Core Scientific ($CORZ): This Isn’t a Bitcoin Miner Anymore

Re-levered post-bankruptcy, signed a $10bn contract, and stopped talking about Bitcoin. If that’s not a pivot, what is?

Connect with me on Twitter / Instagram / Threads / Bluesky | Estimated Read Time: 14 Minutes

🚨 Something new is coming. Join the early access list — limited spots.

I. Situation Overview

Most Bitcoin miners promising AI infrastructure buildouts are full of sh*t. Core Scientific might be the exception. Since my August write-up, the stock doubled and crashed back to where we started. You’d think nothing’s changed. But you’d be wrong.

The CoreWeave deal has now mushroomed to mind-boggling proportions. 590 megawatts (MW). $10 billion over 12 years. That’s nearly triple their current market cap! CoreWeave funds the construction while Core Scientific collects the rent. It’s the infrastructure equivalent of having your cake and eating it too.

CoreWeave itself is showing signs of life. After an IPO that fell flat, the stock has climbed 34% from its lows. Investors are finally connecting the dots between OpenAI’s ~$12 billion contract and CoreWeave’s actual business model. That’s good news for Core Scientific’s primary (and sole) tenant.

Operationally, the Denton facility is turning into something real. 64 acres. 260 megawatts. 600+ contractors swarming the site. Not PowerPoint dreams – actual construction happening now. They’ve lit up 8MW already with 40MW more this quarter. That’s hardware, not vaporware.

Yes, timelines have stretched. Show me an infrastructure project that doesn’t slip. Microsoft’s behind. Amazon’s behind. Building these facilities is hellishly complicated, especially when you’re retrofitting Bitcoin mines into liquid-cooled AI powerhouses. The question isn’t whether they’re delayed – it’s whether they’re delivering. And they are.

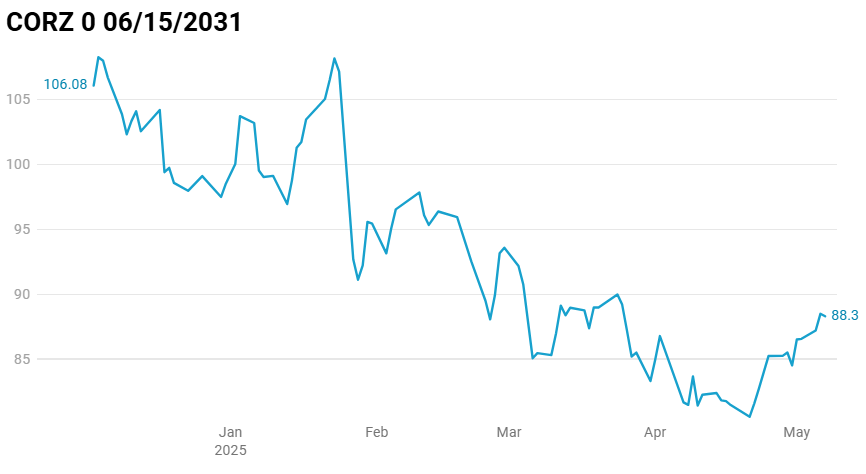

The company issued converts which have restocked the war chest. $625 million at zero coupon plus another $460 million at 3%. Yes, it’s re-leveraging a company fresh out of bankruptcy. But $780 million in liquidity buys a lot of runway to get through the messy building phase. One of the converts is busted and trades below par.

Bitcoin mining? That’s so 2022. Now it’s just the side hustle with 1,200 coins on the balance sheet. They’ve even announced they would stop publishing monthly mining reports. The message is clear: “We’ve moved on.”

Where are the OTHER customers? That’s the billion-dollar question. Management keeps teasing conversations with enterprises hungry for 50-100MW blocks. The Auburn acquisition suggests they believe in their pipeline. But until they sign another deal, it’s just…talk.

Wall Street still sees them as the crypto company in AI clothing. The Bitcoin miner stigma is tough to shake. Each quarter without customer diversification reinforces that skepticism. But the power assets are real, and power is the ultimate AI bottleneck.

First-mover advantage in this space is everything. Core Scientific has 1.3GW locked up while others struggle with multi-year permitting nightmares. That advantage compounds daily as AI demand accelerates and the grid capacity gap widens.

We’re now watching a company reinvent itself in real time. The pieces are falling into place - contracted megawatts, actual energization, secured equipment, sufficient liquidity. CoreWeave validates the model. If they can execute on the CoreWeave contract and/or land just one more major customer, the whole narrative could flip from “failed Bitcoin miner” to “essential AI infrastructure provider” almost overnight.

The building blocks for a legitimate comeback story are all there.