Comscore ($SCOR): Inside the Challenges of Preferred Equity Overhang

Second Edition of #ShitCoSunday

In an effort to keep up with my newly-initiated #ShitCoSunday posts, I solicited input on Twitter for a new idea. One idea came out of this—ComScore, Inc. (“Comscore”). What drew me to the situation was (1) recent insider buys and (2) recent activist investor involvement so I decided to take a quick look this morning.

Founded in 1999, Comscore provides cross-platform measurement and analytics across digital, TV, and movie platforms for media buyers/sellers. At one point, the company was a challenger to Nielsen’s TV ratings monopoly but this has since faded given increased industry competition and declining linear TV viewership. Like a typical #shitco, the company’s stock has been an absolute disaster, having declined 78% over the last 2 years to $0.78/share. This compares to its all-time high of $58.50/share in 2015.

There’s a few things that are interesting about the situation.

Insiders have been buying the stock recently, although in small dollar amounts.

EBITDA is positive and recently appears to be on the upswing, having grown 2.3% over the LTM period.

The company only has $16mm of corporate debt outstanding or 0.4x EBITDA.

WPP, the ad agency, is the largest shareholder with 11.9% of the common equity.

180 Degree Capital Corp, an activist investor, has recently built a 6.4% position in the equity and is pushing for change. They’ve published multiple letters on their website—here’s one for example.

However, that’s likely the extent of the positives here. What complicates the picture is a nasty preferred equity note that will likely capture most of the value generated by the company for the foreseeable future. Let’s explore this in a bit more detail.

In January 2021, Comscore raised perpetual preferred stock from Charter Communications, Qurate (subsequently sold their stake to Liberty Global in May 2023), and Cerberus for $187.9mm of net proceeds in order to refinance its existing debt. This preferred stock carries a 7.5% annual dividend equating to roughly $14mm per annum. While initially the company chose to pay these amounts, they decided to defer the latest payment in June 2023 in order to preserve liquidity and give management the flexibility to drive its business turnaround. This amount is now due to be paid by December 2023 and is currently accruing at 9.5%.

While not technically debt, the preferred stock sits above the common equity and has liquidation preference. In addition, each share of preferred stock is convertible into 1.076270 shares of common stock at the holders option. Importantly, the preferred stock is also owed a one-time special dividend equal to the highest dividend that the board determines can be paid. That amount hasn’t been disclosed or paid. As a result, there is uncertainty around the amount and timing of payment. The activist fund involved estimates this could be $65 million—see below.

The company clearly doesn’t have the cash/liquidity to pay this and might resort to raising debt, which would further constrain FCF. All of this is not good for the common equity which sits at the very bottom of the capital structure. If we include the estimated special dividend payment, the total amount of priority obligations ahead of the common equity equates to roughly 7.0x and is accruing by $15mm (0.4x) per annum (if dividends are not paid). The capital structure table below illustrates this point.

For the stock to work, the overhang of the special dividend needs to go away and/or the preferred equity needs to be refinanced. In today’s rising interest rate environment, I do not realistically see a new lender providing 7.0x leverage to a minimal-growth, $38mm EBITDA business. While performance is at least stable and growing slightly, FCF is minimal post the dividend payment and would likely be even lower if the preferred stock was refinanced with new debt. I suspect any new debt financing would come with terms that are highly restrictive or dilutive to existing equity holders.

The other alternative would be a sale, which the activist investor is suggesting. However, with tepid revenue/EBITDA growth coupled with a challenging advertising market environment and linear TV pressures, I don’t see a realistic bid for the company in the near term. Moreover, what angle is a new investor going to have that’s different than the current preferred stock holders, a few of which are strategics? The preferred stock holders control 6 out of ten board seats and one of them (Charter) is also a key supplier to the company. Interestingly, Commscore is currently in dispute with Charter (outlined below) so I find it highly unlikely a new buyer steps in without resolution to that.

The company is also subject to some restrictive covenants in its recently amended revolving credit facility and this also matures next year in May 2024.

As such, I do not think there is anything to do with the stock at this time (neither long or short). The heart of the issue is that the preferred equity is in the driver’s seat here and will continue to extract value from the business. I don’t see a change to the board any time soon. With the overhang of the special dividend and no prospects for shareholder returns in the foreseeable future, this to me seems like dead money at best.

Where could I be wrong? Well the company is guiding to low-single-digit growth and double-digit adjusted EBITDA margins. The company also recently underwent significant leadership changes (CEO, CFO, COO) and implemented a restructuring plan to enhance cost efficiency and align resources with strategic priorities, including workforce reduction and technology modernization. So perhaps they can grow their way out of this but for now, it’s a still show-me story. Time will tell.

Note that this is a quick review so if you have been following the company for a while or have different views, please let me know!

Company Overview:

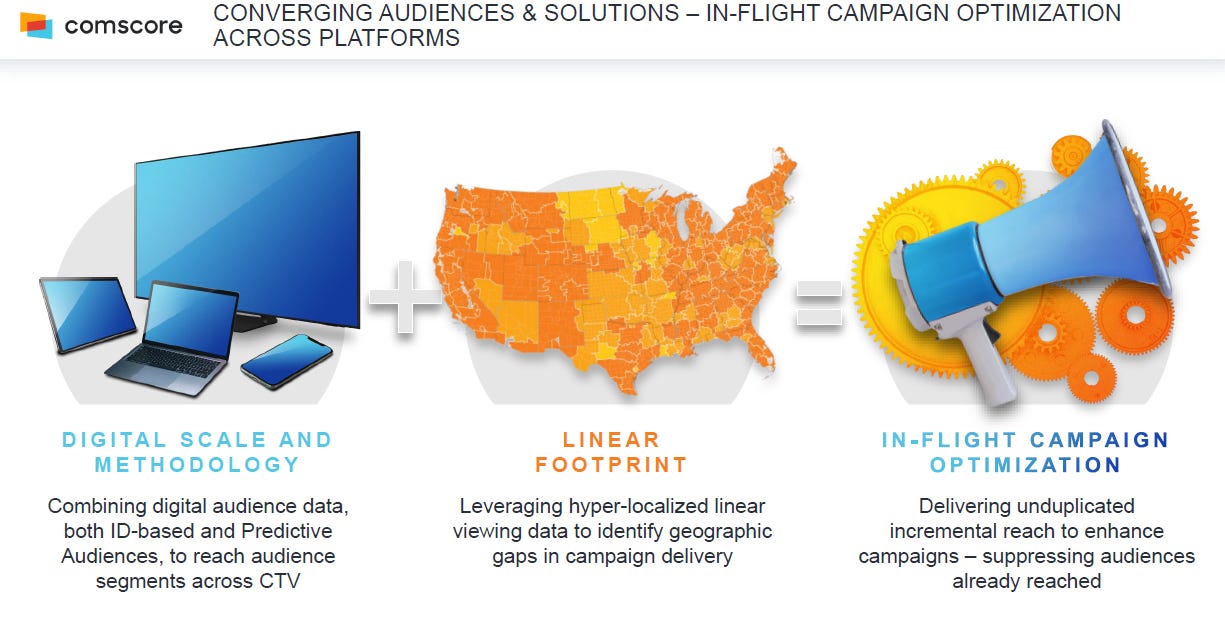

Comscore is a global cross-platform measurement company that specializes in quantifying audiences, brands, and consumer behavior across various media platforms. By integrating proprietary intelligence related to digital, TV, and movie with demographic information, Comscore provides a comprehensive analysis of multiscreen consumer behavior at scale. The company's global data platform encompasses connected devices like Smart TVs, mobile devices, tablets, computers, direct-to-consumer applications, and movie screens, along with other descriptive data.

Comscore's products and services include audience ratings, advertising verification, and detailed consumer segments that describe hundreds of millions of consumers worldwide. These offerings enable media buyers and sellers to make informed business decisions by understanding and monetizing multiscreen behavior. Founded in 1999, Comscore has a significant presence in the US, which accounts for about 90% of its revenue. Overall, Comscore's ability to unify behavioral and descriptive data positions it as a significant player in the information and analytics industry, aiding clients in advertising, content measurement, and consumer insights on a global scale.

Disclosure: The information provided is for informational purposes only and should not be considered as investment advice. I am not a registered investment advisor, and any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release me from any liability. Seek professional advice tailored to your financial situation and objectives.

great coverage, thank you!

https://ir.180degreecapital.com/press-releases/detail/385/180-degree-capital-corp-presents-analysis-supporting