Clear Skin, Cloudy Outlook: Dissecting Cutera's ($CUTR) Distressed Convertible Bonds

A Deep Dive into Cutera's Acne-Fighting Technology

Follow me on Twitter / Instagram / Threads🚨 Read time below = 15 minutes 👇

This week, I’ll be looking into Cutera, Inc. at the request of a few readers. If you’ve got a situation you want me to dissect, drop your suggestions in the link below. I’m particularly interested in under-the-radar situations that aren’t already picked over—the more obscure, complex, and messy, the better.

On a separate note, keep your eyes peeled for my upcoming 2Q’24 update. I’ve got some exciting and significant updates as well as a roadmap for new ideas in the pipeline. More to come soon!

Situation Overview:

Founded in 1998 and headquartered in California, Cutera, Inc. (“CUTR”) is a global manufacturer and distributor of laser and radiofrequency-enabled aesthetic devices as well as dermatology solutions. The company’s product portfolio includes established platforms such as excel V for vascular and pigmented lesions, enlighten for tattoo removal and skin revitalization, and truSculpt for body contouring. In 2022, Cutera launched AviClear, the first FDA-cleared energy-based device for long-term acne treatment, positioning the company at the forefront of a potential paradigm shift in the $14+ billion acne market.

The company’s flagship product, AviClear, uses a proprietary 1726 nm wavelength laser to selectively target and suppress sebaceous glands, which are responsible for producing sebum, a key factor in acne formation. By damaging these glands, AviClear reduces sebum production and thereby treats acne at its source, offering a non-pharmacologic alternative to traditional acne treatments like antibiotics or isotretinoin (i.e., Accutane). See below for a demonstration video.

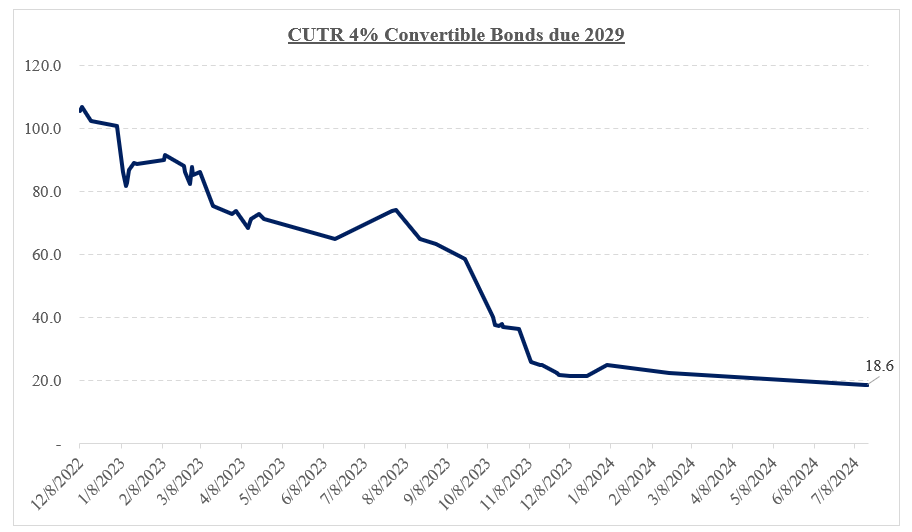

Busted Convertible Bonds

Despite a strong market position and innovative product offerings, Cutera has nonetheless faced significant headwinds in recent years that have weighed heavily on its financial performance. The company’s shares have plummeted over 97% from their 2022 highs, while its 2021/2022-vintage convertible bonds due 2026, 2028, and 2029 are currently trading at distressed levels around 20 cents on the dollar (~50% YTW).