Elevated Yields, Elevated Risks: An Analysis of Deluxe Corp's ($DLX) Senior Notes Yielding 11%

Navigating Deluxe's Shift from Traditional Check Printing to Tech Solutions

Situation Overview:

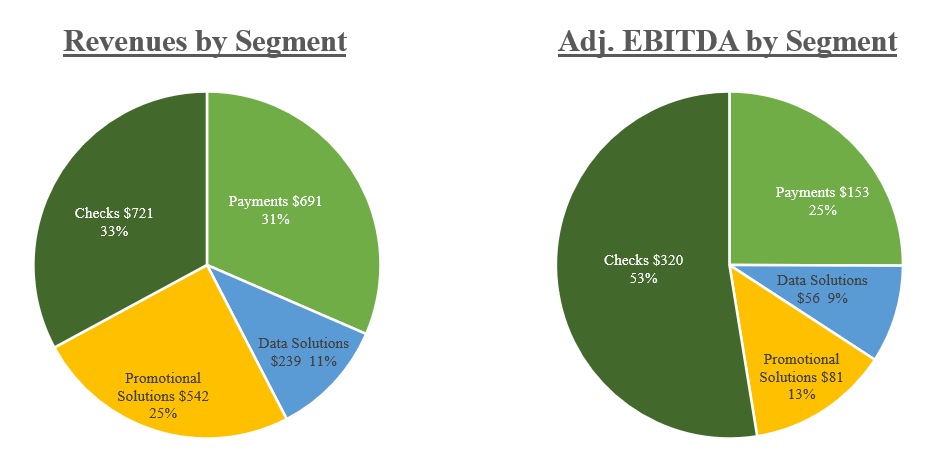

Headquartered in Minneapolis, MN, Deluxe Corp. (“Deluxe” or “DLX”) is a business services company that specializes in providing a wide range of payment processing services. Founded in 1915, Deluxe initially started as a check printing business but has since diversified through strategic acquisitions. The company currently operates across four key areas: (1) Payments, (2) Data Solutions, (3) Promotional Solutions, and (4) Checks. While revenues are broadly diversified, Deluxe’s Checks segment remains disproportionately the company’s most profitable.

Deluxe primarily operates in the United States, but its products and services also extend to Canada, Australia, select European countries, and South America. With over 5,000 employees, the company serves 4+ million businesses, ranging from large enterprises to SMBs, with a focus on sectors such as financial services, healthcare, real estate/construction, and insurance.

Unsurprising to anyone that lives in the modern age, the company’s legacy core business in checks printing is in secular decline driven by the rise of digital payments (e.g., Venmo/Zelle), which offer greater convenience, speed, cost-effectiveness, and environmental friendliness. To management’s credit, this decline has been actively managed through market share gains, price increases, and cost-cutting measures, all of which have contributed to maintaining a fairly stable EBITDA despite broader industry declines. In 2021, Deluxe even saw an unexpected uptick in check-printing demand due to factors like the Paycheck Protection Program, changes in consumer addresses due to remote work, a surge in new business formations, and new contracts. Nonetheless, industry trends suggest continued declines in the HSD range.

To counteract these obvious industry headwinds, Deluxe has strategically acquired several industry-adjacent companies to expand its offerings for small businesses and financial institutions. These acquisitions include companies like PsPrint (online printing), OrangeSoda (web-based marketing), VerticalResponse (email marketing), Wausau Financial Services (transaction processing), and LogoMix (logo design).

On April 22, 2021, Deluxe announced the largest acquisition in its 100+ year history of First American Payment Systems for $960 million in cash. This acquisition significantly expanded the company’s Payments segment and was expected to boost overall revenue growth through product innovation and cross-selling opportunities. The deal was financed with $1 billion of new debt which now serves as the foundation of the company’s current capital structure. This included raising $500 million of 8.0% Senior Notes due 2029.

Despite the inherent risks/challenges integrating a major acquisition, Deluxe’s performance has been fairly stable, beating consensus EBITDA estimates nearly every quarter. In late 2023, the company hosted its first investor day since 2020, during which Project North Star was introduced. Under CEO Barry McCarthy’s guidance, this initiative marked a stark movement away from its traditional roots in check printing to becoming a tech-forward solutions provider for businesses and financial institutions. The plan aims to leverage Deluxe’s substantial client base, encompassing over 4 million small businesses and 4,000 financial entities, and expand into sectors like payment processing and cloud services. The North Star Plan also set ambitious financial goals, aiming to increase Adj. EBITDA by $80 million and FCF by $100 million by 2026, while continuing a strong dividend policy.

Since issuance, the company’s Senior Notes, alongside the equity, have seen considerable volatility. In March 2023, the Senior Notes saw lows of 72.5, fueled by March’s regional banking crisis (Silicon Valley Bank, First Republic, etc.) as well as a CCC credit-rating downgrade by S&P. While sentiment, alongside business performance, has improved since then, today the company’s Senior Notes due 2029 trade at ~89 for an implied YTM/STM of 10.7% / 635 bps.

In the next section, I will review the company’s capital structure, financials, and covenant considerations. Whether you’re a credit investor evaluating a pitch from your bucket-shop broker or an equity investor looking to get a creditor’s perspective, the following section should give you enough information to make a more informed judgement call—whether that’s going long or short.

Disclosure: The information provided is for informational purposes only and should not be considered as investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release me from any liability. Seek professional advice tailored to your financial situation and objectives.