Fresh Vine Wine's Vintage Troubles: The Uncorked Reality of $VINE

From Celebrity Sparkle to Financial Fizzle: The Complex Story of Fresh Vine Wine ($VINE)

I was recently looking into a stock when I happened to see the following headline. Naturally, this piqued my interest.

I’ve never heard of Fresh Vine Wine but the ticker alone ($VINE) intrigued me so I decided to have a quick look at what I thought would be a prime #shitco candidate. And after a quick review, it’s actually much worse! The company doesn’t even have any debt on its balance sheet!

How bad could it be? Let’s find out.

Situation Overview:

Established in 2019, Fresh Vine Wine, Inc. ("VINE") is a US-based wine producer specializing in premium wines that cater to the budget-conscious while prioritizing low carb and low-calorie content. Co-founded and endorsed by celebrities Nina Dobrev and Julianne Hough, who collectively own ~17% of the equity, the vision was to harness the power of celebrity branding to carve a niche in the market, emulating the success George Clooney achieved with Casa Migos.

In December 2021, the company decide to go public (for reasons unknown to investors), raising $22mm of equity proceeds in the process. You could read the original S-1 statement here and the related invested presentation here. The investment highlights are outlined below. Anytime you see “strong management team,” you know you’re entering #shitco territory.

To keep it simple, the basic investor pitch was VINE could develop its brand and flip it to a larger multinational beverage company like Diageo, similar to these guys:

At its peak, which unsurprisingly was the company’s first trading day, the company’s market cap reached approximately $87mm. Woohoo, time to celebrate!

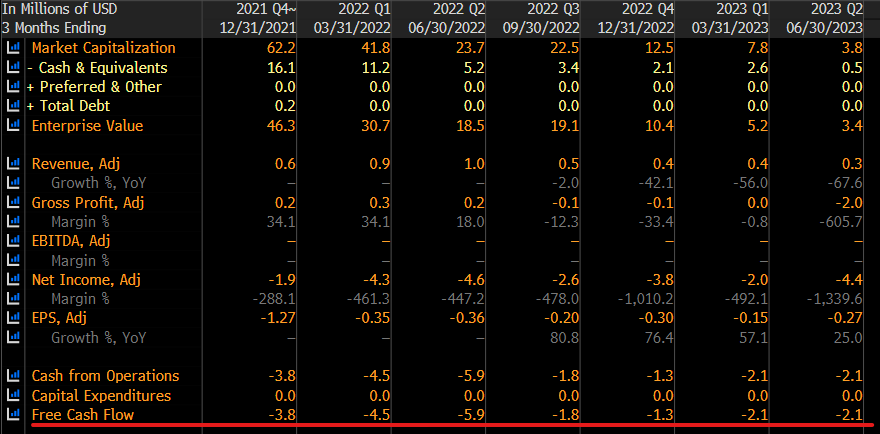

Of course, the company has been a complete disaster since then. As you can tell from the below, the company has burned cash every quarter as a public company, burning a cumulative $21.5mm over the last 7 quarters. Cash burn is OK for a growing company with attractive investment opportunities; however, this is NOT OK for a shrinking company. VINE’s revenues have been on the decline since Q3’22.

Why are sales declining? Well, it seems there is absolutely nothing special about their wine. The lower calorie count was basically attributable to it being a dry wine. Take a look this r/wine reddit thread for color from some wine enthusiasts. Furthermore, the company is lacking capital to expand which is constraining their ability to generate sales. The company itself attributes revenue decline due to insufficient coverage of fixed and variable costs from product shipments, reduced sales and marketing spending, termination of related party sales agreements, and increased billbacks.

Over the same period, shares outstanding have gone from 8.9mm to 16.6mm, an 86% increase! Love to see that. As you might guess, the stock has unsurprisingly declined 96% since going public.

So where does that leave VINE today? Currently, the company is sitting on ~$476K of cash on its balance sheet. This is even after the company, somehow, completed a rights offering in Q1’23 where they raised $2.6mm of new proceeds. In terms of their burn rate, I estimate the monthly burn to be ~$700k (last quarter FCF divided by 3). So, the company is clearly close to running out of money. With expenses consistently outweighing revenues, the company enacted cost-saving and restructuring efforts in 2022. Key changes included staff layoffs and outsourcing sales and marketing initiatives. In April 2023, the company hired former CEO Roger Cockroft to enhance operational efficiency.

In early Q3’23, the company secured a purchase order for 40,000 cases of their existing inventory at a price of $800,000 to a large wholesaler. This compares to a current inventory balance of $1.5mm, which was recently written down by $1.7mm.

On August 2, 2023, the company strangely was able to secure $1.0mm of preferred equity financing from NYF Group and EROP Enterprises (I have no idea who these guys are). This preferred stock will sit ahead of the common equity in terms of liquidation preference. The combination of the inventory firesale and preferred equity raise might allow them to survive through Q4’23. Nonetheless, the company’s precarious financial situation has led management to casts doubt on the company's ability to continue as a “going concern.”

However, on August 24, 2023, the company announced that it was exploring strategic opportunities, causing the stock to trade 16% higher on the day. This is not unexpected given that one would naturally believe the brand holds SOME value. However, here’s where this logic fails.

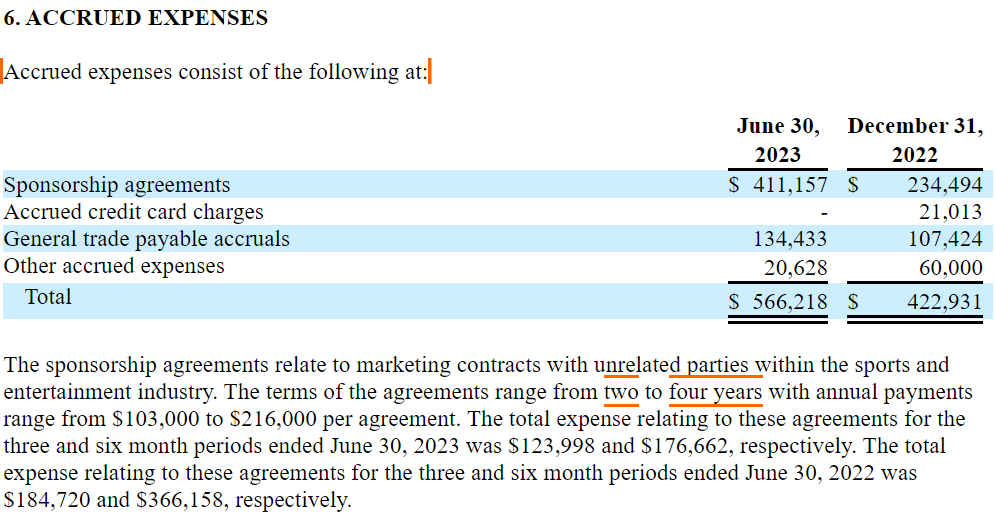

To date, the brand's success has been significantly tied to the celebrity endorsements of co-founders, Nina Dobrev and Julianne Hough, who have actively promoted the wines. On August 8, the company received written letters from Nina Dobrev and Jaybird Investments notifying the company that it was in default of its respective license agreements based on failure to pay their August 2023 license fees. Facing licensing termination, the company had 30 days to cure this notice.

How much were they owed? Based on the accrued expenses detail in the company’s 10-Q filing, I believe approximately $411,157. This is nearly the entirety of the company’s cash balance as of 6/30.

It’s now been over a month and I’m pretty sure the company has not paid this, suggesting the licensing agreement has terminated.

So what good is a generic wine maker without the backing of its key celebrity co-founders and brand endorsers? Coupling that with significant cash burn makes me believe there is 0 equity value here. To highlight this point even further, Nina Dobrev owns ~9% of the equity today which is valued at ~$623k based on current market prices. The fact that she’s looking to enforce a cash licensing fee payment of maybe ~$400k should tell you a lot about what she thinks of the value of her equity (I’ll give you a clue: 🥯)

So how does this all play out? I think company will probably liquidate sometime in 2024 with value, if any, accruing to the preferred equity holders. The stock will likely be de-listed (company received a notice on 9/14). Even if the company does survive and does secure additional capital, there is nearly 100% chance of further dilution or priming.

Does this make the equity a short? From a fundamental perspective, probably. Practically however, the cost to borrow is high (100%+) and the chance of a massive short squeeze is non-zero, making an outright short in the stock difficult and largely unactionable.

A Few Other Interesting #ShitCo Tidbits:

Like any true #shitco, the company has material weakness in its reporting:

VINE has recently seen a flurry of director resignations:

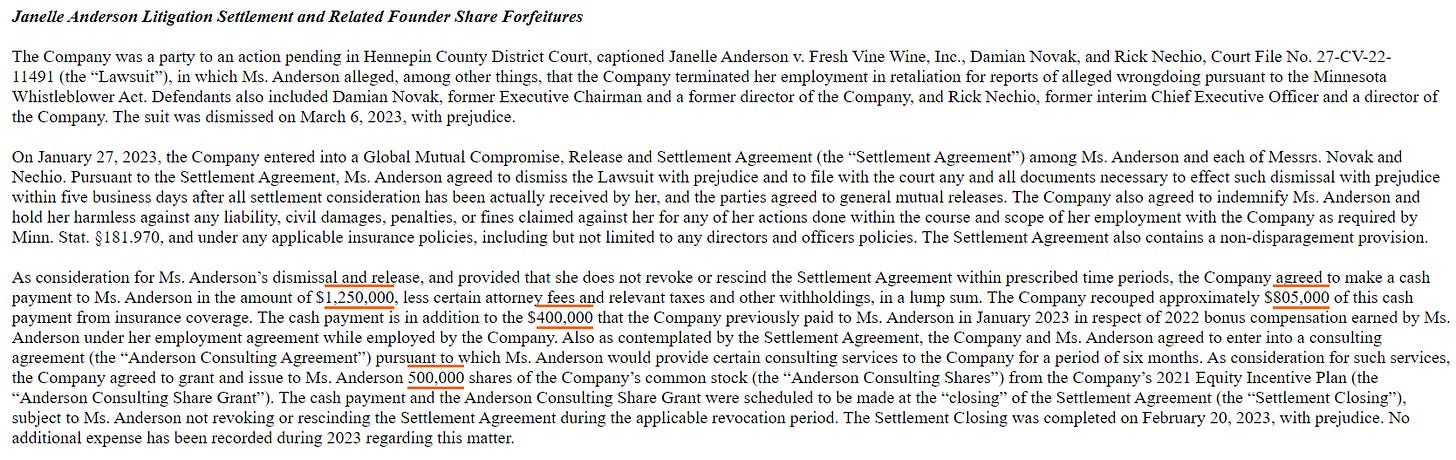

The company is engaged in litigation with its former COO:

The company is NOT operating with a permanent CEO or CFO, both of whom resigned in July 2023, including the recent CEO who joined in April 2023.

The company somehow is still using the likeness of Nina Dobrev and Julianne in its Instagram campaigns.

Company Overview:

Fresh Vine Wine, Inc. is a U.S.-based premium wine producer, specializing in low-calorie, low-carb wines tailored for consumers with health-conscious and active lifestyles. Established in 2019, the company offers a range of varietals produced and bottled in Napa, California, and distributes its products throughout the U.S. and Puerto Rico via wholesale, retail, and direct-to-consumer channels. Emphasizing quality and value, Fresh Vine Wine prices its wines competitively, ensuring they resonate with a wide demographic, particularly those aged 21 to 34. Through strategic partnerships, the company operates with an asset-light model, leveraging third-party land and production facilities.

Disclosure: The information provided is for informational purposes only and should not be considered as investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release me from any liability. Seek professional advice tailored to your financial situation and objectives.

That was fast response!

Thx