Distressed Debt Alert: Is Time Running Out for Canacol Energy ($CNE)?

An Inside Look at Operational Challenges and a Potential Liquidity Crunch in Colombia's Gas Giant

Follow me on Twitter / Instagram 🚨 Read time below = 15 minutes 👇 We are hiring (part-time/internships), contact me for more information.

Situation Overview:

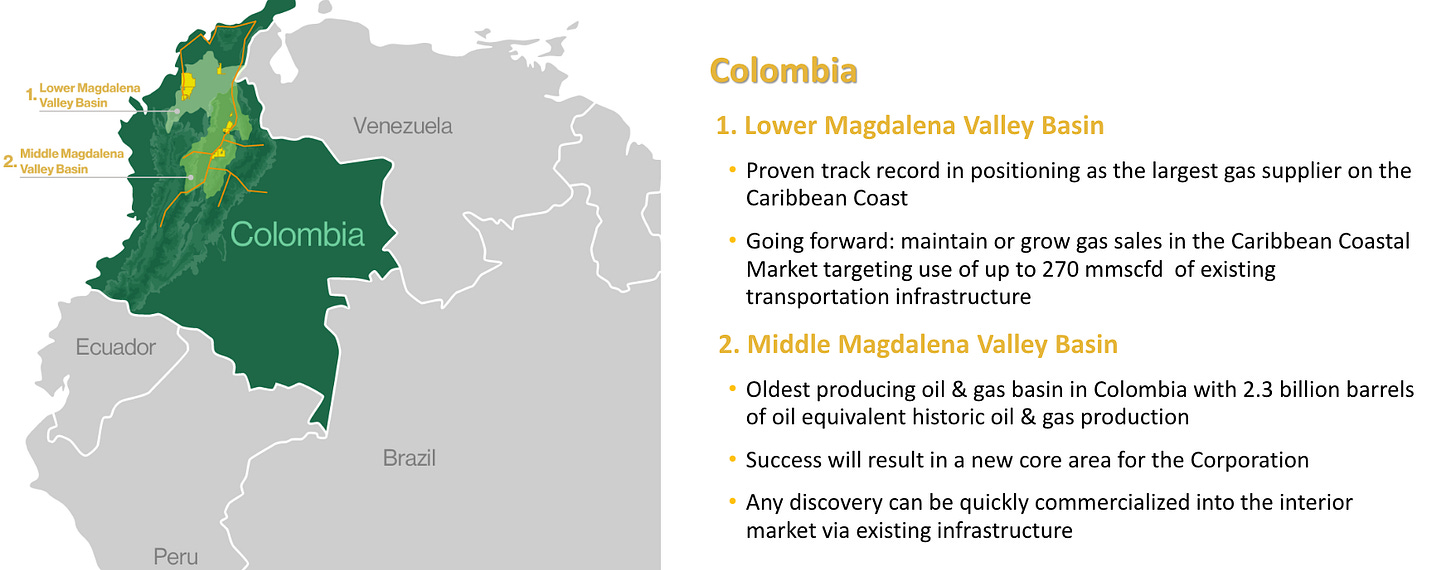

Headquartered in Canada, Canacol Energy Ltd. (“Canacol” or “CNE”) is the largest independent natural gas exploration and production company in Colombia. The company has a strong market position in the region, historically representing ~17% of Colombia’s total gas production through its operations in the Lower Magdalena Valley basin. In 2023, Canacol sold an average of 178,000 mcf/d of gas, accounting for 98% of its total sales volumes.

The company’s business model centers around selling the majority (~75-80%) of its natural gas production under long-term (avg. life of ~5 years), fixed-price, take-or-pay contracts denominated in U.S. dollars with the remaining volumes sold into the local spot market. These contracts historically have provided cash flow stability and insulated the company from local gas price volatility.

However, Canacol’s defensive business model has shown cracks over the past few years. Despite heavy capital investment, the company’s gas production has remained flat since 2021 due to exploration disappointments and unexpected operational issues. Proved developed producing (“PDP”) and 1P reserves have declined precipitously, with Canacol replacing just 46% of its extracted volumes in 2023. The company exited the year with a PDP reserves life of ~1.5 years and a 1P reserves life of ~4.4 years.

In October 2023, Canacol announced the termination of a major long-term, take-or-pay gas sales contract with Empresas Públicas de Medellín (EPM), which was set to commence in December 2024. The EPM contract was a key growth driver for Canacol, as it would have required the company to supply an additional 75 mmcf/d of gas to Medellin via a new pipeline. Canacol attributed the cancellation to delays in permitting for the pipeline, an increasingly challenging operating environment, shifting market dynamics in Colombia, and a desire to reallocate capital to exploration opportunities. The loss of the EPM contract eliminated a visible avenue for production growth and forced Canacol to re-evaluate its plans in the Lower Magdalena Valley.

Overall, Canacol’s aggressive pace of investment and stagnant production has strained its financial position. The company generated negative FCF of $120 million in 2023 due to heavy CapEx and cash taxes, requiring the company to fully draw on its $200 million revolving credit facility (“RCF”). As a result, net debt increased to $674 million, pushing net leverage to 2.8x EBITDAX compared to 2.3x at YE’22. With its revolver fully drawn and negative FCF expected again in 2024, Canacol appears to have limited liquidity to fund its capital program and could face a cash crunch if operations don’t improve.

In response to its deteriorating financial position, Canacol cancelled its dividend (freeing up ~$28 million annually) and reduced 2024 CapEx guidance to $138-151 million (down 30-36% y/y). However, the company still expects production to decline to 160-177 mmcf/d in 2024, with recovery weighted towards 2H’24. Management is also pivoting to new growth initiatives, such as exploration in the Middle Magdalena Valley and Bolivia, but these are high-risk and unlikely to be NAV-accretive in the near-term. Moreover, on April 29, 2024 CNE announced the sale of its entire holdings in Arrow Exploration, helping to slightly bolster liquidity by $14 million

Canacol’s strained balance sheet and uncertain operational outlook have weighed heavily on its bonds, which currently trade ~47 cents (YTM of 26%) compared to par in early 2022. The significant drop in bond prices has been driven by heightened liquidity concerns and structural worries surrounding reserves and output levels. While some investors see an opportunity for a potential rebound in bond prices, others express concerns about the company’s FCF burn expected for the first half of 2024 and the risks associated with the upcoming May coupon payment.

In light of these challenges, rating agencies have taken negative actions on Canacol’s credit ratings. On April 26, 2024, S&P downgraded Canacol to B- from B and maintained a negative outlook, citing weaker 1P reserves, liquidity, and limited growth prospects. Similarly, Moody’s downgraded CNE to Caa1 from B3 on April 4, 2024, with a negative outlook. Fitch had previously downgraded CNE to B from BB- on March 25, 2024, also assigning a negative outlook.

Despite the challenging backdrop, the company has reaffirmed its commitment to making debt payments and expects enhanced liquidity starting in 2024. The company also announced a significant gas discovery at the Chontaduro-1 exploration well on April 18, 2024, which could help bolster reserves if successful. However, until there are clear signs of operational and financial stabilization, CNE’s bonds are likely to remain under pressure. Some market speculation has emerged about Canacol as a potential acquisition target for strategic or distressed investors, but no firm details have been announced. In the next section, I’ll review the company’s capital structure and key covenants as well as provide my views on whether the bonds look interesting at current levels.

Disclosure: The information provided is for informational purposes only and should not be considered as investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release me from any liability. Seek professional advice tailored to your financial situation and objectives.