High Yield Market Weekly: Till the Wheels Fall Off...Primary Market on Fire as Spreads Compress (August 11, 2025)

When $15 Billion Feels Like the New Normal

🚨 Connect on Twitter | Threads | Instagram | Reddit | YouTube

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list — limited spots.

The issuance floodgates have officially burst open. While everyone was busy debating August seasonals and employment data, borrowers quietly stampeded to market with ~$15 billion across 17 tranches last week. Issuers across sectors found eager buyers, from mining credits upsizing despite commodity headwinds to technology names clearing billion-dollar offerings with ease.

What’s the big picture here? This represents a fundamental breakdown of traditional market timing. When supposedly “challenging” economic conditions produce this kind of reception for credit risk, you have to question whether normal rules still apply. The technical momentum has become so powerful that it’s steamrolling both macro concerns and seasonal patterns.

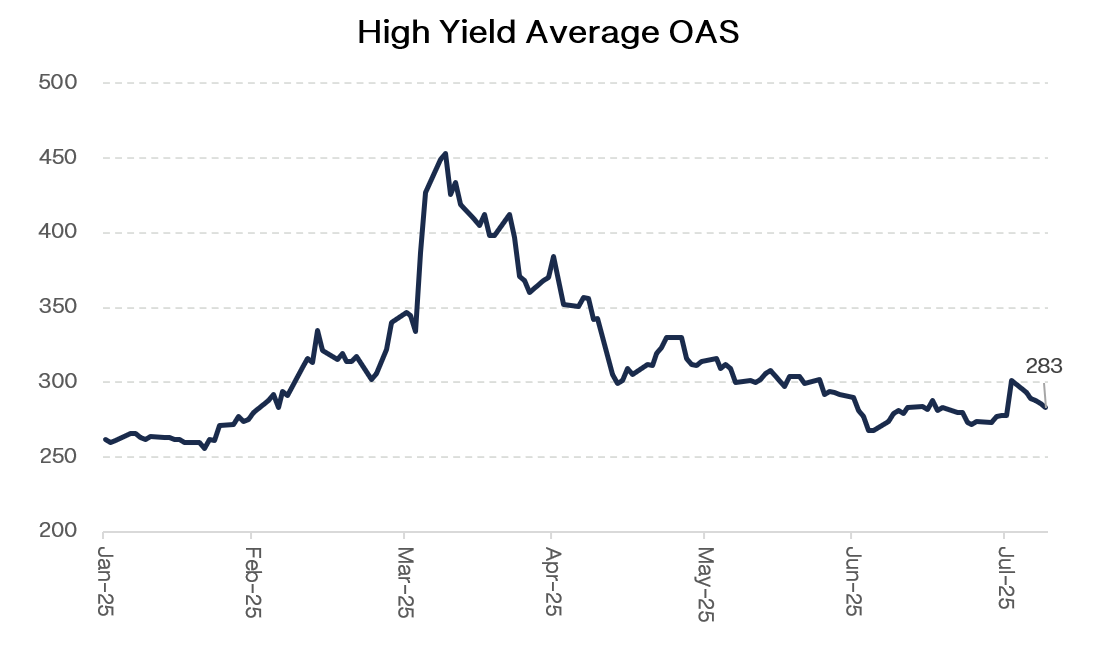

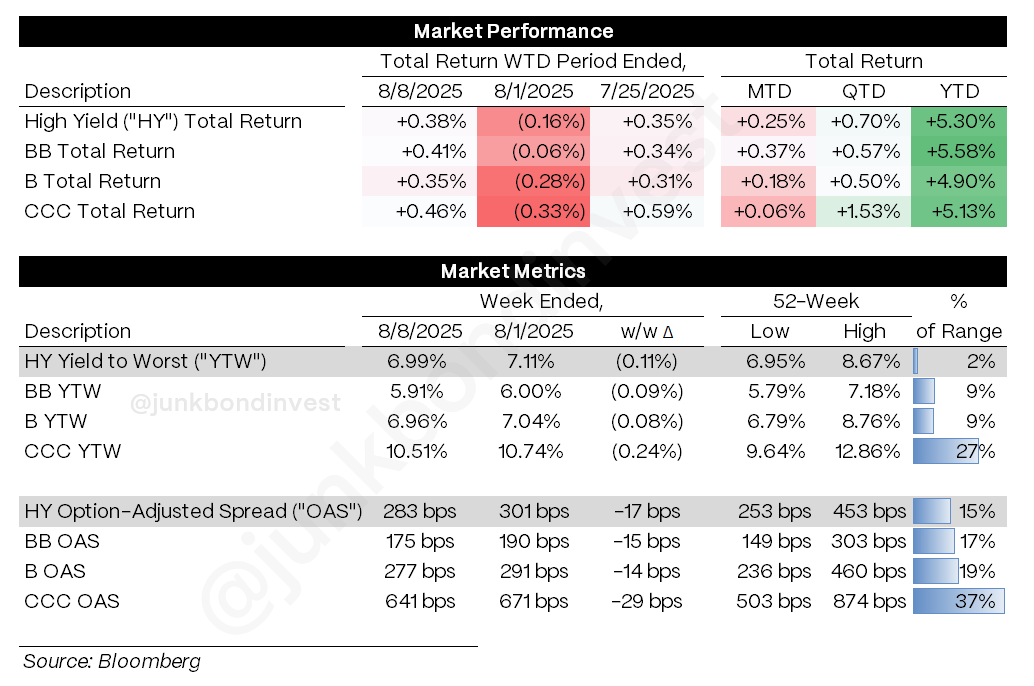

The market’s response was swift and decisive. CCCs ripped +0.46% for the week while spreads crushed 17bps tighter to 283bps. Yields collapsed 11bps to 6.99%. In just five trading sessions, buyers didn't just reverse last Friday’s employment shock, they obliterated it and kept going.

The question every credit investor should be asking: if this is what “challenging” economic conditions look like for high yield, what happens when things actually get good?

Weekly Performance Recap

Last week’s employment shock? What employment shock. Overall HY delivered +0.38% gains, led by the market’s biggest risk-takers:

CCCs absolutely ripped at +0.46%, proving once again that when sentiment flips, the lowest quality leads the party

BBs climbed +0.41%, showing that even defensive players got caught up in the momentum

Bs gained +0.35%, demonstrating broad-based demand across the entire rating spectrum

The overall picture:

Yields collapsed 11bps to 6.99%, hitting five-week lows and sitting at a mere 2% of their annual range

Spreads compressed 17bps to 283bps, sliding back under that psychologically important 300bp level

CCC spreads got annihilated by 29bps to 641bps, as the yield chase went into hyperdrive

YTD returns now look genuinely impressive: +5.30% overall, with BBs leading at +5.58% and CCCs managing +5.13%. For an asset class that was supposedly vulnerable to economic weakness, these numbers suggest either incredible resilience or dangerous complacency.