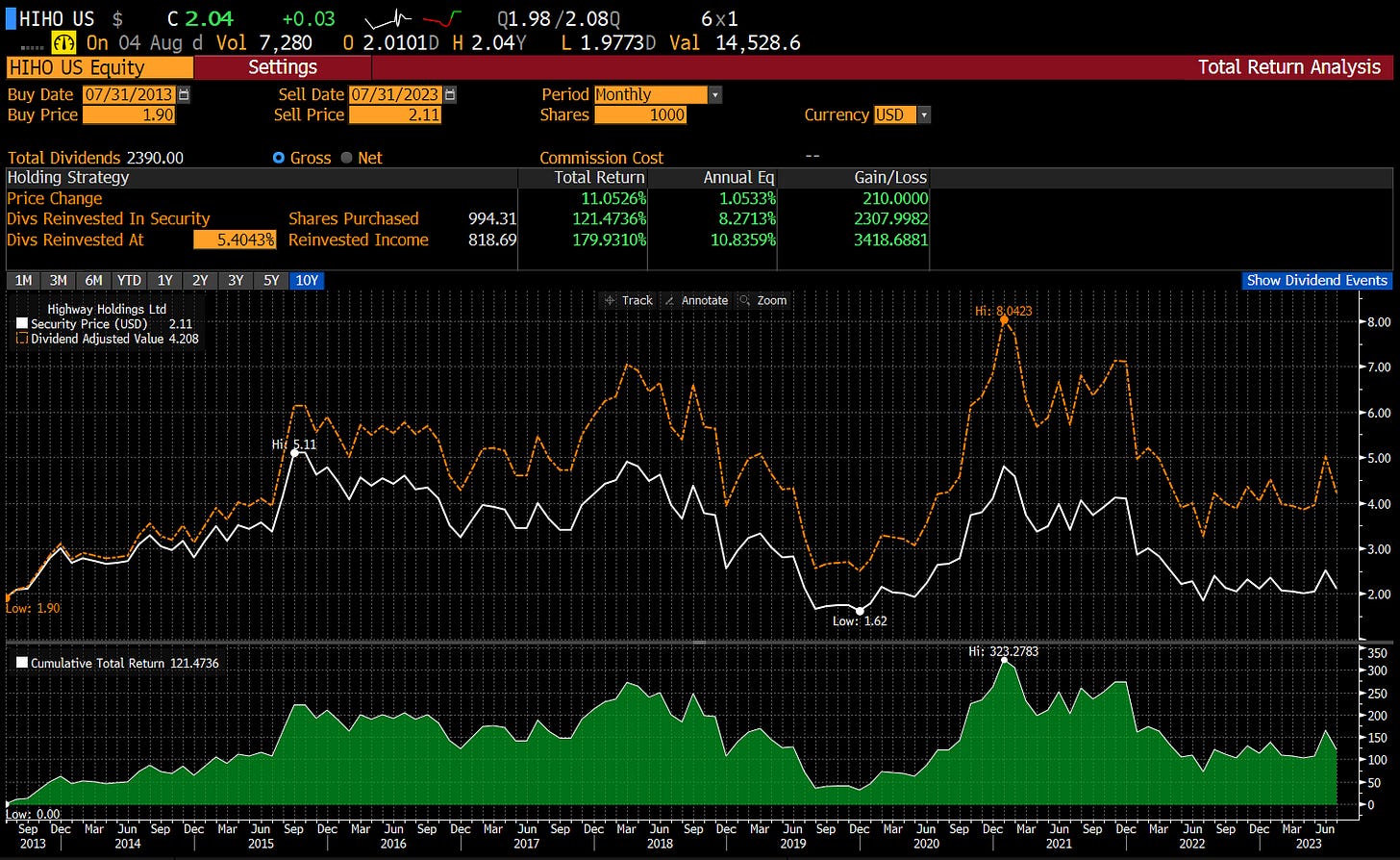

Management is shareholder friendly. The company pays dividends quarterly and has a long track record of dividend payment. Today’s indicated yields imply a 20% dividend yield, which can be supported given the company’s current cash balance. Despite flat stock price performance, dividend payout has supported shareholder returns. Over the last 10 years, an investor in HIHO could have realized 8%+ annualized returns (assuming reinvested dividends).

Unlike for many other #shitcos, share count has remained surprisingly flat over the last 10-years. I am not surprised given management’s ownership and history of dividend payout.

That being said, fundamentally there’s not much else to really like about this company given political tailwinds to recreate domestic supply chains. Nonetheless, this business will probably continue to exist. The company recently announced the full resumption of production of a certain large contract. In addition, the CEO/Founder recently outlined his vision for the business that may lead to new growth and potentially even M&A.

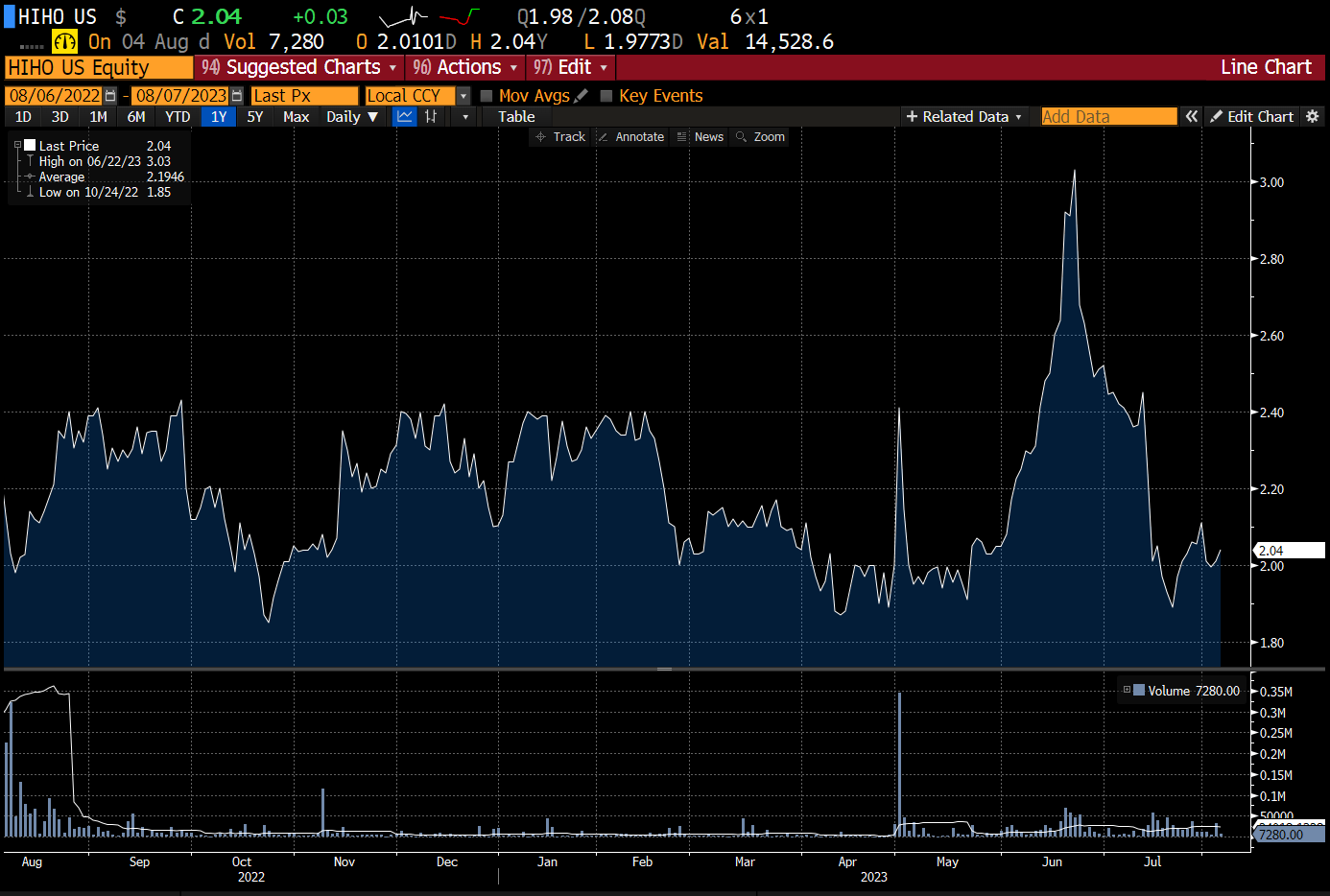

How has the stock performed this year? It’s largely been flat. We did see an unexplainable run-up back in June 2023 to $3.00/share after management announced a 100% increase in the dividend only to see it return to pre-announcement levels a few months later. Based on past precedent, management should be announcing a dividend sometime in the next week. Might we see that again? Perhaps. For me, this could be a trade at best and definitely not a long-term hold.

Anyways, just wanted to summarize my thoughts after a quick review. It’s important to remember this is a microcap stock with limited trading volume. Wild swings in the share price are expected and may materially deviate from fundamentals. Ultimately, I don’t think this is too compelling but could be interesting for a quick trade in small dollar amounts. If you’ve been following this company, let me know your thoughts!

Company Overview:

HIHO is a fully integrated manufacturer of high-quality metal, plastic, electric, and electronic components, subassemblies, and finished products for OEMs and contract manufacturers, mainly in Europe and Asia. The company has been manufacturing primarily through its factory complex in Long Hua, Shenzhen, China, and since 2013, it also conducts product assembly and some component manufacturing in Yangon, Myanmar.

The company supplies a variety of parts and products used in the manufacturing of items such as photocopiers, laser printers, vacuum cleaners, LED power supplies, and washing machine components. It also assists customers in design and development and offers a range of manufacturing and engineering services, such as metal stamping, plastic injection molding, and electronic assembly of printed circuit boards.

The company started its metal stamping operations for original equipment manufacturers in China in 1991. However, increased competition from other manufacturers in Shenzhen and low-cost areas in China has resulted in the company shifting from producing low margin, low-cost individual parts to manufacturing higher margin, more expensive components, subassemblies, and complete units. HIHO has also been progressively reducing its operations in China due to changes in government regulations, increasing costs, and diminishing benefits for foreign companies. Consequently, it has moved all its labor-intensive assembly and manufacturing activities to Myanmar.

HIHO benefits from low operating costs, consistent high-quality product manufacturing, extensive manufacturing capabilities, and engineering, design, and development expertise. Initially, the company manufactured high-quality metal parts primarily for Japanese customers, but it has increasingly been producing parts and components for European companies, especially German ones. Over the past few years, more than 70% of the company's revenues have been derived from its European customers.

Recent Performance:

Over the past three years, the Company primarily earned revenue from manufacturing and selling metal, plastic, and electronic products. Net sales declined last year due to decreased demand for home appliances in Europe following the easing of COVID-19 restrictions, and a decrease in production at the Company's Shenzhen, China, facility caused by a surge in COVID-19 cases.

The Company's operations in Yangon, Myanmar, and Shenzhen, China, returned to more typical levels during most of the fiscal year ending March 31, 2023. However, lingering travel restrictions, and the sudden easing of China's stringent COVID-19 policies in December 2022, negatively impacted the Company's operations and sales due to staff shortages as a result of sick employees.

In 2022, the Company signed a deal to manufacture video game consoles for a new US-based customer. However, the production and delivery of these products were delayed due to electronic components shortage and shipping delays. The Company has since resumed production for this customer.

Risks

Key man risk. Founder/CEO/Chairman is still heavily involved in the business. He may be fundamentally crucial for maintaining relationships with key customers.

High customer concentration. HIHO’s aggregate sales to its 4 largest customers account for 95% of the company’s revenues

Microcap stock. Market cap is <$10 million and only $60k worth of shares trade per day.

China/Myanmar country risk. There’s a lot of political risk investing in companies that operate in any of these jurisdictions. That being said, the company has operated in these geographies for a substantial amount of time and even saw a military coup in Myanmar, where it continues to still operate.

Disclosure: The information provided is for informational purposes only and should not be considered as investment advice. I am not a registered investment advisor, and any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release me from any liability. Seek professional advice tailored to your financial situation and objectives.

I might have to research this a bit more. Not that the mild suggestion of an M&A means it is likely but worth a look. My best trades of last year were scooped TWTR and TIG and then profiting on the M&A at the end. Then again with TIG, I didn't have any clue the M&A was going to happen. Thanks again for the heads up.

Iťs a gem, buying with all I have! 😂