From Luxury Resale to Liquidity Crisis: The RealReal's Convertible Bond Saga

A Deep Dive into the Company's Financial Challenges and Potential Turnaround Strategies

Situation Overview:

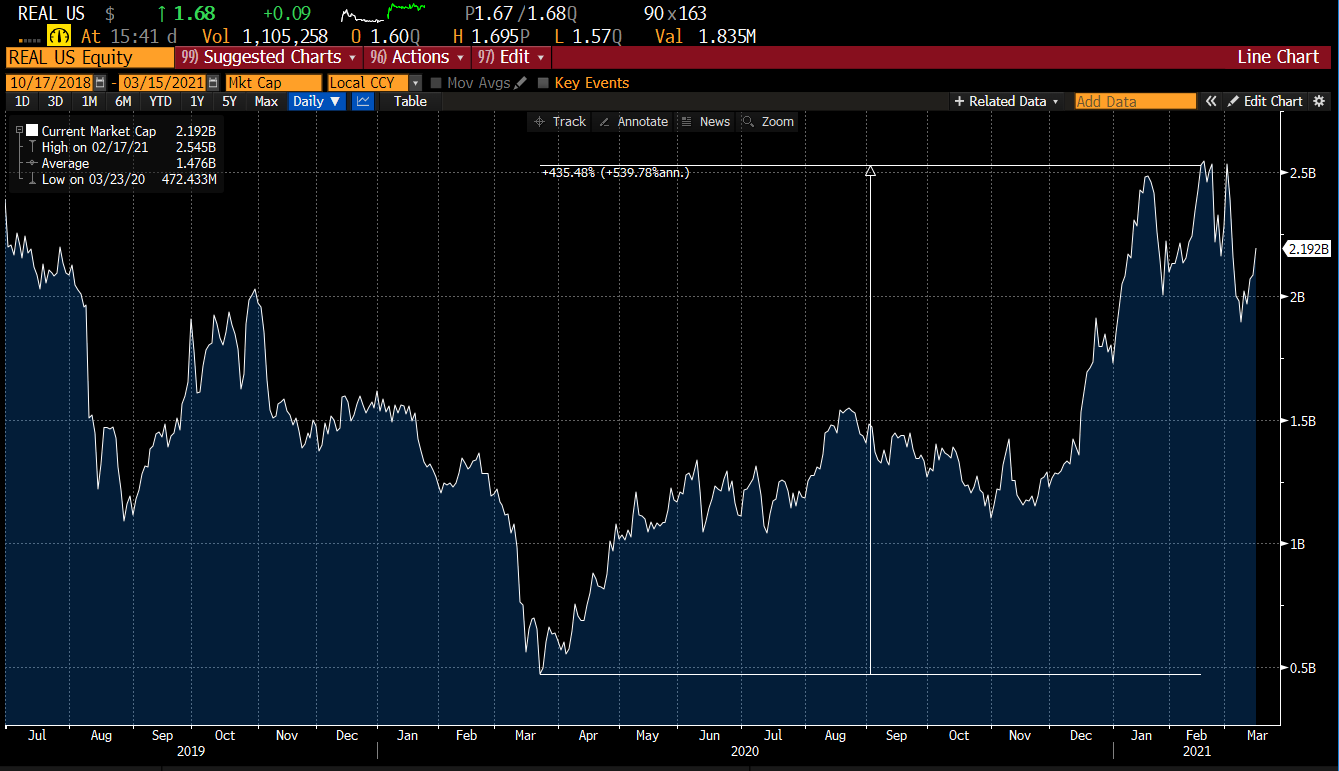

Founded in 2011, The RealReal Inc. (“REAL”) is the largest online marketplace for authenticated, consigned luxury goods. The company saw a surge in demand for luxury resale goods in the early days of the pandemic as people were looking for ways to save money and declutter their homes. The RealReal also benefited from the shift to online shopping as more people were buying and selling goods online. This helped revenues to nearly double relative to 2019 and the stock price to 5x+ from its March 2020 lows. In February 2021, the company saw a market capitalization high of ~$2.5bn.

In recent times, the company has faced a litany of challenges as the entire retail sector grappled with pricing issues and reductions in consumer discretionary spending. Moreover, increased competition, operational issues scaling the business, and changes to executive management have negatively weighed in on stock price sentiment. Most importantly, the company’s EBITDA and FCF generation, or rather the lack thereof, has been put in focus. Since going public, The RealReal has never had a quarter with positive cash flow or EBITDA for that matter. This has received even more scrutiny given the company’s dwindling liquidity profile and upcoming debt maturities. In recent years, the company issued a series of convertible bonds to finance its cash flow deficits. With the stock price collapsing over the last two years, the now way out-of-the-money convertible bonds have become real debt obligations that must either be refinanced, repaid, or ultimately restructured.

In response, the company has taken a number of steps to improve its business in short order, including cutting costs, investing in technology, expanding into new categories, and focusing on profitability. Earlier this year, The RealReal appointed Kory Koryl as its new CEO. Koryl is a veteran of the retail industry who has a track record of turning around troubled companies.

Not too long after his appointment, on February 15, 2023, REAL unveiled a cost-cutting plan that involved laying off around 230 employees (~7% of total staff). Additionally, the company began to downsize its real estate footprint by shutting down two flagship stores in San Francisco and Chicago, two neighborhood stores in Atlanta and Austin, and two luxury consignment offices in Miami and Washington, D.C., as well as reducing office spaces in San Francisco and New York.

On the sales side, several initiatives have been launched to boost sales. One step was the introduction of advertising. Initially restricted to a single page and a fraction of their website traffic, REAL expanded this to all of its pages as the shift did not have a discernible impact on customer behavior. REAL also altered its product range to exclude items priced below $100 which it found to be unprofitable. The company also began to shift away its direct model which involved taking inventory directly from suppliers back to its roots of pure consignment. While the impact of this is expected to hurt topline in the near-term, this transition will help improve gross margins and working capital intensity.

Despite the company’s efforts, both EBITDA and FCF remain substantially negative. With $189mm of current liquidity relative to a historical quarterly cash burn rate of ~$40mm, the company has limited runway to improve its operations and reduce its rate of FCF burn. REAL also faces another major hurdle in the form of an upcoming $172million convertible bond maturity less than two years away in June 2025. Normally, this debt would be refinanceable. However, given the underperformance in its business, coupled with an uncertain overall business model and a potential recession, the prospects of a regular-way refinancing do not look promising. This is even truer in the context of rising rates and diminishing credit availability, particularly for ventures that burn FCF. Currently, these near-term maturity convertible bonds remain “busted” and trade for 70 cents on the dollar, implying a yield to maturity of over 25%.

REAL has been striving to improve its financial performance, but the long-term margin profile remains in question. If REAL is able to reach EBITDA inflection in the near-term and prove out sustainable FCF generation while preserving its current liquidity, the company might be able to refinance its 2025 maturities as the balance is not particularly large at $172mm. However, even if the company does somehow address this near-term maturity, it still faces the daunting task of refinancing a larger $288 million convertible bond maturity three years later in 2028. Credit markets ascribe even less likelihood to that, as those bonds currently trade at 40 cents on the dollar.

Adding fuel to the fire, on September 12, 2023, the company witnessed a major setback when eBay unveiled its luxury consignment service, facilitating users to collaborate with expert sellers for listing and selling products. Initially, the service will cater to handbags from around 35 luxury brands but is expected to expand into other brands and categories in 2024. While eBay’s history includes an authentication guarantee launched in 2020 for fine jewelry and sneakers, the new venture positions it more as a luxury managed marketplace, relying on expert sellers for authentication. Such a move places eBay in direct competition with REAL, more so than before. EBAY, a much larger and profitable company might offer users more attractive consignment fee terms compared to REAL and could also hinder REAL’s ability to procure new supply.

To cap it all off, on September 29, 2023, REAL’s CFO announced his departure after serving for two years as CFO and briefly as its interim co-CEO. This departure comes after leadership reshuffles earlier in 2023 when John Koryl was appointed CEO, succeeding founder Julie Wainwright who resigned in June 2022.

It remains to be seen whether Koryl will be able to turn The RealReal around. However, the company has a strong brand, a loyal customer base, and market leadership in its niche category. It is also well-positioned to benefit from the growing trend of luxury resale. In the following sections, I will delve into the company’s financial performance in more detail, review the current capital structure, and provide my preliminary investment views on the company’s convertible bonds due 2025 and 2028. I will also provide additional detail on the luxury resale industry and delve into the company’s bull case narrative.

Disclosure: The information provided is for informational purposes only and should not be considered as investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release me from any liability. Seek professional advice tailored to your financial situation and objectives.